Deerbrook Insurance Company: Customer Ratings & Reviews [2026]

Deerbrook Insurance Company, offers a comprehensive range of insurance products, including auto, home, renters, and umbrella insurance, maintaining an A (Excellent) rating from A.M. Best, and while customer reviews are mixed, the company remains dedicated to delivering quality customer service and a hassle-free claims filing process.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated April 2024

Deerbrook Insurance Company is a trusted insurance provider that offers a range of insurance products including auto, home, renters, and umbrella insurance. The company has been in operation for over 30 years and is rated A (Excellent) by A.M. Best.

Deerbrook operates in select states across the United States and offers competitive rates with discounts available for eligible customers. While customer reviews are mixed, the company is dedicated to providing quality customer service and a hassle-free claims filing process.

Overall, Deerbrook Insurance Company is a good option for those in the states where they operate and looking for a reliable insurance provider.

What You Should Know About Deerbrook

Company Contact Information:

- Website: deerbrook.com

- Phone: 1-800-532-4221

- Mailing address: Deerbrook Insurance Company, P.O. Box 660420, Dallas, TX 75266-0420

Financial ratings: Rated A (Excellent) by A.M. Best

Customer service ratings: While there is no specific rating available, Deerbrook Insurance Company is dedicated to providing quality customer service.

Claims information: While the the claims filing process is hassle-free, Deerbrook Insurance Company has mixed customer reviews, with some complaints of slow claims processing and difficulty reaching representatives.

Company apps: There is no specific information available about Deerbrook Insurance Company apps.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deerbrook Insurance Coverage Options

Deerbrook Insurance Company offers several types of insurance coverage, including:

- Auto Insurance: Deerbrook offers liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer roadside assistance and rental reimbursement coverage.

- Homeowners Insurance: Deerbrook offers coverage for a wide range of events including fire, theft, vandalism, and natural disasters. They also offer additional coverage options for personal property, liability, and living expenses.

- Renters Insurance: Deerbrook offers coverage for personal property, liability, and living expenses in the event of a covered loss.

- Umbrella Insurance: Deerbrook offers additional liability coverage that extends beyond the limits of your existing policies.

- Condo Insurance: Deerbrook offers coverage for a variety of events including fire, theft, and vandalism, as well as personal property and liability coverage.

- Flood Insurance: Deerbrook offers coverage for damage caused by flooding, which is not typically covered by standard homeowners or renters insurance policies.

It’s worth noting that not all coverage options may be available in all states, and coverage may vary based on individual policies. Customers should contact Deerbrook Insurance Company to learn more about the specific coverage options available in their area.

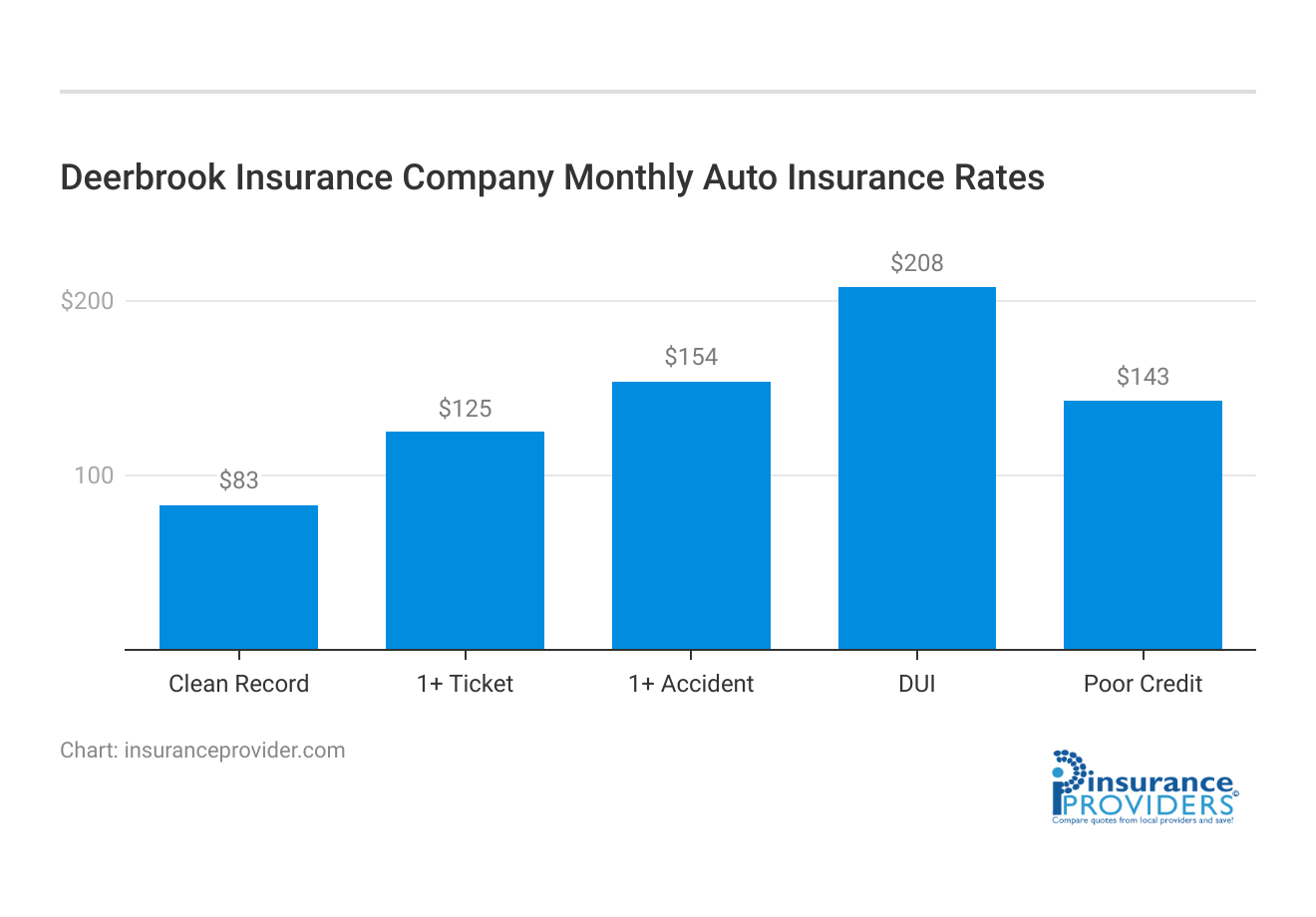

Deerbrook Insurance Rates Breakdown

| Driver Profile | Deerbrook | National Average |

|---|---|---|

| Clean Record | $83 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $154 | $173 |

| DUI | $208 | $209 |

| Poor Credit | $143 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Deerbrook Discounts Available

| Discounts | Deerbrook |

|---|---|

| Anti Theft | 8% |

| Good Student | 13% |

| Low Mileage | 10% |

| Paperless | 8% |

| Safe Driver | 13% |

| Senior Driver | 10% |

Deerbrook Insurance Company offers several discounts to eligible customers, including:

- Multi-Policy Discount: Customers who have multiple policies with Deerbrook, such as auto and home insurance, can qualify for a discount on their premiums.

- Safe Driver Discount: Customers who have a clean driving record for a certain number of years may be eligible for a discount.

- Good Student Discount: Students who maintain a certain GPA or are on the honor roll may be eligible for a discount on their auto insurance.

- Defensive Driving Discount: Customers who complete an approved defensive driving course may be eligible for a discount on their auto insurance.

- Anti-Theft Discount: Customers who have anti-theft devices installed in their vehicle may be eligible for a discount on their auto insurance.

- Homeowner Discount: Customers who own a home may be eligible for a discount on their auto insurance.

- Paid in Full Discount: Customers who pay their premium in full may be eligible for a discount on their auto insurance.

It is important to note that not all discounts are available in all states or for all policies, and eligibility requirements may vary. Customers should contact Deerbrook Insurance Company to learn more about the specific discounts they may qualify for.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Deerbrook Ranks Among Providers

Deerbrook Insurance Company operates in a highly competitive market, with several well-established players vying for market share. Some of the main competitors of Deerbrook Insurance Company include:

- State Farm: State Farm is the largest provider of auto insurance in the United States and offers a wide range of insurance products, including homeowners, renters, life, and health insurance.

- Allstate: Allstate is one of the largest personal insurance companies in the United States, providing coverage for auto, home, life, and health insurance. They are known for their innovative product offerings and strong customer service.

- Geico: Geico is a popular insurance provider with a focus on low rates and convenient digital services. They offer coverage for auto, home, renters, and business insurance.

- Progressive: Progressive is a leading auto insurance provider in the United States, offering competitive rates and innovative coverage options like usage-based insurance and pet injury coverage.

- Nationwide: Nationwide is a well-established insurance provider that offers a wide range of insurance products, including auto, home, renters, and pet insurance. They are known for their strong customer service and personalized coverage options.

Overall, Deerbrook Insurance Company competes with these and other insurers by offering competitive rates, a range of coverage options, and strong customer service.

Frequently Asked Questions

How long has Deerbrook Insurance Company been in operation, and what types of insurance do they offer?

Deerbrook Insurance Company has been in operation for over 30 years. They offer a comprehensive range of insurance products, including auto, home, renters, and umbrella insurance.

What is Deerbrook Insurance Company’s financial rating, and how do customers rate their service?

Deerbrook Insurance Company holds an A (Excellent) rating from A.M. Best. Customer ratings are mixed, with some praising the company’s customer service and affordable rates, while others express concerns about slow claims processing.

In which states is Deerbrook Insurance available, and how can customers obtain a quote?

Deerbrook Insurance is available in select states, including Alabama, Arizona, Arkansas, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, Nevada, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, and Wisconsin. Customers can obtain a quote online or by calling a customer service representative.

What discounts does Deerbrook Insurance Company offer, and how can customers qualify for them?

Deerbrook Insurance Company provides various discounts, including safe driver discounts, multiple vehicle discounts, anti-theft device discounts, and good student discounts. Eligibility requirements may vary by state, and customers can contact Deerbrook to learn more about specific discounts they may qualify for.a

How can I file a claim with Deerbrook?

To file a claim with Deerbrook, you can call their toll-free claims hotline or file a claim online through their website. You will need to provide details about the incident and any relevant documentation.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.