Tower National Insurance Company: Customer Ratings & Reviews [2026]

Explore Tower National Insurance Company comprehensively, delving into its history, mission, coverage options, rates, and discounts, alongside real customer reviews and answers to frequently asked questions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated April 2024

Tower National Insurance Company is a New York-based insurance provider that has been operating for over 50 years. They offer a variety of insurance products, including auto, homeowners, renters, condo, and flood insurance, to customers in many states.

Customers can qualify for discounts on their insurance, such as a multi-policy discount, safety features discount, and claim-free discount. Tower National Insurance Company has a low complaint level and an A- (Excellent) rating from A.M. Best. The company is not available in all states and some customers have reported difficulty reaching customer service representatives.

Overall, Tower National Insurance Company may be a good option for customers in the market for insurance products, but it is important to review the coverage options and discounts carefully.

What You Should Know About Tower National Insurance Company

Company Contact Information:

- Phone: 888-856-5522

- Email: customerservice@tower-national.com

- Address: 120 Broadway, 31st Floor, New York, NY 10271

Related Parent or Child Companies:

- Tower Group Companies

Financial Ratings:

- A.M. Best rating: A- (Excellent)

- S&P Global rating: Not rated

Customer Service Ratings:

- National Association of Insurance Commissioners complaint index: 0.19 (lower than the national median of 1.0)

Claims Information:

- Claims can be reported 24/7 by calling the claims hotline at 888-856-5522

- Claims can also be reported online through the customer portal

Company Apps:

- Tower National Insurance Company does not currently have a mobile app.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tower National Insurance Company Insurance Coverage Options

Tower National Insurance Company offers a variety of insurance products to meet the needs of its customers. Here are the coverage options offered by Tower National Insurance Company:

Auto Insurance:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

- Roadside assistance

Homeowners Insurance:

- Property coverage

- Liability coverage

- Additional living expenses coverage

- Personal property coverage

- Loss of use coverage

Renters Insurance:

- Personal property coverage

- Liability coverage

- Additional living expenses coverage

Condo Insurance:

- Property coverage

- Liability coverage

- Loss assessment coverage

- Personal property coverage

- Loss of use coverage

Flood Insurance:

- Building property coverage

- Personal property coverage

- Replacement cost coverage

It is important to note that coverage options may vary by state, and customers should review their policy carefully to ensure they have the coverage they need.

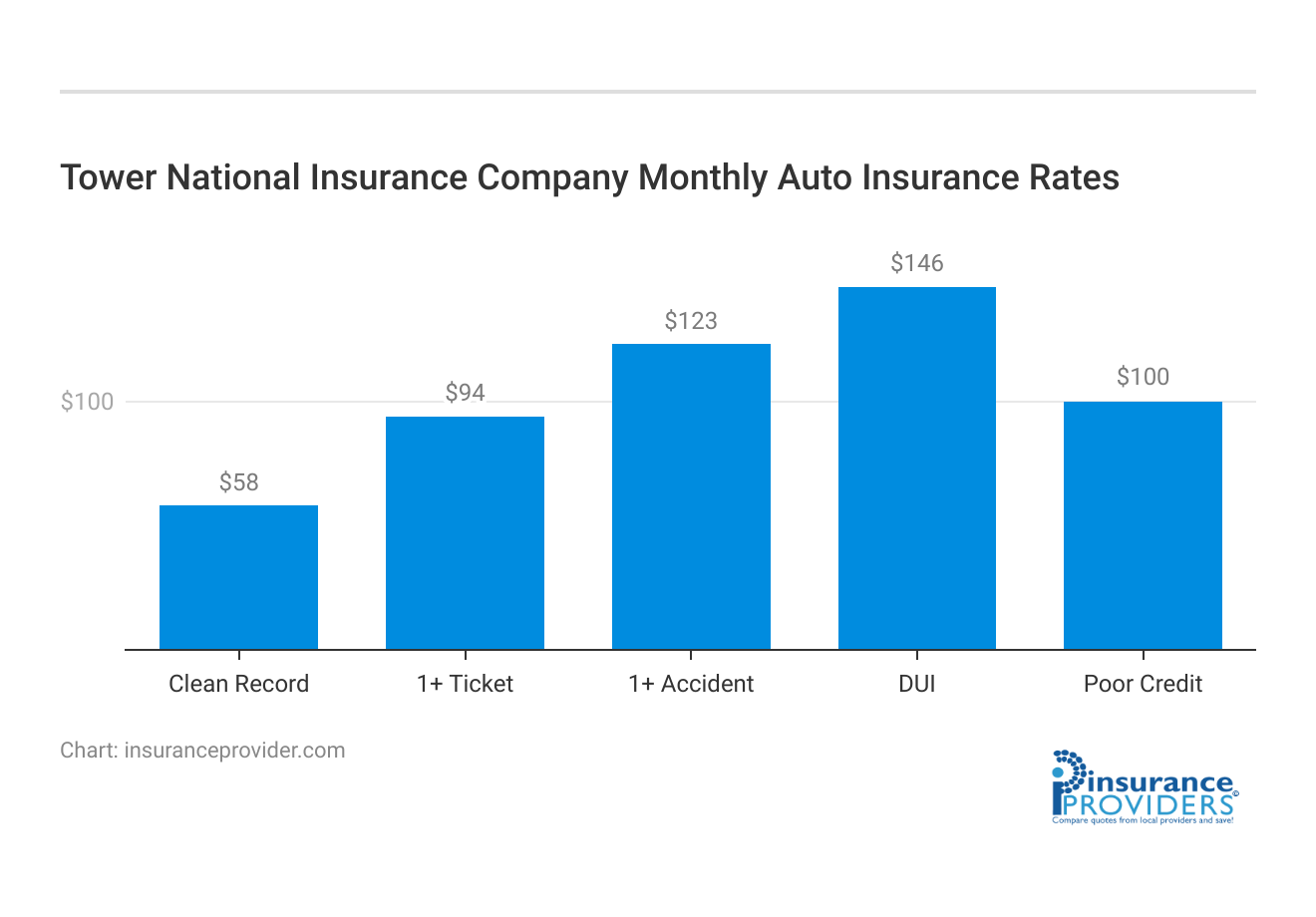

Tower National Insurance Company Insurance Rates Breakdown

| Driver Profile | Tower Life | National Average |

|---|---|---|

| Clean Record | $63 | $119 |

| 1+ Ticket | $100 | $147 |

| 1+ Accident | $125 | $173 |

| DUI | $156 | $209 |

| Poor Credit | $108 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Tower National Insurance Company Discounts Available

| Discounts | Tower National |

|---|---|

| Anti Theft | 18% |

| Good Student | 23% |

| Low Mileage | 14% |

| Paperless | 12% |

| Safe Driver | 24% |

| Senior Driver | 17% |

Tower National Insurance Company offers various discounts to customers who qualify. These discounts can help customers save money on their insurance premiums. Here are some of the discounts that Tower National Insurance Company offers:

- Multi-policy discount: Customers who have more than one policy with Tower National Insurance Company can qualify for a multi-policy discount.

- Safety features discount: Customers who have safety features installed in their vehicle, such as anti-lock brakes, airbags, and automatic seat belts, can qualify for a safety features discount.

- Claim-free discount: Customers who have not filed a claim with Tower National Insurance Company in a certain period of time can qualify for a claim-free discount.

- Good student discount: Full-time students who maintain a certain grade point average can qualify for a good student discount.

- Senior driver discount: Customers who are over a certain age and have completed an approved driver safety course can qualify for a senior driver discount.

- Home safety discount: Customers who have installed safety features in their home, such as smoke detectors and burglar alarms, can qualify for a home safety discount.

- Loyalty discount: Customers who have been with Tower National Insurance Company for a certain period of time can qualify for a loyalty discount.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Tower National Insurance Company Ranks Among Providers

Tower National Insurance Company operates in a competitive market with many other insurance providers. Here are some of the main competitors of Tower National Insurance Company:

- State Farm: State Farm is one of the largest insurance providers in the United States, offering a variety of insurance products, including auto, homeowners, renters, and life insurance.

- Allstate: Allstate is another large insurance provider that offers a range of insurance products, including auto, homeowners, renters, and life insurance.

- Geico: Geico is a popular insurance provider that offers auto insurance to customers in all 50 states. They are known for their competitive rates and user-friendly online platform.

- Progressive: Progressive is another well-known insurance provider that offers a variety of insurance products, including auto, homeowners, renters, and life insurance. They are known for their innovative approach to insurance and their competitive rates.

- Liberty Mutual: Liberty Mutual is a global insurance provider that offers a variety of insurance products, including auto, homeowners, renters, and life insurance. They are known for their strong financial ratings and customer service.

Customers looking for insurance products should compare coverage options, discounts, and rates from several providers to find the best fit for their needs.

Frequently Asked Questions

What insurance products does Tower National Insurance Company offer?

Tower National Insurance Company provides a range of insurance products, including auto, homeowners, renters, condo, and flood insurance, catering to customers in various states.

What discounts are available for policyholders at Tower National Insurance Company?

Customers can qualify for discounts such as a multi-policy discount, safety features discount, and claim-free discount, enhancing the affordability of their insurance coverage.

How does Tower National Insurance Company rate in terms of financial stability and credibility?

Tower National Insurance Company boasts an A- (Excellent) rating from A.M. Best, indicating a high level of financial strength and stability in the insurance market.

Are there any notable pros and cons associated with Tower National Insurance Company?

Tower National Insurance Company has a low complaint level and offers competitive rates, but it’s essential to note that availability varies by state, and some customers have reported challenges in reaching customer service representatives.

How does Tower National Insurance Company compare to other insurance providers in the market?

Tower National Insurance Company operates in a competitive market, and customers are advised to compare coverage options, discounts, and rates from several providers to find the best fit for their individual needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.