Graphic Arts Mutual Insurance Company: Customer Ratings & Reviews [2026]

Graphic Arts Mutual Insurance Company, with its A- (Excellent) rating from A.M. Best, competitive pricing for small to medium-sized enterprises, and unwavering commitment to excellent customer service, stands as a beacon for businesses seeking tailored insurance solutions, although its limited coverage options for non-graphic arts businesses may pose a drawback for some customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated April 2024

In this article, we reviewed Graphic Arts Mutual Insurance Company, a specialized insurance provider for graphic arts businesses. We explored the company’s history, mission, products, and services, coverage areas, discounts, and customer reviews.

With an A- (Excellent) rating from A.M. Best and competitive pricing for small to medium-sized businesses, Graphic Arts Mutual Insurance Company offers tailored insurance solutions and excellent customer service.

However, the company’s limited coverage options for non-graphic arts businesses and the lack of discounts compared to other insurance providers may be a drawback for some customers.

Arts Mutual Insurance Company Insurance Coverage Options

The article mentions that Graphic Arts Mutual Insurance Company offers specialized insurance coverage for graphic arts businesses. Here are the coverage options mentioned in the article:

- Property insurance: Covers damage or loss to property caused by theft, fire, or other covered events.

- Liability insurance: Provides protection against claims of bodily injury, property damage, or personal injury caused by the insured’s business activities.

- Workers’ compensation insurance: Covers medical expenses and lost wages for employees who are injured or become ill as a result of their job.

- Business interruption insurance: Helps businesses recover lost income and pay expenses if their operations are disrupted due to a covered event.

- Cyber liability insurance: Protects businesses from cyber threats and data breaches.

It’s worth noting that the article states that Graphic Arts Mutual Insurance Company offers limited coverage options for non-graphic arts businesses. However, the company can work with customers to provide customized insurance solutions to fit their specific needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Arts Mutual Insurance Company Insurance Rates Breakdown

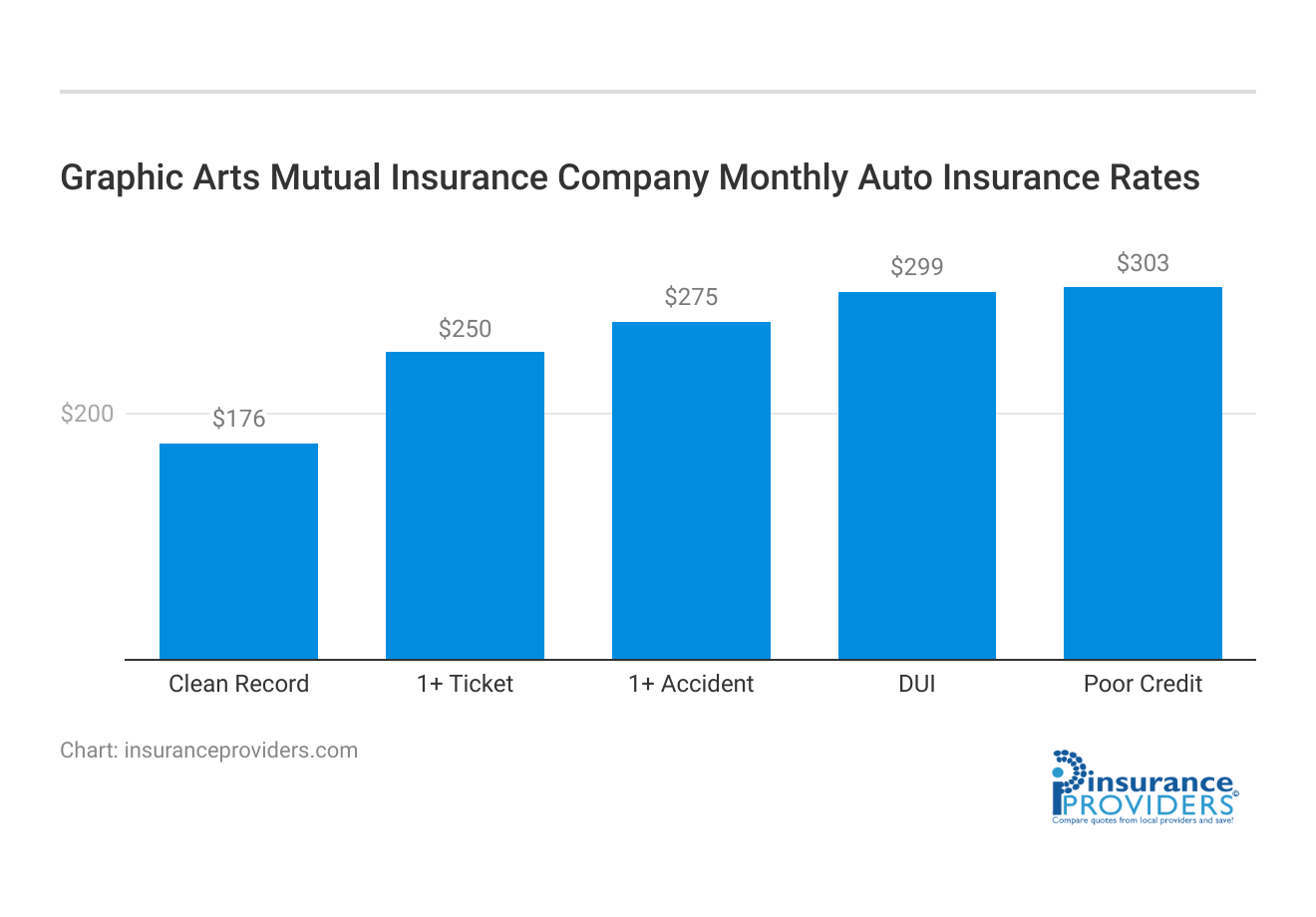

| Driver Profile | Graphic Arts Mutual Insurance Company | National Average |

|---|---|---|

| Clean Record | $176 | $193 |

| 1+ Ticket | $250 | $275 |

| 1+ Accident | $275 | $300 |

| DUI | $299 | $325 |

| Poor Credit | $303 | $332 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Arts Mutual Insurance Company Discounts Available

| Discount | Graphic Arts Mutual Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 8% |

| Safe Driver | 20% |

| Senior Driver | 5% |

The article states that Graphic Arts Mutual Insurance Company offers discounts to its customers. Here is a list of the discounts mentioned in the article:

- Multi-policy discount: Customers who bundle their insurance policies with Graphic Arts Mutual Insurance Company can receive a discount on their premiums.

- Safety discount: Customers who implement safety measures, such as installing security systems, can qualify for a safety discount.

- Claims-free discount: Customers who do not file any claims during a specified period can receive a claims-free discount.

It’s worth noting that the article mentions that Graphic Arts Mutual Insurance Company offers fewer discounts compared to other insurance providers. However, these discounts can still provide significant savings for eligible customers.

How Arts Mutual Insurance Company Ranks Among Providers

In the dynamic landscape of insurance, Graphic Arts Mutual Insurance Company faces competition from various providers offering similar services. Understanding the alternatives in the market allows businesses to make informed choices when selecting an insurance partner. Here are some competitors that businesses may consider when exploring insurance options.

- Global Business Assurance: Providing specialized insurance for niche industries, Global Business Assurance competes with Graphic Arts Mutual Insurance Company by offering customized solutions and robust risk management.

- National Commercial Underwriters: Recognized for its financial stability and extensive coverage offerings, National Commercial Underwriters is a formidable competitor, especially in the realm of commercial insurance.

While Graphic Arts Mutual Insurance Company excels in providing specialized coverage for graphic arts businesses, exploring alternatives is a prudent approach. Each competitor brings its unique strengths to the table, ranging from extensive coverage options to customer service excellence.

Frequently Asked Questions

Does Graphic Arts Mutual Insurance Company have customer ratings and reviews?

Yes, Graphic Arts Mutual Insurance Company has customer ratings and reviews available.

Where can I find customer ratings and reviews for Graphic Arts Mutual Insurance Company?

You can find customer ratings and reviews for Graphic Arts Mutual Insurance Company on various online platforms, such as review websites, social media platforms, and insurance comparison websites.

Are customer ratings and reviews helpful in evaluating Graphic Arts Mutual Insurance Company?

Customer ratings and reviews can be helpful in evaluating Graphic Arts Mutual Insurance Company as they provide insights into the experiences of other policyholders. They can give you an idea of the company’s customer service, claims handling, and overall satisfaction levels.

Can I rely solely on customer ratings and reviews to make a decision about Graphic Arts Mutual Insurance Company?

While customer ratings and reviews can provide valuable information, it is recommended to consider them alongside other factors such as coverage options, pricing, financial stability, and the company’s reputation in the industry. It’s important to gather a comprehensive view before making a decision.

How should I interpret customer ratings and reviews for Graphic Arts Mutual Insurance Company?

When interpreting customer ratings and reviews, it’s essential to look for common themes or trends in the feedback. Focus on aspects that are important to you, such as customer service, claims handling, and policy features. Keep in mind that individual experiences may vary, so consider the overall consensus rather than individual opinions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.