Maine Auto Insurance Guide [Providers + Coverage]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, Vitacost, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Comp...

Melissa Morris

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated March 2024

| Maine Statistics Summary | Details |

|---|---|

| Miles of Roadway | 22,911 |

| Number of Vehicles Registered | 1,049,337 |

| Population | 1,344,212 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Uninsured % | 4.5% of Motorists State Rank: 51 (includes DC) |

| Total Driving Related Deaths | Speeding: 42 DUI: 161 |

| Average Annual Premiums | Liability Avg Premium: $338.87 Collision Avg Premium: $259.98 Comprehensive Avg Premium: $104.98 |

| Cheapest Providers | USAA Geico |

An abundance of fresh lobster. The proud home state of renowned author Stephen King. Miles of epic rocky coastline with plenty of Instagram-worthy lighthouses.

These are just a few of the many things that make Maine the hidden gem of the United States.

Although the state is sometimes overlooked due to its smaller population, there are still over a million people that live in the Pine Tree State. Mainers, just like residents of other parts of the country, have to abide by the laws regulating the roads within the state’s borders.

If you’re proud to call this beautiful state home, do yourself a favor by keeping this comprehensive article handy. It contains everything you’ll ever need to know about affordable car insurance providers, state driving laws, and more.

You can even start shopping for car insurance right now by entering your ZIP code above if you’re in a hurry.

Maine Auto Insurance Rates

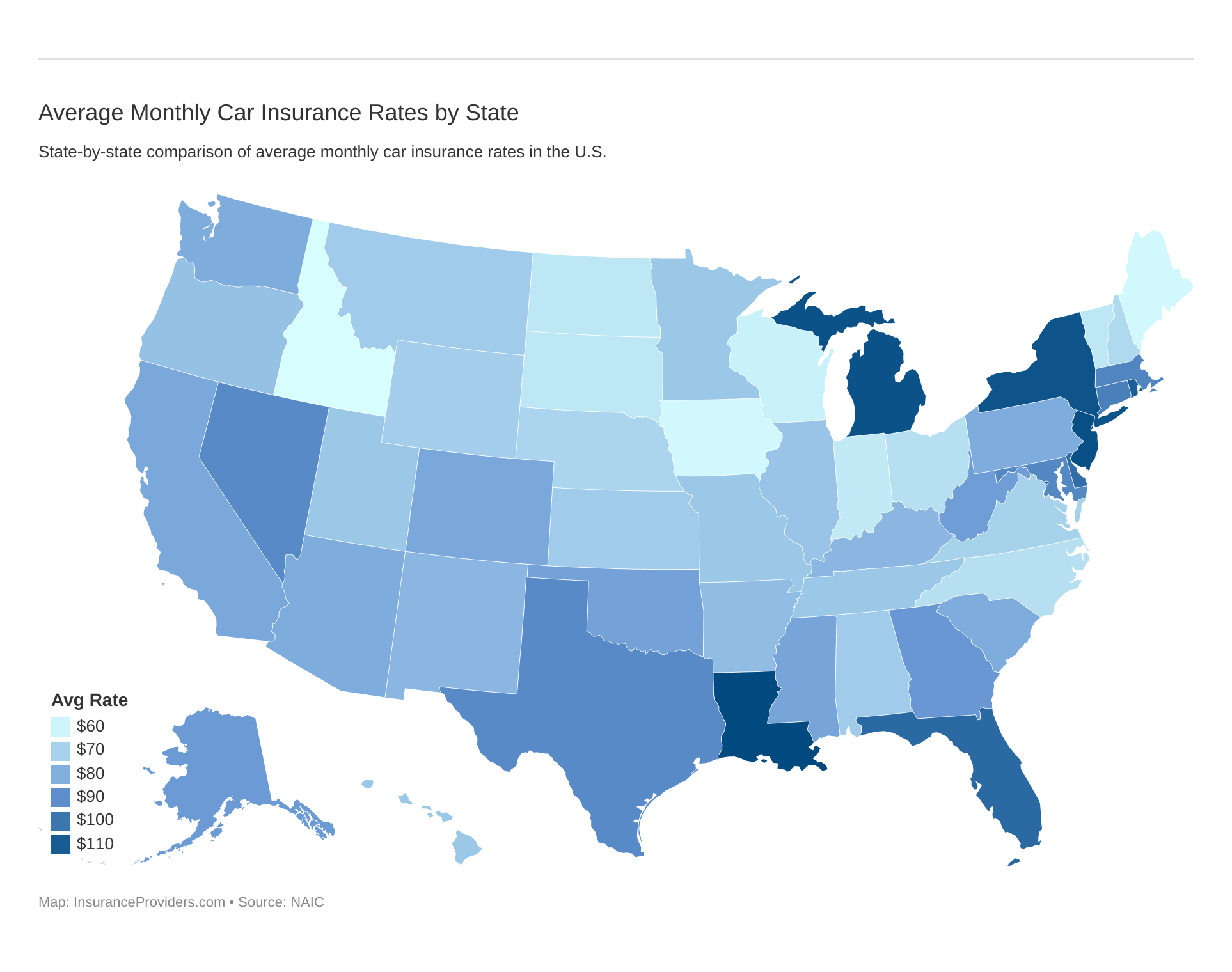

Mainers pay $805 on average in car insurance premiums a year, making it the most affordable state in the entire country for insurance rates. This is a full $506 cheaper than the national average of $1,311.

There are a number of factors that make the Pine Tree State the most affordable on average in the U.S. Some of these include the state’s car culture, the minimum insurance requirements that drivers must legally carry, and the demographics of its citizens.

The following section will examine these topics and more in detail so you can learn all about the average cost of car insurance in Maine.

How much coverage is required for Maine Minimum Coverage?

If you want to get out and enjoy the beautiful roads of Maine, you’re going to need auto insurance. The minimum amount of coverage you must have in order to drive legally in the state is as follows:

- $50,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $100,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 for property damage per accident caused by the owner/driver of the insured vehicle

Failure to carry the minimum coverage can result in a fine of $100 to $500, along with the possible suspension of your driver’s license and vehicle registration.

Read more: Auto Insurance FAQ

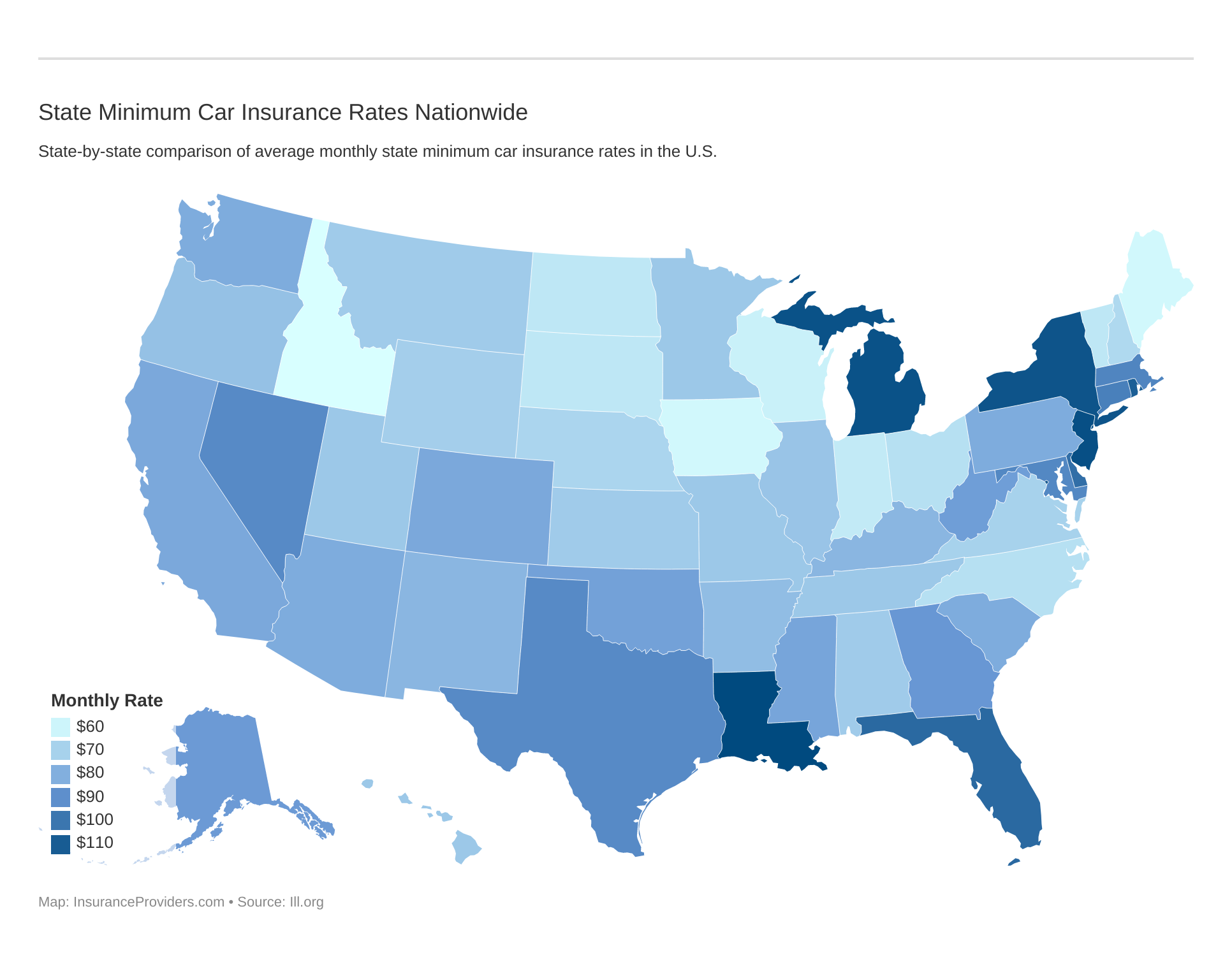

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

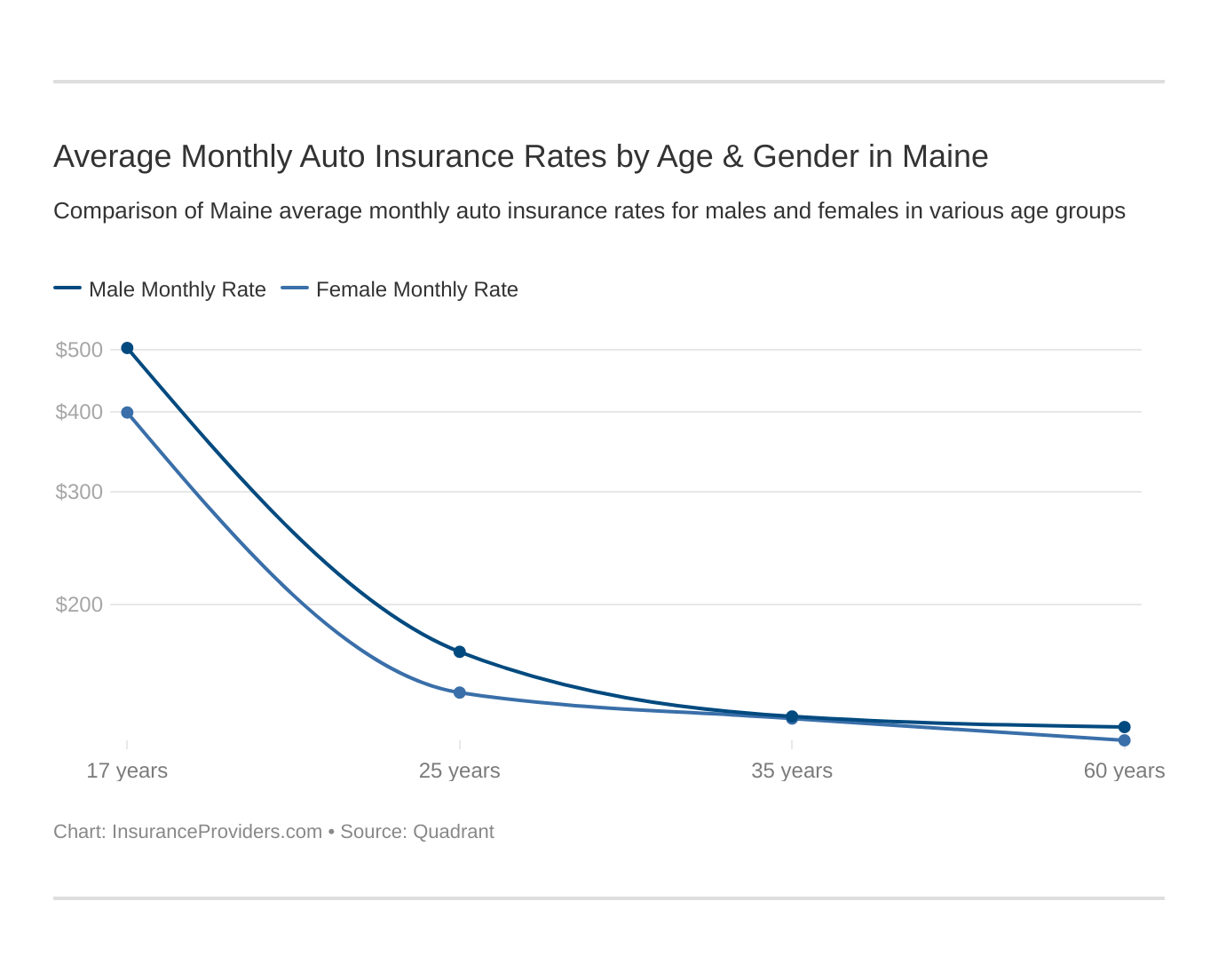

Does gender and age affect my car insurance in Maine?

While it may seem like an outdated concept given the current times, things like gender and age have a direct impact on car insurance premiums. For example, teenage males are considered to be riskier than their female counterparts in the eyes of insurance providers.

Gender and age will affect your auto insurance. Younger drivers are often in a higher risk class. See if the gender stereotype (males vs female car insurance rates) holds true in ME.

Take a look at the following table that shows a breakdown of what Mainers are paying for car insurance based on gender and age.

| Company | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $4,503.88 | $6,027.66 | $1,952.18 | $2,183.62 | $1,794.12 | $1,845.70 | $1,611.55 | $1,747.46 |

| Bristol West | $5,376.87 | $5,969.29 | $2,002.79 | $2,075.88 | $1,705.76 | $1,722.32 | $1,596.13 | $1,716.53 |

| Geico | $2,470.70 | $3,213.99 | $1,108.71 | $1,184.65 | $1,016.66 | $1,053.15 | $1,016.66 | $1,016.66 |

| Liberty Mutual | $6,336.04 | $9,480.14 | $2,984.27 | $4,201.37 | $2,984.27 | $2,984.27 | $2,841.84 | $2,841.84 |

| Progressive | $7,945.51 | $8,930.09 | $2,221.50 | $2,512.75 | $1,905.85 | $1,868.00 | $1,905.85 | $1,868.00 |

| State Farm | $4,189.75 | $5,224.15 | $1,465.85 | $1,605.41 | $1,313.61 | $1,313.61 | $1,238.91 | $1,238.91 |

| Travelers | $4,689.11 | $6,340.02 | $1,157.44 | $1,336.27 | $1,165.23 | $1,207.33 | $1,055.86 | $1,080.39 |

| USAA | $2,838.93 | $3,134.30 | $1,104.67 | $1,162.18 | $868.52 | $857.16 | $863.42 | $844.46 |

Going back to our example about teenagers, you can see from the data that 17-year-old males pay $6,039.96 when you average the numbers compared to $4,793.85 for 17-year-old females.

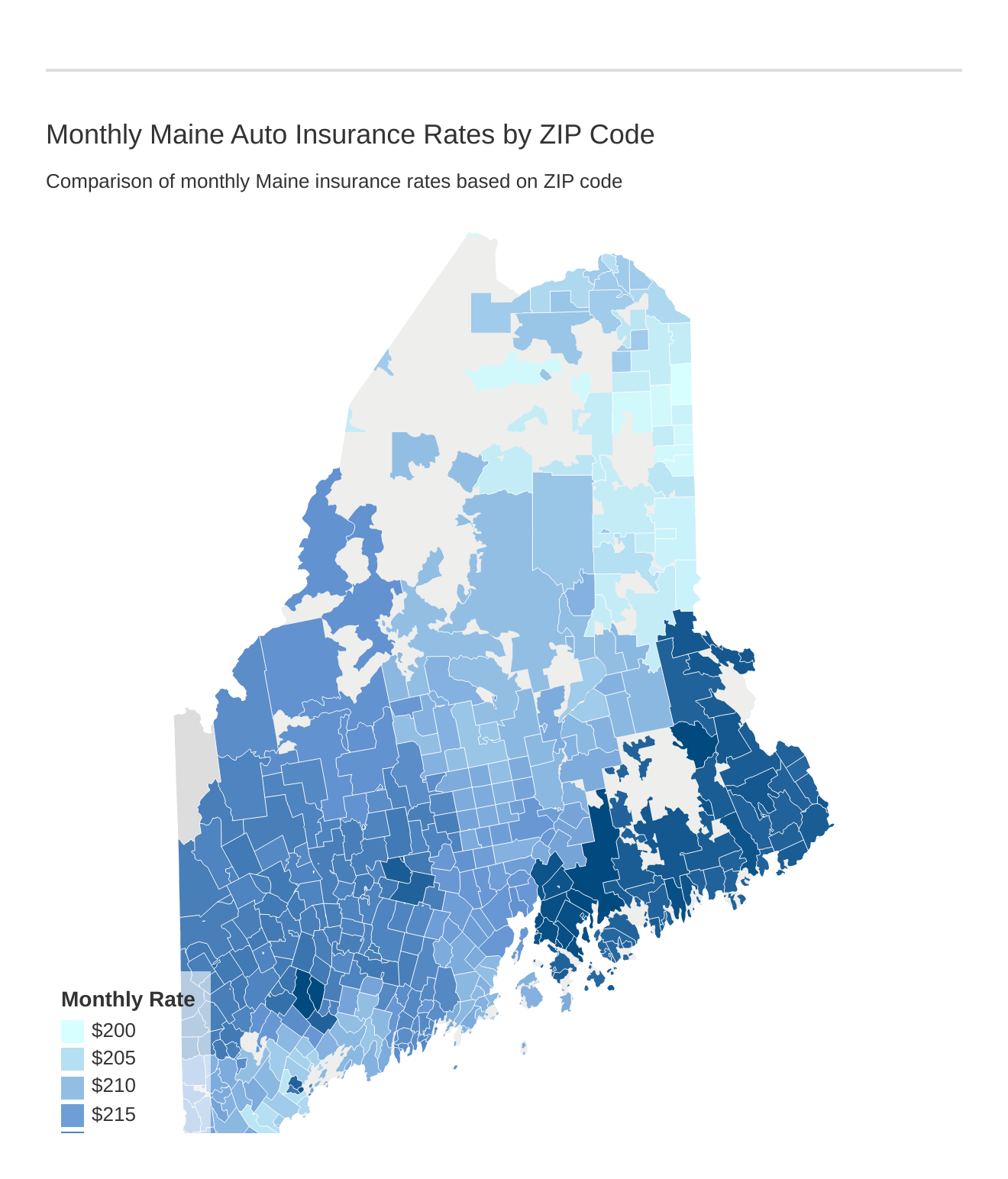

What are the cheapest rates by ZIP code in Maine?

Another factor that determines your car insurance rate is where you live within the Pine Tree State. Are you a proud Portlander that some people would consider a Downeaster? Or maybe you live further up I-95 in the North Maine Woods.

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in ME.

Regardless of what part of the state you choose to reside in, some ZIP codes are more affordable than others. The following table will show you the 25 cheapest areas in Maine.

| City | ZIP Code | Average | Allstate | Bristol West | Geico | Liberty Mutual | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Ashland | 04732 | $2,435.63 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,078.18 | $2,186.66 | $1,361.37 |

| Benedicta | 04733 | $2,438.16 | $2,665.39 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,081.80 | $2,125.98 | $1,361.37 |

| Blaine | 04734 | $2,409.12 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,102.15 | $1,950.54 | $1,361.37 |

| Bridgewater | 04735 | $2,412.81 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,131.70 | $1,950.54 | $1,361.37 |

| Caribou | 04736 | $2,432.72 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,129.61 | $2,111.94 | $1,361.37 |

| Crouseville | 04738 | $2,442.42 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,132.43 | $2,186.66 | $1,361.37 |

| Easton | 04740 | $2,427.24 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,080.00 | $2,117.71 | $1,361.37 |

| Estcourt Station | 04741 | $2,413.66 | $2,588.13 | $2,513.42 | $1,448.09 | $4,166.28 | $3,181.74 | $2,132.43 | $1,917.81 | $1,361.37 |

| Fort Fairfield | 04742 | $2,403.90 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,080.00 | $1,930.94 | $1,361.37 |

| Houlton | 04730 | $2,425.97 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,191.25 | $1,996.24 | $1,361.37 |

| Limestone | 04750 | $2,430.01 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,102.15 | $2,117.71 | $1,361.37 |

| Mapleton | 04757 | $2,407.26 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,078.18 | $1,959.64 | $1,361.37 |

| Mars Hill | 04758 | $2,409.12 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,102.15 | $1,950.54 | $1,361.37 |

| Monticello | 04760 | $2,442.05 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,166.54 | $2,149.65 | $1,361.37 |

| New Limerick | 04761 | $2,418.61 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,132.43 | $1,996.24 | $1,361.37 |

| Oakfield | 04763 | $2,433.46 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,150.00 | $2,097.43 | $1,361.37 |

| Orient | 04471 | $2,421.98 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,159.34 | $1,996.24 | $1,361.37 |

| Oxbow | 04764 | $2,442.42 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,132.43 | $2,186.66 | $1,361.37 |

| Portage | 04768 | $2,408.81 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,132.43 | $1,917.81 | $1,361.37 |

| Presque Isle | 04769 | $2,410.18 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,078.18 | $1,983.05 | $1,361.37 |

| Sherman | 04776 | $2,431.27 | $2,653.70 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,083.71 | $2,080.65 | $1,361.37 |

| Smyrna Mills | 04780 | $2,439.76 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,148.22 | $2,149.65 | $1,361.37 |

| Washburn | 04786 | $2,432.28 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,080.00 | $2,158.01 | $1,361.37 |

| Westfield | 04787 | $2,439.55 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,132.43 | $2,163.74 | $1,361.37 |

| Wytopitlock | 04497 | $2,437.65 | $2,588.13 | $2,513.42 | $1,409.30 | $4,166.28 | $3,181.74 | $2,091.12 | $2,189.81 | $1,361.37 |

Now that we know which parts of the state are the most affordable, this next table will show you the 25 most expensive areas in Maine starting with the 04684 area of Surry, which tops the list with the highest average rate.

| City | ZIP Code | Average | Allstate | Bristol West | Geico | Liberty Mutual | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Auburn | 4210 | $2,782.70 | $2,789.16 | $3,479.32 | $1,431.46 | $4,549.27 | $3,793.09 | $2,169.61 | $2,456.10 | $1,593.62 |

| Blue Hill | 4614 | $2,769.32 | $2,836.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,102.38 | $2,195.63 | $1,551.43 |

| Brooklin | 4616 | $2,776.95 | $2,834.70 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,113.61 | $2,247.09 | $1,551.43 |

| Brooksville | 4617 | $2,773.50 | $2,834.70 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,085.85 | $2,247.29 | $1,551.43 |

| Brookton | 4413 | $2,752.46 | $2,588.13 | $3,020.57 | $1,499.95 | $4,495.96 | $4,148.39 | $2,257.86 | $2,453.20 | $1,555.59 |

| Bucksport | 4416 | $2,763.59 | $2,796.88 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,080.25 | $2,240.39 | $1,522.47 |

| Castine | 4421 | $2,775.46 | $2,836.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,085.85 | $2,261.33 | $1,551.43 |

| Danville | 4223 | $2,785.73 | $2,789.16 | $3,479.32 | $1,431.46 | $4,371.49 | $3,793.09 | $2,294.98 | $2,702.92 | $1,423.45 |

| East Blue Hill | 4629 | $2,759.66 | $2,836.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,081.35 | $2,195.63 | $1,495.22 |

| Ellsworth | 4605 | $2,781.49 | $2,806.38 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,115.41 | $2,436.20 | $1,425.16 |

| Frenchboro | 4635 | $2,753.68 | $2,806.38 | $3,178.04 | $1,499.95 | $4,467.58 | $4,112.97 | $2,093.22 | $2,319.86 | $1,551.43 |

| Grand Lake Stream | 4637 | $2,781.85 | $2,588.13 | $3,020.57 | $1,499.95 | $4,495.96 | $4,148.39 | $2,243.29 | $2,702.92 | $1,555.59 |

| Harborside | 4642 | $2,763.80 | $2,804.58 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,081.35 | $2,204.33 | $1,551.43 |

| Hulls Cove | 4644 | $2,753.11 | $2,588.13 | $3,020.57 | $1,499.95 | $4,467.58 | $4,112.97 | $2,081.35 | $2,702.92 | $1,551.43 |

| Isle Of Springs | 4549 | $2,766.13 | $2,595.20 | $2,769.40 | $1,651.09 | $4,265.96 | $4,958.71 | $2,294.98 | $2,170.23 | $1,423.45 |

| Lewiston | 4240 | $2,782.26 | $2,783.25 | $3,479.32 | $1,431.46 | $4,549.27 | $3,793.09 | $2,169.61 | $2,458.45 | $1,593.62 |

| Machias | 4654 | $2,758.71 | $2,588.13 | $3,020.57 | $1,499.95 | $4,495.96 | $4,148.39 | $2,295.32 | $2,465.76 | $1,555.59 |

| Milbridge | 4658 | $2,764.99 | $2,806.38 | $3,020.57 | $1,499.95 | $4,495.96 | $4,148.39 | $2,267.50 | $2,325.58 | $1,555.59 |

| Orland | 4472 | $2,758.59 | $2,790.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,080.25 | $2,206.92 | $1,522.47 |

| Penobscot | 4476 | $2,775.91 | $2,836.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,113.11 | $2,237.62 | $1,551.43 |

| Portland | 4101 | $2,754.12 | $2,674.58 | $3,261.84 | $1,548.54 | $4,475.38 | $3,597.14 | $2,430.69 | $2,575.46 | $1,469.33 |

| Sargentville | 4673 | $2,770.24 | $2,804.58 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,081.35 | $2,255.81 | $1,551.43 |

| Sedgwick | 4676 | $2,768.44 | $2,834.70 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,113.61 | $2,179.00 | $1,551.43 |

| Steuben | 4680 | $2,777.95 | $2,806.38 | $3,020.57 | $1,499.95 | $4,495.96 | $4,148.39 | $2,272.25 | $2,424.54 | $1,555.59 |

| Surry | 4684 | $2,785.77 | $2,836.36 | $3,178.04 | $1,537.88 | $4,467.58 | $4,285.24 | $2,121.86 | $2,336.75 | $1,522.47 |

As you can see from the data, the change in premiums isn’t all that great from most expensive to least expensive ZIP code. The difference between 04684 (most expensive) and 04742 (cheapest ZIP code) is a grand total of $381.87.

Read more: Bristol West Auto Insurance Review

What are the cheapest rates by city in Maine?

For a more general idea of car insurance rates by geographical location, we can examine what Mainers pay on average by city. This next table will show you the 25 cities of Maine that have the most affordable auto insurance plans on average.

| City | Average ME Auto Insurance Rates by City |

|---|---|

| Biddeford | $1,337.42 |

| Biddeford Pool | $1,337.42 |

| Chebeague Island | $1,313.92 |

| Cliff Island | $1,313.92 |

| Cumberland Center | $1,313.92 |

| Cumberland Foreside | $1,313.92 |

| Cumberland Foreside | $1,355.56 |

| Falmouth | $1,313.92 |

| Gorham | $1,313.92 |

| Gorham | $1,355.56 |

| Gray | $1,313.92 |

| Gray | $1,355.56 |

| Long Island | $1,313.92 |

| Long Island | $1,355.56 |

| North Bridgton | $1,313.92 |

| North Yarmouth | $1,313.92 |

| North Yarmouth | $1,355.56 |

| Ocean Park | $1,337.42 |

| Old Orchard Beach | $1,337.42 |

| Peaks Island | $1,313.92 |

| Peaks Island | $1,355.56 |

| Saco | $1,337.42 |

| Westbrook | $1,356.82 |

| Windham | $1,313.92 |

| Yarmouth | $1,313.92 |

Comparatively speaking, people who live in Maine’s more expensive cities end up paying a great deal more than the cities listed above. You can see this for yourself by examining the cities within the Pine Tree State that pay the most for auto insurance.

| City | Average ME Auto Insurance Rates by City |

|---|---|

| Addison | $4,495.96 |

| Auburn | $4,549.27 |

| Baileyville | $4,495.96 |

| Beals | $4,495.96 |

| Brookton | $4,495.96 |

| Calais | $4,495.96 |

| Cherryfield | $4,495.96 |

| Columbia Falls | $4,495.96 |

| Cutler | $4,495.96 |

| Danforth | $4,495.96 |

| Dennysville | $4,495.96 |

| East Machias | $4,495.96 |

| Eastport | $4,495.96 |

| Fairfield | $4,855.22 |

| Grand Lake Stream | $4,495.96 |

| Harrington | $4,495.96 |

| Isle Of Springs | $4,958.71 |

| Jonesboro | $4,495.96 |

| Jonesport | $4,495.96 |

| Lambert Lake | $4,495.96 |

| Lewiston | $4,549.27 |

| Lubec | $4,495.96 |

| Machias | $4,495.96 |

| Machiasport | $4,495.96 |

| Waterville | $4,855.22 |

The difference between Isle Springs (most expensive) and Chebeague Island (cheapest) is a total of $3,644.79.

What are forms of financial responsibility in Maine?

State law declares that the driver of a vehicle must be able to show proof of insurance at all times. The most commonly accepted way to prove this to a police officer during a traffic stop is by showing forms of financial responsibility.

Forms that prove an operator of a vehicle is financially responsible include a paper or electronic copy of an insurance policy.

Any driver who is unable to produce a form that proves they are financially responsible for their vehicle and any damage it causes is in violation of Maine’s insurance laws.

More information about forms that prove financial responsibility can be found within Maine’s Revised Statutes Title 29-A section 1601.

How much percentage of income are premiums in Maine?

With the lowest average premium in the country, Mainers don’t have to allocate a high percentage of their income towards auto insurance. In fact, the average resident of Maine pays only 1.86 percent of their total income for premiums, which is lower than the national average of 2.29 percent.

Take a look at the following table that shows a three-year trend of this ratio in Maine.

| Year | Full Coverage | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| 2014 | $689.12 | $37,049 | 1.86% |

| 2013 | $674.94 | $35,588 | 1.90% |

| 2012 | $667.66 | $35,993 | 1.85% |

These percentages can change a lot since everybody has different policies and income levels.

Is your percentage lower, higher, or on par with the rest of the state? Depending on the answer, you can use this information as bragging rights with your neighbors, or an opportunity to consider a new policy if you’re paying too much.

Average Monthly Car Insurance Rates in ME (Liability, Collision, Comprehensive)

Now that you know about minimum insurance requirements in Maine, you might be interested to know about core coverages. These policies give drivers added protection from a variety of different incidents.

The four most common types of core coverages in Maine are liability, collision, comprehensive, and combined (sometimes referred to as full coverage).

Take a look at the following table that outlines a five-year trend of what Mainers have been paying for each. This data comes directly from the National Association of Insurance Commissioners (NAIC).

| Coverage Type | 2015 | 2014 | 2013 | 2012 | 2011 | Average |

|---|---|---|---|---|---|---|

| Liability | $338.87 | $336.70 | $333.69 | $332.07 | $328.25 | $333.92 |

| Collision | $259.98 | $255.07 | $245.85 | $241.00 | $243.08 | $249.00 |

| Comprehensive | $104.98 | $97.35 | $95.40 | $94.60 | $90.95 | $96.66 |

| Combined (Full) | $703.82 | $689.12 | $674.94 | $667.66 | $662.28 | $679.56 |

After reviewing this data, it’s important to keep in mind that the information provided by the NAIC is based on the state minimum in Maine. Therefore, it is entirely possible that your policy will look a little different based on what you go with.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

What additional liability is available in Maine?

Let’s say you’re interested in having a low-price policy but don’t feel it necessary to look into collision, comprehensive, or full coverage. If this is the case, you can explore additional liability insurance. This will protect you from personal injuries, medical payments, and uninsured drivers.

Luckily for us, Maine has the least amount of uninsured drivers in the country at a clip of 4.5 percent. But it still doesn’t hurt to be cautious.

Three of the most popular forms of additional liability insurance include Personal Injury Protection (PIP), MedPay, and Uninsured Motorist Coverage.

- Personal Injury Protection is a form of no-fault coverage that will cover your own medical expenses in the event of an accident.

- MedPay is reserved for covering the costs of medical expenses for everyone in your vehicle in the event of an accident.

- Uninsured Motorist Coverage is a security blanket that will keep you protected should you be involved in an accident with an at-fault driver who does not have any liability coverage. This will also keep you protected if the offending driver’s insurance is too minimal to cover any medical expenses you might have.

So what happens when an accident occurs and you file a claim with your own insurance provider? Depending on the nature of the accident, you will be in good shape as long as your provider has a healthy loss ratio.

In the insurance industry, a company’s loss ratio is the difference between how much money they take in from customers as premiums against how much they spend on claims. Generally speaking, a loss ratio between 60-70 is considered to be favorable.

When shopping for car insurance with the intention of having additional liability, it’s a good idea to research the provider’s loss ratio before making a decision.

What add-ons, endorsements, and riders are available in Maine?

Beyond additional liability insurance, car owners in Maine are free to explore even more coverage for their policies in the form of add-ons, endorsements, and riders. Some of these extra programs include the following:

- Guaranteed Auto Protection (GAP) — Often referred to by the acronym GAP, this form of insurance takes care of any difference in what you might owe following an accident. For example, GAP insurance will cover the difference between what you owe on your car lease or loan and the real-time value of the car after a fender bender or even a major crash.

- Personal Umbrella Policy (PUP) — For an easy way to add an additional level of protection to your policy, consider a PUP to keep you safe from lawsuits that may result from an accident.

- Rental Reimbursement — If you need a rental car while your personal vehicle is in the shop for repairs, Rental Reimbursement will cover the cost.

- Emergency Roadside Assistance — This add-on will help you if your tire blows out, the engine overheats, or some other mishap occurs that leaves you stranded by the side of the road.

- Mechanical Breakdown Insurance — Anytime a mechanical failure occurs that didn’t result from an accident, Mechanical Breakdown Insurance will cover it.

- Non-Owner Car Insurance — If you don’t own or lease your own vehicle but still drive on occasion, this add-on will provide you with limited liability coverage.

- Modified Car Insurance Coverage — There are plenty of cars on the road that have been modified, and if you are the type that likes to customize your ride, this policy will cover the cost of those modifications in the event of an accident.

- Collector Car Insurance — Vintage cars are special, and that’s why this additional form of insurance is a good idea to consider if you drive a classic car.

- Pay-As-You-Drive, aka Usage-Based Insurance — A lot of drivers have switched over to usage-based coverage and pay per mile or however much you drive. This is a good option for people who don’t drive as often and are interested in saving money on their policy.

Do any of the preceding add-ons, endorsements, and riders appeal to you? If so, talk to your insurance provider about including them in your policy. The more protection you have, the better off you’ll be if something goes awry while you’re on the road in the Pine Tree State.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Maine Car Insurance Companies

As you begin shopping for car insurance in Maine, you’ll want to have the state’s most credible providers on your radar. Even if you already have a good idea of which provider you plan to go with, it’s always a good idea to see how they compare against the competition.

In the following section, you’ll learn everything you need to know about the best car insurance providers in the Pine Tree State.

We’ve compiled data that outlines the state’s largest insurance providers, those that have the best ratings, and even those that have the most complaints. We’ll also cover details about rates so you can get a firm understanding of what you can expect to pay.

Keep reading to learn helpful information about the best car insurance companies in Maine.

What are the financial ratings of the largest car insurance companies in Maine?

In case you’re unfamiliar, AM Best is an American-based global credit agency that evaluates insurance companies across several industries. They grade auto insurance providers on a scale that closely resembles what you find in schools. For example, a D is considered extremely poor and A+ or A++ grades are very high.

Naturally, car insurance providers who maintain superior financial ratings are often seen as more favorable to customers because they have a stronger future outlook.

If you’re in the process of determining who your next insurance provider will be, it’s a good idea to consider their financial rating. Here’s how AM Best graded the largest providers in the Pine Tree State.

| Company | Financial Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm | A++ | $104,784 | 59.92% | 14.27% |

| Progressive | A+ | $102,508 | 64.69% | 13.96% |

| Geico | A++ | $75,421 | 68.30% | 10.27% |

| Liberty Mutual | A | $65,408 | 56.93% | 8.91% |

| Allstate | A+ | $53,971 | 55.75% | 7.35% |

| USAA | A++ | $33,024 | 66.39% | 4.50% |

| Metropolitan | A | $28,213 | 58.92% | 3.84% |

| Auto-Owners | A++ | $27,707 | 65.40% | 3.77% |

| Travelers | A++ | $26,877 | 60.98% | 3.66% |

| Hanover Insurance | A | $24,098 | 53.19% | 3.28% |

These ratings confirm that the state’s largest car insurance companies receive positive grades ranging from A to A++, which is great news for drivers in Maine.

Which car insurance companies have the best ratings in Maine?

It’s only natural to be interested in what current customers have to say about their insurance providers. This is why we read reviews online before deciding where to go out to eat or what brand of television to buy.

The same logic of doing the research before you buy holds true for auto insurance shoppers, and the best resource to turn to is J.D. Power.

In the world of auto insurance, J.D. Power collects service quality and customer satisfaction information from several providers. The agency then provides each company with a score and a rating of up to five stars.

Take a look at the following table that shows how J.D. Power rated car insurance companies in the state of Maine.

| Company | Rating | Power Circle Rating |

|---|---|---|

| Amica Mutual | 852 | 5 Stars |

| State Farm | 844 | 4 Stars |

| Geico | 836 | 4 Stars |

| Allstate | 830 | 4 Stars |

| Progressive | 825 | 3 Stars |

| Nationwide | 822 | 3 Stars |

| The Hanover | 817 | 3 Stars |

| Travelers | 810 | 2 Stars |

| Liberty Mutual | 808 | 2 Stars |

| MAPFRE | 807 | 2 Stars |

| Arbella | 802 | 2 Stars |

| Plymouth Rock | 801 | 2 Stars |

| Safeco | 801 | 2 Stars |

| Safety Insurance | 797 | 2 Stars |

| MetLife | 794 | 2 Stars |

| USAA | 898 | 5 Stars |

Read more: Amica Mutual Insurance Company Review

This is a great resource, especially if you’re trying to decide between two different providers. Check the J.D. Power scores of each before making your final decision.

Who is the cheapest car insurance company in Maine? Review the average auto insurance rates by company below:

Which car insurance companies have the most complaints in Maine?

The driving world is indeed a stressful one, especially if you get involved in an accident. When that happens, you want to know that your insurance provider will have your back.

Unfortunately, the auto insurance world is just as imperfect as the driving world. When a customer feels like they’ve been short-changed or wronged by their provider, it’s common to log a complaint.

As you can imagine, insurance providers receive a fair number of complaints, but some companies have a few more than others. Take a look at the following table that contains complaint ratio data from the NAIC.

| Company | Complaint Ratio |

|---|---|

| Allstate | 0.9 |

| Amica | 0 |

| Auto Club | 1.3 |

| Auto-Owners | 0.5 |

| Geico | 0.8 |

| Liberty Mutual | 1 |

| Metropolitan | 0.7 |

| Progressive | 0.8 |

| Quincy Mutual | 0.7 |

| State Farm | 1.3 |

| Travelers | 0.5 |

| USAA | 1 |

Read more:

These figures are low for all of the companies listed. This means that drivers in Maine don’t make a lot of complaints about the auto insurance providers, so they must be relatively happy with their service.

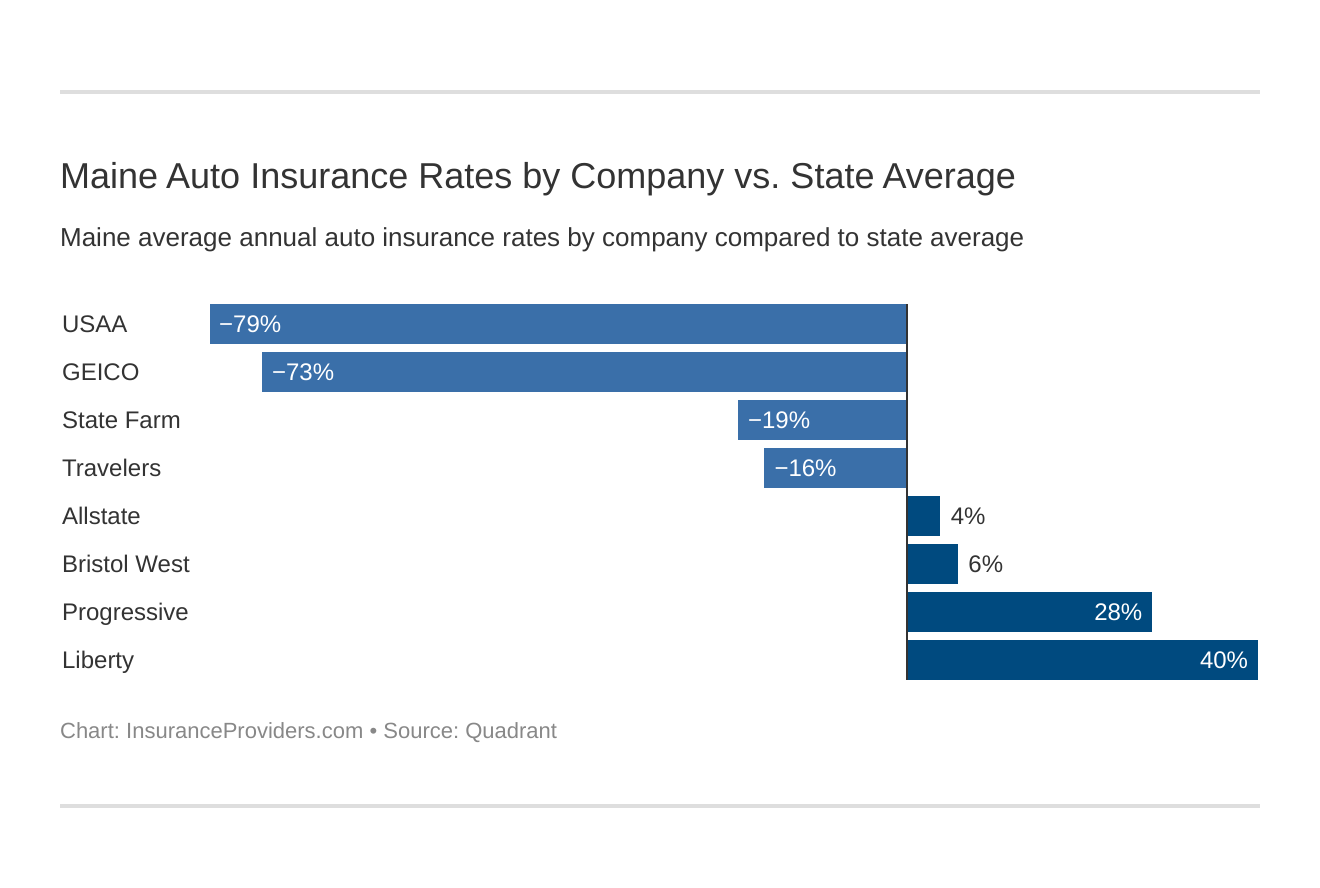

What are the cheapest car insurance companies in Maine?

When thinking about auto coverage, you don’t want to end up paying more than you have to. This can be a difficult thing to put a price on because you’re trying to place a value on something intangible.

Some people subscribe to the philosophy of “you get what you pay for.” And while that may be true in a lot of cases, there are still budget-friendly insurance options that will be there for you when you need them.

For instance, take a look at the following companies, which provide the cheapest options you can find in the state of Maine.

| Company | Average | Compared to State Average (Rate) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $2,708.27 | $98.58 | 3.64% |

| Bristol West | $2,770.70 | $161.01 | 5.81% |

| Geico | $1,510.15 | -$1,099.54 | -72.81% |

| Liberty Mutual | $4,331.75 | $1,722.07 | 39.75% |

| Progressive | $3,644.69 | $1,035.00 | 28.40% |

| State Farm | $2,198.78 | -$410.91 | -18.69% |

| Travelers | $2,253.96 | -$355.73 | -15.78% |

| USAA | $1,459.20 | -$1,150.48 | -78.84% |

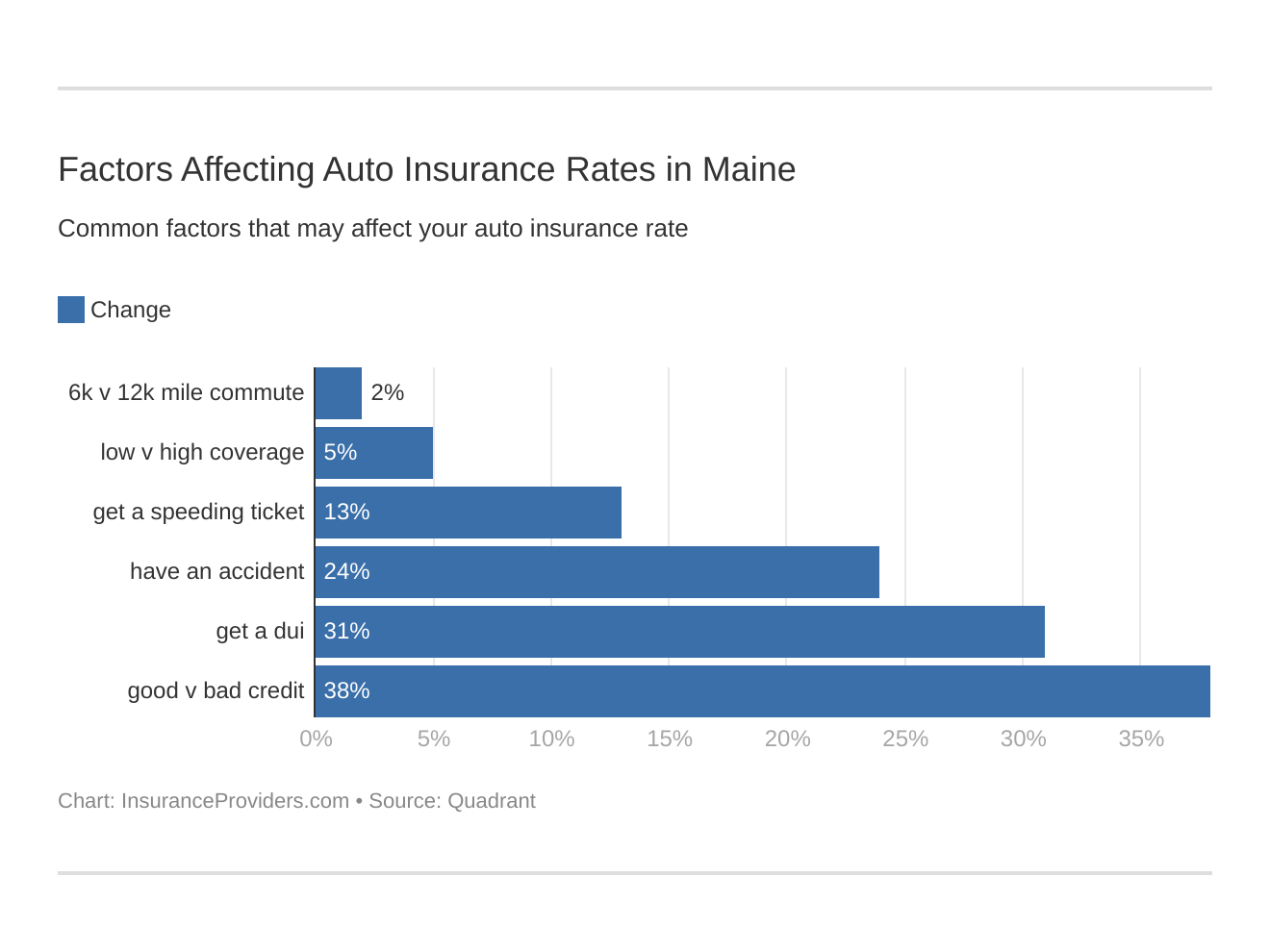

Does my commute affect my car insurance rate in Maine?

Insurance providers are interested in how long you drive for your daily commute because it helps them determine your rate.

The logic here is that if you’re on the road less, the chances of you getting into an accident are not as great. On the flip side of that coin, commuters who travel a long way back and forth each day expose themselves to the elements of the road much more, increasing their chances of getting into an accident.

The following table shows how your normal commuting patterns can impact how much you pay for car insurance in Maine.

| Company | 10-Mile Commute, 6000 Annual Mileage | 25-Mile Commute, 12000 Annual Mileage |

|---|---|---|

| Allstate | $2,708.27 | $2,708.27 |

| Farmers | $2,770.70 | $2,770.70 |

| Geico | $1,485.46 | $1,534.83 |

| Liberty Mutual | $4,242.69 | $4,420.82 |

| Progressive | $3,644.69 | $3,644.69 |

| State Farm | $2,126.96 | $2,270.59 |

| Travelers | $2,253.96 | $2,253.96 |

| USAA | $1,418.24 | $1,500.17 |

As you can see from the results, providers stay mostly consistent with rates, regardless of how far you have to drive for work. Even if your commute is a bit longer, the difference you have to pay is minimal.

Six major factors affect car insurance rates in Maine. Which auto insurance factors will affect rates the most? Find out below:

Can coverage level change my car insurance rate with companies in Maine?

When thinking about the level of coverage you want to get, you’ll see that the top companies have different rates available. The following table breaks down these rates from the lowest available coverage to the highest.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $2,673.88 | $2,674.94 | $2,775.99 |

| Farmers | $2,661.47 | $2,678.87 | $2,971.75 |

| Geico | $1,481.10 | $1,489.97 | $1,559.36 |

| Liberty Mutual | $4,280.23 | $4,280.23 | $4,434.80 |

| Progressive | $3,571.22 | $3,578.24 | $3,784.62 |

| State Farm | $2,143.52 | $2,176.08 | $2,276.74 |

| Travelers | $2,217.68 | $2,221.73 | $2,322.46 |

| USAA | $1,430.61 | $1,441.85 | $1,505.15 |

Liberty Mutual is the most expensive provider, with its cheapest option being $4,280.23. To put that into perspective, Progressive’s high coverage policy is almost $500 cheaper at $3,784.62.

An important thing to keep in mind is that the average across all of these policies comes to $2,609.87. Use this figure as a reference point as you take a second look at the data and consider what type of policy you’d like to get.

How does my credit history affect my car insurance rate with companies in Maine?

Have you checked your credit score recently? If you’re shopping for car insurance, it’s a wise idea to do so.

Insurance providers in Maine will take your score into account, and it will be a determining factor in your car insurance rate.

The following table provides examples of what Mainers are paying based on good, fair, or poor credit. Keep in mind that this is general data, and rates vary on an individual basis.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $2,127.24 | $2,593.20 | $3,404.37 |

| Farmers | $2,438.88 | $2,647.42 | $3,225.79 |

| Geico | $1,150.06 | $1,348.10 | $2,032.28 |

| Liberty Mutual | $3,056.31 | $3,907.95 | $6,031.00 |

| Progressive | $3,280.04 | $3,532.35 | $4,121.68 |

| State Farm | $1,481.04 | $1,912.93 | $3,202.36 |

| Travelers | $1,935.65 | $2,173.41 | $2,652.81 |

| USAA | $1,145.97 | $1,316.74 | $1,914.90 |

Liberty Mutual and State Farm seem to care more about credit scores, since their premiums vary the most from good to poor credit. The other six companies don’t seem to change their rates too much based on credit score.

How does my driving record change my rates with car insurance companies in Maine?

Auto insurance providers will also look at your driving record to make a decision as to whether or not they will cover you, and how much they will charge. They look at factors like how many traffic violations you have and the seriousness of each offense.

In short, the type of driver you are will have a direct impact on how much you pay for car insurance in Maine.

Here’s how the state’s biggest providers vary their car insurance rates for a driver with a clean report, one with a speeding ticket, and one with a DUI on their record.

| Company | Clean Record | One Speeding Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $2,210.22 | $2,498.06 | $2,997.10 | $3,127.70 |

| Farmers | $2,423.90 | $2,893.43 | $3,087.02 | $2,678.43 |

| Geico | $1,097.11 | $1,097.11 | $1,545.64 | $2,300.73 |

| Liberty Mutual | $3,344.21 | $3,633.30 | $3,922.40 | $6,427.11 |

| Progressive | $2,921.65 | $3,471.89 | $4,933.51 | $3,251.72 |

| State Farm | $1,995.95 | $2,198.77 | $2,401.62 | $2,198.77 |

| Travelers | $1,879.56 | $2,433.24 | $2,088.83 | $2,614.19 |

| USAA | $1,109.39 | $1,220.09 | $1,459.28 | $2,048.07 |

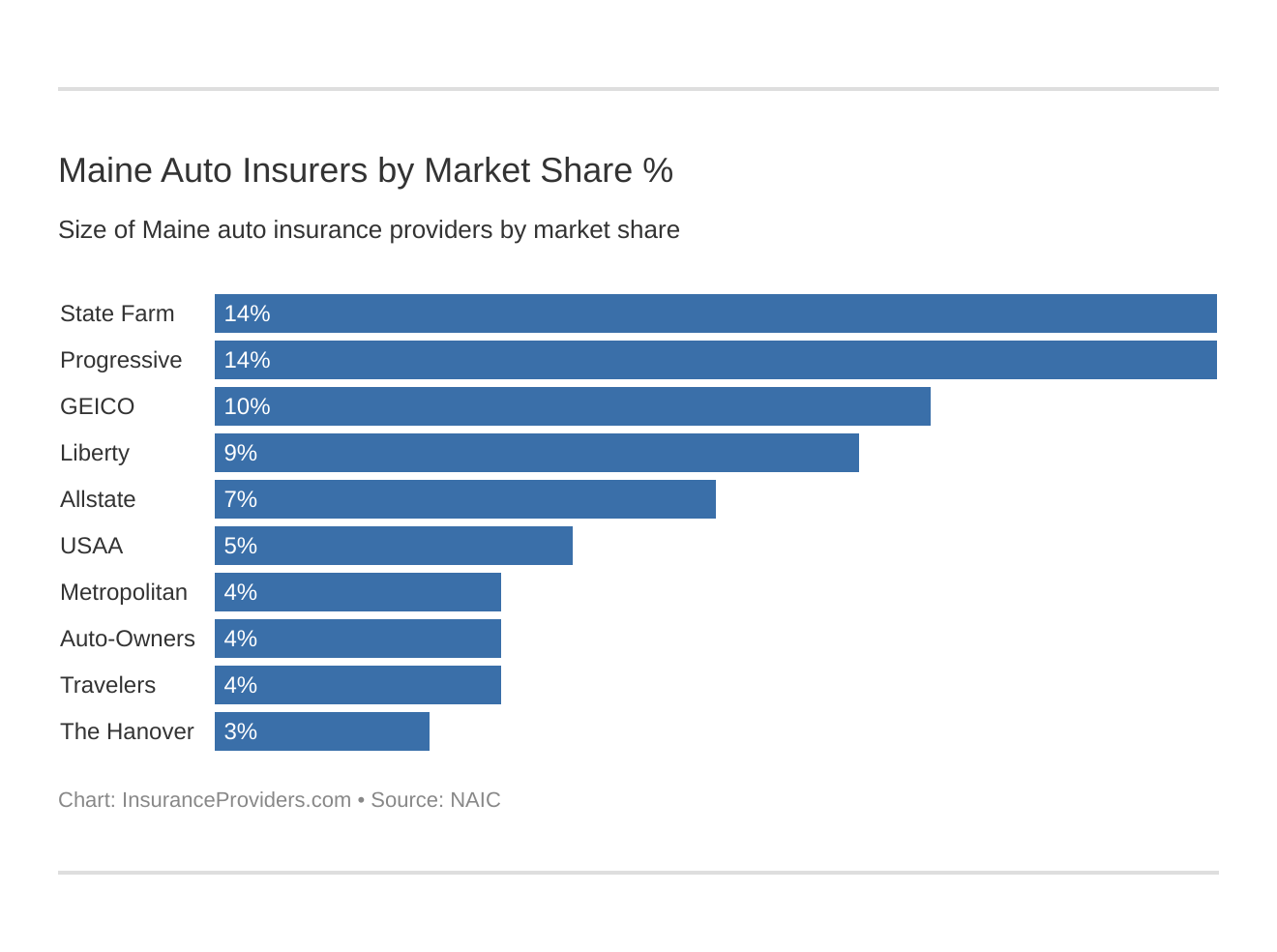

Which car insurance companies are the largest in Maine?

The top 10 providers in the state are always fighting to earn more customers and, in turn, receive a higher market share. Here’s how those percentages are broken up in the Pine Tree State.

| Company | Market Share |

|---|---|

| Allstate | 7.35% |

| Auto-Owners | 3.77% |

| Geico | 10.27% |

| The Hanover | 3.28% |

| Liberty Mutual | 8.91% |

| Metropolitan | 3.84% |

| Progressive | 13.96% |

| State Farm | 14.27% |

| Travelers | 3.66% |

| USAA | 4.50% |

State Farm tops the list, as they account for almost 15 percent of the market share in all of Maine.

The next biggest providers are Progressive and Geico, the only other two to eclipse a market share of over 10 percent.

Liberty Mutual, Allstate, USAA, Metropolitan, Auto-Owners, Travelers, and The Hanover all rank on the low end of this list. However, while their market shares may seem minuscule in comparison to the others, they still have enough to earn a spot on the top 10 list.

Who are the largest auto insurance companies in ME?

How many car insurance companies are available in Maine?

Maine has a total population of 1,344,212 people, according to the U.S. Census Bureau. Of those 1.3 million Mainers, there are nine insurance providers domestic to the state with an additional 696 foreign entities. In this context, foreign just means the company is based outside of the state. Residents of Maine are free to choose from any of these 705 companies.

For a little perspective, there is one provider for every 1,906 people who live in the state.

This ratio will fluctuate depending upon the state’s population and the number of new foreign providers that get licensed to sell insurance in the Pine Tree State. Nonetheless, it gives you an idea of how many options are available to the state’s residents.

Maine Laws

There are plenty of federal driving laws that apply to the entire country, such as driving on the right side of the road. But we often don’t stop to think that there are also driving laws on the state level that everybody must abide by, regardless of whether you live there or just happen to be passing through.

As a state the shares a border with Canada, Maine sees a lot of domestic and foreign traffic come through. And more often than not, troopers have to remind both native Mainers and visitors of the unique driving laws that apply to the Pine Tree State.

In order to adequately prepare you for a safe trip on the roads of Maine, this next section will cover the state laws in detail. After you’ve finished reading the information, you will have a clear understanding of the state’s car insurance laws, vehicle licensing laws, rules of the road, and safety laws.

What are the car insurance laws in Maine?

Maine’s traffic laws are subject to changes, and the same can be said for car insurance. One way you can see the current car insurance laws and required documents for the state is by visiting the Maine Bureau of Motor Vehicles website.

How State Laws for Insurance are Determined

Similar to the rest of the country, car insurance laws in the state of Maine are passed through a traditional legislative process.

Maine is also a file-and-use state, which means that insurance providers are able to use new rates prior to receiving formal approval.

The governing body that works to enforce the rules and regulations of the state’s insurance industry is called the Maine Bureau of Insurance. Mainers can utilize this arm of the state government to better understand the state laws pertaining to car insurance.

Windshield Coverage

Your car windshield plays a crucial role in keeping you safe on the road. If there’s a crack or damage to the glass that obstructs your view, you put yourself and others at risk. That’s why Maine has rules about having a proper windshield in order to drive.

For example, you are not allowed to drive if you have an obstructed view of the road caused by a crack in the glass that exceeds six inches in length.

Should you be in a situation where you need to get your windshield repaired, drivers are allowed to use aftermarket parts. If you decide that you want to replace the windshield with original equipment manufacturer (OEM) parts, insurers don’t have to cover it, so the difference in cost is on the driver.

Even though it’s a small state, Maine has plenty of options that will help you with your windshield, like this friendly company called Downeast Glass.

High-Risk Insurance

Your driving record will follow you for your entire life. Bad marks like speeding tickets, reckless driving, and traffic violations all point to a high-risk driver who will have a more difficult time finding an insurance provider.

If you’re considered a high-risk driver in Maine, you’re required to purchase something called SR-22 coverage.

SR-22 auto coverage is required for any driver who has been convicted of an OUI, has an excessive amount of points on their license, or has been cited by an officer for reckless driving.

In most cases, the high-risk driver must carry the SR-22 policy for the duration of their probation period, which is typically three years.

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Low-Cost Insurance

There are only three states in the country that have government-funded programs that help low-income households find affordable car insurance.

Maine does not have a state-run program to provide low-cost insurance options for lower-income individuals.

Therefore, the best way to find low-cost insurance in the Pine Tree State is by researching car insurance discounts. Generally, the best rates are available for applicants with a clean driving record and good credit history.

Automobile Insurance Fraud in Maine

According to the Insurance Information Institute, automobile insurance fraud is a deliberate deception perpetrated against or by an insurance company or agent for the purpose of financial gain.

Read more: State Automobile Mutual Insurance Company Review

This happens all over the country in different capacities, and Maine is no different.

In the event that a person or group of people commits automobile insurance fraud, the Maine State Police is responsible for enforcing the law, while local prosecutors handle fraud cases under the state’s penal code.

Insurers are required to report any fraudulent acts on a yearly basis in accordance with Title 24-A; Section 2186 of the state legislative law. The state can be reached with the following contact information:

Bureau of Insurance

76 Northern Avenue

Gardiner, Maine 04345

Phone: 207-624-8475

Complaint Form: https://www.maine.gov/pfr/insurance/complaint.html

Statute of Limitations

Simply put, a statute of limitations is the time limit a person or entity has to settle a claim or file a legal matter in order for the case to be heard in a court of law.

The statute of limitations in the state of Maine for both personal injury and property damage cases is six years. Compared to other states, Maine has a more liberal deadline, but it’s still generally a good idea to file your claims and lawsuits as soon as possible.

Maine-Specific Laws

When we first introduced this section of the article, we covered how there are both federal and state-specific laws.

One example of a Maine-specific law is that it’s illegal to drive when you are tired.

It’s also illegal to drive too slowly in the passing lane or watch a movie while driving. However, Maine has no law related to headphones or footwear, so it is perfectly legal to have AirPods in while driving barefoot (but that doesn’t mean you should).

What are the vehicle licensing laws in Maine?

Vehicle licensing laws are handled at the state level. They include the following concerns:

- REAL ID compliance

- Consequences for driving without insurance

- Teenage drivers

- Older drivers’ license renewal procedures

- Licenses for residents new to the state of Maine

- License renewal procedures

- Driving to Endanger (DTE)

This section will explore the most recent information about these vehicle licensing laws to keep you informed and legal on the roads of Maine.

REAL ID

Like most other states in the country, Maine is compliant with the REAL ID Act. That means a Maine driver’s license or identification card is accepted at the federal level, so the ID card alone is acceptable to gain access to federal facilities or board an airplane for a domestic flight.

Becoming a REAL ID-compliant state raised a lot of questions in the past couple of years, but most Mainers have gotten through it by now thanks to helpful communication from the Secretary of the State.

The most important thing to know is that Mainers can use their old IDs for the time being but must get a REAL ID by Oct. 1, 2020 in order to board planes or enter federal government facilities.

Penalties for Driving Without Insurance

Maine has strict penalties for drivers who get caught operating an automobile without proof of insurance.

A first-time offender will have to pay a fine between $100-$500 at the judge’s discretion. They will also have their license and registration suspended until the state’s minimum insurance coverage requirements are met.

These penalties aren’t worth the time and money they will cost you, which is why it’s a good idea to get covered right away.

Teen Driver Laws

Teenage drivers have to pass through two different stages of driving before they can be considered an unrestricted motorist in the state of Maine, according to the IIHS.

The first is called the “Learner Stage,” where a driver must be at least 15 years old and only operate a vehicle with a parent, guardian, grandparent, or driving instructor for a period of six months. Once the new driver reaches age 16, their learner’s permit is valid as long as they are operating the car with a licensed driver who is at least 21.

The driver must acquire a total of 70 hours minimum of supervised driving while they have their learner’s permit. At least 10 of those hours must be spent driving at night.

Once a teenager has moved onto the “Intermediate Stage,” they are allowed to drive unsupervised but cannot do so between the hours of midnight to 5 a.m. and cannot carry any passengers who are not family members.

The teen’s driving privileges become unrestricted once they reach their total number of driving hours and the age of 16 years and nine months old.

Older Driver License Renewal Procedures

Most states have special provisions for older drivers when it comes to renewing their driver’s licenses, and Maine is no different.

Mainers aged 65 and older are required to renew their driver’s licenses every four years, according to the IIHS.

Drivers who are 62 and older must pass a vision test every renewal and may not renew online or by mail.

New Residents

Newcomers to the Pine Tree State are officially considered Maine residents once they take a job, sign a lease, buy a home, or enroll children in school. At this point, new Mainers will have 30 days to apply for a state driver’s license and acquire a new state title and plates for their vehicle.

In order to make sure that everything goes smoothly at the Maine BMV when applying for your new driver’s license, you’ll need to take care of the following:

- Conversion of a CDL license must be processed by the Bureau of Motor Vehicles’ main office located on Hospital Street in Augusta.

- Provide proof of:

- Complete a vision screening. You may not be required to take a written and road test.

- Turn in your out-of-state license.

- Pay the exam and license fees (these fees differ by license class).

- If the name on your legal presence document is different than the name you currently have, you will need to provide supporting documents (i.e. marriage license, court order, divorce decree, etc.) to link the names together.

As a form of good practice, it’s best to bring more documentation with you than you might need, rather than showing up and realizing you’re missing something. If you’re in doubt about a certain form, bring it with you just in case.

License renewal procedures

Most drivers are required to renew their licenses every six years. Renewing your license in the state of Maine is a fairly straightforward process. A vision test is required for the first renewal after age 40 and then every other renewal. If a vision test is not required, drivers under 62 can renew online or by mail.

Keep the following points in mind from AAA:

- Prior to the expiration of a license, the Secretary of State will send the license holder a renewal application.

- A driver’s license issued to a person under 65 expires at midnight on the license holder’s sixth birthday following the date of issuance.

- A driver’s license issued to a person 65 or older expires at midnight on the license holder’s fourth birthday following the date of issuance.

- Any valid driver’s license issued to a person on active duty with the U.S. Armed Forces (or the spouse of an active-duty serviceperson) is effective without the requirement for renewal until 180 days after the date of the person’s discharge from the service.

If you want to avoid any hassle, renew your ID once you receive your notice from the Maine BMV.

Read more: What happens if you drive without a license and get stopped by the police?

Driving to Endanger

Every state has different laws when it comes to reckless driving. This is called “Driving to Endanger” or “DTE” in the Pine Tree State.

According to Title 29-A; Section 2413, DTE occurs when a person drives a motor vehicle in any place in a manner that endangers the property of another or a person, including the operator or passenger in the motor vehicle being driven.

If found guilty of DTE, the offender will be charged with a Class E misdemeanor. That driver will face a mandatory minimum sentence of 30 days and pay a $575 fine.

What are the rules of the road in Maine?

If you want to take your car out for a spin across the scenic routes of rural Maine, you must obey the rules of the road.

While you may believe that you already have a firm understanding of how to drive, these laws do vary from state to state, and it’s never a bad idea to get in a quick refresher.

Keep reading to learn all about Maine’s driving laws.

Fault vs. No-Fault

Similar to many other states, Maine follows a fault system.

Since Maine is considered an “at fault” state, the person responsible for causing an accident will be held financially responsible for any injuries or damage that occurred as a result.

An individual who was involved in a car accident and wishes to make a claim can pursue these legal options:

- File a claim with your insurance company, assuming that the loss is covered under the policy

- File a third-party claim directly with the at-fault driver’s insurance carrier

- File a personal injury lawsuit in civil court against the at-fault driver

Every state has a different philosophy regarding fault versus no-fault, but Maine legislators believe it makes the most sense to have these situations remedied by whoever is deemed responsible for the accident.

Seat belt and car seat laws

Regardless of where you are in the country, you most likely believe that everyone is required to wear a safety belt. While this is mostly true (fun fact: seat belts are not legally required for adults in New Hampshire), the specifics surrounding seat belt and car seat laws vary from state to state.

Maine law requires that every person over the age of 18 must have a seat belt fastened while the vehicle is in motion. Passengers aged 17 and younger are subject to the state’s child seat laws.

In Maine, a child must be in a rear-facing car seat if they are younger than two or until they outgrow the manufacturer’s top height or weight recommendations. If a child is older than two and less than 55 pounds, they can be in a child restraint system in accordance with the manufacturer’s instructions.

Young passengers can start to wear a normal seat belt when they exceed 57 inches in height or become heavier than 80 pounds.

Keep Right and Move Over Laws

In order to ensure a safe flow of traffic on the roads of Maine, Title 29-A; Section 2052 declares that you must keep right at all times except when attempting to pass on a road that has a speed limit of at least 65 MPH.

Drivers may use the left lane only when they are about to turn or to pass the vehicle in front of them.

Furthermore, drivers are required to slowly move over to the side of the road in the event that they are met by an emergency vehicle displaying flashing lights. This includes ambulances, police cars, and even road maintenance and waste collection vehicles, according to the AAA Digest of Motor Laws. (For more information, read our “Is AAA the same as Auto Club?“).

Speed Limits

Just like every other state, there are certain limits to how fast you can drive in Maine. Take a look at the following table that will tell you how fast you can go on each type of roadway.

| Roadway Type | Speed Limit (MPH) |

|---|---|

| Rural Interstate | 75 |

| Urban Interstate | 75 |

| Limited Access Roads | 75 |

| Other Roads | 60 |

In order to make sure you don’t see flashing police lights in your rearview mirror, it’s best to keep an eye out for the black and white speed limit signs along Maine’s highways and roads.

Ridesharing

Ridesharing has transformed the way Mainers get around, especially for Downeasters. Tech companies like Uber and Lyft have made it easy for passengers to find rides and provide a platform for Mainers to drive as an opportunity to make money.

In order to work as a rideshare driver in the Pine Tree State, you must acquire a specific rideshare insurance policy from Geico or State Farm. These are the only two providers that offer this type of policy in Maine.

Automation on the Road

It’s amazing to think that we’re discussing self-driving cars and what automation will look like in the state of Maine.

At the state level, autonomous vehicles are currently in the testing phase, meaning that legislators in Maine are not ready to allow automated vehicles on any of the state’s public roads.

When the state does bring automation to the road, the law will require the vehicle to have liability insurance, but other than that, there have been no specific regulations put into place yet.

This information comes courtesy of the IIHS. More laws will likely be passed on this front in the future, so keep your eyes peeled for new developments regarding self-driving vehicles and their insurance requirements.

What are the safety laws in Maine?

Following all of Maine’s unique safety laws is the only way to ensure safe passage for everyone using the state’s public infrastructure system.

Maine’s safety laws are deisgned to discourage reckless behavior, such as driving under the influence of a controlled substance and distracted driving.

Keep reading to learn about the safety laws of the Pine Tree State and the associated penalties for drivers who don’t follow them.

DUI Laws

The formal name for driving a car with a blood-alcohol level above .08 is Operating a Vehicle Under the Influence (or OUI) in the state of Maine.

Punishment for driving while under the influence of alcohol or other controlled substances varies from the first offense to subsequent offenses. This chart will show you what to expect in terms of fines, jail time, and more.

| Category | First Offense | Second Offense | Third Offense | Fourth Offense |

|---|---|---|---|---|

| ALS or Revocation | 150 days min w/ or w/o aggravating factors | 3 years minimum | 6 years minimum | 8 years minimum |

| Imprisonment | none; 48 hours min w/ aggravating factors | 7 days minimum | 30 days minimum | 6 months minimum |

| Fines | $500 | $700 minimum | $1100 minimum | $2100 minimum |

The greatest jump in punishment occurs from the third to the fourth offense. When this happens, offenders are looking at a minimum of six months in jail and over $2,000 in fines.

Marijuana-Impaired Driving Laws

Marijuana is legal in the Pine Tree State and has been cleared for adult recreational use since 2016. But that doesn’t mean you are free to drive around while you’re high.

In fact, offenders who are pulled over by a police officer and determined to be too high to drive are subject to the same set of punishments as drunk drivers.

The state law does not have a clear policy in place in terms of legal limits like the .08 BAC level. Instead, Maine law allows adults to carry up to 70.8 grams of flower on their person and it must be placed in a sealed child-proof container within the vehicle.

When pulled over under suspicion of being under the influence, you will have to give an officer consent to test your blood, urine, and oral fluids for THC levels at the time of the incident.

Distracted Driving Laws

Distracted driving is exactly what it sounds like. Any time the driver’s focus is taken away from the road, law enforcement can determine that they were distracted and, therefore, not acting responsibly behind the wheel.

The most common forms of distracted driving include texting or holding your phone, eating or drinking, applying makeup or personal care products, and fiddling with the car’s stereo or navigation system.

In order to keep everybody on the road safe, Maine has the following distracted driving laws in place to discourage this type of behavior:

- Texting while driving is prohibited for everyone.

- There is a handheld ban for all drivers.

That means you cannot have your cellphone in your hand at any time for any reason while driving. Instead, it’s a better idea to install a phone mount if you want to reference your phone while driving.

Driving in Maine

If you’re beginning to think you have the ins and outs of Maine figured out by now, you’re mostly correct.

However, we still have some more facts to go over pertaining to driving safely in Maine.

This final section will provide in-depth data and analysis on vehicle theft, road fatalities, and what transportation is like in the Pine Tree State.

How many vehicle thefts occur in Maine?

Automakers have spent a lot of time researching ways to make their vehicles more difficult to steal, and this effort has been put to good use. Technology has made the newest models more secure, so you don’t see as much vehicle theft with cars that were made within the past five years or so.

However, there are still a lot of older models that are being driven around Maine, and these are easier targets for car thieves. According to the most recent report from the FBI, a total of 554 cars were stolen in the Pine Tree State in 2017.

Of those 554 vehicle thefts, the most targeted model was a 2001 Chevrolet pickup. A complete list of the top 10 most stolen vehicles in Maine looks like this:

| Year/Make/Model | Number of Thefts |

|---|---|

| 2001 Chevrolet Pickup (Full Size) | 29 |

| 1993 GMC Pickup (Full Size) | 26 |

| 2004 Jeep Cherokee/Grand Cherokee | 18 |

| 2004 Ford Pickup (Full Size) | 15 |

| 2009 Toyota Corolla | 13 |

| 1996 Toyota Camry | 13 |

| 2009 Honda Civic | 11 |

| 2000 Chevrolet Impala | 8 |

| 2001 Ford Focus | 8 |

| 2005 Chevrolet Cobalt | 7 |

These crimes happen all over the state, but the city that experienced the most vehicle thefts was Portland with a total of 97. Take a look at the following table that shows a breakdown of vehicle theft by city in Maine.

| City | Population | # of Vehicles Stolen |

|---|---|---|

| Ashland | 1,217 | 3 |

| Auburn | 22,931 | 11 |

| Augusta | 18,394 | 9 |

| Baileyville | 1,433 | 2 |

| Bangor | 31,814 | 24 |

| Bar Harbor | 5,422 | 6 |

| Bath | 8,272 | 7 |

| Belfast | 6,644 | 3 |

| Berwick | 7,627 | 4 |

| Biddeford | 21,378 | 15 |

| Boothbay Harbor | 2,188 | 0 |

| Brewer | 9,048 | 7 |

| Bridgton | 5,414 | 4 |

| Brunswick | 20,711 | 10 |

| Bucksport | 4,924 | 2 |

| Buxton | 8,222 | 3 |

| Calais | 2,940 | 1 |

| Camden | 4,833 | 0 |

| Cape Elizabeth | 9,383 | 1 |

| Caribou | 7,666 | 5 |

| Carrabassett Valley | 781 | 4 |

| Clinton | 3,300 | 1 |

| Cumberland | 7,956 | 1 |

| Damariscotta | 2,166 | 0 |

| Dexter | 3,710 | 4 |

| Dixfield | 2,457 | 1 |

| Dover-Foxcroft | 4,045 | 5 |

| East Millinocket | 2,943 | 0 |

| Eastport | 1,243 | 1 |

| Eliot | 6,481 | 2 |

| Ellsworth | 7,940 | 2 |

| Fairfield | 6,560 | 7 |

| Falmouth | 12,260 | 2 |

| Farmington | 7,548 | 5 |

| Fort Fairfield | 3,294 | 0 |

| Fort Kent | 3,900 | 2 |

| Freeport | 8,520 | 1 |

| Fryeburg | 3,389 | 2 |

| Gardiner | 5,592 | 1 |

| Gorham | 17,554 | 4 |

| Gouldsboro | 1,750 | 0 |

| Greenville | 1,585 | 1 |

| Hallowell | 2,318 | 2 |

| Hampden | 7,363 | 3 |

| Holden | 3,049 | 0 |

| Houlton | 5,781 | 6 |

| Islesboro | 565 | 1 |

| Jay | 4,628 | 1 |

| Kennebunk | 11,406 | 2 |

| Kennebunkport | 3,604 | 0 |

| Kittery2 | 9,669 | 3 |

| Lewiston | 36,067 | 42 |

| Limestone | 2,165 | 1 |

| Lincoln | 4,944 | 2 |

| Lisbon | 8,820 | 6 |

| Livermore Falls | 3,104 | 2 |

| Machias | 2,087 | 0 |

| Madawaska | 3,760 | 0 |

| Mechanic Falls | 2,986 | 4 |

| Mexico | 2,584 | 0 |

| Milbridge | 1,277 | 0 |

| Millinocket | 4,267 | 4 |

| Milo | 2,256 | 0 |

| Monmouth | 4,036 | 2 |

| Newport | 3,224 | 4 |

| North Berwick | 4,690 | 2 |

| Norway | 4,902 | 2 |

| Oakland | 6,145 | 6 |

| Ogunquit | 922 | 0 |

| Old Orchard Beach | 8,842 | 7 |

| Old Town | 7,466 | 1 |

| Orono | 11,400 | 7 |

| Oxford | 4,037 | 2 |

| Paris | 5,119 | 14 |

| Phippsburg | 2,246 | 2 |

| Pittsfield | 4,076 | 2 |

| Portland | 67,079 | 97 |

| Presque Isle | 9,016 | 4 |

| Rangeley | 1,159 | 1 |

| Richmond | 3,412 | 1 |

| Rockland | 7,161 | 5 |

| Rockport | 3,389 | 0 |

| Rumford | 5,692 | 5 |

| Sabattus | 5,038 | 0 |

| Saco | 19,332 | 23 |

| Sanford | 20,963 | 12 |

| Scarborough | 20,215 | 8 |

| Searsport | 2,638 | 9 |

| Skowhegan | 8,255 | 11 |

| South Berwick | 7,469 | 1 |

| South Portland | 25,679 | 19 |

| Southwest Harbor | 1,780 | 0 |

| Thomaston | 2,772 | 0 |

| Topsham | 8,790 | 5 |

| Van Buren | 2,068 | 1 |

| Veazie | 1,827 | 2 |

| Waldoboro | 5,023 | 3 |

| Washburn | 1,558 | 0 |

| Waterville | 16,522 | 12 |

| Wells | 10,287 | 3 |

| Westbrook | 18,560 | 10 |

| Wilton | 3,944 | 5 |

| Windham | 18,175 | 7 |

| Winslow | 7,534 | 4 |

| Winter Harbor | 515 | 0 |

| Winthrop | 5,950 | 4 |

| Wiscasset | 3,680 | 1 |

| Yarmouth | 8,594 | 3 |

| York | 13,018 | 5 |

How many road fatalities occur in Maine?

The Maine Department of Public Safety reported that there were a total of 153 traffic deaths in its most recent report, with 21 percent of those fatalities occurring between 9 p.m. and 2 a.m. There are a number of factors that contribute to these unfortunate statistics that occur every year due to the dangerous nature of driving.

If you want to keep yourself safe, remember to always wear your seat belt, obey traffic laws, and keep in mind the information outlined in this section. Here you’ll learn everything you need to know about the dangers of driving in Maine so you can avoid becoming a statistic yourself.

Most fatal highway in Maine

GeoTab suggests that the most dangerous highway in the Pine Tree State is U.S. Route 1. This highway runs along the east side of the state, so most of the roadway is coastal driving.

While Route 1 does not go through a lot of densely populated areas, it is still susceptible to unpredictable weather patterns, which leads to more dangerous driving conditions.

Mainers love driving on this serene highway, and overall the traffic fatalities on this road are low compared to other parts of the country. If you plan to take a drive along the beautiful Atlantic coast, exercise some caution and make sure the weather is favorable.

Fatal Crashes by Weather Condition and Light Condition

Visibility and weather play an important part in driving safely, especially during the snowy winter months. As you can imagine (or know from experience), it’s more difficult to drive under these conditions, especially at night on the dimly lit rural roads of Maine.

Though we’re accustomed to tough driving conditions, Mainers still fall victim to fatal car accidents that are brought about by weather and lighting.

The following table shows data regarding fatal crashes by weather and light conditions in the Pine Tree State.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 81 | 20 | 39 | 2 | 1 | 143 |

| Rain | 3 | 1 | 3 | 2 | 0 | 9 |

| Snow/Sleet | 3 | 0 | 4 | 0 | 0 | 7 |

| Other | 1 | 0 | 2 | 1 | 0 | 4 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 88 | 21 | 48 | 5 | 1 | 163 |

Surprisingly, the highest number of fatal car accidents that occur in Maine happen in normal daylight conditions. Next time you take the wheel in the middle of a winter storm, you can remember that it’s technically not the most dangerous time to drive. (For more information, read our “Most Car Accidents By State: How does your state rank?“).

Fatalities (All Crashes) by County

Maine’s more populated counties tend to see more fatal car accidents, and that is simply because there are a greater number of people there that can contribute to these statistics.

Nonetheless, we’ve outlined the fatalities by county in the following table so you can see which parts of the state see more accidents than others.

| County | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Androscoggin County | 9 | 10 | 15 | 17 | 5 |

| Aroostook County | 3 | 17 | 3 | 8 | 10 |

| Cumberland County | 12 | 16 | 21 | 26 | 22 |

| Hancock County | 8 | 8 | 10 | 7 | 7 |

| Kennebec County | 11 | 14 | 15 | 18 | 10 |

| Oxford County | 12 | 11 | 9 | 6 | 12 |

| Penobscot County | 21 | 16 | 22 | 17 | 11 |

| Somerset County | 8 | 16 | 6 | 10 | 8 |

| Waldo County | 5 | 3 | 10 | 13 | 9 |

| York County | 12 | 21 | 21 | 19 | 22 |

| All Other Counties | 20 | 20 | 24 | 28 | 21 |

| All Counties | 131 | 156 | 160 | 173 | 137 |

The counties that consistently see the most traffic deaths in the state are Cumberland, York, and Penobscot. There’s a great deal of switching back and forth in terms of the numbers between these three, but the good news is that these figures are mostly down for Penobscot County as of 2018.

Traffic Fatalities

As we begin to understand what all of these traffic death statistics look like, it’s best to have a general overview of what contributes to them. Take a look at the following table that displays traffic fatality data from the National Highway Traffic Safety Administration (NHTSA).

| Type | Total Fatalities |

|---|---|

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 101 |

| Speeding-related Fatalities | 42 |

| Alcohol-impaired Driving Fatalities | 42 |

| Pedestrian Fatalities | 7 |

| Motorcyclist Fatalities | 23 |

| Bicyclist and Other Cyclist Fatalities | 2 |

| Total Traffic Fatalities | 137 |

As you can see from the data, passenger vehicle occupant fatalities sit atop the list as the most common type of traffic death in Maine.

Fatalities by Person Type

The data collected from the NHTSA also revealed a breakdown of fatalities by racial makeup. The following table will show you a breakdown of how many fatalities occur on Maine’s roads by person type.

| Person Type by Race/Hispanic Origin | # of Fatalities |

|---|---|

| White, Non-Hispanic | 96 |

| Black, Non-Hispanic | 1 |

| Asian, Non-Hispanic/Unknown | 0 |

| All Other Non-Hispanic or Race | 32 |

| Unknown Race and Unknown Hispanic | 10 |

| Total | 139 |

Caucasians are at the top of the list, but that also coincides with the demographics of the state since white/non-Hispanics account for roughly 94.4 percent of all Mainers.

Fatalities by Crash Type

Fatality numbers also differ depending on what types of vehicles were involved and what caused the accident. For example, an accident involving a roadway departure is the most common form of fatal crash in the state.

The following table provides a full breakdown of fatalities by crash type.

| Crash Type | Number of Fatalities |

|---|---|

| Total Fatalities (All Crashes) | 137 |

| Single Vehicle | 86 |

| Involving a Large Truck | 16 |

| Involving Speeding | 42 |

| Involving a Rollover | 43 |

| Involving a Roadway Departure | 103 |

| Involving an Intersection (or Intersection Related) | 16 |

Five-Year Trend For The Top 10 Counties

The NHTSA also found the following five-year trend for fatalities for the top 10 counties in Maine. While examining the figures, keep in mind that the median fatality rate for U.S. counties is 17.

| Maine County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Androscoggin | 8.38 | 9.33 | 13.97 | 15.8 | 4.64 |

| Aroostook | 4.31 | 24.69 | 4.4 | 11.84 | 14.9 |

| Cumberland | 4.16 | 5.53 | 7.21 | 8.89 | 7.49 |

| Franklin | 13.23 | 16.64 | 23.3 | 16.75 | 16.72 |

| Hancock | 14.68 | 14.75 | 18.33 | 12.82 | 12.77 |

| Kennebec | 9.07 | 11.57 | 12.35 | 14.76 | 8.19 |

| Knox | 10.03 | 10.05 | 7.54 | 25.08 | 2.51 |

| Lincoln | 35.24 | 5.92 | 11.77 | 8.77 | 14.56 |

| Oxford | 20.95 | 19.26 | 15.73 | 10.45 | 20.83 |

| Penobscot | 13.71 | 10.53 | 14.54 | 11.24 | 7.28 |

Maine’s counties consistently rank under the median national average. Oxford County was the only one on the list to surpass the median fatality rate of the country with a rate of 20.83.

Fatalities Involving Speeding by County

Speeding is never a good idea. In fact, it leads to the untimely deaths of many Mainers every ear. This table will break down the number of speeding-related deaths by county.

| Maine County | Number of Fatalities |

|---|---|

| Androscoggin | 2 |

| Aroostook | 2 |

| Cumberland | 3 |

| Franklin | 4 |

| Hancock | 3 |

| Kennebec | 2 |

| Knox | 0 |

| Lincoln | 1 |

| Oxford | 3 |

| Penobscot | 4 |

| Piscataquis | 1 |

| Sagadahoc | 0 |

| Somerset | 3 |

| Waldo | 2 |

| Washington | 2 |

| York | 10 |

As it turns out, York County had the highest number of speeding-related deaths with a total of 10.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Anyone driving with a BAC level of .08 or greater is considered alcohol-impaired. It is illegal to drive a car when you’re in this condition, since alcohol greatly impacts your motor skills and reaction time.

Nonetheless, drinking and driving still happens in the Pine Tree State and often leads to tragic results. Take a look at the following chart that shows a breakdown of fatalities by county in crashes that involved an alcohol-impaired driver.

| Maine County | Number of Fatalities |

|---|---|

| Androscoggin | 3 |

| Aroostook | 4 |

| Cumberland | 4 |

| Franklin | 3 |

| Hancock | 4 |

| Kennebec | 2 |

| Knox | 0 |

| Lincoln | 1 |

| Oxford | 4 |

| Penobscot | 3 |

| Piscataquis | 1 |

| Sagadahoc | 1 |

| Somerset | 1 |

| Waldo | 1 |

| Washington | 2 |

| York | 7 |

Similar to speeding-related fatalities, York County also had the most traffic fatalities involving alcohol with a total of seven.

Teen Drinking and Driving

Sadly, young drivers make up a portion of the road fatality statistics we have covered in this section. The national average for teenagers involved in a drinking and driving accident is 1.2 fatalities per 100,000 population, according to responsibility.org.

Maine teenagers rank above the national average when it comes to drinking and driving fatalities at a rate of 2.3 per 100,000 population.

Since Maine has a ratio that is higher than the national average, it might be a wise idea to educate any young drivers in your life about the dangers of getting behind the wheel after they’ve had a few drinks.

EMS Response Time

With so much danger on the roads, it’s crucial to have a quick response time for emergency vehicles. Every second is crucial in a major traffic accident, and can very well be the determining factor for whether a person involved will live or die.

According to the NHTSA, EMS response times in Maine vary depending on whether the crash occurred in a rural or urban setting. Here’s a full breakdown of the data by minutes.

| Setting of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 5.2 | 11.78 | 38.97 | 57 |

| Urban | 5.07 | 6.81 | 25.52 | 38.19 |

It takes nearly an hour for an ambulance to make its way from the accident scene to a hospital in rural Maine, which can be scary to think about in an emergency situation.

What is transportation like in Maine?

At the beginning of this article, we mentioned that there is a lot of beauty to behold on the roads of the Pine Tree State. And while Maine may seem like the best-kept secret in the country, there are still plenty of natives and tourists who all must share the roads together.

That’s why this next section will cover car ownership, commute times, commuter transportation, and traffic congestion in Maine.

Car Ownership

A majority of Maine households own two cars, making up 46.4 percent of all Mainers, according to Census.gov.

Next on the list are the three-car households, which make up 20.7 percent of the state’s residents, followed by one-car households at 19.1 percent. Lastly, only 2.06 percent of Maine’s households do not own a car at all, which is lower than the national average of 4.26 percent.

Commute Time

The average American spends 25.5 minutes commuting to work, and this is the exact amount of time that Mainers spend traveling to work each day.

There is a small percentage of Mainers (2.03 percent) that have “super commutes” of 90 minutes or more. If you’re part of this group, you might be keeping a closer eye on fuel prices compared to the rest of the pack.

Commuter Transportation

If you ever stopped to wonder where everybody on the road is going during rush hour, it’s safe to assume that they are commuting to their place of employment. This is one of the main reasons people choose to buy cars in Maine — because it’s necessary for them to make a living.

The most common way Mainers get to and from work each day is by driving alone. This group makes up 77.8 percent of commuters.

For those that don’t report driving to work alone, 9.88 percent of the workforce carpools, and 5.95 percent work from home.

Traffic Congestion

INRIX is one of the most reputable sources in the world when it comes to covering traffic congestion in major municipalities. However, this resource does not include information on any of Maine’s cities.

Even though major analytics companies like INRIX, TomTom, and Numbeo don’t have statistics on the Pine Tree State, that doesn’t mean that the state never experiences any congestion on the roads.

The Maine Department of Transportation releases an annual traffic report that shares data pertaining to how the state analyzes information to make the public roadways work as efficiently as possible.

Unfortunately, there is no hard data surrounding the amount of time and money that’s lost to Maine’s drivers due to traffic, but you can still read the full report on Maine’s DOT website.

Now that you’ve learned just about everything there is to know about Maine’s car culture, you must be getting psyched up to get behind the wheel. But before you do that, we’d like to know:

Is there anything we covered that you found especially helpful or wish to see expanded?

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

If not, enter your ZIP code below so you can be on your way to finding a car insurance provider for a great price.

Frequently Asked Questions

What does Maine Auto Insurance cover?

Maine Auto Insurance typically covers a range of potential risks and damages associated with owning and operating a vehicle. This can include liability coverage for bodily injury and property damage, personal injury protection, uninsured/underinsured motorist coverage, and comprehensive/collision coverage.

Are there minimum coverage requirements for Maine Auto Insurance?