American Memorial Life Insurance Company: Customer Ratings & Reviews [2026]

American Memorial Life Insurance Company has been a trusted provider of customizable life insurance policies, offering a diverse range of products and discounts, including multi-policy, non-smoker, good health, and military discounts, with nationwide coverage and a commitment to responsive customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

American Memorial Life Insurance Company is a reputable provider of life insurance policies, having been in the business since 1954. They offer a variety of products, including term life insurance, whole life insurance, final expense insurance, and guaranteed issue life insurance.

American Memorial Life Insurance Company’s mission is to provide reliable, affordable, and customizable policies to meet the unique needs of their clients. They offer discounts, such as multi-policy, non-smoker, good health, and military discounts.

Customers appreciate their responsive and helpful customer service, and they operate in all 50 states in the US. If you’re in the market for life insurance, American Memorial Life Insurance Company is definitely worth considering.

American Memorial Life Insurance Company Insurance Coverage Options

American Memorial Life Insurance Company offers a range of coverage options to meet the needs of their customers.

These options include:

- Term Life Insurance: Provides coverage for a specific period of time, typically between 10 and 30 years.

- Whole Life Insurance: Provides coverage for the duration of the policyholder’s life, with premiums and death benefits remaining fixed.

- Final Expense Insurance: Provides coverage for end-of-life expenses, such as funeral and burial costs.

- Accidental Death Insurance: Provides coverage in the event of accidental death or dismemberment.

- Mortgage Protection Insurance: Provides coverage to pay off a mortgage in the event of the policyholder’s death.

- Disability Income Insurance: Provides coverage for lost income in the event of a disability.

- Long-Term Care Insurance: Provides coverage for the costs of long-term care, such as nursing home care or home health care.

It’s important to note that coverage options and availability may vary depending on the specific policy and location. Be sure to speak with a representative from American Memorial Life Insurance Company to determine which coverage options are available to you.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

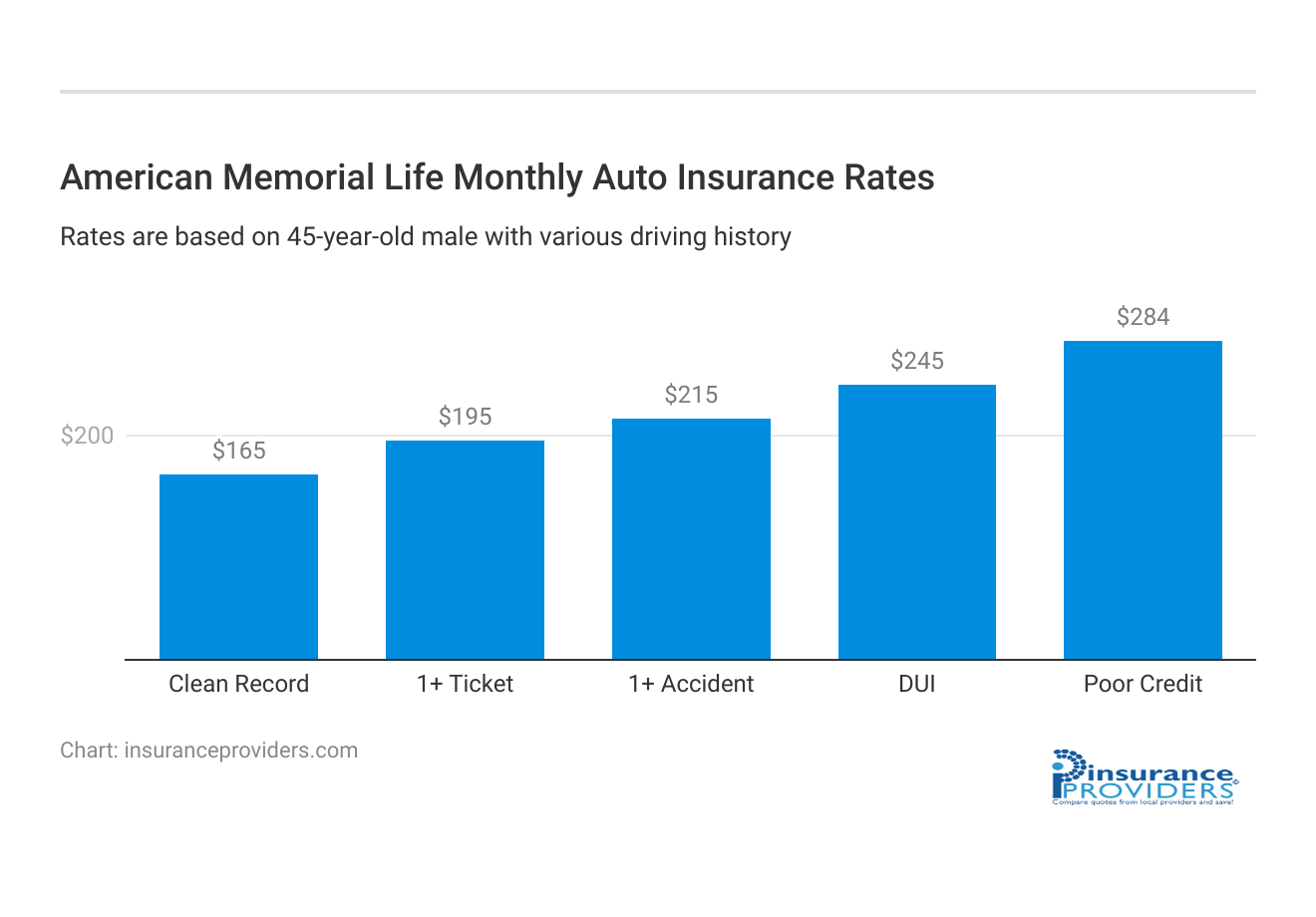

American Memorial Life Insurance Company Insurance Rates Breakdown

| Driver Profile | American Memorial Life | National Average |

|---|---|---|

| Clean Record | $165 | $119 |

| 1+ Ticket | $195 | $147 |

| 1+ Accident | $215 | $173 |

| DUI | $245 | $209 |

| Poor Credit | $284 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American Memorial Life Insurance Company Discounts Available

| Discount | American Memorial Life |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 7% |

| Safe Driver | 18% |

| Senior Driver | 9% |

American Memorial Life Insurance Company understands the significance of providing affordable coverage to its customers. In pursuit of this goal, they offer a range of discounts to make life insurance more accessible. Here’s a breakdown of the discounts available to eligible policyholders.

- Multiple Policy Discount: Customers who bundle multiple insurance policies with American Memorial Life Insurance Company may be eligible for a discount on their premiums.

- Non-Smoker Discount: Customers who do not smoke may be eligible for a discount on their life insurance premiums.

- Preferred Health Discount: Customers who are in good health and have a clean medical history may be eligible for a discount on their life insurance premiums.

- Safe Driver Discount: Customers who have a good driving record and no recent accidents may be eligible for a discount on their auto insurance premiums.

- Senior Discount: Customers who are over the age of 50 may be eligible for a discount on their life insurance premiums.

It’s worth noting that not all discounts are available in all states, and eligibility requirements may vary depending on the specific policy and customer profile. Be sure to speak with a representative from American Memorial Life Insurance Company to determine which discounts you may be eligible for.

How American Memorial Life Insurance Company Ranks Among Providers

American Memorial Life Insurance Company has established itself as a reputable provider in the insurance industry, offering a range of life insurance products tailored to diverse needs.

To provide a comprehensive perspective, here’s a list of competitors that potential customers may consider when exploring insurance options. Here is the breakdown list of American Memorial Life Insurance Company’s competitors:

- State Farm Life Insurance: A well-known insurance company that offers a range of life insurance options, including term life insurance, whole life insurance, and universal life insurance.

- Allstate Life Insurance: Another large insurance company that offers a variety of life insurance policies, including term life insurance, whole life insurance, and universal life insurance.

- Prudential Life Insurance: One of the largest life insurance companies in the U.S., offering a range of coverage options, including term life insurance, universal life insurance, and variable life insurance.

- MetLife Life Insurance: A global insurance company that offers a range of life insurance products, including term life insurance, whole life insurance, and universal life insurance.

- Nationwide Life Insurance: An insurance company that offers a variety of life insurance policies, including term life insurance, whole life insurance, and universal life insurance.

These are just a few examples of companies that may be considered competitors of American Memorial Life Insurance Company. It’s important to compare policies and rates from multiple insurers to ensure you’re getting the best coverage at the most affordable price.

Frequently Asked Questions

What types of insurance policies does American Memorial Life Insurance Company offer?

American Memorial Life Insurance Company offers a variety of insurance policies, including term life insurance, whole life insurance, final expense insurance, and guaranteed issue life insurance.

In how many states does American Memorial Life Insurance Company operate?

American Memorial Life Insurance Company operates in most states in the U.S., but availability may vary depending on the specific product and location.

What discounts are available from American Memorial Life Insurance Company?

American Memorial Life Insurance Company offers several discounts, such as multiple policy, non-smoker, preferred health, safe driver, and senior discounts. However, it’s important to note that not all discounts may be available in all states, and eligibility requirements may vary.

How do I file a claim with American Memorial Life Insurance Company?

Claims with American Memorial Life Insurance Company can be submitted by calling 1-800-548-4337 or visiting the company’s website. The claims process may vary depending on the specific policy held by the customer.

How long has American Memorial Life Insurance Company been in business?

American Memorial Life Insurance Company has been in business since 1954, providing over 50 years of experience in the insurance industry.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.