Will auto insurance pay for electrical repairs?

Car insurance does cover electrical problems in many scenarios. If your electrical problems were caused by an accident, collision coverage will pay for damages, and if they were caused by a weather-related event, comprehensive will cover it. Car insurance does not usually cover wear and tear.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2024

- Modern cars have complex electrical systems that are easily damaged, but damage can be hard to detect

- As long as you have the right policy, your car insurance will cover most electrical problems

- Car insurance doesn’t cover normal wear and tear, so it’s essential to keep your engine maintained

Facing an electrical problem in your car can be a nightmare. From your overhead light to the computer system that tells your car how to drive, electrical problems can affect nearly every part of your vehicle.

It’s especially frustrating when problems seem to pop out of nowhere. Electrical issues in your car rarely wave a red flag to let you know they’re coming — one minute your car is fine, and the next, you’re on the way to the mechanic.

Drivers facing an issue in their vehicle usually wonder if car insurance covers electrical problems. The good news is that your policy covers most types of damage as long as you have the right coverage.

The damage also needs to be sudden or unexpected, meaning your electrical problem can’t be from normal wear on your car.

Learn more about which types of coverage protect your vehicle from electrical damage below. Then, compare prices with as many insurance companies as possible to find the best rates.

If you are concerned for your car’s safety and want better auto insurance, compare at least three to four policies today! Enter your ZIP code above to begin!

Does car insurance cover electrical problems?

Modern cars have more electrical parts than ever before. From backup cameras to safety features that prevent you from hitting another driver, newer cars have a lot of computing power.

The electrical system also includes the battery, starter, alternator, and all the wires that feed your lights, radio, and anything else that needs electricity.

With the increasing number of parts that go into it, many things can damage your electrical system. From car accidents to normal wear and tear, keeping your car’s electrical system safe can be a tough job.

The good news is that your car insurance often covers problems in the electrical system. All you need are the right types of coverage in your car insurance policy.

There are five primary types of car insurance, which cover different kinds of damage. To understand what you need in case of an electrical issue, you should know what each insurance covers.

- Liability. Liability coverage helps pay for damage you cause in an accident, both to people and their property. Most states require a minimum amount of liability coverage before you can legally drive.

- Collision. This optional coverage helps pay for damage to your car in an accident, even if you are at fault.

- Comprehensive. There are many things that can damage your car other than an accident. Comprehensive insurance helps repair your vehicle after damage from an unpredictable event.

- Uninsured/underinsured motorist. If you’re involved in an accident with a driver who doesn’t have insurance, you’ll be stuck with the repair bill. This coverage will help repair your car if you are involved in an accident with an uninsured driver.

- Personal injury protection. Medical bills get expensive after an accident, but personal injury protection helps pay for medical expenses, physical therapy, and lost wages.

While there are many add-ons you can buy for a car insurance policy, these are the primary forms of coverage. Electrical damage caused by an event covered in any of the above policies will be covered.

When does collision insurance cover electrical damage?

As stated above, collision insurance helps pay for damage to your car after an accident. Collision insurance covers accidents involving other drivers and stationary objects (like trees). It doesn’t matter who is at fault — collision insurance will help you with repairs no matter what.

Read more: Does my Auto Insurance cover other drivers of my car?

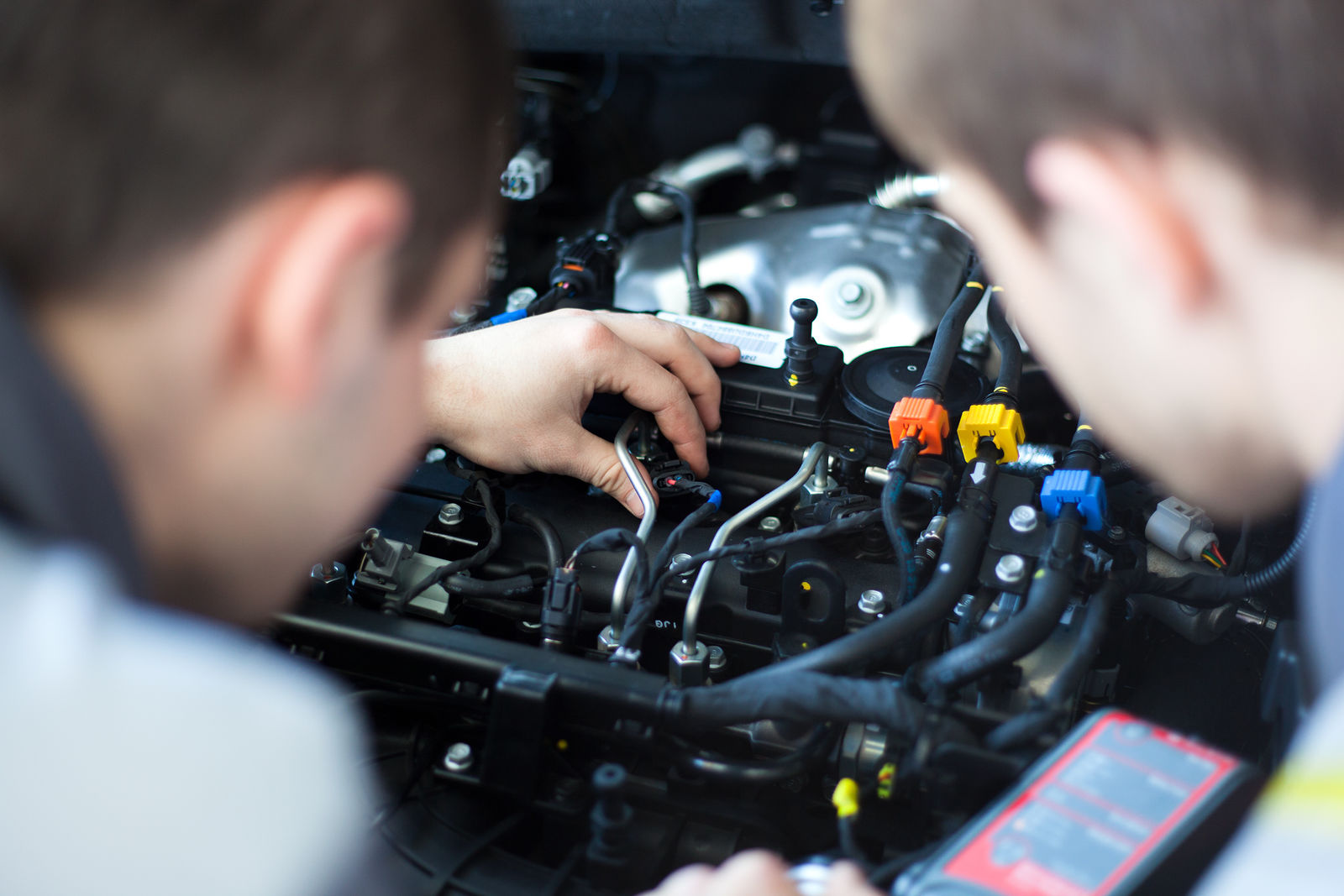

Today’s cars have complex electrical systems easily damaged after a collision. Unfortunately, electrical problems don’t always immediately present themselves. After an accident, you should have your car examined by a mechanic to ensure everything is still in working order.

If an accident causes damage to your electrical system, there are a few avenues that will help pay for repairs. Your collision policy will pay for repairs if you are at fault, while the other driver’s liability will cover you if they cause the accident.

Finally, if you have uninsured/underinsured motorist coverage and a driver with inadequate coverage hits you, your policy will make up the difference in the price of repairs.

When does comprehensive insurance cover electrical damage?

Comprehensive insurance covers unforeseen events. You’ll need to check with your insurance company to see what’s covered, but most comprehensive policies cover the following incidents:

- Hitting an animal

- Objects falling on your car, like a tree branch

- Extreme weather, including floods, tornadoes, hurricanes, and earthquakes

- Theft

- Vandalism

You can file an insurance claim for an electrical fault with comprehensive coverage if it was caused by one of the events listed above. For example, water can cause significant damage to electrical systems. If your car was partially submerged in a flood and some wires shorted out, comprehensive insurance would cover it.

Does car insurance cover electrical fires? Yes, an electrical fire in your car is covered by insurance under your comprehensive policy, if you have one. Comprehensive insurance typically treats spontaneous fires similarly to weather or flood damage.

What is mechanical breakdown insurance?

Mechanical breakdown insurance (MBI) is an add-on you can purchase for your primary policy. MBI covers mechanical issues in most systems of your car, including the following:

- Electrical system

- Exhaust

- Cooling and heating systems

- Brakes

- Steering

- Transmission

- Drivetrain

Finding a company that sells MBI can be difficult, and they aren’t permanent fixtures for your policy after you buy it. MBI is usually only renewable for a few years, and only newer cars are eligible. (For more information, read our “Understanding Mechanical Breakdown Insurance (MBI)“).

Another important thing to remember is that MBI doesn’t cover parts that need to be replaced periodically or routine maintenance like oil changes. It won’t cover electrical parts that degrade over time, but it will help if you have a sudden failure due to reasons not covered by your primary insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much does insurance for electrical damage cost?

Typically speaking, comprehensive insurance is cheaper than collision insurance. However, there are many factors that go into determining the price of your insurance. There’s no way of knowing exactly how much you’ll pay without a quote.

Full coverage typically includes liability, comprehensive, collision, and uninsured/underinsured coverage. It costs more to buy full coverage compared to the state minimum requirements, but it’s the only way you get protection for your electrical system.

You can get an idea of how much coverage might cost you by looking at the average monthly prices from some of the biggest car insurance companies.

Average Monthly Price of Car Insurance Coverage by Company

| Company | Minimum coverage | Full coverage |

| Geico | $30 | $102 |

| Travelers | $37 | $118 |

| Allstate | $54 | $166 |

| Nationwide | $45 | $111 |

| Farmers | $53 | $145 |

| American Family | $49 | $121 |

| State Farm | $39 | $115 |

| Progressive | $52 | $144 |

| USAA | $33 | $103 |

As you can see, the difference between the minimum and full coverage can be substantial. However, the additional coverage can save you thousands if you ever need to make a claim.

When does insurance not cover electrical damage?

Unfortunately, there are times when your car insurance won’t help cover electrical problems. Wear and tear like rust damage or worn brakes are not covered by car insurance, no matter what insurance policy you have.

Your car is subjected to stress every time you drive it, and that’s especially true for your sensitive electrical system. However, electrical problems don’t usually present themselves in an obvious way like other engine problems.

Sometimes your check engine light will come on, but you can’t rely on that because electrical damage could prevent it from lighting up. As your car gets older, it’s good to have your mechanic occasionally look everything over.

Electrical problems are common as a car ages and wires start breaking down. If you file a claim for electrical damage, the first thing an insurance adjuster will check is if the damage was caused by normal wear and tear.

However, you can still have protection for your electrical system through warranties. When you buy a car, you usually have the option to purchase an extended warranty that will cover the electrical parts of your vehicle for years.

Protect Your Car From Electrical Damage With the Right Insurance

Making an insurance claim for an electrical fault is easy when you have the right coverage. Whether the damage comes from an accident or an unexpected incident, collision or comprehensive coverage can protect your car.

If you want to find insurance that protects your car from electrical problems, comparing quotes from multiple companies is a great place to start. Shopping for full coverage quotes will also help you find the best rates possible.

Start comparison shopping today for better auto insurance rates by entering your ZIP code below!

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Auto Insurance Coverage for Electrical Repairs

Case Study 1: John’s Electric Car

John’s electric car experienced an electrical malfunction, but his comprehensive auto insurance covered the repairs, including fixing the wiring and replacing electrical components. His expenses were fully covered, allowing him to get his vehicle fixed without any financial burden.

Case Study 2: Sarah’s Hybrid Vehicle

Sarah’s hybrid vehicle had an electrical issue, but her comprehensive auto insurance covered the repairs, as per her policy. Her insurance provider agreed to pay for the electrical repairs, ensuring Sarah could have her hybrid vehicle fixed without any out-of-pocket expenses.

Case Study 3: Mark’s Conventional Car

Mark’s conventional car experienced an electrical problem caused by a faulty alternator. Despite contacting his auto insurance company, he discovered that his policy lacked comprehensive coverage, leaving him responsible for the repair expenses. As a result, Mark had to cover the entire cost of fixing the electrical issue in his car out of his own pocket.

Case Study 4: Lisa’s Classic Car

Lisa’s classic car had electrical issues, but her auto insurance policy included specific coverage for classic cars, which covered the repair costs. By reviewing her policy, Lisa found that the electrical repairs were covered, allowing her to have her classic car fixed without incurring any out-of-pocket expenses.

Case Study 5: Michael’s Rental Car

During his vacation, Michael faced an electrical issue with his rented car. Fortunately, the car rental company’s insurance policy included comprehensive coverage, which covered the electrical repairs, ensuring that Michael didn’t have to pay anything extra and could continue his trip smoothly.

Frequently Asked Questions

Does auto insurance cover electrical repairs?

In most cases, standard auto insurance policies do provide coverage for electrical repairs. However, coverage may vary depending on the specific policy and the circumstances surrounding the electrical issue.

What types of electrical repairs are typically covered by auto insurance?

Auto insurance policies generally cover electrical repairs resulting from covered perils such as accidents, fire, theft, vandalism, or natural disasters. These repairs may include fixing or replacing damaged wiring, electrical components, or systems within the vehicle.

Are there any limitations or exclusions for electrical repairs?

Yes, there can be limitations and exclusions for electrical repairs in auto insurance policies. Some common exclusions may include mechanical breakdowns or wear and tear. Additionally, coverage may be subject to deductibles, policy limits, and specific terms outlined in the insurance contract.

How can I determine if my auto insurance policy covers electrical repairs?

To determine if your policy covers electrical repairs, you should review your insurance policy documents or contact your insurance provider directly. They can provide specific information about your coverage, including any applicable deductibles or limitations.

What should I do if my vehicle requires electrical repairs?

If your vehicle requires electrical repairs, it is important to follow these steps:

- Contact your insurance provider: Inform them about the situation and ask about the coverage for electrical repairs.

- Document the damage: Take photographs or videos of the affected areas to support your insurance claim.

- Follow the claims process: Your insurance provider will guide you through the claims process, including providing necessary documentation and arranging for repairs.

- Seek professional repairs: Choose a reputable auto repair shop or a professional electrician to handle the electrical repairs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.