CEM Insurance Company: Customer Ratings & Reviews [2026]

Explore the comprehensive coverage, affordable rates, and exceptional customer service offered by CEM Insurance Company, backed by an A.M. Best rating of A Excellent and a strong reputation for reliability, as we delve into the details of their insurance products and benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated April 2024

CEM Insurance Company offers a wide range of insurance products and services with an excellent customer service reputation. The company provides discounts for eligible customers and has a long history of reliability and trustworthiness.

With an A (Excellent) rating from A.M. Best and a low complaint level, CEM Insurance Company is a top choice for insurance needs. However, rates may be higher than some competitors and the online quoting system could be more user-friendly.

CEM Insurance Coverage Options

CEM Insurance Company takes pride in providing a diverse range of insurance products and coverage options to meet the varied needs of its customers. From fundamental coverage to specialized policies, CEM Insurance Company aims to offer comprehensive protection. Below is a list of coverage options available with CEM Insurance Company.

- Auto Insurance: Liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- Homeowners Insurance: Coverage for the structure of the home, personal property, liability, and additional living expenses.

- Renters Insurance: Coverage for personal property, liability, and additional living expenses.

- Condo Insurance: Coverage for personal property, liability, and upgrades made to the unit.

- Business Insurance: Coverage for property damage, liability, and business interruption.

- Life Insurance: Term life insurance and whole life insurance options.

- Health Insurance: Individual and family health insurance plans.

- Disability Insurance: Short-term and long-term disability insurance.

CEM Insurance Company’s extensive coverage options cater to a wide range of insurance needs. Whether you’re protecting your vehicle, home, business, or loved ones, CEM aims to provide reliable and tailored solutions. Contact CEM Insurance Company to explore these coverage options further and find the right insurance plan for your unique circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

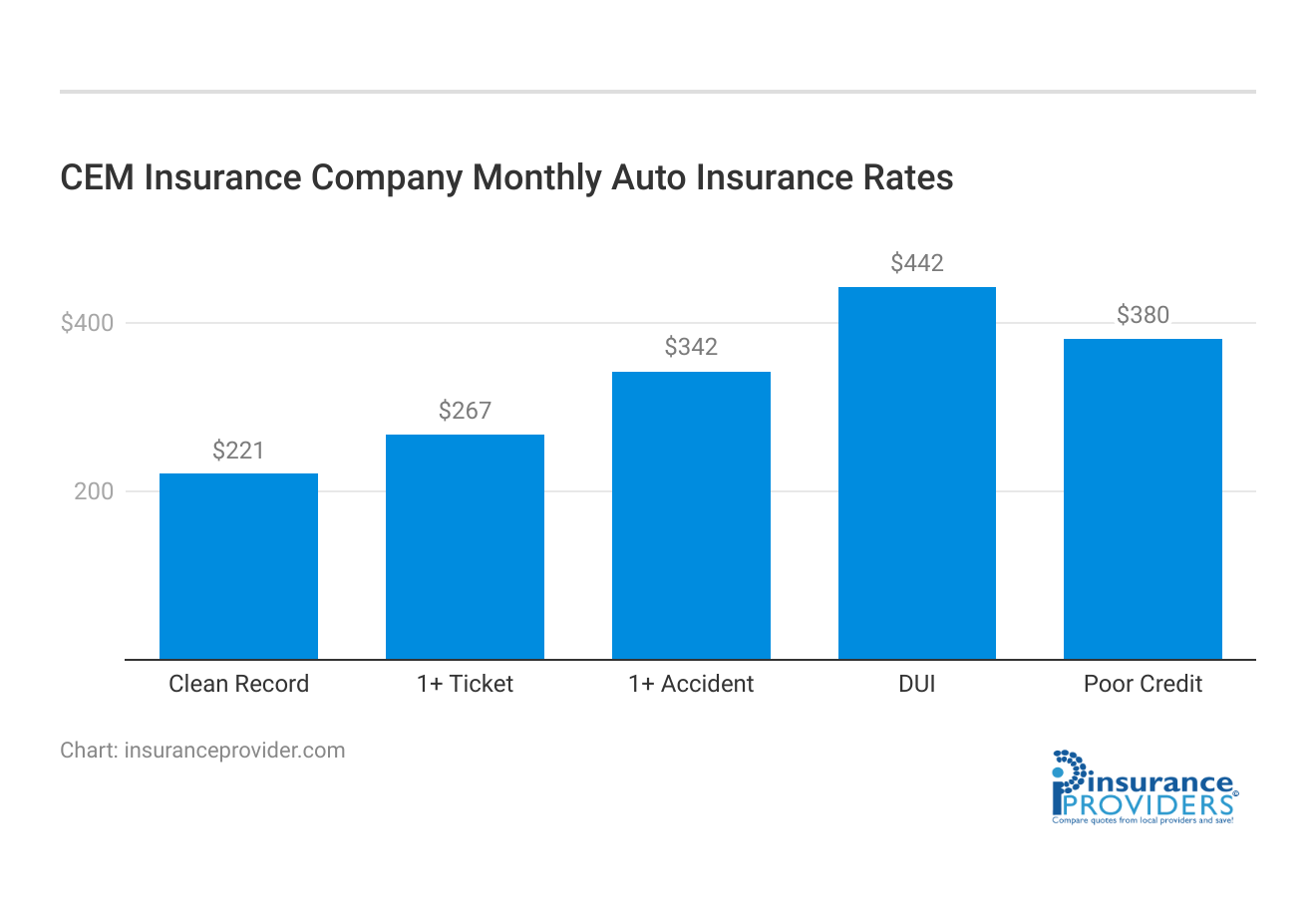

CEM Insurance Rates Breakdown

| Driver Profile | CEM Insurance | National Average |

|---|---|---|

| Clean Record | $221 | $119 |

| 1+ Ticket | $267 | $147 |

| 1+ Accident | $342 | $173 |

| DUI | $442 | $209 |

| Poor Credit | $380 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

CEM Insurance Discounts Available

| Discounts | CEM Insurance |

|---|---|

| Anti Theft | 13% |

| Good Student | 16% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 15% |

| Senior Driver | 10% |

CEM Insurance Company offers a variety of discounts to eligible customers, providing opportunities to save on insurance premiums. These discounts cater to different criteria, rewarding policyholders for various factors. Below is a list of discounts available with CEM Insurance Company.

- Multi-policy Discount: Save money by bundling multiple insurance policies together, such as home and auto insurance.

- Safe Driver Discount: Get a discount for having a clean driving record with no accidents or traffic violations.

- Good Student Discount: Students with good grades can receive a discount on their auto insurance.

- Business Owner Discount: Business owners can receive a discount on their commercial insurance policies.

- Paid-in-Full Discount: Customers who pay their entire premium upfront can receive a discount.

- New Car Discount: Customers with a new car may be eligible for a discount on their auto insurance.

- Anti-Theft Discount: Vehicles equipped with anti-theft devices may qualify for a discount on comprehensive coverage.

These discounts from CEM Insurance Company aim to make insurance coverage more affordable and accessible for a diverse range of policyholders. To learn more about eligibility criteria and maximize your potential savings, contact CEM Insurance Company’s customer service representatives today.

How CEM Insurance Ranks Among Providers

CEM Insurance Company faces competition from several reputable companies, each striving to offer unique products and services to cater to the diverse needs of customers. Below is a list of some key competitors vying for customers in the insurance industry.

- State Farm: One of the largest insurance companies in the US, offering a wide range of insurance products and coverage options.

- Allstate: A major insurance provider offering auto, home, and life insurance policies, among others.

- Progressive: A leading provider of auto insurance with a focus on innovative technology and competitive pricing.

- Geico: A popular insurance company known for its catchy advertising campaigns and low rates for auto insurance.

- Nationwide: A well-established insurance company offering a variety of insurance products and services, including auto, home, and life insurance.

These companies, along with many others, compete with Cem Insurance Company by offering similar products and services and differentiating themselves through pricing, customer service, and innovative technologies.

Frequently Asked Questions

Is CEM Insurance a Good Choice?

CEM Insurance Company is indeed a reliable choice with a long history of providing comprehensive coverage and exceptional customer service. It holds an A (Excellent) rating from A.M. Best, reflecting its financial strength, and maintains a low complaint level, making it a top choice for insurance needs.

How do I file a claim with Cem Insurance Company?

To file a claim with Cem Insurance Company, you can call the toll-free claims hotline at 1-800-CEM-CLAIMS (1-800-236-2524). Claims representatives are available 24/7 to assist customers.

Can I get a quote for insurance coverage before signing up?

Absolutely! You can obtain a free quote for any of CEM Insurance’s products by visiting their website or calling their customer service line. This allows you to explore coverage options and understand the associated costs before making a commitment.

How can I qualify for discounts on my insurance policy?

To qualify for discounts, you must meet specific criteria, such as maintaining a clean driving record for the Safe Driver Discount or owning a business for the Business Owner Discount. Contact CEM Insurance Company’s customer service representatives for more eligibility information and how to maximize your potential savings.

Does CEM Insurance Company have any mobile apps?

CEM Insurance Company does not have any mobile apps available. They may, however, provide other convenient ways to access and manage your insurance information, which you can inquire about when contacting their customer service.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.