NYCM Auto Insurance Review [2026]

Discover the comprehensive review of NYCM auto insurance, exclusively available in New York State, highlighting its exceptional financial and customer service ratings despite the higher-than-average rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Updated April 2024

NYCM auto insurance offers great customer service with higher-than-average rates. While coverage options are limited, available coverage meets New York state requirements. Drivers can take advantage of discounts to get lower rates. Most drivers qualify for multiple discounts, such as defensive driver, claims-free, and multi-policy savings.

Before choosing NYCM car insurance, shop around. Compare regional and nationwide insurers to find the policy that meets your needs.

What You Should Know About New York Central Mutual Insurance Company (NYCM)

The New York Central Mutual Insurance Company (NYCM) provides insurance options for drivers in New York State. While coverages are limited and rates are higher than average, NYCM has excellent customer service and financial ratings.

New York Central Mutual car insurance is a good choice for drivers who value customer service above all else. However, drivers looking for cheap New York car insurance may need to look elsewhere.

Keep reading our NYCM auto insurance review to learn more about the company and determine if it’s right for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New York Central Mutual Insurance Company (NYCM) Insurance Coverage Options

New York requires that drivers carry bodily injury and property damage liability, uninsured/underinsured motorist, and personal injury protection coverages. NYCM provides coverage that meets the New York mandatory car insurance requirements.

NYCM offers other standard car insurance coverages, including collision and comprehensive. New York requires neither coverage, but the minimum required coverage doesn’t include protection for your car.

While collision and comprehensive coverages protect your vehicle, they are very different. Collision pays for damages resulting from an accident, and comprehensive covers damage unrelated to an accident, such as fire, theft, vandalism, and acts of nature.

NYCM provides additional coverages, such as roadside assistance. NYCM roadside assistance includes towing, jump starts, locksmith services, fuel delivery, and winching. The low radius depends on which package you choose, with towing up to 100 miles.

Besides car insurance coverage, NYCM offers other insurance products, including homeowner, renter, condo, mobile home, classic car, motorcycle, and business insurance.

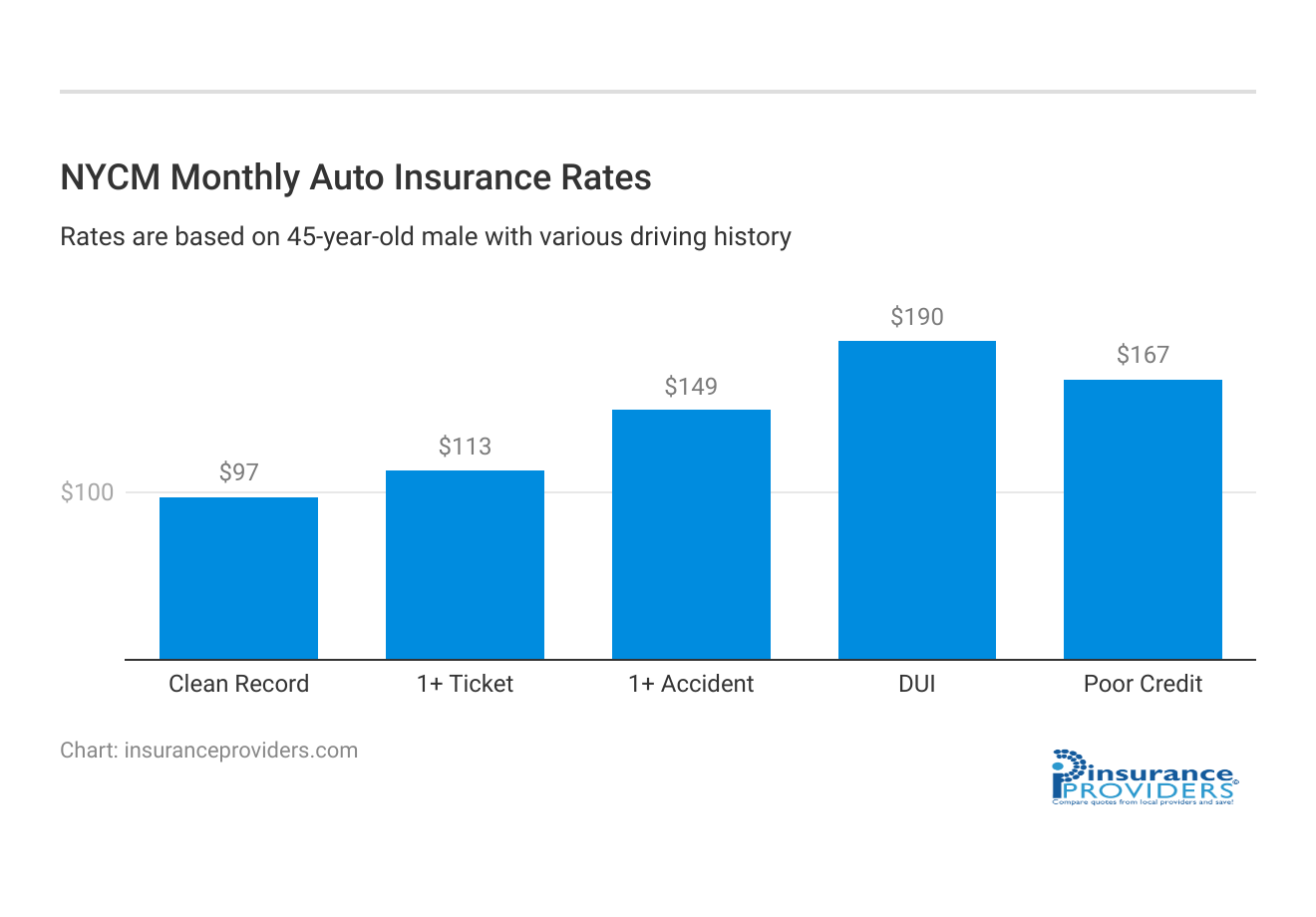

New York Central Mutual Insurance Company (NYCM) Insurance Rates Breakdown

| Driver Profile | NYCM Auto Insurance | National Average |

|---|---|---|

| Clean Record | $97 | $119 |

| 1+ Ticket | $113 | $147 |

| 1+ Accident | $149 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $167 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Many factors affect car insurance rates, such as age, driving record, vehicle, coverage, and ZIP code. For example, adult drivers with a clean driving record and affordable cars see the lowest auto insurance rates. Because these factors are different for each driver, rates vary widely. There is no one-size-fits-all approach to car insurance.

NYCM is a regional insurer and only provides coverage in New York. While many national car insurance companies offer competitive rates and discounts, NYCM is more expensive than average and has few discounts.

In addition, NYCM auto insurance rates increase significantly after an accident, ticket, or DUI. Therefore, one or more of these infractions may make finding affordable high-risk car insurance with NYCM impossible. However, if you prioritize customer service over rates, NYCM is a good option.

New York Central Mutual Insurance Company (NYCM) Discounts Available

| Discount | NYCM Auto Insurance |

|---|---|

| Anti Theft | 8% |

| Good Student | 6% |

| Low Mileage | 10% |

| Paperless | 5% |

| Safe Driver | 10% |

| Senior Driver | 5% |

NYCM offers various car insurance discounts to help lower rates by up to 55%. In addition, many drivers qualify for more than one discount, so savings increase significantly. Discounts offered by NYCM include:

- Automatic payment: Save 2.5% if you allow NYCM to automatically deduct payments from your checking, savings, or credit card account.

- Paid in full: A 10% discount is applied if you pay your 12-month policy in full.

- Driver’s education: Save up to 10% for taking driver’s training courses under 21. However, discount amounts vary by age.

- Away student discount: Save up to 25% if you have a student who attends school more than 100 miles from home and doesn’t regularly use a car.

- Defensive driving class: Save up to 10% by taking a refresher course on safe driving.

- Good student: Full-time students with at least a B average can save up to 10%.

- Senior discount: Drivers over 65 can save up to 5% if they’ve been insured with NYCM for at least five years and qualify for the claims-free discount.

- Multi-policy: Save up to 25% for bundling policies like auto, home, and renter.

NYCM also offers savings based on specific features, such as vehicle safety and alarm system discounts. Keep in mind that not all discounts apply to the entire car insurance policy. For example, the NYCM car alarm discount applies only to your comprehensive coverage, not the whole policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How New York Central Mutual Insurance Company (NYCM) Ranks Among Providers

While NYCM ratings are high, so are their car insurance rates. Many national car insurance companies offer lower rates and more discounts. In addition, some have better A.M. Best ratings.

Look at this table to see the average monthly rates from the top car insurance companies to get an idea of the cost of full coverage.

Average Monthly Liability-Only vs. Full Coverage Auto Insurance Rates by Company

| Companies | Monthly Liability-Only Coverage Auto Insurance Rates | Monthly Full Coverage Auto Insurance Rates |

|---|---|---|

| Allstate | $162 | $318 |

| American Family | $114 | $224 |

| Farmers | $147 | $288 |

| Geico | $91 | $179 |

| Liberty Mutual | $203 | $398 |

| Nationwide | $117 | $229 |

| Progressive | $144 | $283 |

| State Farm | $120 | $235 |

| Travelers | $147 | $287 |

| USAA | $82 | $161 |

| National Average | $133 | $260 |

The best way to compare NYCM to other insurers is to compare quotes. Shop around to compare rates, coverages, and discounts to find your best deal.

Frequently Asked Questions

Can I customize my NYCM Auto Insurance policy?

Yes, NYCM Auto Insurance allows customers to customize their policies according to their specific requirements. They offer various coverage options, deductibles, and limits that can be adjusted to fit your individual needs and budget. This flexibility ensures that you get the coverage that best suits your unique circumstances.

How can I file a claim with NYCM Auto Insurance?

Filing a claim with NYCM Auto Insurance is a straightforward process. You can initiate a claim by contacting their claims department via phone or online. NYCM has a dedicated team of professionals who will guide you through the claims process and help you resolve your claim efficiently and effectively.

Does NYCM Auto Insurance have a good reputation?

Yes, NYCM Auto Insurance has built a solid reputation over the years. With their commitment to exceptional customer service, prompt claims handling, and competitive rates, NYCM has earned the trust and loyalty of many policyholders. Their positive reputation is reflected in their high customer satisfaction ratings.

Can I manage my NYCM Auto Insurance policy online?

Absolutely! NYCM Auto Insurance provides a user-friendly online portal that allows policyholders to manage their policies conveniently. Through the online platform, you can access your policy information, make payments, update personal details, view documents, and even request policy changes.

Is NYCM Auto Insurance licensed to operate in all states?

NYCM Auto Insurance is a prominent provider exclusively serving New York State, known for its exceptional commitment to excellence and comprehensive coverage, holding all necessary licenses and approvals.

How long has NYCM Auto Insurance been in business?

NYCM Auto Insurance has been in business for over 125 years, establishing itself as a trusted and reliable provider in the insurance industry. With such a long-standing presence, NYCM has gained extensive knowledge and experience in insuring vehicles and ensuring customer satisfaction.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.