Good Samaritan Life Insurance Company: Customer Ratings & Reviews [2025]

Explore the comprehensive coverage options offered by Good Samaritan Life Insurance Company, a trusted provider committed to safeguarding individuals and families from life's unexpected moments, with competitive rates and flexible payment choices available nationwide.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated April 2024

Good Samaritan Life Insurance Company is a reliable and trusted provider of life insurance for individuals and families, offering competitive rates and flexible payment options for term life insurance policies.

With coverage available in all 50 states, the company has a low complaint level and positive customer reviews for its customer service. While they have limited policy options compared to larger insurance companies, their mission is to help protect their clients’ financial future with comprehensive life insurance policies that meet their specific needs.

In this article, we explored the history, products, customer reviews, and more of Good Samaritan Life Insurance Company to provide readers with a comprehensive overview of the company and its services.

Good Samaritan Life Insurance Company Insurance Coverage Options

Good Samaritan Life Insurance Company offers a range of coverage options to meet the needs of individuals and families. Here are the coverage options available:

- Term life insurance: Provides coverage for a specific period of time, typically 10, 20, or 30 years. Premiums remain level during the term of the policy, and beneficiaries receive a death benefit if the insured passes away during that time.

- Whole life insurance: Provides lifelong coverage and includes a savings component that can grow over time. Premiums are typically higher than term life insurance, but the policy builds cash value that can be borrowed against or used to pay premiums.

- Universal life insurance: Offers flexible premiums and the ability to adjust coverage amounts over time. The policy builds cash value that can be used to pay premiums, and beneficiaries receive a death benefit if the insured passes away.

- Final expense insurance: Also known as burial insurance, provides a smaller death benefit to cover final expenses, such as funeral costs and medical bills. Premiums are typically lower than other types of life insurance.

Good Samaritan Life Insurance Company also offers riders that can be added to policies to provide additional coverage, such as accidental death or disability coverage. It’s important to speak with a representative to determine which type of coverage is best for your individual needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Good Samaritan Life Insurance Company Insurance Rates Breakdown

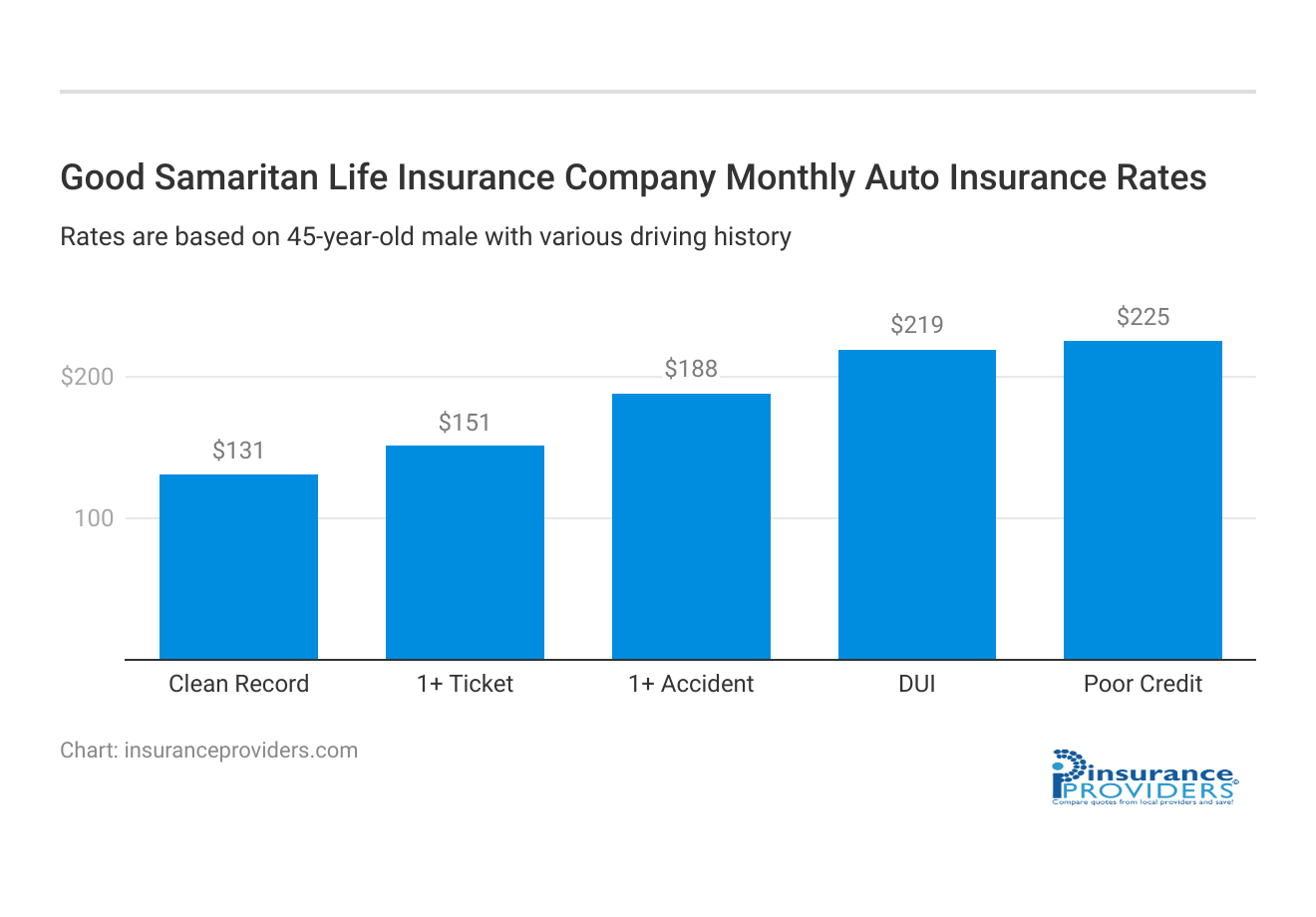

| Driver Profile | Good Samaritan Life Insurance Company | National Average |

|---|---|---|

| Clean Record | $131 | $119 |

| 1+ Ticket | $151 | $147 |

| 1+ Accident | $188 | $173 |

| DUI | $219 | $209 |

| Poor Credit | $225 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Good Samaritan Life Insurance Company Discounts Available

| Discount | Good Samaritan Life Insurance Company |

|---|---|

| Anti Theft | 15% |

| Good Student | 10% |

| Low Mileage | 13% |

| Paperless | 7% |

| Safe Driver | 20% |

| Senior Driver | 14% |

Good Samaritan Life Insurance Company rewards its customers with various discounts, providing opportunities to save on life insurance premiums. These discounts are designed to cater to different preferences and circumstances, ensuring that policyholders can secure reliable coverage while enjoying cost-effective solutions.

- Bundle Discount: Save on premiums by bundling multiple insurance policies with Good Samaritan Life Insurance Company.

- Non-Smoker Discount: Enjoy reduced rates if you’re a non-smoker, promoting a healthier lifestyle.

- Good Driving Record Discount: Benefit from lower premiums by maintaining a positive driving record.

Good Samaritan Life Insurance Company goes beyond offering quality coverage; it rewards responsible choices and healthy habits. By taking advantage of these discounts, policyholders not only protect their financial future but also enjoy the added advantage of affordable and customizable life insurance solutions.

How Good Samaritan Life Insurance Company Ranks Among Providers

Good Samaritan Life Insurance Company operates in a competitive industry, with several other companies offering similar products and services. Here are some of the main competitors of Good Samaritan Life Insurance Company:

- State Farm: One of the largest insurance companies in the US, State Farm offers a range of life insurance products, including term, whole, and universal life insurance.

- Allstate: Another large insurance company, Allstate offers term, whole, and universal life insurance, as well as other insurance products, such as auto and home insurance.

- Nationwide: Offers term, whole, and universal life insurance, as well as other insurance products, such as auto and home insurance.

- New York Life: Specializes in whole life insurance, as well as other financial products, such as retirement planning and investments.

These are just a few of the main competitors of Good Samaritan Life Insurance Company. Each company has its own strengths and weaknesses, and it’s important to compare coverage options and pricing to determine which company is the best fit for your individual needs.

Read more: Allstate Life Insurance Company of New York: Customer Ratings & Reviews

Frequently Asked Questions

What types of life insurance does Good Samaritan Life Insurance Company offer?

Good Samaritan Life Insurance Company offers term life, whole life, and universal life insurance.

Can I customize my life insurance policy with Good Samaritan Life Insurance Company?

Yes, Good Samaritan Life Insurance Company offers several riders and endorsements that can be added to your policy for additional coverage and customization.

How can I make a claim with Good Samaritan Life Insurance Company?

You can make a claim with Good Samaritan Life Insurance Company by calling their claims department or by submitting a claim online through their website.

Does Good Samaritan Life Insurance Company offer any discounts?

Yes, Good Samaritan Life Insurance Company offers several discounts, such as a discount for bundling multiple policies, a discount for being a non-smoker, and a discount for having a good driving record.

How can I access customer ratings and reviews for Good Samaritan Life Insurance Company?

To access customer ratings and reviews for Good Samaritan Life Insurance Company, you can visit reputable review websites such as Trustpilot, ConsumerAffairs, or the Better Business Bureau. These platforms often provide insights from actual customers who have shared their experiences with the company.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.