Old Reliable Casualty Company: Customer Ratings & Reviews [2026]

Old Reliable Casualty Company stands as a stalwart in the insurance industry, offering a diverse array of coverage options and substantial discounts, making it a go-to choice for individuals seeking reliable protection for life's pivotal moments.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated April 2024

Old Reliable Casualty Company is a trusted name in the insurance industry, with a commitment to providing comprehensive coverage options and generous discounts. Their products include auto, home, business, and life insurance, with rates averaging $1,200 for a 45-year-old male driver with a clean record.

The company has a low complaint level and high customer satisfaction ratings, with positive reviews highlighting their competitive rates and attentive customer service.

However, their availability may be limited in certain states, and rates may be higher for high-risk drivers or those with poor credit history. Overall, Old Reliable Casualty Company is a reliable and customer-focused insurance provider worth considering for your insurance needs.

Old Reliable Casualty Company Insurance Coverage Options

Old Reliable Casualty Company provides a range of coverage options to meet the needs of their customers. These include:

- Auto insurance: Liability coverage, collision coverage, comprehensive coverage, personal injury protection, uninsured/underinsured motorist coverage, roadside assistance, and rental car coverage.

- Home insurance: Coverage for the structure of the home, personal property, liability, and additional living expenses.

- Business insurance: General liability insurance, commercial property insurance, commercial auto insurance, workers’ compensation insurance, and business interruption insurance.

- Life insurance: Term life insurance, whole life insurance, and universal life insurance.

Old Reliable Casualty Company offers a range of coverage options that can be customized to meet the unique needs of each customer. Their comprehensive coverage options give customers peace of mind knowing that they are protected from potential risks and losses

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Old Reliable Casualty Company Insurance Rates Breakdown

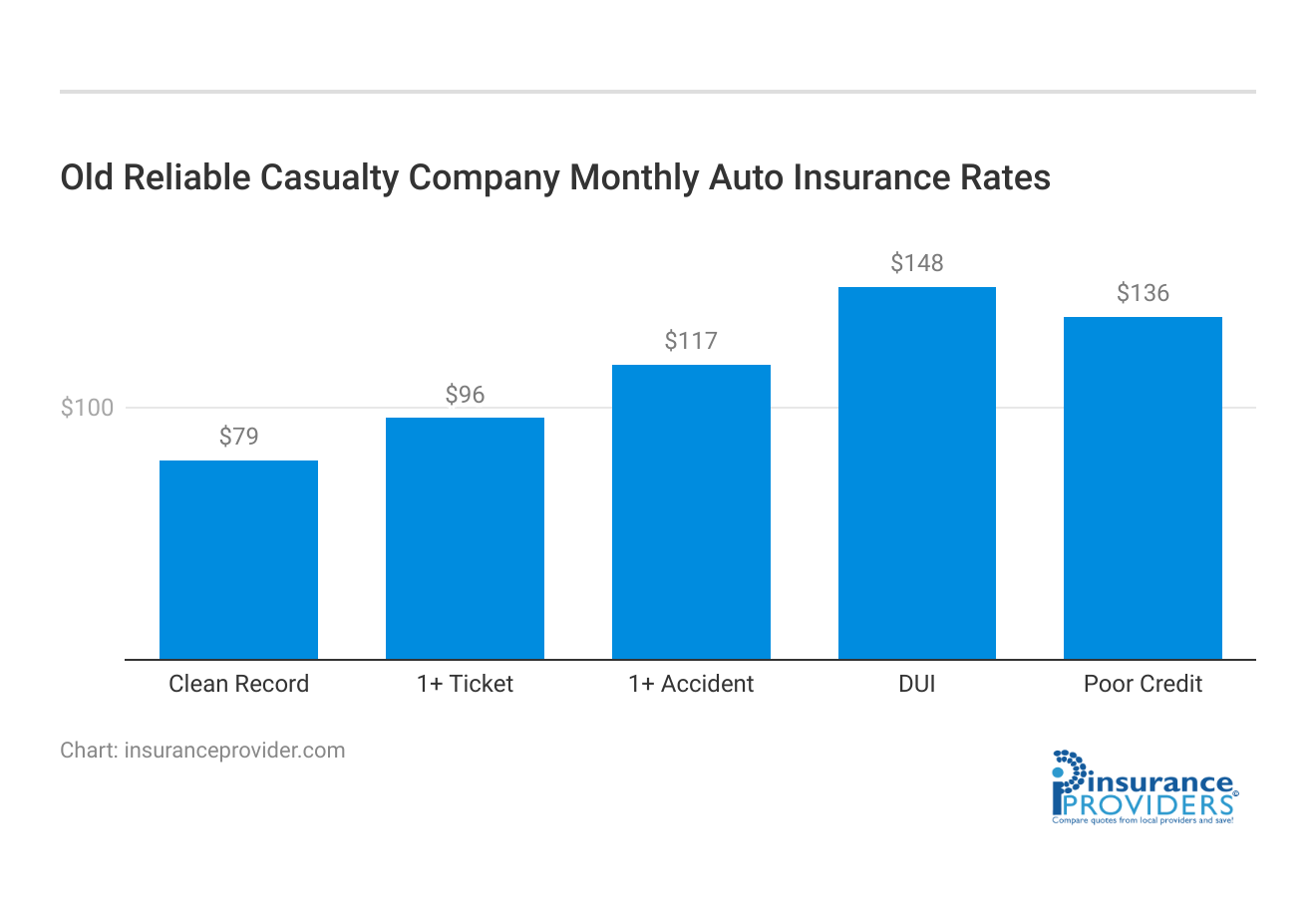

| Driver Profile | Old Reliable Casualty | National Average |

|---|---|---|

| Clean Record | $79 | $119 |

| 1+ Ticket | $96 | $147 |

| 1+ Accident | $117 | $173 |

| DUI | $148 | $209 |

| Poor Credit | $136 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Old Reliable Casualty Company Discounts Available

| Discounts | Old Reliable Casualty |

|---|---|

| Anti Theft | 13% |

| Good Student | 14% |

| Low Mileage | 13% |

| Paperless | 11% |

| Safe Driver | 22% |

| Senior Driver | 16% |

Old Reliable Casualty Company offers a variety of discounts to help customers save money on their insurance premiums. These include:

- Safe driving discount: Customers who maintain a safe driving record with no accidents or traffic violations can qualify for a discount.

- Multiple policy discount: Customers who have more than one policy with Old Reliable Casualty Company, such as home and auto insurance, can qualify for a discount.

- Military discount: Active-duty military personnel and veterans may be eligible for a discount on their insurance premiums.

- Anti-theft device discount: Customers who have anti-theft devices installed in their vehicles can qualify for a discount.

- Good student discount: Students who maintain good grades in school can qualify for a discount on their auto insurance premiums.

- Bundling discount: Customers who bundle multiple types of insurance, such as home and auto insurance, with Old Reliable Casualty Company can qualify for a discount.

These discounts can add up to significant savings for customers and make Old Reliable Casualty Company a competitive option in the insurance marketplace.

How Old Reliable Casualty Company Ranks Among Providers

Here are the following are some of the main competitors of Old Reliable Casualty Company in the insurance industry:

- State Farm: State Farm is one of the largest insurance companies in the United States and offers a wide range of insurance products, including auto, home, life, and business insurance. They are known for their extensive network of agents and high-quality customer service.

- Geico: Geico is a major player in the auto insurance industry and offers coverage in all 50 states. They are known for their affordable rates and user-friendly online platform.

- Allstate: Allstate is a well-known insurance company that offers a range of products, including auto, home, and life insurance. They are known for their comprehensive coverage options and excellent customer service.

- Progressive: Progressive is another major player in the auto insurance industry and is known for their innovative approach to insurance, including their Snapshot program which rewards safe driving behavior.

- Nationwide: Nationwide is a large insurance company that offers a range of insurance products, including auto, home, and life insurance. They are known for their strong financial ratings and comprehensive coverage options.

These companies are some of the main competitors of Old Reliable Casualty Company in the insurance industry. While each company has its strengths and weaknesses, they all offer similar types of insurance products and compete for customers in the same market.

Read more: Reliable Life Insurance Company: Customer Ratings & Reviews

Frequently Asked Questions

What types of insurance does Old Reliable Casualty Company offer?

Old Reliable Casualty Company offers a range of insurance products, including auto, home, business, and life insurance.

What states does Old Reliable Casualty Company offer coverage in?

Old Reliable Casualty Company offers coverage in multiple states. For a complete list of states where their services are available, you can contact the company directly or visit their website.

What types of discounts does Old Reliable Casualty Company offer?

Old Reliable Casualty Company offers a range of discounts to help customers save money on their insurance premiums. Some of the discounts they offer include safe driving discounts, multi-policy discounts, and discounts for paying your premium in full.

How can I file a claim with Old Reliable Casualty Company?

To file a claim with Old Reliable Casualty Company, you can call their claims department directly or file a claim online through their website. You will need to provide information about the incident, including the date, time, and location, as well as any relevant details and documentation.

What is the financial rating of Old Reliable Casualty Company?

Old Reliable Casualty Company has a financial rating of A- (Excellent) from A.M. Best, which indicates that they have a strong financial outlook and are able to meet their obligations to policyholders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.