Freedom National Auto Insurance Review [2026]

Freedom National Auto Insurance specializes in providing affordable coverage to high-risk drivers, including those with DUIs, multiple at-fault accidents, or a need for SR-22 insurance, operating in California, Arizona, Georgia, and Utah.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Tonya Sisler

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated April 2024

Freedom National sells auto insurance policies in four states and focuses primarily on high-risk drivers.

So if you have a DUI, have multiple at-fault accidents on your record, or need SR-22 insurance, you can still qualify for affordable Freedom National auto insurance policies.

Keep reading this Freedom National auto insurance review to compare customer experiences and financial ratings, learn about the potential costs, and determine if this company is right for you.

After learning how to buy Freedom National auto insurance, don’t forget to enter your ZIP code into our free rate comparison tool above to compare quotes from the best companies in your region.

What You Should Know About Freedom National Insurance Services Inc

Freedom National sells auto insurance policies to higher-risk drivers in Arizona, California, Georgia, and Utah.But technically, in California, the company is registered as Freedom General Insurance Services. This is a smaller company, and there is currently no available mobile app for customers to use.

However, you can create a membership login after you’ve secured coverage. In the membership portal on the company website, you can pay your bill, make any necessary policy changes, access your ID cards, and more.

When it comes to coverage options, you can purchase most of the basic auto insurances from Freedom National, including liability insurance as well as collision and comprehensive insurance.

In select states, uninsured or underinsured motorist coverage, medical payments (MedPay) coverage, and personal injury protection (PIP) insurance are also available.

Plus, as policy add-ons, the website mentions rental car reimbursement, roadside assistance packages, and guaranteed asset protection (GAP) insurance.

Overall, Freedom National offers affordable auto insurance policies to drivers that traditional companies typically view as too high-risk to insure.

The company mainly focuses on simple auto insurance for people with bad driving records. It covers people in need of SR-22 insurance, those with suspended licenses, and also international drivers. Plus, Freedom National insurance offers a handful of payment options to drivers for customer ease, including paying in full upfront or setting up monthly auto-pay.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the history of Freedom National?

Freedom National is a privately held company founded in 1999. It’s headquartered in Newport Beach, California, and the current president and CEO is Bijan Abdi.

From the start, it focused on selling no-frills auto insurance policies to higher-risk individuals with any type of driving background.

Freedom National, registered as Freedom General Insurance Services in California, is a small company with only 11 to 50 employees in total.

This company only sells auto insurance policies in Arizona, California, Georgia, and Utah.

It does not plan to expand to other parts of the country at any point in the future. It also does not intend to roll out any additional insurance offerings.

Freedom National Insurance Services Inc Insurance Coverage Options

Freedom National Auto Insurance is committed to providing comprehensive coverage, specially tailored for high-risk drivers. Explore the various coverage options offered by the company to ensure you have the protection you need on the road.

- Liability Insurance: Basic coverage to meet legal requirements.

- Collision and Comprehensive Insurance: Protects against damage to your vehicle in different scenarios.

- Uninsured or Underinsured Motorist Coverage: Safeguards you in case of accidents with drivers without adequate insurance.

- Medical Payments (MedPay) Coverage: Additional coverage for medical expenses.

- Personal Injury Protection (PIP) Insurance: Provides coverage for medical expenses and more, depending on the state.

- Optional Add-ons: Rental car reimbursement, roadside assistance, and guaranteed asset protection (GAP) insurance.

Freedom National offers a range of coverage options to cater to the diverse needs of high-risk drivers. Contact the company to tailor your policy and ensure you have the right protection for your unique driving situation.

Freedom National only sells auto insurance policies and does not plan to offer any additional lines of insurance at any point in the future.

The company appears to focus on basic policies for higher-risk individuals.

This includes people with DUIs, at-fault accidents, or multiple traffic citations on their records.

However, Freedom National does offer some optional policy add-ons to its customers, including towing coverage, roadside assistance, rental reimbursement, and even GAP insurance.

Contact a customer service representative during operational business hours for more information about what specific policy add-ons are available to you from Freedom National.

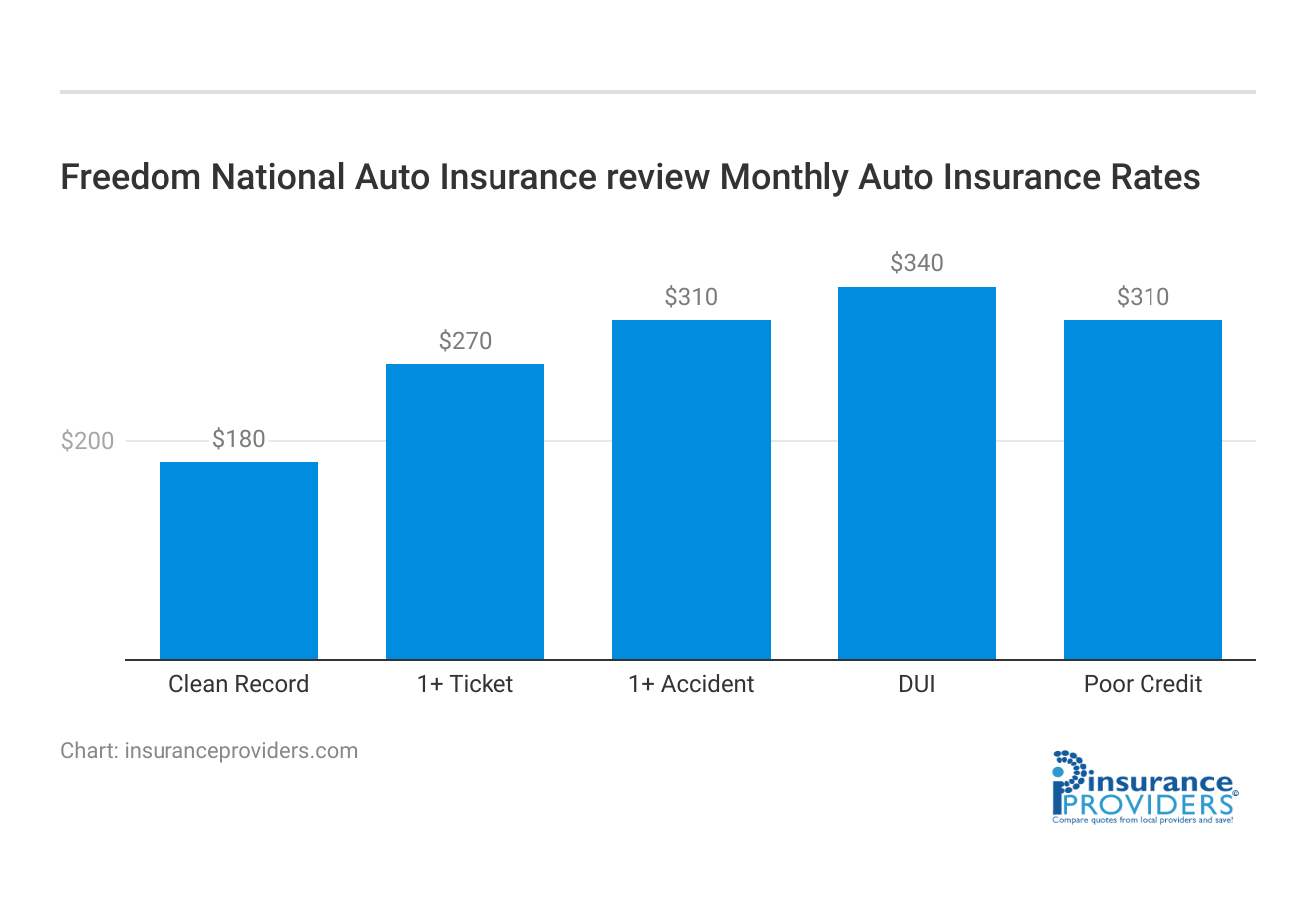

Freedom National Insurance Services Inc Insurance Rates Breakdown

| Driver Profile | Freedom National Auto Insurance review | National Average |

|---|---|---|

| Clean Record | $180 | $200 |

| 1+ Ticket | $270 | $290 |

| 1+ Accident | $310 | $330 |

| DUI | $340 | $350 |

| Poor Credit | $310 | $344 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Currently, Freedom National auto insurance rates are not publicly available.

However, if you request a quote, you can compare it to the average cost of auto insurance in the state where you live.

The table below shows the average annual auto insurance expenditures in 2018 in the four states where Freedom National operates, as recorded by the Insurance Information Institute (III).

Average Annual Auto Insurance Expenditures by State

| State | Average Annual Auto Insurance Expenditure |

|---|---|

| Arizona | $1,046.40 |

| California | $1,034.05 |

| Georgia | $1,212.04 |

| Utah | $941.14 |

Keep in mind that many factors impact your auto insurance costs, including your age, driving record, coverage needs, and the type of vehicle you’re insuring.

In fact, even your ZIP code affects your auto insurance.

Plus, if you’re looking into Freedom National because you’re a high-risk driver, your rates from traditional companies may be exceptionally high compared to the average.

So to secure the best rates without compromising your coverage, compare quotes from multiple top auto insurance companies and choose the policy that best fits your unique situation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Freedom National Insurance Services Inc Discounts Available

| Discount | Freedom National Auto Insurance review |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 8% |

| Safe Driver | 15% |

| Senior Driver | 5% |

Freedom National Auto Insurance aims to provide affordable coverage to high-risk drivers. While the company doesn’t provide detailed information about its discounts on the website, there are potential savings opportunities for policyholders. Contact a customer service representative for more specific details about the available auto insurance discounts.

- Good Driver Discount: Available in Arizona, Georgia, and Utah.

- Multi-Car Discount: Savings are offered for insuring multiple vehicles, specifics may vary.

- Additional Discounts: Other potential discounts may be available, inquire with a customer service representative for personalized details.

While Freedom National focuses on offering accessible coverage to drivers with challenging records, exploring available discounts can further enhance affordability. Contact the company’s customer service to discover how you can maximize savings on your auto insurance policy.

Freedom National does not provide detailed information about available discounts on the company website. However, this does not necessarily mean the company does not offer any.

For example, on the state pages of the website, the company does reference a good driver discount available in Arizona, Georgia, and Utah.

It also mentions a multi-car discount but does not explain how many cars you must insure to qualify or what rate reduction you may earn.

Contact a customer service representative for more specific details about what auto insurance discounts Freedom National can offer you.

How do you file a Freedom National auto insurance claim?

To file an auto insurance claim with Freedom National, you must contact the correct claims office by phone or submit an online form.

The claims office you report to is based on your policy number. Four departments are available, and all are listed on the company website.

In the same section of the website as the claims office phone numbers, you will also find a checklist of information you should provide to successfully and efficiently file your claim.

This includes details like your full name, policy number, and driver’s license number. Plus, the company requests that you secure similar information for any other driver involved in the incident.

If anyone was injured in the accident, a second claims adjuster might be assigned to your case to assist with the bodily injury portion.

Freedom National says the entire process moves quickly. However, no specific timeline or estimation is available on the company website.

But if you feel the process is moving too slowly, the company encourages you to follow up with your adjuster at any point throughout the process.

Read more: Claims Adjuster: Insurance Explained

How Freedom National Insurance Services Inc Ranks Among Providers

In the competitive landscape of auto insurance, Freedom National faces several noteworthy competitors. These companies provide alternatives for high-risk drivers seeking coverage. Explore the list below to consider other options and find the best fit for your insurance needs.

- Geico: Known for competitive rates and extensive coverage options.

- Progressive: Offers a variety of discounts and user-friendly online tools.

- The General: Specializes in providing coverage for drivers with a challenging record.

- Dairyland: Focuses on non-standard auto insurance, catering to high-risk drivers.

- Infinity Insurance: Provides affordable options for drivers with less-than-perfect records.

While Freedom National is a viable choice, comparing quotes and coverage from these competitors can help you make an informed decision. Each company has its strengths, so explore your options to secure the best coverage for your unique driving situation.

Read more:

- Dairyland National Insurance Company Review

- Dairyland County Mutual Insurance Company of Texas: Customer Ratings & Reviews

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you request Freedom National auto insurance quotes?

Requesting Freedom National auto insurance quotes is as easy as visiting the company website. Once there, you can quickly use one of the available online quote tools. However, you can also call Freedom National at 888-542-4222 for personalized assistance. Plus, the company provides you with a customer service email address.

Once you’ve secured your policy, you get an email with instructions about setting up your online account, and you get printable ID cards as well. Freedom National also mails you physical copies of your insurance ID cards for your convenience.

What are the Freedom National ratings and reviews like?

Evaluating an insurance company’s customer reviews and financial ratings allows you to determine if the company is reliable before actually committing to a policy.

Unfortunately, Freedom National has not been evaluated by any leading credit rating agencies, such as A.M. Best, S&P Global, or Moody’s.

However, in terms of customer experiences, Freedom National is accredited by the Better Business Bureau (BBB) and earned an A+ rating.

On the website, Freedom National displays reviews from customers through TrustSpot. Out of 918 total submissions, the company earned a score of 9.49 out of 10.

So while we cannot evaluate the financial stability of this company, real customers of Freedom National appear satisfied with the services they receive from this company.

Notably, customers enjoy the affordable rates and fast customer service responses.

Frequently Asked Questions

What states does Freedom National sell auto insurance in?

Freedom National sells auto insurance policies in four states: Arizona, California, Georgia, and Utah.

What kind of drivers does Freedom National focus on insuring?

Freedom National focuses primarily on high-risk drivers, such as those with DUIs, multiple at-fault accidents on their record, or who need SR-22 insurance.

What types of coverage options are available from Freedom National?

Most basic auto insurance options are available, including liability insurance, as well as collision and comprehensive insurance. In select states, uninsured or underinsured motorist coverage, medical payments (MedPay) coverage, and personal injury protection (PIP) insurance are also available.

How can I request a quote for Freedom National auto insurance?

You can request a quote by visiting the Freedom National website and using one of the available online quote tools. You can also call Freedom National at 888-542-4222 for personalized assistance.

What are the customer reviews and financial ratings like for Freedom National?

Freedom National has not been evaluated by any leading credit rating agencies but is accredited by the Better Business Bureau (BBB) and has earned an A+ rating. On the website, Freedom National displays reviews from customers through TrustSpot and has received a score of 9.49 out of 10 from 918 total submissions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.