GAINSCO Auto Insurance Review (2026)

GAINSCO Auto Insurance, catering to high-risk drivers in 18 states, offers basic coverage with limited options, while its recent acquisition by State Farm introduces unique considerations, making it essential for drivers to explore the nuances before determining if GAINSCO aligns with their insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Diego Anderson

Updated April 2024

Through thousands of local agents, GAINSCO provides auto insurance to high-risk drivers in 18 states. However, while offered coverage meets state requirements, the company only provides a few extras. For example, drivers can’t bundle home and auto coverage with GAINSCO.

Although GAINSCO was purchased by State Farm recently, it has a large number of customer complaints. However, GAINSCO will file an SR-22 and offers non-owner car insurance.

Customers looking for basic coverage auto insurance for high-risk drivers will find GAINSCO a good fit, but drivers looking for standard coverage and multiple policies should look elsewhere.

Keep reading our GAINSCO auto insurance review to learn more about the company and determine if it’s a good fit for you.

What You Should Know About GAINSCO Auto Insurance

GAINSCO got its start in 1978 in Dallas, Texas. The company now provides auto insurance in 18 states and was purchased by State Farm auto insurance in 2020. However, State Farm has not yet merged insurance products with GAINSCO.

GAINSCO provides non-standard car insurance to high-risk drivers who may have trouble finding affordable coverage with other insurers. In addition, the company files SR-22 forms for drivers who need them.

Drivers can quickly get a GAINSCO quote on the company’s website or mobile app. In addition, GAINSCO has over 7,000 local agents to provide quotes, take payments, and make policy changes. In fact, GAINSCO seems to do business primarily through local agents rather than online or through centralized customer service.

GAINSCO’s website lacks some information, such as the specific coverages offered and detailed claims information. However, drivers can file claims, make payments, and access the helpful FAQ section online. Drivers can also find a local agent through the website.

Keep in mind that high-risk auto insurance is typically much more expensive than traditional coverage. Insurers charge drivers much higher rates if they have DUIs or other serious offenses on their driving record since those drivers are more likely to cost the insurer money through claims.

GAINSCO prides itself on offering flexible policies, multiple payment options, and local agents that provide personalized customer service. However, the company’s car insurance options are limited, and it doesn’t offer other insurance products, such as home, renters, or boat coverage.

While GAINSCO provides car insurance coverage to drivers who may be denied coverage elsewhere, those with clean driving records and those who need multiple insurance products likely won’t find a good deal.

What are the pros and cons of GAINSCO auto insurance?

As with any insurance provider, GAINSCO auto insurance has advantages and disadvantages. Because GAINSCO offers non-standard auto insurance, it looks different than other standard insurers.

Pros of using GAINSCO auto insurance include:

- High-risk coverage. Drivers with multiple DUIs, tickets, accidents, and serious infractions on their driving records may have difficulty finding coverage since many insurers won’t take on the risk. GAINSCO offers cheap high-risk car insurance.

- SR-22 filing. High-risk drivers may be required to file an SR-22, which shows they have at least the state’s mandatory coverage. While filing the form is inexpensive, car insurance rates increase significantly for those drivers.

- Quotes available. Drivers can quickly and easily get quotes online, through a local agent, or with the company’s mobile app.

- Local agents. GAINSCO has more than 7,000 local agents to provide one-on-one service and answer questions. Local agents can also provide quotes and take payments.

- Mobile app. GAINSCO’s mobile app allows drivers to get quotes and make payments easily.

Cons of GAINSCO car insurance include:

- Significant number of complaints. GAINSCO earns more than the average number of complaints based on its size. Most complaints center around customer service and claims.

- Limited coverage area. GAINSCO car insurance is only available in 18 states, so drivers may have to find new coverage if they move to a different state.

- Website isn’t informative. The GAINSCO website doesn’t list coverage options or available discounts.

- Limited mobile app. GAINSCO only offers the mobile app in the Google Play Store. In addition, drivers can only get a quote or make a payment and cannot see their policy information on the app.

- Limited coverage. GAINSCO doesn’t offer the variety of insurance products that many larger insurers provide. For example, the company doesn’t offer homeowners, renters, or motorcycle coverage.

Auto insurance isn’t one-size-fits-all. It’s up to each driver to determine if the pros outweigh the cons of GAINSCO coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the GAINSCO insurance ratings?

Low car insurance rates are essential, but you also need to know if an insurer is dependable and easy to work with. Unfortunately, the GAINSCO insurance reviews and ratings aren’t comforting. However, it does provide car insurance coverage to drivers who may not otherwise be able to drive legally.

It should be noted that GAINSCO receives ratings from only some organizations due to its smaller size. So, it may be more challenging to compare GAINSCO ratings with those of larger insurers. However, since State Farm owns the company, we’ll also examine how this company stacks up.

What are GAINSCO’s financial ratings?

A.M. Best rates companies on financial stability. GAINSCO received an A- rating, showing an excellent ability to meet financial obligations. So, you can be confident the company has the ability to pay any claims you may file.

In addition, State Farm received an A++ rating, showing superior financial strength. This high rating should increase your confidence since you know that a financially sound company backs GAINSCO.

How does GAINSCO rate for customer service?

When it comes to customer satisfaction, J.D. Power rates companies on factors like customer service, billing, and products offered. Unfortunately, GAINSCO doesn’t show up on J.D. Power’s rankings. However, State Farm ranked above average in most regions of the U.S.

The Better Business Bureau rates companies on how well they interact with customers. GAINSCO received an A- rating but only a 1/5 customer rating on the BBB website. In addition, most reviewers rated the claims process poorly.

State Farm received an A+ BBB rating but only a 1.18/5 customer rating. Most customer complaints center around an unsatisfactory claims process.

Does GAINSCO receive many complaints?

Unfortunately, GAINSCO receives more than the average number of complaints for a company of its size. The National Association of Insurance Commissioners (NAIC) tracks how many complaints each insurer receives. The national average complaint index score is 1.0, and anything lower than this means a company receives fewer than the average number of complaints. However, GAINSCO has a complaint index of 1.60.

In addition, State Farm has a complaint index score of 1.44, which is also above the national average for a more prominent insurer.

This means drivers shouldn’t necessarily expect a smooth customer experience with GAINSCO. Although, for high-risk drivers who have a difficult time finding coverage, availability may outweigh customer service.

Most customer complaints center around the claims process, with many complaining about denied claims. This is a significant concern since drivers need to be confident their insurer will pay out for repairs and/or medical bills.

Why should you consider GAINSCO auto insurance?

While a driver with few infractions on their driving records may choose to skip the more expensive high-risk coverage offered by GAINSCO, some drivers will benefit from selecting the insurer.

First, drivers who need high-risk coverage or an SR-22 filed may consider GAINSCO. Despite high rates, the insurer specializes in car insurance coverage for risky drivers. Drivers may be required to file an SR-22 by their state for multiple reasons, such as numerous DUIs, driving without insurance, and other serious offenses. If you have had a DUI, it doesn’t stay on your record forever, find out how long a DUI stays on your record here.

Next, GAINSCO uses local agents offering face-to-face service. Drivers can make payments, get quotes, and make policy changes through their local agent. While GAINSCO lacks the convenience of handling your insurance policy entirely online, many drivers like building a relationship with a local agent.

GAINSCO also offers bilingual customer support through its customer service number. Customer service representatives provide English and Spanish support.

Finally, GAINSCO provides quotes, payment services, and claims filing options on its website. In addition, drivers can use the mobile app to get quotes and make payments. While drivers can’t access policy information through the app, they can print ID cards online. However, drivers need to contact their local agents to make policy changes.

GAINSCO isn’t a good fit for drivers who don’t need high-risk auto insurance. Since the company has higher rates than standard insurers and offers fewer coverage options, drivers who can get car insurance through another insurer should look elsewhere.

In addition, the company only provides auto insurance in 18 states and doesn’t offer other insurance products. So, your policy may not transfer if you move, and you can’t bundle policies, such as home and auto.

Does GAINSCO insurance have a mobile app?

Yes, GAINSCO has a mobile app for Android users in the Google Play Store. The app allows GAINSCO customers to get a quote and make a payment. However, the app has a 3.4/5 rating, and many reviewers note that they can’t access their policy information.

Compared to other insurers, GAINSCO’s app does not have many helpful features.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GAINSCO Auto Insurance Coverage Options

Most states require at least a minimum amount of car insurance coverage to drive legally. However, each state determines what coverages and limits are necessary. Therefore, insurance needs vary from state to state.

As a non-standard insurer, GAINSCO specializes in meeting minimum coverage requirements in each state for high-risk drivers. While the insurance coverage needs of a high-risk driver are the same as anyone else, rates are typically significantly higher.

Car insurance coverages offered by GAINSCO include:

- Liability auto insurance. Most states require liability coverage, including bodily injury liability and property damage liability. The former pays for injuries to other drivers and their passengers, the latter pays for damage to other drivers’ property.

- Uninsured/underinsured motorist coverage. Some states require this coverage, which pays out if a driver hits you and they have little or no liability coverage. Since their liability coverage would pay for your damages, your car insurance must step in to pay for injuries and damages in this case.

- Personal injury protection (PIP) insurance coverage. A few states require PIP, which pays for medical expenses as well as related costs like lost wages and childcare.

- SR-22 filing. A driver may be required to file an SR-22 auto insurance form to show proof of minimum coverage if they have serious infractions on their driving record, like DUIs, uninsured driving, or serious at-fault accidents.

- Non-owner. Drivers who don’t own a vehicle but still need car insurance can find non-owner insurance through GAINSCO. Non-owner coverage helps drivers who need to file an SR-22 avoid a lapse in coverage.

Drivers may also find roadside assistance and rental car reimbursement coverage through GAINSCO. Remember, each state is different, so the coverages and limits vary widely.

Some coverages, such as collision and comprehensive, seem to be missing from GAINSCO’s insurance options. Collision auto insurance coverage pays for damages to your vehicle from an accident, and comprehensive auto insurance pays for damages unrelated to an accident, such as damages from fire, theft, vandalism, and acts of nature like floods and hurricanes.

Full coverage auto insurance includes collision, comprehensive, and state-mandated coverages. Although no state requires full coverage, it provides the most protection for your vehicle. Unfortunately, GAINSCO doesn’t seem to offer full coverage, so drivers needing the additional protection should consider other insurers.

How do you make changes to your GAINSCO auto insurance policy?

While you can make payments, view your policy, and print ID cards on the website, you must visit your local agent to make changes to your policy. GAINSCO has over 7,000 local agents, so finding one should be convenient.

You’ll also need to contact your local agent to renew or cancel your car insurance policy.

Is State Farm auto insurance good?

State Farm is the largest insurer in the country, and it purchased GAINSCO in 2020. However, the companies aren’t very similar. Whether it’s availability, coverages, discounts, or online presence, State Farm offers more than GAINSCO.

State Farm provides car insurance in all 50 states, whereas GAINSCO only offers coverage in 18 states. So, if you have State Farm insurance and you move, your State Farm insurance moves with you. However, rates and coverage options may vary by state.

Coverage options are also very different between GAINSCO and State Farm. For example, while GAINSCO only offers basic car insurance, State Farm provides numerous car insurance options, such as collision, comprehensive, and rideshare insurance.

In addition, State Farm offers more than just car insurance. For example, drivers can also find motorcycle, boat, homeowners, renters, and business insurance. State Farm also provides life, health, pet, and disability insurance. Drivers can bundle multiple policies to get extra savings.

State Farm provides multiple ways for drivers to save on their car insurance. In addition to various car insurance discounts, drivers can save by participating in Drive Safe & Save, a telematics program that monitors safe driving habits and issues a discount based on your score.

State Farm’s website and mobile app provide more services than GAINSCO. On the website, drivers can get a quote, make a payment, file and track a claim, and even request roadside assistance. In addition, drivers can manage their policies, make payments, and file claims from the mobile app, which is available in the Google Play Store and the Apple App Store.

While GAINSCO specializes in high-risk auto insurance, State Farm provides affordable car insurance to teens and other drivers needing standard coverage. However, State Farm also offers coverage to drivers with less-than-perfect driving records.

Does State Farm provide SR-22 insurance?

Yes, State Farm offers SR-22 insurance. State Farm offers auto insurance coverage to high-risk drivers and will file a State Farm SR-22 form. So if you’re wondering “does State Farm have SR-22 insurance”, the answer is yes. However, don’t expect your car insurance rates to stay the same if you need State Farm SR-22 insurance.

DUIs, speeding tickets, and at-fault accidents significantly raise your State Farm car insurance rates. Likewise, multiple infractions or other serious offenses, such as driving without a license or car insurance, greatly increase those rates. So while State Farm won’t necessarily turn away high-risk drivers, rates won’t be the same as with a clean driving record.

If you live in a state where both GAINSCO and State Farm car insurance are available, compare quotes to see which company offers the better deal. While State Farm owns GAINSCO, rates, coverages, and discounts are different.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GAINSCO Auto Insurance: The Bottom Line

As we’ve discussed in our GAINSCO car insurance review, GAINSCO provides high-risk car insurance to drivers in 18 states who may need help acquiring coverage due to their driving records.

However, rates are high, and customer service ratings are low. In addition, GAINSCO’s complaint index score is significantly above average.

GAINSCO is a good choice for drivers who need high-risk coverage or help filing an SR-22. But coverage options are limited, so drivers looking for multiple insurance products won’t find what they need.

Before deciding on GAINSCO auto insurance, shop around. Compare multiple companies’ coverages, rates, and discounts to find your best deal. Since GAINSCO has high rates and many complaints, it pays to comparison shop before signing up.

GAINSCO Auto Insurance Rates Breakdown

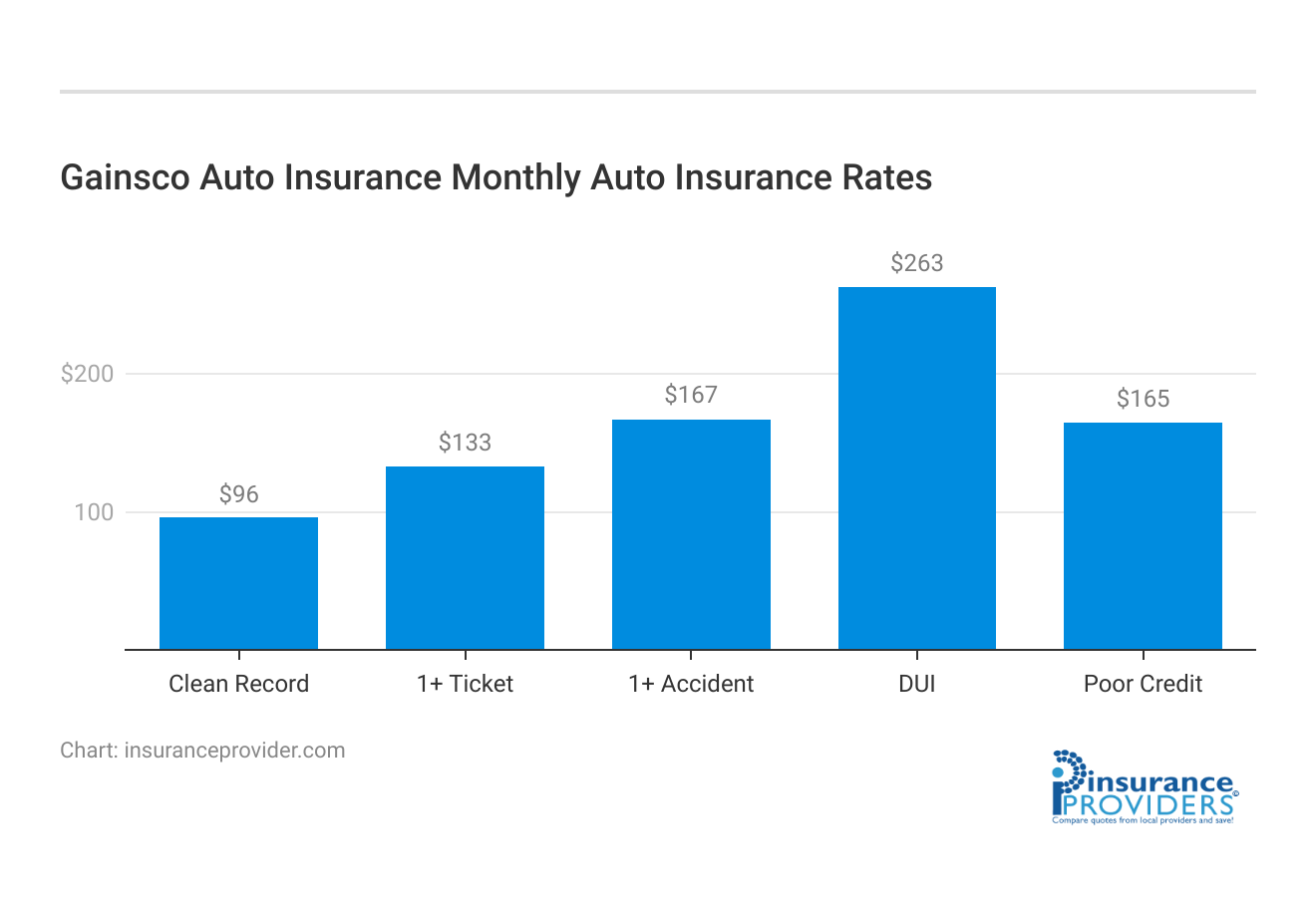

| Driver Profile | Gainsco Auto | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $167 | $173 |

| DUI | $263 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Unfortunately, high-risk drivers see much higher car insurance rates than standard drivers. The good news is that there are still a few ways drivers can lower GAINSCO rates.

First, look at your car insurance policy. Since GAINSCO only offers basic car insurance, you won’t be able to make many policy changes. However, you can remove add-on coverages, such as roadside assistance, to lower your rates.

Next, avoid adding infractions to your driving record. How long does an accident stay on your record? Many states remove accidents and tickets after three to five years. However, DUIs can raise your rates for up to 10 years in some states. As your driving record clears, you’ll be able to find cheaper car insurance rates.

Some states also allow drivers to remove driver’s license points and earn a car insurance discount by taking a defensive driving course. In addition, such a class reinforces safe driving skills and helps drivers avoid more infractions.

Finally, take advantage of discounts. GAINSCO offers several car insurance discounts that will save you money. For example, paying for your policy upfront or setting up automatic payments earns you a discount. Your local agent will know which discounts are available in your state and add them to your policy.

GAINSCO Auto Insurance Discounts Available

| Discounts | Gainsco Auto |

|---|---|

| Anti Theft | 5% |

| Good Student | 6% |

| Low Mileage | 3% |

| Paperless | 4% |

| Safe Driver | 7% |

| Senior Driver | 7% |

One way to significantly lower GAINSCO car insurance rates is to take advantage of discounts. Although most car insurance companies offer numerous discounts, GAINSCO offers fewer ways to save.

GAINSCO auto insurance discounts include:

- Early signing. Drivers can earn a discount by signing up for a new policy or renewing their existing GAINSCO policy 3-30 days before it expires. In some states, drivers can sign up as late as one day before their current policy expires.

- Paid in full. Earn a discount by paying for your policy in full at the beginning of your term. Not only does paying your policy in full lower your rates, but you also don’t have to worry about missing a payment.

- Autopay. Drivers can earn a discount for signing up for automatic payments through the website with their checking account, debit card, or credit card. Automatic payments ensure that your payment arrives on time and your coverage won’t lapse.

- Prior coverage. Drivers who can show proof of at least four months of continuous coverage with less than a six-month lapse in coverage before signing up for GAINSCO can see a discount.

- Homeowner. Drivers who also own a home, including a mobile home, condo, or townhome, may earn an additional discount. However, you can’t get homeowners insurance through GAINSCO.

While these discounts are listed on the GAINSCO website, others may also be available. In addition, discount amounts aren’t listed online. Since your state determines car insurance discounts, discount amounts and availability will vary.

However, drivers that qualify for more than one discount can bundle them for the most significant savings. Since high-risk car insurance rates are very high, adding discounts is essential.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How GAINSCO Auto Insurance Ranks Among Providers

As you explore your auto insurance options, it’s essential to consider various providers to find the coverage that best suits your needs. Here is a list of competitors that operate in a similar space as GAINSCO Auto Insurance:

- State Farm: Known for its extensive network of agents, State Farm provides personalized service and various coverage options.

- Geico: Geico is recognized for its user-friendly online platform, quick quotes, and various discounts.

- Progressive: Progressive is acclaimed for its Snapshot program, which uses telematics to reward safe driving habits with potential discounts.

- Allstate: Allstate is known for features like accident forgiveness and customizable policies to meet individual needs.

- Nationwide: Nationwide emphasizes a range of coverage options and offers features like vanishing deductibles and accident forgiveness.

These competitors represent some of the major players in the insurance industry, each with its own strengths and unique offerings. When choosing an insurance provider, it’s crucial to consider factors such as coverage options, pricing, customer service, and individual preferences.

Frequently Asked Questions

Is GAINSCO Auto Insurance suitable for drivers with clean records or those seeking multiple insurance products?

GAINSCO primarily caters to high-risk drivers and offers basic coverage with limited options. Drivers with clean records or those in need of multiple insurance products may find better alternatives, as GAINSCO’s focus is on providing coverage to high-risk individuals.

What distinguishes GAINSCO from other insurance providers, especially after its acquisition by State Farm?

GAINSCO specializes in non-standard car insurance, serving high-risk drivers in 18 states. The recent acquisition by State Farm brings about potential changes, but as of now, State Farm has not merged insurance products with GAINSCO, and each operates independently.

How does GAINSCO compare to State Farm in terms of coverage options and availability?

While State Farm is a larger insurer offering a variety of insurance products nationwide, GAINSCO focuses on high-risk auto insurance in 18 states. State Farm provides more coverage options, including home, renters, and boat insurance, making it a more versatile choice compared to GAINSCO.

What are the key considerations for drivers thinking about choosing GAINSCO, especially in terms of financial stability and customer satisfaction?

GAINSCO has an A- rating from A.M. Best, indicating strong financial stability. However, customer reviews suggest mixed experiences, with some complaints about the claims process and customer service. Drivers must weigh the financial stability against potential customer service concerns when considering GAINSCO.

Does GAINSCO offer a mobile app for managing insurance-related tasks?

Yes, GAINSCO provides a mobile app for Android users, available on the Google Play Store. The app allows customers to obtain quotes and make payments. However, some users note limitations in accessing detailed policy information through the app.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.