Foremost Lloyds of Texas: Customer Ratings & Reviews [2026]

Explore the comprehensive landscape of Foremost Lloyds of Texas in this detailed guide, delving into the company's history, mission, and a spectrum of insurance products and services, offering Texans a robust selection backed by an 'Excellent' A.M. Best rating.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Updated April 2024

Foremost Lloyds of Texas: A Complete Guide (2023) provides a comprehensive overview of this insurance company’s history, mission, products, and services. With a strong A.M. Best rating of “Excellent,” Foremost Lloyds of Texas offers a wide range of insurance options for Texans, including specialty coverage.

The article highlights the company’s competitive rates, excellent customer service, and discounts available to eligible customers. However, it also notes some limitations such as the company’s coverage area limited to Texas and limited online resources.

The article also includes a summary of customer reviews and an FAQ section to provide readers with helpful information.

What You Should Know About Foremost Lloyds of Texas

Company Contact Information:

- Company Name: Foremost Lloyds of Texas

- Website: www.foremost.com/texas

- Phone: 1-800-527-3907

- Address: [Insert company’s official address]

Related Parent or Child Companies:

- Foremost Insurance Group (Parent Company)

Financial Ratings:

- A.M. Best Rating: A (Excellent)

Customer Service Ratings:

- Customer service ratings vary based on customer reviews and feedback.

Claims Information:

- Claims can be filed online or through the company’s customer service hotline.

- Claim processing times may vary based on the nature and complexity of the claim.

Company Apps:

- Foremost Insurance Group offers a mobile app called “Foremost Insurance” available for download on iOS and Android devices.

- The app provides access to policy information, payment options, claims filing, and other convenient features for policyholders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Foremost Lloyds of Texas Insurance Coverage Options

Foremost Lloyds of Texas offers a variety of coverage options to meet the insurance needs of their customers. Some of the coverage options offered by the company include:

- Auto Insurance: Foremost Lloyds of Texas provides auto insurance coverage, including liability coverage, comprehensive coverage, collision coverage, and personal injury protection (PIP) coverage.

- Home Insurance: The company offers home insurance coverage for homeowners, including dwelling coverage, personal property coverage, and liability coverage. They also provide coverage for other structures on the property, such as detached garages or sheds.

- Specialty Insurance: Foremost Lloyds of Texas offers specialty insurance coverage for unique risks, such as recreational vehicles (RVs), motorcycles, boats, and off-road vehicles.

- Flood Insurance: The company offers flood insurance coverage, which provides protection against damages caused by flooding, a common risk in many areas of Texas.

- Personal Umbrella Insurance: Foremost Lloyds of Texas offers personal umbrella insurance, which provides additional liability coverage above and beyond the limits of the underlying policies, offering added protection and peace of mind.

- Rental Property Insurance: The company provides insurance coverage for rental properties, including dwelling coverage, liability coverage, and loss of rental income coverage.

It’s important to note that coverage options may vary by state and policy type, and it’s recommended to consult with a Foremost Lloyds of Texas representative or review their website for specific information on coverage options available in your area.

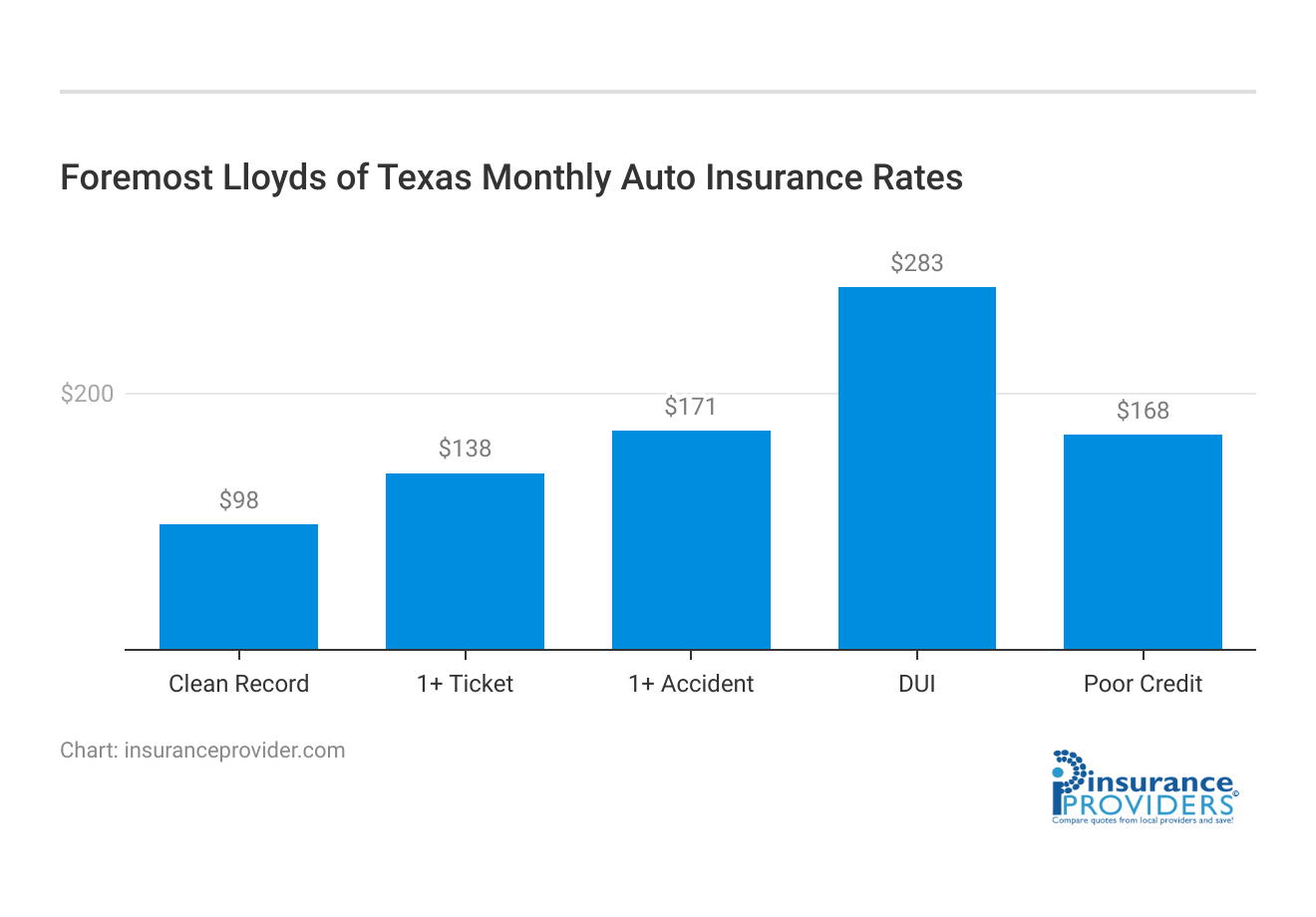

Foremost Lloyds of Texas Insurance Rates Breakdown

| Driver Profile | Foremost Lloyds | National Average |

|---|---|---|

| Clean Record | $98 | $119 |

| 1+ Ticket | $138 | $147 |

| 1+ Accident | $171 | $173 |

| DUI | $283 | $209 |

| Poor Credit | $168 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Foremost Lloyds of Texas Discounts Available

| Discounts | Foremost Lloyds |

|---|---|

| Anti Theft | 7% |

| Good Student | 10% |

| Low Mileage | 5% |

| Paperless | 8% |

| Safe Driver | 13% |

| Senior Driver | 6% |

Foremost Lloyds of Texas offers various discounts to eligible customers, making their insurance products more affordable. Some of the discounts offered by the company include:

- Multi-Policy Discount: Customers who have multiple policies with Foremost Lloyds of Texas, such as auto and home insurance, may qualify for a discount on their premiums.

- Safe Driver Discount: Customers who have a clean driving record with no accidents or violations may be eligible for a safe driver discount.

- Anti-Theft Device Discount: Customers who install anti-theft devices in their vehicles may qualify for a discount on their comprehensive coverage.

- Homeowner Discount: Customers who own a home may be eligible for a discount on their auto insurance premiums.

- Renewal Discount: Customers who renew their policies with Foremost Lloyds of Texas may qualify for a renewal discount.

- Paid-in-Full Discount: Customers who pay their premiums in full upfront may be eligible for a paid-in-full discount.

It’s important to note that discounts may vary by state and policy type, and eligibility requirements may apply. It’s recommended to consult with a Foremost Lloyds of Texas representative or review their website for specific information on discounts and how to qualify for them.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Foremost Lloyds of Texas Ranks Among Providers

Foremost Lloyds of Texas, as an insurance company, operates in a competitive market where there are other insurance companies offering similar products and services. Some of the main competitors in the insurance industry in Texas may include:

- State Farm: State Farm is a well-known insurance company that offers a wide range of insurance products, including auto, home, and specialty insurance.

- Allstate: Allstate is another major insurance company that provides various insurance products, such as auto, home, and renters insurance, among others.

- Farmers Insurance: Farmers Insurance is a popular insurance company that offers a range of insurance products, including auto, home, and specialty insurance coverage.

- Progressive: Progressive is a well-known insurance company that specializes in auto insurance but also offers other types of insurance, such as home, renters, and recreational vehicle insurance.

- Geico: Geico is a prominent insurance company that focuses primarily on auto insurance but also provides other types of coverage, such as home and renters insurance.

It’s important to note that the competitive landscape of the insurance industry can vary depending on factors such as location, customer demographics, and market trends. It’s recommended to conduct thorough market research to identify the specific competitors of Foremost Lloyds of Texas in the insurance market within Texas.

Frequently Asked Questions

What is Foremost Lloyds of Texas?

Foremost Lloyds of Texas is an insurance company that operates in the state of Texas. They provide various insurance products, including home insurance, auto insurance, and recreational vehicle insurance.

How can I find customer ratings and reviews for Foremost Lloyds of Texas?

Customer ratings and reviews for Foremost Lloyds of Texas can typically be found on independent review websites, such as Yelp, Google Reviews, or the Better Business Bureau (BBB). Additionally, you can check the company’s website for any testimonials or customer feedback they may have published.

Are customer ratings and reviews important when considering insurance companies?

Yes, customer ratings and reviews can provide valuable insights into the experiences of others who have dealt with the company. They can help you assess the quality of service, claims handling, and overall customer satisfaction. However, it’s essential to consider multiple sources and not base your decision solely on ratings and reviews.

What factors should I consider when evaluating customer ratings and reviews?

When evaluating customer ratings and reviews, consider the overall rating and the number of reviews received. Look for recurring themes or patterns in the feedback. Pay attention to comments related to customer service, claims processing, policy coverage, and pricing.

Are there any specific review platforms recommended for researching Foremost Lloyds of Texas?

While there are no specific review platforms recommended, you can start by checking websites like Yelp, Google Reviews, or the Better Business Bureau. These platforms typically offer a range of customer reviews and ratings for various businesses, including insurance companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.