Top Alaska Homeowners Insurance Providers [2026]

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated March 2024

Alaska Home Insurance Statistics

| Key Info | Details |

|---|---|

| State Population | 731,545 |

| Median Home Price | $326,000 |

| Homeownership Percentage | 65.6% |

| Biggest Home Insurance Company | State Farm |

| Average Annual Rate | $959 |

| Direct Premiums Written Annually | $171,663 |

| Homeowners Insurance Incurred Losses | $100,859 |

Whether you’re new to Alaska or have lived there all your life, it’s important to research home insurance options before purchasing a home in its metropolitan or rural areas. With a state that boasts so much housing and geographic diversity, we know finding the right home insurance coverage can get confusing.

This expert guide will equip you with everything you need to purchase Alaska home insurance with confidence and ease. We’ll cover popular insurers like State Farm and USAA as well as review insurance laws, average rates, and more. Once we’re done, you’ll know exactly how to protect your home.

If you want to compare home insurance rates before reading up, enter your ZIP code in our quote box to get started.

How to get Alaska home insurance coverage & rates

If you live in Alaska, your home is likely subject to extreme weather conditions all year long. The first step to protecting your home from these harsh environments is distinguishing which type of home insurance best fits your property.

Homeowners insurance coverage changes depending on your relationship with your property.

Homeowners, condo owners, mobile homeowners, renters, and landlords each require a different type of home insurance.

The state’s top three writers of home insurance are State Farm, USAA Insurance Group, and Allstate; all offer homeowners, condo owners, mobile homeowners, renters, and landlords insurance policies.

Standard home insurance policies within these categories offer comprehensive coverage for your home. A typical standard home insurance policy comprises:

- Dwelling Coverage, which insures the outer structure of your home.

- Other Structures Coverage, which insures any structure on your property that is not attached to your home, such as sheds, garages, and gazebos.

- Personal Property Coverage, which insures personal belongings within your home.

- Liability Coverage, which protects you from lawsuits related to your property.

- Additional Living Expenses Coverage (also known as Loss of Use Coverage), which covers your living expenses if you can’t live in your house because of damage or loss.

Policy type is one of many determining factors for your insurance rate. Rates are also determined by your location and the specifics of your home. Let’s examine the average cost in Alaska to get a sense of how much your home insurance may be.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average premiums in Alaska?

Here’s a quick look at average premiums in Alaska between 2015 and 2017.

Average Annual Home Insurance Rates in Alaska (2015–2017)

| Years | Alaska Average | National Average |

|---|---|---|

| 2015 | $982 | $1,173 |

| 2016 | $974 | $1,192 |

| 2017 | $959 | $1,211 |

Though countrywide premiums rose between 2015 and 2017, average premiums went down in Alaska. In general, home insurance premiums in Alaska are lower than countrywide premiums and significantly lower than premiums in a number of U.S. states, including Louisiana, where the average home insurance premium is a staggering $1,000 higher.

This is great news for Alaskan residents. Though Alaskan properties endure challenging weather conditions, policyholders still get great home insurance rates. This is probably because the state’s homes and buildings are built with extreme weather in mind.

Is there an additional coverage in Alaska?

While standard policies protect your home from a multitude of perils, they don’t often cover damage from unusual risks like floods or earthquakes.

Flood insurance, earthquake insurance, and other natural disaster protections are often separate policies you can purchase in addition to your standard coverage. If you’re in an area that is susceptible to floods or earthquakes, you should consider purchasing these coverage options if they are not covered by your standard policy.

Flooding is common in Alaska, where flowing rivers, heavy storms, and water overflow can cause damage to your house, especially if you live in a coastal community. You can purchase a flood insurance policy through the National Flood Insurance Program; many insurance companies partner with NFIP to provide their policyholders with a separate flood insurance policy.

In 2018, 2,411 Alaskans purchased a flood insurance policy.

Earthquakes are also a serious hazard in Alaska. Here’s a look at the damage a 7.0 magnitude earthquake caused in 2018.

The Alaska Earthquake Center detects an earthquake every 15 minutes. Though not all of them cause significant damage, the Alaska Seismic Hazards Safety Commission recommends you protect your home with earthquake insurance, which can also be purchased as a separate policy.

Alaska also has a history of volcanoes, wildfires, tsunamis, and landslides. While standard policies cover volcano and wildfire damage, you’ll have to purchase additional coverage options like tsunami and landslide coverage separately.

Are there any Alaska home insurance add-ons, endorsements, & riders?

Home insurance endorsements, and riders can be added to your existing standard homeowners insurance policy to provide protection for assets that are not traditionally covered by a regular policy. While available add-ons vary depending on your state of residence and insurance provider, here’s a list of the most common insurance coverage options:

- Sewer & Water Backup Coverage – Because standard homeowners insurance policies don’t often cover sewer and water damages, this is a very useful add-on.

- Equipment Breakdown Coverage – This coverage helps repair or replace home equipment that has been damaged due to electrical or mechanical failure.

- Inflation Guard Coverage – Inflation guard protection changes the limits of your insurance over time in accordance with the changing costs of rebuilding it.

- Personal Property Replacement Cost Coverage – If your standard policy doesn’t offer personal property coverage, you can purchase this coverage as an add-on.

- Home Business Coverage – If you operate a business from your home, you can customize your policy to insure your business as well as your house.

- Watercraft Coverage – If you keep boats or other watercraft on your home property, you can purchase an add-on policy for those assets.

- Identity Theft Coverage – This add-on can cover costs for things like reclaiming your financial identity or regaining credit if your identity has been stolen.

- Personal Injury Coverage – This add-on protects you from lawsuits, libel, and other prosecutions if someone has been injured on your property.

- Secondary Residence Coverage – If you have a secondary residence, like a vacation home that you’d like to protect, you can get partial coverage through a secondary residence policy. If you’d like to get comprehensive coverage for that home, however, it’s best to purchase a separate homeowners insurance policy for that property.

- Limited Time Endorsements – Limited time endorsements offer perks like vacancy permits, which keep your home insured while it is vacant.

- Floaters/Riders for High-Value Items – These may include jewelry, firearms, fine arts, computer hardware and software, silverware, business personal property, antiques, money, and collectibles.

If you require one or more of these additional coverages, make sure they are offered by your life insurance provider.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are some Alaska exclusions?

As we mentioned earlier, flood or earthquake damage is not covered by standard home insurance policies in Alaska. Standard policies also don’t cover damages that result from neglect. These may include mold damage, water damage, and infestation.

Even if Alaska doesn’t have a statewide exclusion, your insurance company may have company-specific exclusions in its standard policy. Some insurance carriers, for instance, have pet breed exclusions. Make sure to check what’s excluded from your policy to avoid any surprises when you make a claim.

What are the best Alaska home insurance companies?

Even if you’ve figured out exactly which policies and add-ons your home needs, it can be difficult to find the right company who makes the cost of insurance affordable. With something as precious as your house, you want to make the best choice in terms of service and savings opportunities.

That’s why we’re next going to break down the financial ratings of top insurance companies in Alaska and their trustworthiness, and customer complaints. This will give you plenty of insight into which companies are successful, trustworthy providers, and help you take steps toward protecting your home with confidence.

What are the financial ratings of the largest companies in Alaska?

Financial ratings indicate the stability of a company within the global market. If you’re an Alaskan homeowner in need of insurance in a state where frequent natural disasters cause sudden increases in insurance payouts, you want to feel confident that your insurer is financially stable enough to weather major change.

These ratings for the top 10 insurance companies in Alaska were pulled from A.M. Best, an agency that rates company stability across the globe.

A.M. Best Ratings for the Top 10 Home Insurance Companies in Alaska

| Companies | A.M. Best Rating |

|---|---|

| Allstate | A+ |

| Country Financial | A+ |

| Farmers | A |

| Hartford Financial Services | A+ |

| Horace Mann | A |

| IAT Insurance | A- |

| Liberty Mutual | A |

| State Farm | A++ |

| USAA | A++ |

| Western National | A+ |

As you can see, A.M. Best ranks companies using a letter scale. The top 10 companies in Alaska have all received either Excellent (A, A-) or Superior (A+, A++) ratings.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Alaska home insurance companies have the best ratings?

So these companies are stable, but are they well-liked by their customers?

Let’s take a look at J.D. Power’s company ratings to learn more. J.D. Power is an independent rating agency that uses customer surveys to publish ratings based on a company’s customer satisfaction.

Be aware that these are national rankings, as J.D. Power doesn’t provide regional rankings for home insurance.

Below are J.D. Power’s ratings for the top 10 insurance companies’ homeowners insurance, renters insurance, and property claims policies.

J.D. Power Ratings for the Top 10 Home Insurance Companies in Alaska

| Companies | Home Insurance Study | Renters Insurance Study | Property Claims Study |

|---|---|---|---|

| Allstate | 814 points 3/5 | 829 points 2/5 | 868 points 3/5 |

| Country Financial | 814 points 3/5 | N/A | 893 points 4/5 |

| Farmers | 808 points 3/5 | 826 points 2/5 | 880 points 3/5 |

| Hartford Financial Services | 806 points 3/5 | 803 points 2/5 | 888 points 4/5 |

| Horace Mann | N/A | N/A | N/A |

| IAT Insurance | N/A | N/A | N/A |

| Liberty Mutual | 792 points 2/5 | 824 points 2/5 | 878 points 3/5 |

| State Farm | 831 points 4/5 | 850 points 5/5 | 866 points 3/5 |

| USAA | 878 points 5/5 | 895 points 5/5 | 901 points 5/5 |

| Western National | N/A | N/A | N/A |

Some companies, like Liberty Mutual and Allstate, have received ratings of average or less from J.D. Power. Others, like USAA and State Farm, have been rated as among the best. In fact, USAA received the top score within J.D. Power’s entire home insurance study across all three categories.

Country Financial was only partially rated by J.D. Power, and Western National Insurance Group, Horace Mann, and IAT Insurance were not included in the study.

Which companies have the most complaints in Alaska?

To learn more about how satisfied customers are with these top 10 companies, let’s take a look at data from the National Association of Insurance Commissioners.

The NAIC gathers data about customer complaints and compiles them into a complaint index, which tells us how much higher a company’s complaint rate is than the national average.

NAIC Complaint Index of the Top 10 Home Insurance Companies in Alaska

| Companies | Number of Complaints In Alaska | National Complaint Index |

|---|---|---|

| Liberty Mutual | 0 | 15.39 |

| Hartford Financial Services | 0 | 6.27 |

| State Farm | 0 | 0.89 |

| Allstate | 2 | 0.89 |

| Farmers | 0 | 0.61 |

| Horace Mann | 0 | 0.53 |

| Western National | 0 | 0.49 |

| USAA | 1 | 0.33 |

| Country Financial | N/A | N/A |

| IAT Insurance | N/A | N/A |

There are few complaints filed by Alaskans about the state’s top 10 insurance companies. However, we can see that two companies, Liberty Mutual and Hartford Financial Services, have a complaint index far higher than what is considered average by the NAIC.

What are the largest home insurance companies in Alaska?

Now that we know about these companies’ ratings, let’s take a look at their market shares in Alaska.

Top 10 Home Insurance Companies by Market Share in Alaska

| Companies | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm | $55,290,000 | 32.2% |

| USAA | $32,207,000 | 18.8% |

| Allstate | $31,785,000 | 18.5% |

| Liberty Mutual | $16,665,000 | 9.7% |

| Country Financial | $14,187,000 | 8.3% |

| Western National | $11,136,000 | 6.5% |

| Horace Mann | $2,990,000 | 1.7% |

| Farmers | $2,297,000 | 1.3% |

| IAT Insurance | $1,476,000 | 0.9% |

| Hartford Financial Services | $1,402,000 | 0.8% |

According to this data pulled from the Insurance Information Institute, State Farm is by far the largest insurance provider in Alaska. USAA, with a market share of 18.8 percent, is its closest competitor.

It’s worth noting that, though many Alaskan residents live in extreme weather conditions, the number of premiums written in Alaska is far less than in many other states. This is partially because Alaska is less populated, but it still tells us that the damage rates in Alaska are relatively low.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the number of insurers in Alaska?

Alaska has domestic and foreign insurers. An insurer is considered domestic if its headquarters are in Alaska and foreign if its headquarters are outside of Alaska.

In Alaska, there are four domestic insurers and 397 foreign insurers, including property and casualty.

What are Alaska homeowners insurance laws?

When you’re insuring an asset as large as your home, knowing your state’s laws is important. However, learning the ins and outs of your local legislature can be confusing. Are you required to have home insurance by law? What is considered insurance fraud?

In this section, we’ll review Alaska’s home insurance laws and provide answers to these and other questions. Once you’ve read through our guide, you’ll be able to navigate your state laws like a pro.

What are the home insurance laws in Alaska?

Unlike auto insurance, home insurance isn’t required by law in the U.S. However, if you have a mortgage, your mortgage company will require home insurance.

If you do not purchase insurance coverage that meets your mortgage company’s requirements, your company is legally allowed to force-place insurance on you.

Forced-placed insurance, or lender-placed insurance, is a policy your mortgage company charges you for that protects your home but not you or your personal property.

Flood insurance may be legally required if you live in a high-risk area of Alaska. In 1994, FEMA began required flood insurance in some flood hazard areas through the National Flood Insurance Reform Act.

If you’d like to learn more about flood insurance, you can watch this video created by FEMA:

If you live in a coastal or flood-prone neighborhood, make sure to check your area’s flood insurance requirements before purchasing a policy.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to get high-risk insurance in Alaska

Sometimes, insurance companies deny coverage to properties that are too high-risk. A home may be considered high-risk if:

- It is located in an area that is prone to severe weather like hurricanes, tornadoes, or windstorms.

- It is located in an area with a high rate of theft, vandalism, or other crime.

- It is a home with old electrical, plumbing, or heating systems.

Often, states have nonstandard resources such as Fair Access to Insurance Requirements (FAIR) programs in place. Fair Plans combine taxpayer and private insurance funds to help people with high-risk properties insure their homes.

In Alaska, however, there is no Fair Plan. The state instead encourages you to keep searching for coverage and consult with an insurance professional.

What is considered a valued policy law in Alaska?

In the event of total loss, valued policy law requires your provider to pay the full limits of its policy rather than only the replacement costs of your loss. So, if for example, you lose a house worth $200,000 while on a policy with $300,000 in dwelling coverage, you receive the entire $300,000 in a state with a valued policy law.

Unlike some U.S. states, Alaska does not have a valued policy law. Consequently, if the house in the above scenario is located in Alaska, the insurer is only legally obliged to pay $200,000.

Is there a home insurance fraud in Alaska?

The definition of insurance fraud is a deliberate deception perpetrated against or by an insurance company or insurance agent for the purpose of financial gain.

This includes but is not limited to:

- Filing inaccurate claims

- Inflating service costs

- Accepting a payout under false pretenses

- Forgery

- Working without a solicitation permit

- False sworn statements

- Wrongfully removing a report

- Operating without a license

In Alaska insurance fraud is a crime. You can receive up to a Class B Felony charge for insurance fraud, which is punishable by up to 10 years in prison, up to $100,000 in fines, or both.

Between 2015 and 2019, 10 people were convicted for insurance fraud in Alaska District Court.

If you’d like to report insurance fraud to the Alaska Department of Commerce, you can contact their insurance division online or by phone:

- Online at: www.commerce.alaska.gov

- By email at: insurance@alaska.gov

- By phone at: 1-907-269-7900 (or 1-800-867-8725 from within Alaska but outside Anchorage).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Alaska home insurance risks?

When you’re shopping for home insurance, it’s hard to tell which risks you should be best prepared for. Is it worth it to buy a high-value item floater, or are you better off investing in equipment breakdown coverage?

Understanding the specific risks in your area can help you answer these important questions. In this section, we’ll go over the most common crimes and catastrophes in Alaska to help you see risks coming from a mile away.

What are the most common property crimes in Alaska?

One of the most common property crimes is burglary. Knowing how often burglary happens is a great way to be prepared and stay informed. Luckily, the FBI releases regular statistics about burglaries in Alaska, and we’ve compiled their data below. Take a look to find out how many burglaries took place in your city in 2018.

Property Crimes in Alaska

| Cities | Burglaries |

|---|---|

| Anchorage | 2,068 |

| Bethel | 15 |

| Bristol Bay Borough | 2 |

| Cordova | 3 |

| Craig | 5 |

| Dillingham | 7 |

| Fairbanks | 111 |

| Haines | 4 |

| Homer | 24 |

| Juneau | 294 |

| Kenai | 49 |

| Ketchikan | 38 |

| Kodiak | 81 |

| Kotzebue | 20 |

| Nome | 5 |

| North Pole | 1 |

| North Slope Borough | 27 |

| Palmer | 12 |

| Petersburg | 15 |

| Seward | 10 |

| Sitka | 17 |

| Skagway | 1 |

| Soldotna | 8 |

| Unalaska | 5 |

| Valdez | 11 |

| Wasilla | 92 |

| Wrangell | 1 |

Though the above data includes nonresidential theft, the FBI states that 67 percent of burglaries are residential.

Are there many home fires in Alaska?

Though the fire death rate in the U.S. has decreased by 6 percent over the past 10 years, homeowners are still at risk of residential fire. Here are some useful statistics about Alaska’s 2017 fires according to the Alaska Department of Public Safety

Fire Statistics in Alaska (2017)

| Statistics | Details |

|---|---|

| Residential Fires | 799 |

| Fire-Related Injuries | 82 |

| Fire-Related Fatalities | 19 |

| Number of Fire Departments | 144 |

In 2017, Alaskan fire departments responded to a call about a residential fire once every 11 hours. Though the number of fire-related fatalities may not seem high, it is about double the national average.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there many catastrophic risks in Alaska?

Luckily for Alaskans, catastrophe-related damage is minimal in the state. From 2009-2013, less than 10 percent of insurance claim payments in Alaska were attributed to catastrophes.

However, Alaska is not without its catastrophic risks. Let’s take a look at its most common catastrophes in more detail.

What are the most common types of flooding in Alaska?

As we mentioned earlier, Alaska’s many bodies of water cause frequent flooding. Here are the most common types of flooding:

- Flash flooding

- River flooding

- Tropical systems and coastal flooding

- Burn scars/debris flows

- Ice/debris jams

- Snowmelt

- Dam breaks/levee failure

The three most recent significant floods are the 1994 Koyukuk River Flood, the 1995 South-Central Alaska Flooding, and the 2013 Yukon River Ice Jam Flood.

If you want to find out whether your home is at risk of flood, you can find a flood map for your home’s address through FEMA’s Flood Map Service Center.

Are there many earthquakes in Alaska?

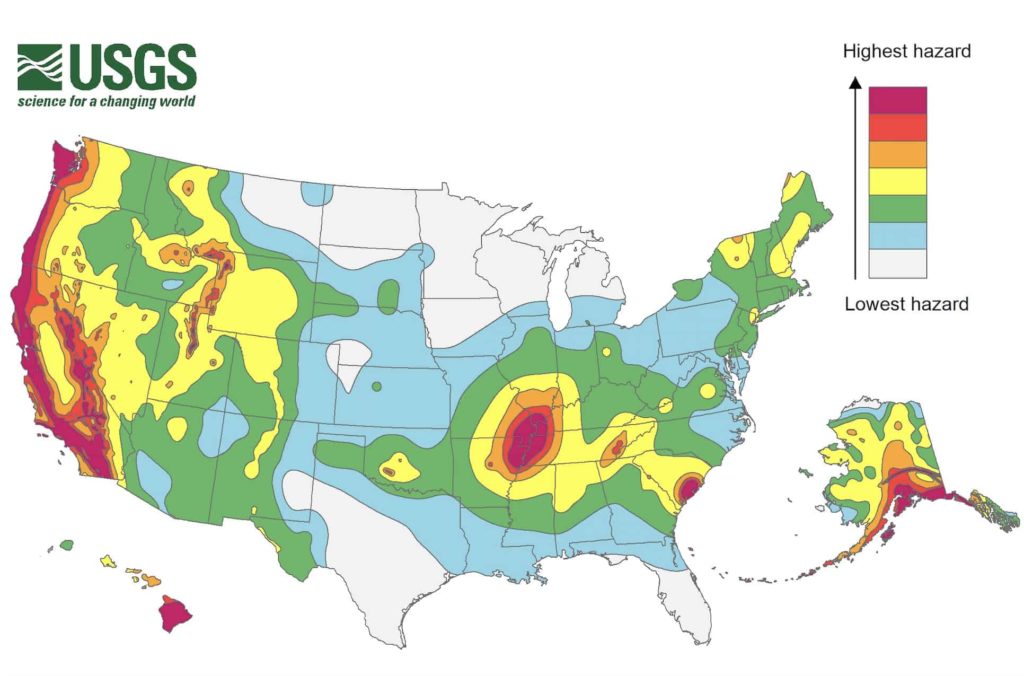

According to this seismic hazard map from the U.S. Geological Survey, Alaska’s earthquake hazard levels range from high to low risk depending on where you are in the state. It is one of 16 U.S. states with the highest risk of earthquakes.

Alaska’s southern rim is part of the Circum-Pacific Seismic Belt, also known as the Ring of Fire, making it is an extremely high-hazard area. While North Alaska is still at risk of earthquakes, it has lower hazard levels.

Earthquakes are a definite risk if you live in Alaska. If you live in a high-hazard area, take the necessary precautions to protect yourself and your home from damage.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is the weather extreme during winter in Alaska?

Alaska is subject to heavy storms and snow, high winds, and extreme cold during its harsh winters. According to the Alaska Climate Research Center, the average temperature in Anchorage, Alaska, is below freezing for five months of the year.

Alaska’s winters can cause all kinds of home damage.

Alaska’s residents should be as prepared for these winter hazards as they are for catastrophes like earthquakes and floods.

Alaska is also at risk of volcanic eruption.

There are 130 volcanoes and volcanic fields in Alaska, though not all of them are active. The most common volcanic hazard is ashfall, which can damage infrastructure and cause respiratory problems.

Read more: Top Volcano Insurance: What You Need to Know

Your insurance company’s standard policy will cover the majority of these damages, though you may have to purchase an add-on or separate policy for pipe systems and flooding. Make sure to confirm what is and isn’t covered with your insurance professional before purchasing your policy.

What’s the percentage of homeownership in Alaska?

Although the state has many advantages, living in Alaska can be expensive. The median property value was $276,100 in 2018, which is 1.2 times higher than the national average of $229,700.

The property value has also increased by 1.1 percent over the past couple of years. According to Zillow, the home market in Alaska is very hot.

Let’s break down more homeownership statistics for those interested in settling down in the state.

Alaska homeownership statistics

The homeownership rate in Alaska is 65.6 percent, which is higher than the national average of 63.9 percent. The median household income has been increasing over time; in 2018, it rose from $73,181 to $74,346.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the average home price in Alaska?

Even though Alaska had a recession in 2015, housing prices have remained relatively stable. A government report on Alaska’s economic trends has attributed this stability to factors like migration patterns and low-interest rates.

In Alaska, the majority of households have a property value of $300,000 to $400,000. The city of Sitka boasts the highest median home value at $383,800. There are, however, cities with a far more affordable housing market. Badger, Alaska, for example, has a median home value of $209,600.

For an in-depth look into Alaska’s housing market, check out this detailed analysis by Alaska Public Media.

Let’s next take a look at the state’s average mortgage debt.

What’s the average mortgage in Alaska?

According to Experian, the average mortgage debt in 2018 was $221,505, which increased slightly to $223,430 in 2019, marking a 0.9 percent change.

This increase in mortgage debt can be attributed to increases in property value across the state. As the price of homes increases in Alaska, so will the average amount of mortgage debt.

What are the average property taxes in Alaska?

The average property tax for a $250,000 home is $3,293 in Anchorage county and $2,975 in the entire state of Alaska. Both of these numbers are significantly higher than the national average property tax, which is $2,700.

However, some cities in Alaska do not levy property tax, so whether or not property tax will affect your cost of living depends on where you live.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alaska home insurance: What’s the bottom line?

While it’s important to purchase home insurance in advance of geographical risks like floods, earthquakes, and harsh winters, Alaskan properties are built to endure a variety of hazards.

For this reason, insurance premiums in Alaska are lower than the national average. The lower cost of homeowners insurance may help offset the expenses of homeownership in the state.

Though there isn’t a FAIR program in place for high-risk homes in Alaska, there are plenty of big and small insurance companies to choose from.

Make sure to purchase the appropriate add-ons and endorsements when you’re building your insurance policy. This will ensure that your home is well protected and help you enjoy the beautiful state of Alaska without worry.

Now that you’ve learned everything there is to know about home insurance in Alaska, you can compare home insurance rates by entering your ZIP code in the online quote box below.

Frequently Asked Questions

Is home insurance required in Alaska?

Home insurance is not legally required in Alaska, but your mortgage company may require it if you have a mortgage on your property.

What natural disasters are covered by standard home insurance in Alaska?

Standard home insurance policies typically cover damage caused by fire, windstorms, and hail. However, they do not typically cover flood or earthquake damage.

How can I get coverage for flood or earthquake damage in Alaska?

You can purchase separate policies for flood insurance and earthquake insurance to cover these specific risks not included in standard home insurance.

Which insurance companies offer the best home insurance in Alaska?

Some top home insurance providers in Alaska include State Farm, USAA Insurance Group, and Allstate. It’s recommended to compare quotes from multiple companies to find the best coverage and rates for your needs.

Are there any exclusions or limitations in Alaska home insurance policies?

Standard home insurance policies in Alaska may have exclusions for flood, earthquake, neglect-related damages, and other specific risks. It’s important to review your policy carefully to understand what is covered and what is not.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.