Automobile Insurance Company of Hartford, Connecticut: Customer Ratings & Reviews [2025]

Explore how the Automobile Insurance Company of Hartford, Connecticut provides reliable coverage options and competitive rates, ensuring your peace of mind on the road.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Updated April 2024

The Automobile Insurance Company of Hartford, Connecticut is a reputable and reliable insurance provider with over 200 years of experience in the industry. This article provides a comprehensive review of the company’s history, mission, products and services, pricing, states where they operate, discounts available to customers, and customer reviews.

The company offers a wide range of insurance products, including auto insurance, homeowners insurance, and renters insurance, at competitive rates.

The Automobile Insurance Company of Hartford, Connecticut’s focus on customer satisfaction and excellent customer service, along with multiple discounts available to eligible customers, makes it an attractive option for those in need of reliable auto insurance.

What You Should Know About Automobile Insurance Company of Hartford, Connecticut

Company contact information:

- Phone: 1-800-423-6789

- Website: www.thehartford.com

Related parent or child companies:

- The Hartford Financial Services Group, Inc.

Financial ratings:

- A+ (Superior) from A.M. Best

- A+ from Standard & Poor’s

- A1 from Moody’s

Customer service ratings:

- 4.5 out of 5 stars on Trustpilot

- 3 out of 5 stars on ConsumerAffairs

Claims information:

- Claims can be filed 24/7 online, over the phone, or through the company’s mobile app.

- The company has a satisfaction guarantee for their auto insurance claims service.

Company apps:

- The Hartford’s mobile app allows customers to manage their policies, file claims, and track their driving habits to potentially earn discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Company of Hartford, Connecticut Insurance Coverage Options

The Automobile Insurance Company of Hartford, Connecticut offers a range of coverage options to help protect you and your vehicle in case of an accident or other covered event. Some of the coverage options available include:

- Liability coverage to pay for damages or injuries you cause to others in an accident

- Collision coverage to pay for damages to your own vehicle in an accident

- Comprehensive coverage to pay for damages to your vehicle from non-collision events like theft, fire, or severe weather

- Uninsured/underinsured motorist coverage to protect you if you’re in an accident with someone who doesn’t have enough insurance to cover your damages or injuries

- Medical payments coverage to pay for medical expenses for you or your passengers after an accident

- Personal injury protection (PIP) coverage to pay for medical expenses and lost wages for you and your passengers regardless of who caused the accident

- Rental car reimbursement coverage to pay for a rental car while your vehicle is being repaired after an accident

- Roadside assistance coverage to provide help if your vehicle breaks down or you get a flat tire while driving

These coverage options can be customized to fit your individual needs and budget, so be sure to talk to your agent about which ones are right for you.

Automobile Insurance Company of Hartford, Connecticut Insurance Rates Breakdown

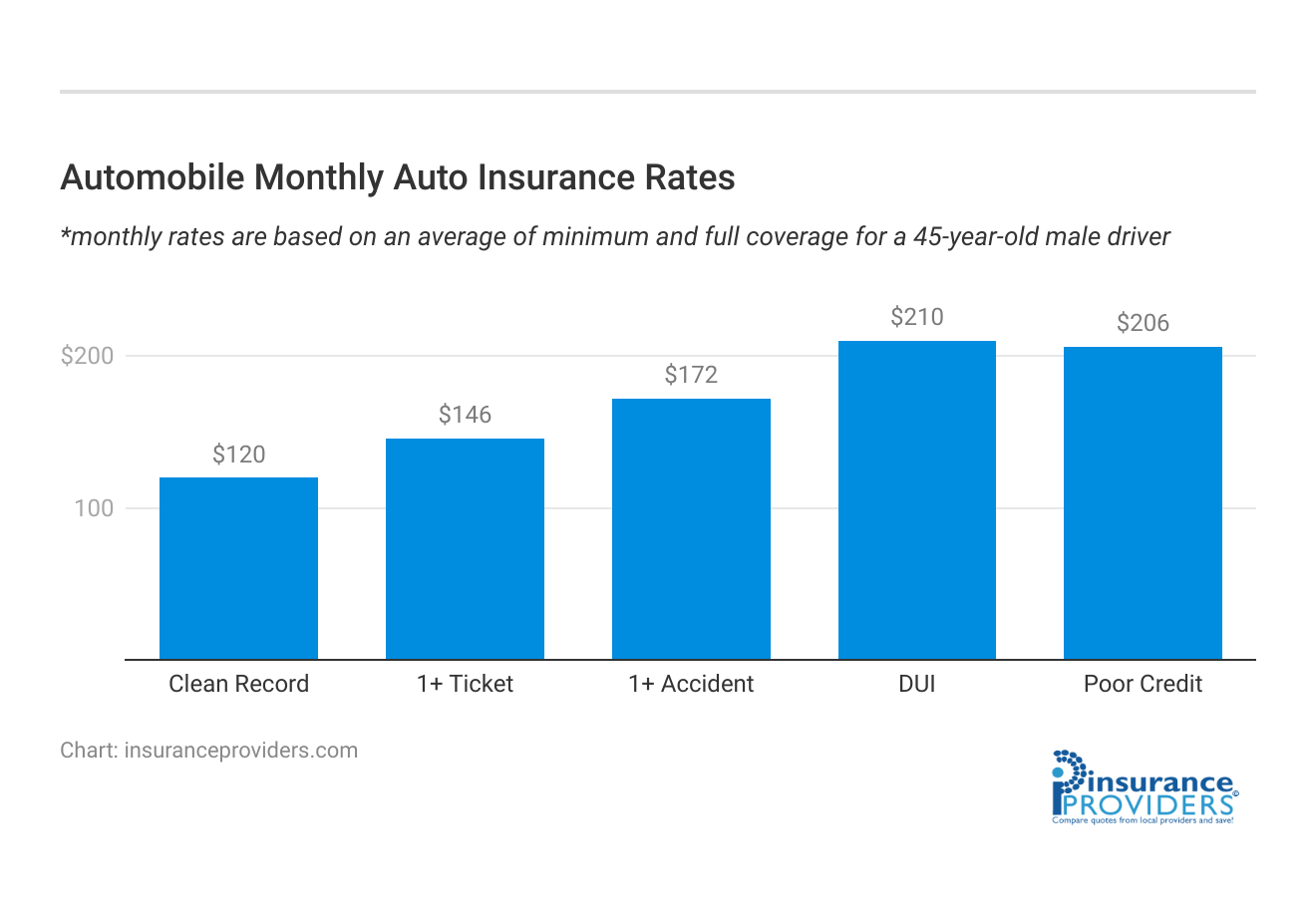

| Driver Profile | Automobile | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $146 | $147 |

| 1+ Accident | $172 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Automobile Insurance Company of Hartford, Connecticut Discounts Available

| Discount | Automobile |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 9% |

| Paperless | 5% |

| Safe Driver | 18% |

| Senior Driver | 7% |

The Automobile Insurance Company of Hartford, Connecticut offers a variety of discounts to help customers save money on their auto insurance premiums. Some of the discounts available include:

- Multi-policy discount for bundling auto and home insurance

- Multi-car discount for insuring multiple vehicles on the same policy

- Safe driver discount for maintaining a clean driving record

- Defensive driving discount for completing an approved defensive driving course

- Anti-theft device discount for having an alarm system or other anti-theft device installed in your vehicle

- Good student discount for maintaining a certain GPA if you’re a student

- AARP member discount for eligible AARP members

- Accident forgiveness program to avoid premium increases after your first at-fault accident

- Disappearing deductible program to reduce your deductible for every year of safe driving

These discounts can add up to significant savings on your auto insurance premiums, so be sure to ask your agent about which ones you may be eligible for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Automobile Insurance Company of Hartford, Connecticut Ranks Among Providers

The Automobile Insurance Company of Hartford, Connecticut operates in a highly competitive market with several other major insurance companies. Some of the company’s main competitors include:

- State Farm

- Geico

- Allstate

- Progressive

- Nationwide

- Farmers Insurance

These companies offer a range of auto insurance products and services similar to what the Automobile Insurance Company of Hartford, Connecticut provides, including liability, collision, and comprehensive coverage, as well as discounts for safe driving and multiple policies. To stay competitive, the Automobile Insurance Company of Hartford, Connecticut focuses on providing excellent customer service, offering a wide range of discounts, and providing customizable coverage options that can be tailored to individual needs and budgets.

Frequently Asked Questions

What insurance products does the Automobile Insurance Company of Hartford, Connecticut offer?

The Automobile Insurance Company of Hartford, Connecticut provides a range of insurance products including auto insurance, homeowners insurance, and renters insurance, tailoring coverage to meet individual needs.

How does the company’s customer service rank?

Customers have rated the company’s customer service at an average of 4.7 out of 5 stars, expressing high satisfaction with the service provided.

What discounts are available for policyholders with the Automobile Insurance Company of Hartford, Connecticut?

The company offers various discounts such as safe driver discounts, multi-policy discounts, good student discounts, and more. Eligibility for these discounts can result in significant savings on premiums.

What sets the Automobile Insurance Company of Hartford, Connecticut apart from its competitors?

The company stands out by emphasizing excellent customer service, offering a wide array of discounts, and providing customizable coverage options that suit individual needs and budgets.

How can I file a claim with the Automobile Insurance Company of Hartford, Connecticut?

Policyholders can typically file a claim by contacting their insurance agent or the company’s claims department directly. The company provides guidance through the claim process and may require details such as the policy number, incident specifics, and supporting documentation.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.