Titan Auto Insurance Review [2026]

Unveil the coverage for high-risk drivers in 24 states, Titan Insurance provides diverse auto options with potential affordability through combined discounts, despite notable customer complaints

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated April 2024

Titan Insurance is the company emerges as a specialized provider catering to high-risk drivers in 24 states. Despite garnering customer complaints, its positive A.M. Best rating underscores financial stability and the ability to meet obligations. Titan’s affiliation with Nationwide Insurance lends additional credibility, backed by Nationwide’s robust financial ratings.

The review delves into coverage options, emphasizing the company’s commitment to tailoring policies for high-risk individuals and offering non-standard insurance. While acknowledging customer concerns, the article provides insights into the company’s transparency and business practices, highlighting the significance of Nationwide’s financial backing.

With a focus on affordability through combined discounts, the article aims to equip readers with a nuanced understanding of Titan Insurance, empowering them to make informed decisions based on their unique insurance needs.

What You Should Know About Titan Insurance Company

Credit rating agencies grade auto insurance companies on financial strength. These ratings help customers determine the likelihood of receiving a payout when they file a claim.

Titan Insurance has been rated an A by A.M. Best. This rating is excellent and near the top of the agency’s scale, indicating that customers can expect a payout whenever they file a claim.

While Titan sells insurance on its own, the company is a subsidiary of Nationwide Insurance. The parent company has been rated an A+ by A.M. Best, an A by S&P, and an A1 by Moody’s. These are among the best financial ratings in the industry.

Nationwide’s ratings are significant because Titan receives financial backing from the company. Therefore, these ratings show that Titan customers will receive a payout for any reasonable claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Titan Insurance history?

Titan Insurance began in 1991 as a part of Nationwide Insurance. Headquartered in Troy, Michigan, the company’s purpose is to provide coverage for high-risk drivers. Today, the company offers personal and commercial policies to drivers in 24 states.

Titan Insurance continues to focus on auto insurance. However, Nationwide and its other subsidiaries provide other types of insurance, like home insurance and renters insurance.

Titan Insurance Company Insurance Coverage Options

While the cost of a policy is a critical factor, customers must also consider the available coverage options. Each state requires a certain amount of insurance, which is usually liability. However, adding more coverage will prepare you for any situation.

Titan Insurance provides the most common auto insurance coverages. The following table shows the primary types of coverage offered by the company and what each one covers.

Titan Insurance Auto Coverages

| Auto Insurance Types | Purpose of Coverage |

|---|---|

| Bodily injury liability | Pays for medical bills if someone else suffers an injury in an accident caused by you. |

| Property damage liability | Liability coverage that covers the cost of any property damage you’ve caused in an accident. |

| Collision | Covers damage to your car after an accident. |

| Comprehensive | Covers damage to your car when you’re not driving. |

| Personal injury protection | Covers medical expenses for you and your passengers after an accident. |

| Uninsured/underinsured motorist | Covers the costs if you’re in an accident caused by a driver with little or no car insurance. |

| Medical payments | Covers medical costs caused by an accident regardless of who is at fault. |

In addition to the typical coverages, Titan Insurance provides non-standard insurance. This type of coverage is for high-risk drivers, resulting in higher rates or the denial of coverage.

If drivers have their driving privileges revoked due to violations, they might require an SR-22 form to reinstate their license. This form proves that the driver has the minimum necessary insurance to operate a vehicle in that state.

Some companies won’t cover a driver requiring an SR-22 form because they’re often the highest-risk drivers. However, Titan Insurance provides coverage for these drivers and will help those requiring SR-22 forms obtain the necessary insurance.

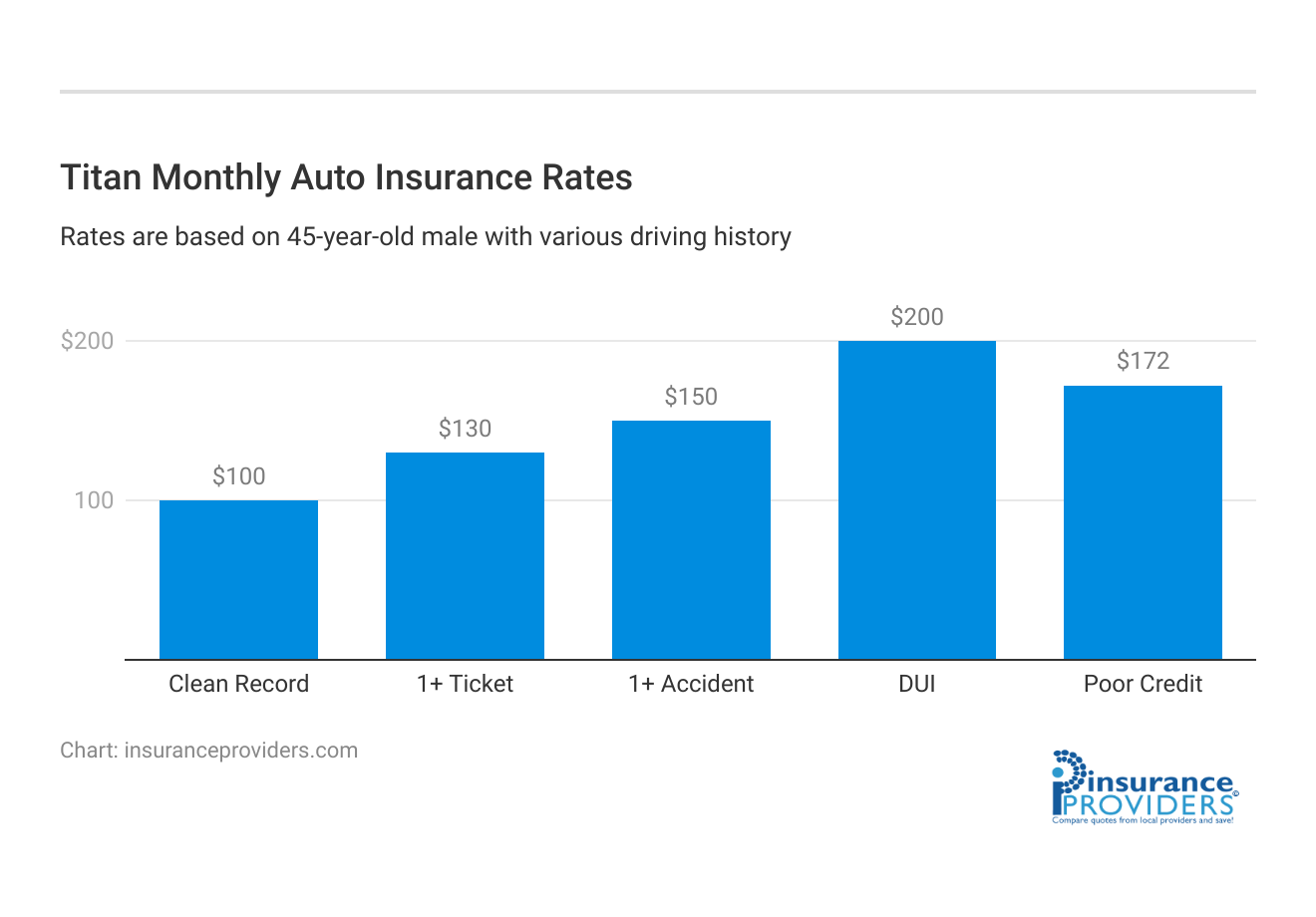

Titan Insurance Company Insurance Rates Breakdown

| Driver Profile | Titan | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $150 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

There are various things to consider when choosing a car insurance company. A significant factor for most customers is price. Comparing affordable Titan auto insurance rates with other companies is a good way of determining the most cost-effective option.

The following chart compares the average monthly Titan Insurance rates for different driver profiles with Geico and Allstate, two popular auto insurance companies.

Titan Insurance Average Annual Monthly Car Insurance Rates vs. GEICO and Allstate by Driving Profile

| Driver Profile | Average Monthly Titan auto insurance Rates | Average Monthly Geico auto insurance rates | Average Monthly Allstate auto insurance rates |

|---|---|---|---|

| Single female, 25 years old | $678 | $699 | $752 |

| Single male, 30 years old | $592 | $582 | $628 |

| Married couple | $1,067 | $993 | $1,171 |

| Senior married couple | $779 | $675 | $696 |

As you can see, Titan has the lowest rates for 25-year-old female drivers. In addition, the company has the second-lowest rates for 30-year-old males and young married couples. However, the company has the highest rates for senior married couples.

These comparisons show that young single females will find Titan Insurance the cheapest option. Geico is more affordable for young single males and young married couples, but the difference is minimal. Additionally, Titan has a more significant increase as drivers age.

While the average cost of coverage is an excellent way to compare companies, every driver is different. Therefore, companies consider various factors when determining rates and the cheapest option depends on your specific circumstances.

Read more: Auto Insurance for Couples: Does having multiple drivers save you money?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Titan Insurance Company Discounts Available

| Discount | Titan |

|---|---|

| Anti Theft | 4% |

| Good Student | 20% |

| Low Mileage | 3% |

| Paperless | 14% |

| Safe Driver | 25% |

| Senior Driver | 1% |

Car insurance might be significantly high depending on your age, gender, and driving habits. Fortunately, most auto insurance companies provide various discounts to lower your rates. Combining multiple deals will help you find the best price for coverage.

The discounts offered by car insurance companies depend on various aspects, including your vehicle, schooling, driving record, and lifestyle. The following table shows the Titan auto insurance company discounts.

Titan Insurance Auto Discounts

| Car Discount | Discount Eligibility |

|---|---|

| Accident-free | Drivers with no accidents in the past three to five years. |

| Airbag | Cars with factory-installed air bags. |

| Anti-lock brakes | Cars with factory-installed anti-lock brakes. |

| Anti-theft | Cars include anti-theft devices, like alarms, tracking systems, and kill switches. |

| Good student | High school or college students with at least a 3.0 grade point average. |

| Mature driver | Drivers over 55 that have completed a mature driver accident prevention course. |

| Military | Driver is a current or former member of the military. |

| Multi-car | Insure more than one car on a single auto insurance policy. |

| Safety course | Completed approved defensive driving course. |

When inquiring about Titan auto insurance quotes, asking about available discounts will allow you to get a more accurate price. The company might also offer advice on becoming eligible for more savings after you buy Titan auto insurance.

Does Titan Insurance have any complaints?

The Better Business Bureau (BBB) and the National Association of Insurance Commissioners (NAIC) examine complaints made about insurance companies. Both organizations have reviewed Titan Insurance.

At the time of this review, the BBB has received 216 complaints about Titan Insurance during the past three years. Nevertheless, Titan has an A+ rating from the BBB despite the significant number of complaints, indicating that the company is transparent and has solid business practices.

According to the NAIC, Titan Insurance has a complaint index ratio of 4.33. This number indicates that the company has far more complaints than similarly-sized competitors.

While Titan Insurance has more complaints than many competitors, every situation is distinct. Therefore, examining the different complaints will allow you to determine if they should be a concern.

How can you file Titan Insurance claims?

Titan Insurance customers can file claims online or by phone. Customers must log in to the site using their designated login information to file a claim online. Accessing the customer portal allows policyholders to:

- Make payments

- View account information

- View an electronic insurance ID card

- Report a claim

- Find an agent

- Make a claim

Additionally, the company provides a mobile app for all mobile devices. The app allows customers to access the same information and complete the same tasks as the website.

For customers who prefer to speak with a representative, you can file a claim by calling the Titan auto insurance phone number at 1-800-926-3168.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Titan Insurance Company Ranks Among Providers

When evaluating Titan Insurance Company among auto insurance providers, several key factors come into play.

- A.M. Best Rating: Titan Insurance has earned a favorable rating of “A” from A.M. Best, indicating a high level of financial stability and the ability to meet its financial obligations. This places Titan among the insurers with a strong standing in the industry.

- Customer Complaints: While Titan Insurance has garnered a notable number of customer complaints, particularly 216 reported to the Better Business Bureau (BBB) within the past three years, it is important to note that the company maintains an impressive A+ rating from the BBB. This suggests that, despite the volume of complaints, Titan is transparent and maintains solid business practices.

- Parent Company Backing: As a subsidiary of Nationwide Insurance, Titan benefits from the financial strength of its parent company. Nationwide Insurance holds high ratings from A.M. Best, S&P, and Moody’s, affirming its robust financial standing. This financial backing enhances the confidence that Titan customers can rely on the company for consistent and reliable payouts.

- Specialization in High-Risk Drivers: Titan Insurance positions itself as a provider specializing in coverage for high-risk drivers. This niche focus allows the company to cater to the unique needs of this demographic, offering policies and options that may not be as readily available from other insurers.

- Coverage Options: Titan Insurance provides a comprehensive range of coverage options, catering to the needs of high-risk drivers. In addition to standard coverages, the company offers non-standard insurance, recognizing the distinct requirements of high-risk individuals. This flexibility in coverage is a distinguishing feature that may appeal to drivers facing challenges in obtaining insurance elsewhere.

While Titan Insurance has its share of customer complaints, its positive A.M. Best rating, strong backing from Nationwide Insurance, specialization in high-risk drivers, and diverse coverage options contribute to its notable position among auto insurance providers. Prospective policyholders should carefully consider their individual needs and priorities when assessing Titan Insurance for their coverage requirements.

Frequently Asked Questions

What types of coverage does Titan Insurance provide for high-risk drivers?

Titan Insurance offers a range of auto coverage options tailored for high-risk drivers, including the most common types of coverage and specialized options for non-standard insurance needs.

How can I lower the costs of Titan auto insurance?

Customers can potentially reduce their Titan auto insurance costs by taking advantage of combined discounts offered by the company. These discounts allow policyholders to customize their coverage for increased affordability.

Despite customer complaints, why does Titan Insurance receive a positive rating from A.M. Best?

A.M. Best, a reputable credit rating agency, rates Titan Insurance positively, indicating a high level of financial strength and the ability to fulfill claims. This positive rating reflects the company’s stability, even in the face of customer complaints.

What is the significance of Nationwide Insurance’s ratings in relation to Titan Insurance?

Titan Insurance is a subsidiary of Nationwide Insurance, and the parent company’s high ratings by A.M. Best, S&P, and Moody’s showcase strong financial backing. This backing ensures Titan customers can expect reliable payouts for reasonable claims.

How can I file a claim with Titan Insurance, and what options are available?

Titan Insurance provides multiple avenues for filing claims. Customers can file claims online through the customer portal, accessible with login information, or by calling the Titan auto insurance phone number at 1-800-926-3168.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.