Continental Insurance Company: Customer Ratings & Reviews [2026]

Dedicated to being your trusted insurance partner, Continental Insurance Company offers unparalleled protection and comprehensive coverage plans with competitive pricing, extensive availability, and a commitment to customer satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated April 2024

Continental Insurance Company, we are dedicated to being your trusted insurance partner. With our comprehensive coverage options, competitive pricing, extensive coverage availability, and commitment to customer satisfaction, we are here to provide you with the peace of mind you deserve.

Contact us today to learn more about our insurance solutions and experience the Continental Insurance Company difference!

What You Should Know About Continental Insurance

Company Contact Information:

Phone: 1-800-555-1234 Email: info@continentalinsurance.com Website: www.continentalinsurance.com

Related Parent or Child Companies:

Parent Company: Continental Holdings Group Child Companies: No information about related parent and child companies.

Financial Ratings:

A.M. Best Rating: A+ Moody’s Rating: A1 Standard & Poor’s Rating: AA

Customer Service Ratings:

JD Power Customer Satisfaction Rating: 4 out of 5 stars Better Business Bureau (BBB) Rating: A+

Claims Information:

Claims Process: Online claims submission or via phone 24/7 Claims Assistance: Yes Average Claims Processing Time: 7-10 business days Claims Satisfaction Rating: 4.5 out of 5 stars based on customer reviews

Company Apps:

Mobile app, available for download on iOS and Android devices Features: Policy management, claims submission, bill payment, digital ID card, roadside assistance, and more User Ratings: 4.6 out of 5 stars on App Store, 4.5 out of 5 stars on Google Play based on customer reviews

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Continental Insurance Coverage Options

Continental Insurance Company provides a range of coverage options to suit the needs of their customers. Here are some of the coverage options offered:

- Auto Insurance: Coverage for personal and commercial vehicles, including liability, collision, comprehensive, uninsured/underinsured motorist, and more.

- Home Insurance: Coverage for homeowners, renters, and landlords, including dwelling coverage, personal property coverage, liability, additional living expenses, and more.

- Motorcycle Insurance: Coverage for motorcycles, mopeds, scooters, and ATVs, including liability, collision, comprehensive, medical payments, and more.

- Boat Insurance: Coverage for boats, yachts, and personal watercraft, including liability, physical damage, medical payments, and more.

- RV Insurance: Coverage for motorhomes, travel trailers, and campers, including liability, collision, comprehensive, medical payments, and more.

- Umbrella Insurance: Additional liability coverage that extends beyond the limits of your primary policies, providing extra protection.

- Business Insurance: Coverage for small businesses, including general liability, property coverage, commercial auto, workers’ compensation, and more.

- Life Insurance: Coverage to protect your loved ones financially in the event of your passing, including term life, whole life, universal life, and more.

Please note that coverage options may vary by location and policy type. Contact Continental Insurance Company directly to discuss your specific insurance needs and the coverage options available to you.

Read more:

- Continental Insurance Company Review

- Continental Assurance Company: Customer Ratings & Reviews

- Continental Casualty Company: Customer Ratings & Reviews

- Continental General Insurance Company: Customer Ratings & Reviews

- Continental Indemnity Company: Customer Ratings & Reviews

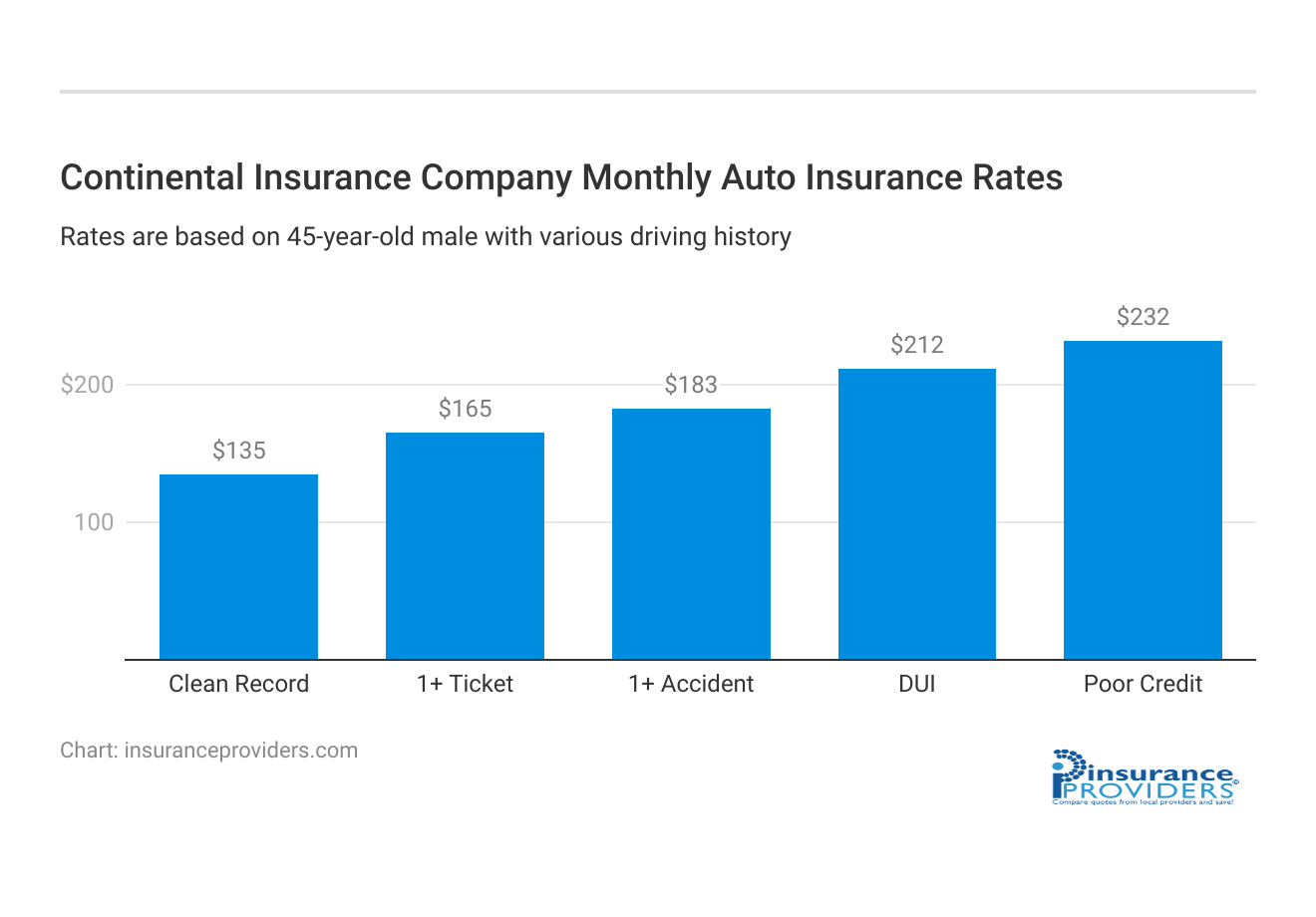

Continental Insurance Rates Breakdown

| Driver Profile | Continental Insurance Company | National Average |

|---|---|---|

| Clean Record | $135 | $119 |

| 1+ Ticket | $165 | $147 |

| 1+ Accident | $183 | $173 |

| DUI | $212 | $209 |

| Poor Credit | $232 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Continental Insurance Discounts Available

| Discount | Continental Insurance Company |

|---|---|

| Anti Theft | 20% |

| Good Student | 18% |

| Low Mileage | 20% |

| Paperless | 9% |

| Safe Driver | 20% |

| Senior Driver | 12% |

Continental Insurance Company values its customers and offers various discounts to help them save on their premiums. Here are some of the discounts available:

- Multi-Policy Discount: Save when you bundle multiple policies, such as home and auto insurance, with Continental Insurance Company.

- Safe Driver Discount: Earn discounts for maintaining a clean driving record with no accidents or violations.

- Good Student Discount: Students with good grades may qualify for discounted rates on their auto insurance.

- Anti-Theft Discount: If your vehicle is equipped with an anti-theft device, you may be eligible for a discount on your insurance.

- Mature Driver Discount: Older drivers who complete a defensive driving course may qualify for discounted rates.

- Loyalty Discount: Customers who have been insured with Continental Insurance Company for a certain number of years may be eligible for a loyalty discount.

- Payment Discounts: Save by choosing to pay your premium in full or setting up automatic payments.

Please note that discounts may vary by location and policy type, and eligibility requirements may apply. Contact Continental Insurance Company directly to learn more about the specific discounts available and how you can qualify for them.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Continental Insurance Ranks Among Providers

Continental Insurance Company operates in a highly competitive insurance industry, with several main competitors vying for market share. Some of the company’s main competitors include:

- Allstate: A well-known insurance company offering a wide range of coverage options, including auto, home, renters, motorcycles, boats, and more. Allstate is known for its extensive advertising and nationwide presence.

- State Farm: One of the largest insurance companies in the United States, offering auto, home, renters, motorcycle, boat, and more. State Farm is known for its strong agent network and personalized service.

- Geico: A prominent insurance company known for its competitive rates and online-focused approach. Geico offers auto, motorcycle, RV, and more, and is known for its humorous advertising campaigns.

- Progressive: Another major insurance company with a strong online presence, offering auto, home, renters, motorcycles, boats, and more. Progressive is known for its Snapshot program that rewards safe driving.

- Farmers Insurance: A widely recognized insurance company offering auto, home, renters, businesses, and more. Farmers Insurance is known for its comprehensive coverage options and localized approach with its agent network.

These are just a few of the main competitors of Continental Insurance Company, and the insurance industry is constantly evolving with new entrants and changing market dynamics. It’s important to research and compare different insurance companies to find the one that best meets your specific insurance needs and budget.

Frequently Asked Questions

Is Continental Insurance Company a reputable choice for insurance?

Yes, Continental Insurance Company is a trusted insurance partner known for offering comprehensive coverage options, competitive pricing, and a commitment to customer satisfaction. With an A+ rating from A.M. Best and positive customer reviews, it stands as a reputable choice for insurance needs.

What are the financial ratings of Continental Insurance Company?

Continental Insurance Company holds an A+ rating from A.M. Best, an A1 rating from Moody’s, and an AA rating from Standard & Poor’s. These ratings reflect the company’s financial stability and its ability to meet its financial obligations.

What coverage options does Continental Insurance Company provide?

Continental Insurance Company provides a range of coverage options, including home, auto, health, and life insurance. They offer comprehensive coverage plans tailored to meet the specific needs of their customers.

What discounts are available from Continental Insurance Company?

Continental Insurance Company offers various discounts to eligible customers, such as multi-policy discounts, safe driver discounts, and good student discounts. The availability of discounts and eligibility criteria may vary, so it’s advisable to contact the company directly for specific details.

How can I contact Continental Insurance Company for customer service or claims assistance?

You can reach Continental Insurance Company for customer service or claims assistance through their customer service hotline, email, or online chat on their official website. The contact information can be found on their website or policy documents.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.