Unitrin Safeguard Insurance Company: Customer Ratings & Reviews [2026]

Uncover the intricacies of Unitrin Safeguard Insurance Company as we delve into a comprehensive exploration of its products, services, discounts, and customer reviews—your definitive guide to securing comprehensive coverage in the dynamic landscape of insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated April 2024

The article provides a comprehensive review of Unitrin Safeguard Insurance Company, a top-rated insurance provider that offers a wide range of insurance products and services, including auto, home, renters, condo, and business insurance. Founded in 1990, the company has a solid reputation for providing affordable, quality insurance coverage that meets the unique needs of its customers. The article covers the company’s history, mission, products, pricing, discounts, and customer reviews, helping readers make informed decisions. Unitrin Safeguard Insurance Company has a low complaint level, offers multiple discounts to customers, and is known for exceptional customer service. However, some customers have reported issues with slow claim processing times, and the company has limited availability in some states.

What You Should Know About Unitrin Safeguard Insurance Company

Company Contact Information:

- Website: https://www.unitrinsafeguard.com/

- Phone: 1-888-834-7780

- Address: Unitrin Safeguard Insurance Company, P.O. Box 3057 Scranton, PA 18505

Related Parent or Child Companies:

- Unitrin Safeguard Insurance Company is a subsidiary of Kemper Corporation, a leading insurance holding company that provides property and casualty insurance, life and health insurance, and other financial services.

Financial Ratings:

- Unitrin Safeguard Insurance Company has an A- (Excellent) rating from A.M. Best, a globally recognized rating agency that evaluates the financial strength and creditworthiness of insurance companies.

Customer Service Ratings:

- Unitrin Safeguard Insurance Company has an exceptional reputation for providing top-notch customer service. Customers can reach the company’s customer service department by phone, email, or mail.

Claims Information:

- Unitrin Safeguard Insurance Company provides quick and efficient claims processing services to its customers. Customers can file a claim online or by phone, and the company’s claims adjusters work diligently to resolve claims as quickly as possible.

Company Apps:

- Unitrin Safeguard Insurance Company has a mobile app that allows customers to manage their policies, pay their bills, file claims, and access other features on the go. The app is available for download on the App Store and Google Play.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unitrin Safeguard Insurance Company Insurance Coverage Options

Unitrin Safeguard Insurance Company offers a wide range of coverage options to meet the diverse needs of its customers. Here are some of the coverage options available:

- Auto Insurance: Unitrin Safeguard offers liability, collision, comprehensive, and uninsured/underinsured motorist coverage for cars, trucks, and other vehicles.

- Homeowners Insurance: The company offers coverage for a variety of property types, including single-family homes, townhouses, and condominiums. Coverage options include dwelling, personal property, liability, and additional living expenses.

- Renters Insurance: Unitrin Safeguard provides renters insurance coverage for personal property, liability, and additional living expenses.

- Condo Insurance: Condo owners can purchase coverage for their personal property, liability, and any improvements or upgrades made to their unit.

- Business Insurance: Unitrin Safeguard offers a variety of business insurance products, including general liability, professional liability, commercial auto, and workers’ compensation insurance.

Customers can customize their policies to meet their specific needs, and the company offers additional coverage options, such as umbrella insurance and identity theft protection, to provide extra peace of mind. It’s important to note that coverage options may vary by state and policy, so customers should check with their agent or the company directly to see which options are available to them.

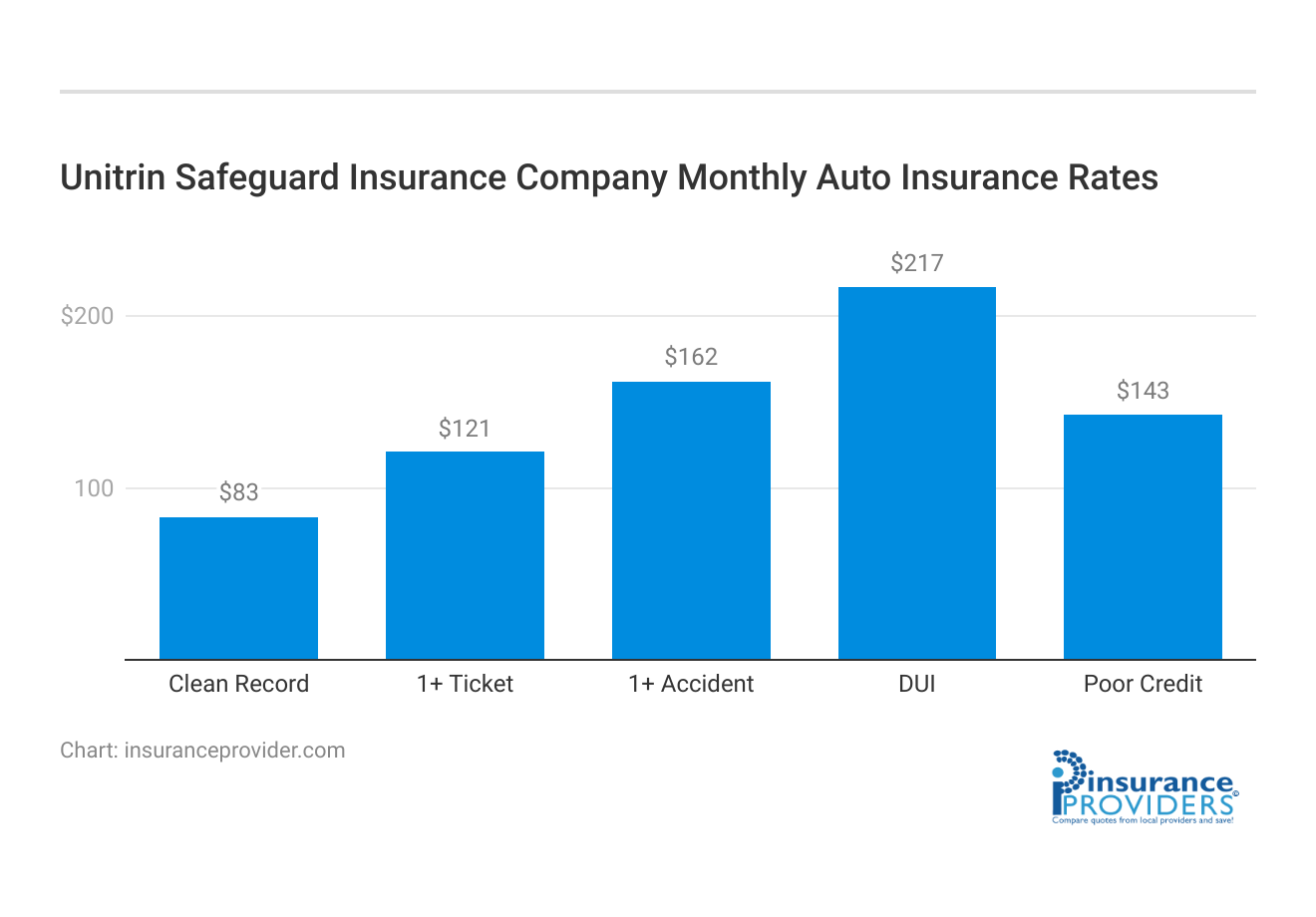

Unitrin Safeguard Insurance Company Insurance Rates Breakdown

| Driver Profile | Unitrin Safeguard Insurance | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $121 | $147 |

| 1+ Accident | $162 | $173 |

| DUI | $217 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Unitrin Safeguard Insurance Company Discounts Available

| Discounts | Unitrin Safeguard Insurance |

|---|---|

| Anti Theft | 16% |

| Good Student | 21% |

| Low Mileage | 17% |

| Paperless | 12% |

| Safe Driver | 25% |

| Senior Driver | 17% |

Unitrin Safeguard Insurance Company offers multiple discounts to its customers, helping them save money on their insurance premiums. These discounts include:

- Multi-Policy Discount: Customers who purchase multiple policies, such as auto and home insurance, can qualify for a multi-policy discount.

- Safe Driver Discount: Customers with a good driving record may qualify for a safe driver discount.

- Anti-Theft Device Discount: Customers who install anti-theft devices in their vehicles can receive a discount on their auto insurance premiums.

- Good Student Discount: Full-time high school or college students with a good academic record may qualify for a good student discount.

- Home Safety Features Discount: Customers with home safety features, such as smoke detectors and burglar alarms, may be eligible for a discount on their homeowners insurance premiums.

- Paid-in-Dull Discount: Customers who pay their insurance premiums in full, rather than in installments, can receive a discount.

These discounts can help customers save money on their insurance premiums while still maintaining quality coverage. It’s important to note that discounts may vary by state and policy, so customers should check with their agent or the company directly to see which discounts they qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Unitrin Safeguard Insurance Company Ranks Among Providers

Unitrin Safeguard Insurance Company operates in a highly competitive market, with numerous competitors offering similar products and services. Some of the company’s main competitors include:

- Geico: As one of the largest auto insurance companies in the US, Geico offers a wide range of insurance products, including auto, home, and renters insurance. The company is known for its affordable rates and popular advertising campaigns.

- State Farm: State Farm is a leading provider of auto, home, and life insurance, as well as banking and financial services. The company has a large network of agents and a strong reputation for customer service.

- Allstate: Allstate offers a variety of insurance products, including auto, home, renters, and life insurance. The company is known for its innovative products and services, such as its Drivewise program that rewards safe driving habits.

- Progressive: Progressive is a major player in the auto insurance market, offering a variety of coverage options and discounts to customers. The company is known for its Snapshot program, which uses telematics technology to reward safe driving.

- Nationwide: Nationwide offers a wide range of insurance and financial products, including auto, home, and renters insurance. The company is known for its strong customer service and personalized approach to insurance.

These competitors and others offer strong competition to Unitrin Safeguard Insurance Company, with each company bringing its own unique strengths and offerings to the market.

Effortless Claims Processing With Unitrin Safeguard Insurance Company: A Seamless Experience for Policyholders

Ease of Filing a Claim

Unitrin Safeguard Insurance Company provides convenient options for filing claims. Policyholders can submit claims easily through the user-friendly online platform or over the phone with assistance from trained representatives. The mobile app streamlines the process, allowing users to submit claims directly from their smartphones for added accessibility and efficiency.

Average Claim Processing Time

Unitrin Safeguard Insurance Company is committed to swift claims processing. The company aims to handle claims efficiently, with a typical processing time of just a few days. Online tracking is available for claimants, enabling them to monitor the progress of their claims in real-time.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on claim resolutions and payouts with Unitrin Safeguard Insurance Company has been generally positive. The company’s commitment to quick and efficient processing reflects in customer satisfaction. However, it’s important to note that, like any insurance provider, individual experiences may vary.

Elevating Insurance Experience: Unveiling Unitrin Safeguard’s Advanced Digital and Technological Features

Mobile App Features and Functionality

Unitrin Safeguard Insurance Company’s mobile app enhances the customer experience by offering convenient policy management on both the App Store and Google Play. Users can easily review policy details, adjust coverage options, and make updates directly within the app. The streamlined interface also allows for secure bill payments and hassle-free claims submission, providing a comprehensive and user-friendly mobile experience.

Online Account Management Capabilities

Unitrin Safeguard Insurance provides extensive online account management via its website, offering policyholders access to detailed policy information, including coverage details and premium amounts. The online portal enables seamless claims tracking in real-time for transparency, and users can easily download essential documents like policy certificates and claim forms directly from their accounts.

Digital Tools and Resources

Unitrin Safeguard Insurance provides customers with a range of digital tools on its website, offering educational materials like articles and guides for informed insurance decisions. The online portal also features a chat option for quick assistance, reflecting the company’s commitment to modern, streamlined customer support and convenience.

Frequently Asked Questions

What are the average monthly rates for good drivers with Unitrin Safeguard Insurance Company?

The average monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver.

What financial rating does Unitrin Safeguard Insurance Company have from A.M. Best?

Unitrin Safeguard Insurance Company holds an A- (Excellent) rating from A.M. Best, indicating strong financial outlook and creditworthiness.

Can I manage my policy online?

Yes, Unitrin Safeguard Insurance Company provides an online portal where customers can manage their policies, make payments, and file claims.

What types of insurance does Unitrin Safeguard Insurance Company offer?

Unitrin Safeguard Insurance Company offers a range of insurance products, including auto, home, renters, condo, and business insurance.

Is Unitrin Safeguard Insurance Company a subsidiary of another company?

Yes, Unitrin Safeguard Insurance Company is a subsidiary of Kemper Corporation, a leading insurance holding company.

How can customers file a claim with Unitrin Safeguard Insurance Company, and what is the typical claims processing time?

Customers can file a claim online or by phone, and claims are typically handled within a few days, with online tracking available to monitor progress.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.