Top Auto Insurance Providers for Veterans in 2026 (Top 10 Companies)

Explore top car insurance companies for veterans with Progressive, USAA, and Farmers. Tailored coverage options address specific military needs, making them optimal choices for high-quality protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Imani Francies is a finance and insurance writer who has strong media and communication skills with a bachelor's degree from Georgia State University. She began her writing career freelancing with various blogs and internships while working full-time as an early childhood educator. She has significant experience in both print and online media as a writer, editor, and author. She works efficient...

Imani Francies

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,072 reviews

3,072 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews

There is no one-size-fits-all when it comes to auto insurance, but there are tons of different options when shopping for the best car insurance for military personnel. For example, military personnel have radically different auto insurance needs than drivers who commute to work.

Our Top 10 Best Companies: Top Auto Insurance Providers for Veterans

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | Progressive | Up to 10% | Up to 5% | Online Convenience | |

| #2 | USAA | Up to 10% | Up to 20% | Military Savings | |

| #3 | Farmers | Up to 25% | Up to 20% | Local Agents | |

| #4 | Chubb | Up to 15% | Up to 5% | Policy Options | |

| #5 | American Family | Up to 29% | Up to 20% | Student Savings | |

| #6 | State Farm | Up to 17% | Up to 5% | Many Discounts | |

| #7 | Liberty Mutual | Up to 25% | Up to 30% | Customizable Polices |

| #8 | AAA | Up to 25% | Up to 10% | Local Agents |

| #9 | Allstate | Up to 10% | Up to 10% | Add-on Coverages | |

| #10 | Geico | Up to 25% | Up to 25% | Cheap Rates |

During their time in the military, veterans and their families frequently move to other bases or are sent abroad, and these changes don’t necessitate the same auto insurance coverage.

Keep reading to learn more about military auto insurance. This guide covers how to buy auto insurance from the top insurance providers and which companies offer the best car insurance military discounts.

#1 – Progressive – Online Convenience

Progressive stands out as the top choice for veterans seeking competitive and personalized coverage, with a focus on online convenience and advantageous options.Ty Stewart Licensed Life Insurance Agent

Pros

- Maximum multi-policy discount: Progressive offers up to a 10% multi-policy discount, allowing veterans to bundle their insurance for savings.

- Maximum low-mileage discount: With a potential 5% low-mileage discount, Progressive caters to veterans who may not drive frequently.

- Online convenience: Progressive’s online platform provides ease of use, allowing veterans to manage policies and claims conveniently.

Cons

- Limited military savings: While Progressive offers competitive rates, it may not provide the extensive military savings that specialized companies like USAA offer.

- Local agent availability: Progressive’s emphasis on online services might limit the availability of in-person consultations, which some veterans may prefer.

Read more: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA – Military Savings

Pros

- Maximum multi-policy discount: USAA provides veterans with up to a 10% multi-policy discount, encouraging them to consolidate their insurance needs.

- Maximum low-mileage discount: With an impressive 20% low-mileage discount, USAA recognizes and rewards veterans who drive fewer miles.

- Military savings: USAA’s primary focus on serving military members ensures specialized coverage and exclusive discounts for veterans.

Cons

- Limited accessibility: USAA is exclusively available to military members and their families, limiting accessibility for non-military customers.

- Potentially higher rates: While offering military-focused benefits, USAA’s rates might not always be the most competitive for certain profiles.

Read more: USAA Auto Insurance Review

#3 – Farmers – Local Agents

Pros

- Maximum multi-policy discount: Farmers stands out with a generous up to 25% multi-policy discount, providing veterans significant savings.

- Maximum low-mileage discount: Offering up to 20% low-mileage discount, Farmers caters to veterans who may not drive extensively.

- Local agents: With a focus on local agents, Farmers ensures personalized service, addressing veterans’ specific needs and concerns.

Cons

- Limited military focus: While Farmers provides competitive rates, it lacks the specialized military focus and savings offered by dedicated companies like USAA.

- Policy options: Farmers may have fewer policy options compared to some competitors, limiting veterans’ choices.

Read more: Farmers Auto Insurance Review

#4 – Chubb – Policy Options

Pros

- Maximum multi-policy discount: Chubb offers up to a 15% multi-policy discount, providing veterans with potential savings when bundling their insurance.

- Maximum low- mileage discount: With a 5% low-mileage discount, Chubb caters to veterans who may not engage in extensive driving.

- Policy options: Chubb stands out for its diverse policy options, allowing veterans to tailor coverage according to their specific needs.

Cons

- Limited military focus: Chubb may not provide the specialized military focus and exclusive savings that dedicated military insurance companies offer.

- Potentially higher rates: While Chubb offers policy flexibility, its rates might not always be the most competitive for certain veteran profiles.

Read more: Chubb Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family – Student Savings

Pros

- Maximum multi-policy discount: American Family offers an impressive up to 29% multi-policy discount, ensuring veterans substantial savings through bundling.

- Maximum low-mileage discount: With up to a 20% low-mileage discount, American Family caters to veterans with limited driving needs.

- Student savings: American Family provides student savings, addressing the insurance needs of veteran families with students.

Cons

- Limited military focus: American Family, while offering competitive rates, may not provide the specialized military focus and savings offered by companies like USAA.

- Age and student-specific: The emphasis on student savings may not benefit all veterans, particularly those without students on their policy.

Read more: American Family Auto Insurance Review

#6 – State Farm – Many Discounts

Pros

- Maximum multi-policy discount: State Farm offers up to a 17% multi-policy discount, encouraging veterans to consolidate their insurance needs.

- Maximum low-mileage discount: With a 5% low-mileage discount, State Farm caters to veterans who may not drive extensively.

- Many discounts: State Farm provides various discounts beyond multi-policy and low-mileage, offering veterans diverse savings opportunities.

Cons

- Limited military focus: While State Farm offers competitive rates, it may not provide the specialized military focus and exclusive savings that dedicated military insurance companies offer.

- Local agent availability: State Farm’s emphasis on local agents might limit accessibility for veterans who prefer online services.

Read more: State Farm Auto Insurance Review

#7 – Liberty Mutual – Customizable Policies

Pros

- Maximum multi-policy discount: Liberty Mutual offers up to a 25% multi-policy discount, providing veterans with substantial savings through bundling.

- Maximum low-mileage discount: With an impressive 30% low-mileage discount, Liberty Mutual recognizes and rewards veterans who drive fewer miles.

- Customizable policies: Liberty Mutual stands out for its customizable policies, allowing veterans to tailor coverage according to their specific needs.

Cons

- Limited military focus: Liberty Mutual, while offering competitive rates, may not provide the specialized military focus and savings offered by companies like USAA.

- Potentially higher rates: While providing customizable policies, Liberty Mutual’s rates might not always be the most competitive for certain veteran profiles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA – Local Agents

Pros

- Maximum multi-policy discount: AAA offers up to a 25% multi-policy discount, encouraging veterans to consolidate their insurance needs.

- Maximum low-mileage discount: With a 10% low-mileage discount, AAA caters to veterans who may not drive extensively.

- Local agents: AAA focuses on local agents, ensuring personalized service and addressing veterans’ specific needs and concerns.

Cons

- Limited military focus: AAA, while offering competitive rates, may not provide the specialized military focus and exclusive savings that dedicated military insurance companies offer.

- Potentially higher rates: While AAA provides local agent support, its rates might not always be the most competitive for certain veteran profiles.

Read more: AAA Auto Insurance Review

#9 – Allstate – Add-on Coverages

Pros

- Maximum multi-policy discount: Allstate offers up to a 10% multi-policy discount, encouraging veterans to bundle their insurance for savings.

- Maximum low-mileage discount: With a 10% low-mileage discount, Allstate caters to veterans who may not engage in extensive driving.

- Add-on coverages: Allstate provides various add-on coverages, allowing veterans to enhance their policies based on specific needs.

Cons

- Limited military focus: Allstate, while offering competitive rates, may not provide the specialized military focus and exclusive savings offered by companies like USAA.

- Potentially higher rates: While providing add-on coverages, Allstate’s rates might not always be the most competitive for certain veteran profiles.

Read more: Allstate Auto Insurance Review

#10 – Geico – Cheap Rates

Pros

- Maximum multi-policy discount: Geico offers up to a 25% multi-policy discount, providing veterans with potential savings through bundling.

- Maximum low-mileage discount: With an impressive 25% low-mileage discount, Geico recognizes and rewards veterans who drive fewer miles.

- Cheap rates: Geico is known for its competitive rates, making it an attractive option for veterans seeking cost-effective coverage.

Cons

- Limited military focus: Geico, while offering competitive rates, may not provide the specialized military focus and exclusive savings that dedicated military insurance companies offer.

- Potentially limited coverage options: Geico’s emphasis on cost-effective coverage may result in fewer policy options compared to some competitors.

Read more: Geico Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

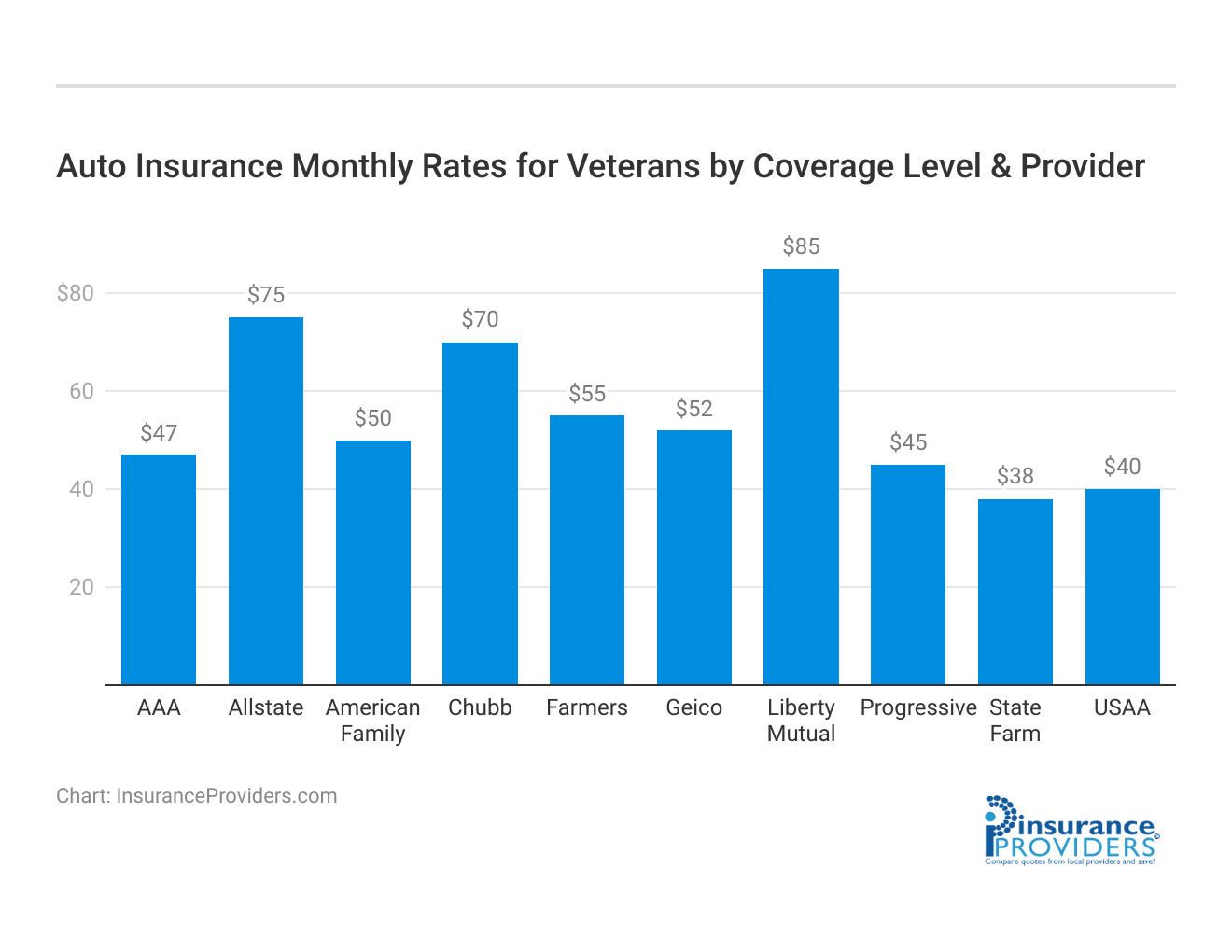

Average Military Auto Insurance Rates by Status

Securing auto insurance as a veteran involves more than just finding affordable rates – it’s about finding coverage that understands the unique experiences and needs of those who have served. In this landscape, Progressive, USAA, and Farmers emerge as top choices.

Average Monthly Auto Insurance Rates for Veterans

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $45 | $130 |

| USAA | $40 | $115 |

| Farmers | $55 | $160 |

| Chubb | $70 | $200 |

| American Family | $50 | $150 |

| State Farm | $38 | $90 |

| Liberty Mutual | $85 | $210 |

| AAA | $47 | $125 |

| Allstate | $75 | $190 |

| Geico | $52 | $140 |

Progressive, known for its user-friendly online services, offers basic coverage starting at $45 and full coverage at $130, providing a seamless experience for veterans seeking convenience. USAA, exclusively dedicated to military personnel, stands out with basic coverage at $40 and full coverage at $115, ensuring savings and specialized benefits tailored to veterans.

Farmers, with basic coverage beginning at $55 and full coverage at $160, adopt a personalized approach through local agents. These insurers not only offer competitive rates but also recognize and address the distinct circumstances veterans may encounter.

As veterans navigate the auto insurance market, these providers stand as pillars, offering not just affordable rates but coverage options that respect and cater to the service they’ve rendered to the nation.

Read more: How to Cancel Progressive Auto Insurance

Military Auto Insurance vs. Standard Policies

Although the fundamentals of auto insurance are the same for military personnel, coverage for those on active duty has certain unique restrictions.

For instance, several states permit service members to continue their automobile registration and insurance coverage via their home state, regardless of where they are stationed. However, each insurance carrier has distinct requirements when a service member deploys abroad.

Finally, some businesses only offer coverage to service members, so if you’re looking for military auto insurance, you might have more options than the typical client.

Comparing the Best Auto Insurance Providers for Military Personnel

The top military auto insurance providers are USAA, Geico, and Armed Forces Insurance. Each offers unique discounts and full coverage auto insurance options that cater to military members on deployment, living on base, or retired.

Scroll through the sections below to learn more about each provider and compare military car insurance coverage options.

USAA: Top Provider for Active-Duty Military and Families

USAA offers exceptional customer service, pricing, and special coverage that is only available to military personnel and their families. Due to this, USAA takes first place in our ranking of the top military auto insurance companies.

Read our USAA auto insurance review to learn more about the company and compare rates.

Pros and Cons of USAA Insurance

Reasons why military members should buy USAA auto insurance:

- One-stop shop for all your banking and insurance needs with multi-policy discounts

- Available in all 50 states

- Unique discounts and savings not available with other companies

- High customer service rankings

USAA consistently scores well above the national average in the annual J.D. Power Customer Satisfaction Study but isn’t officially ranked since it restricts access to coverage, which is one of the only drawbacks to the company.

Cons of USAA insurance include:

- Limited to military and their immediate family members

- Very few in-person locations and agents

Limiting coverage to only the U.S. military is how USAA keeps its rates low. However, young drivers on a family policy will be ineligible for coverage when they age up and move out.

USAA Auto Insurance Coverage

Similar to the majority of other auto insurance companies, USAA’s policies provide the following:

- Bodily injury and property damage liability insurance coverage

- Comprehensive and collision auto insurance coverage

- Uninsured/underinsured motorist coverage (UM/UIM)

- Personal injury protection (PIP) and Medical Payments Coverage (MedPay)

- Rental car reimbursement

- Towing services and roadside assistance coverage

- Usage-based and pay-per-mile auto insurance coverage

USAA offers coverage for more than just automobiles — it covers boats, RVs, and motorcycles. In addition, USAA offers life insurance, homeowners and renters insurance, and rideshare protection for Uber and Lyft drivers.

Members of USAA can also choose to add pet insurance, additional health insurance benefits, and a variety of other unique coverage alternatives, making it one of the most competitive military auto insurance providers in the country.

USAA Auto Insurance Discounts

Military members are eligible for exclusive savings from USAA. To begin with, military personnel on active duty who park their car on base are eligible for a 15% discount. Furthermore, USAA provides a 60% discount if you store your vehicle while serving overseas.

Similar savings you’ll find at USAA and a majority of other insurance providers include:

- Discounts for multiple vehicles and policies

- Safe-driver incentives

- Discounts for new vehicles

- Loyalty rebates

Additionally, children of USAA members get a 10% automatic discount. USAA also offers auto insurance discounts depending on mileage, enabling military personnel who reside on base or find themselves deployed for a portion of the year to save money by not racking up miles on their car.

Availability of USAA Insurance

USAA sells coverage in all 50 states and Washington, D.C., but there are restrictions on who is eligible for military auto insurance.

Those who may enroll are:

- Presently serving in the Army, Air Force, Coast Guard, National Guard, Marines, or Navy

- Retirees or veterans who have been given an honorable discharge

- Those attending U.S. service academies, participating in advanced ROTC, receiving an ROTC scholarship, and officer candidates who will commission within 24 months

- Family members, including current spouses, widows, widowers, divorced ex-spouses who haven’t remarried, and children whose parents have or have had USAA insurance

If you do not meet any of these requirements, you will not be able to buy auto insurance from USAA.

USAA Customer Service Reviews

USAA provides excellent service and car insurance for military personnel and their families. As a result, it earns some of the greatest marks for customer satisfaction in the sector.

Additionally, USAA receives excellent scores for financial stability, with an A++ rating from AM Best.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico: Top Auto Insurance Military Discounts

Did you know that Geico stands for Government Employees Insurance Company? Given this information, it’s not surprising that Geico provides some of the finest military auto insurance discounts.

Pros and Cons of Geico

If you buy Geico military car insurance, you’ll enjoy the following:

- 15% off for all active-duty and retired military

- A wide range of discounts and coverage

- Coverage in all 50 states

Geico consistently offers the cheapest auto insurance quotes in every state, and military discounts can help you save even more on car insurance. However, since Geico is a national provider, it does not provide the same exclusive savings as USAA.

Other disadvantages to Geico insurance include:

- Fewer alternatives and special deals for active duty deployment

- Children of service members are not eligible for military discounts

Active-duty military members will likely be eligible for more savings with other companies, so compare Geico insurance quotes to other local providers before you buy to lock in the best rates.

Geico Auto Insurance Options

Some of the most comprehensive auto insurance coverage options are available from Geico. The many coverage options include:

- Liability insurance for bodily harm and property damage

- Collision and comprehensive coverage

- PIP or MedPay

- UM/UIM

- Insurance for mechanical failure

- Roadside assistance

- Rental car reimbursement

- Usage-based auto insurance

Geico usage-based insurance can help military members save money on car insurance if they don’t drive often. Read our Geico DriveEasy review to learn more and find out how to qualify.

Along with plans for cars, Geico also offers coverage for boats, RVs, motorcycles, and all-terrain vehicles (ATVs). The business also provides commercial vehicle insurance, vintage auto coverage, and Mexican trip insurance if you use your car for several purposes.

Geico Auto Insurance Discounts

The savings possibilities are the best feature of Geico military auto insurance. There are no conditions tied to the 15% discount, which is extended to all active-duty, retired, National Guard, and reserve personnel. Individuals sent to places of “imminent danger” and stored their vehicle while on deployment will enjoy emergency deployment discounts.

Along with these military-specific reductions, you can earn close to 20 more discounts based on the kind of car you drive, your driving record and habits, and any necessary driver’s education. Geico also offers additional discounts for other federal employees and veterans working for the government.

Availability of Geico Insurance

Given that it provides coverage in all 50 states and Washington, D.C., Geico is a fantastic option almost everywhere in the nation. Additionally, many of its auto insurance and a vast range of discounts are open to everyone.

Geico Customer Service Reviews

Geico consistently receives some of the finest customer service scores in the sector. It has an AM Best financial strength rating of A++.

Furthermore, in its 2021 Insurance Shopping Study for the North Central, Northwest, and Southwest regions, J.D. Power gave Geico an above-average rating in terms of client satisfaction for California, Central, and New England.

Armed Forces Insurance (AFI): Top Veterans Auto Insurance Provider

This company specializes in providing insurance to military personnel and their families. Armed Forces Insurance (AFI) was established in 1887, more than 130 years ago, but is smaller and lesser-known than USAA, its main competitor.

When comparing quotes for auto insurance coverage, you should seriously consider Armed Forces Insurance for its low rates and broad coverage.

Pros and Cons of AFI

The pros of buying AFI include:

- Long-standing competitive coverage history

- Coverage for civilians employed by the military

- Accessible across all 50 states

While coverage availability is a little more lax than with USAA, you still must be an active or retired military member to qualify. Fortunately, discount rates are still available to former AFI members and anyone who leaves for a different insurance company and returns to AFI.

Some disadvantages to AFI include:

- Not as many discounts as USAA or Geico

- Limited mobile capabilities

- A.M. Best rating of B+

As a smaller company, AFI lacks some of the perks that come with other national providers. However, the company still earned a Good rating from A.M. Best and is well worth a quote comparison based on its savings opportunities.

Armed Forces Insurance Coverage Options

Armed Forces Insurance offers military car insurance that covers you, your spouse, any children, and other family members who reside in the same home. Coverage will also extend to other licensed drivers you enable to use your vehicle.

AFI provides its members with a variety of auto insurance options, including:

- Liability insurance for bodily harm and property damage

- Collision and comprehensive car insurance

- Insurance coverage for injuries and medical expenses

- UM/UIM

- Roadside assistance

- Rental car reimbursement

AFI provides one-stop shopping for its members, similar to USAA. It offers homeowners’ and renters’ insurance in addition to auto insurance, as well as coverage for motorcycles and other recreational vehicles.

AFI also provides special insurance options such as umbrella policies, valuable object insurance, pet insurance, and fire and flood insurance.

Armed Forces Insurance Discounts

Unfortunately, AFI’s website does not specifically disclose any discounts, and filling out an online price request needs a lot of information.

Despite this, the company does assert that it provides reasonable premiums and a range of discounts based on your driving history, participation in several plans, and other factors.

Armed Forces Insurance Availability

Armed Forces Insurance provides auto, house, and motorcycle insurance through a network of affiliates in all 50 states and Washington, D.C.

Like USAA, AFI restricts car insurance and other types of coverage to the individuals listed below:

- Military personnel who are honorably discharged, retired, or active service in any branch (including National Guard and Reserves)

- Department of Defense civilian employees, active or retired

- Members of the Service Academy, such as cadets in the Merchant Marines or the ROTC

- Survivor spouses, spouses, former spouses, or children

- Former AFI members who terminated coverage and then rejoined

- Active, retired, or former commissioned officer of the NOAA or PHS

AFI also covers other drivers listed on your policy, but limitations may apply. Speak with a local agent to learn more about military auto insurance coverage in your area.

AFI Customer Service Reviews

Armed Forces Insurance has few ratings due to being a smaller company in the auto insurance industry. AFI is too small to be included in research by J.D. Power or other larger rating systems but has an A+ rating with the Better Business Bureau (BBB).

Which companies offer military discounts for auto insurance?

Car insurance discount rates differ by company. However, most military auto insurance providers give active-serving and retired military personnel discounts ranging from 5% to 15%.

Unfortunately, you won’t find these discounts with every provider. To save money on your military auto insurance, check with the following insurers that offer military discounts on car insurance:

- Armed Forces Insurance

- USAA

- Farmers auto insurance

- Liberty Mutual

- Geico

Although the companies don’t specifically cater to military members, Farmers and Liberty Mutual both offer military discounts. Savings vary by state, so shop around with these and other local companies to see which offers the best military discounts.

How to Get an Auto Insurance Military Discount

The verification process for car insurance discounts differs for each insurer, but you normally require a state-issued photo ID (driver’s license, state ID card, or passport) and one of the following military credentials:

- Discharge certificate

- D214 Member 4 copy

- NGB22

- Academy appointment letter or ROTC contract

- Active duty military orders

- Leaving and earning statement

Some auto insurance providers will also permit active-duty service members to temporarily cancel their auto insurance policy to save money, in addition to the regular discounts offered on car insurance for veterans and active military. You will need documents proving your deployment (active-duty military orders) and that you put your car in long-term storage for the period of your deployment in order to do this.

Do veterans qualify for auto insurance discounts?

Many businesses offer veterans a military discount, albeit not all do. Veterans car insurance often comes with a discount from USAA, AFI, Geico, Liberty Mutual, and Farmers Insurance. To find out if a veteran discount is offered, you should always speak with a customer care agent or nearby insurance agent.

Do non-military personnel qualify for auto insurance discounts?

Often you can qualify for additional savings based on certain criteria. For example, some providers offer discounts to teen drivers who maintain good grades. Drivers who don’t smoke, maintain a low annual mileage and clean driving record, and uphold a decent credit score will also pay lower rates.

Non-military personnel can earn other discounts for having anti-theft equipment in their vehicle and staying accident-free for at least three years.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Military Auto Insurance and Deployment

Are you getting ready to deploy but unsure what to do with your military car insurance? Numerous businesses offer pricing support for vehicles that are being stored, including garaging and low-mileage discounts.

To ensure that your car is safe while you are away, ask your agency for a storage protection plan.

Most insurance companies are accommodating for emergency coverage modifications, especially if you are traveling to an area the U.S. Department of Defense has designated as an “imminent danger pay area.” Some insurance providers also permit you to cancel your policy and then reinstate it after your return without incurring any penalties for lapses in coverage.

How to Terminate Auto Insurance in Advance of a Deployment

It may be necessary to make some changes to your auto insurance policy if you are getting ready for deployment. Instead of canceling your policy, pausing your coverage can be the wisest course of action.

When you cancel your auto insurance, there is a delay in coverage, which can lead to increased rates or even the suspension of your driver’s license.

If you keep your car while deployed and have auto insurance through USAA, you might save up to 60% on your premium. However, you should only think about storing your car if it’s not in use and can’t be accessed by anybody else. For instance, you cannot put the automobile into storage if other drivers use it while you are deployed.

Deployed drivers can also earn an auto insurance discount depending on the number of miles they drive each year. For example, if you’re a Geico client and store your car for longer than 30 days, you can suspend or lower your insurance coverage without penalty.

How to Reactivate Auto Insurance Following Deployment

You need to reinstate your auto insurance coverage before you start driving again. If you drive your car while it is still classified as “in storage” on your insurance policy, you risk being left without insurance coverage in the event of a claim.

Call your auto insurance provider and talk with a representative to resume your policy.

Keep in mind that you must meet the minimum insurance requirements in your state to drive again. Before you get behind the wheel, consider upgrading some coverage you may have dropped to save money on auto insurance while deployed.

Case Studies: Top Auto Insurance Providers for Veterans

Case Study 1: Veteran Auto Insurance

In this case study, we examine the experience of John, a retired veteran, who was searching for the best auto insurance provider catering to his unique needs as a veteran. John wanted an insurance company that offered discounts and benefits specifically tailored to veterans. John’s search led him to Veterans Insurance Company, one of the leading auto insurance providers for veterans.

He found that the company offered competitive rates and a range of benefits for veterans, such a lower auto insurance premiums , specialized coverage options, and exceptional customer service. John decided to switch to Veterans Insurance Company and was highly satisfied with their personalized approach to serving veterans.

Case Study 2: Military Affinity Program

In this case study, we explore the experience of Sarah, an active-duty military service member seeking auto insurance coverage. Sarah desired an insurance provider that understood the unique challenges faced by military personnel and offered customized solutions. Sarah discovered United Forces Insurance, a top auto insurance provider renowned for its military affinity program.

The program provided exclusive discounts, flexible coverage options, and special benefits designed specifically for military members. Sarah was impressed by United Forces Insurance’s commitment to supporting the military community and decided to become a policyholder with them.

Case Study 3: USAA – A Trusted Choice

In this case study, we meet Mark, a retired veteran in search of an auto insurance provider with a strong reputation and comprehensive coverage. Mark specifically wanted a company with ties to the military community. He found his perfect fit in USAA (United Services Automobile Association), a highly respected insurance provider exclusively for military personnel and their families.

USAA offered competitive rates, excellent customer service, and a wide range of coverage options tailored to the needs of veterans. Mark became a USAA policyholder and appreciated the peace of mind that came with their trusted reputation.

Case Study 4: Armed Forces Insurance Corporation

In this case study, we examine the experience of Michael, an active-duty service member who required auto insurance that would provide adequate coverage during deployments and frequent relocations. Michael discovered Armed Forces Insurance Corporation, a company specializing in serving the unique insurance needs of military members.

He found that Armed Forces Insurance Corporation offered policies with provisions specifically addressing deployment and relocation scenarios, along with flexible coverage options and attentive customer service. Michael decided to go with Armed Forces Insurance Corporation, as their tailored solutions provided him with the necessary coverage and peace of mind.

Case Study 5: Navy Federal Credit Union

In this case study, we explore the experience of Lisa, a Navy veteran who was seeking an auto insurance provider that offered competitive rates and excellent customer service. Lisa discovered Navy Federal Credit Union, an organization primarily focused on financial services for military personnel and their families.

She found that Navy Federal Credit Union provided auto insurance with favorable rates, discounts, and exceptional customer support. Lisa chose Navy Federal Credit Union as her auto insurance provider and appreciated the benefits of being a member of an institution dedicated to serving the military community.

The Bottom Line on Military Auto Insurance

We examined more than a dozen firms to find out which vehicle insurance providers offer the best coverage options and service member discounts. Overall, Geico, USAA, and AFI provide the most comprehensive military car insurance coverage at the best price.

Like Geico, a lot of auto insurance providers provide exceptional protection for servicemen and women. While some insurers provide discounts and specialized coverage options, others, like USAA and Armed Forces Insurance, cater particularly to veterans and active-duty individuals.

You’ll find the cheapest military auto insurance rates when you comparison shop online. Enter your ZIP code below to start comparing free quotes from local car insurance companies.

Frequently Asked Questions

What are the top auto insurance providers for veterans?

While the choice of auto insurance providers may vary depending on individual needs and preferences, some popular insurance companies that offer competitive policies and benefits for veterans include USAA, GEICO, and Armed Forces Insurance (AFI). These providers are known for their excellent customer service and exclusive offerings tailored to the unique needs of veterans.

Why is USAA frequently recommended as a top auto insurance provider for veterans?

USAA (United Services Automobile Association) is often recommended as a top auto insurance provider for veterans due to its deep roots in serving military members and their families. USAA exclusively caters to active-duty military personnel, veterans, and their immediate families, providing a wide range of insurance products and financial services. Their policies are designed to meet the specific needs and demands of the military community, and they consistently receive high customer satisfaction ratings.

What makes GEICO a popular choice for auto insurance among veterans?

GEICO (Government Employees Insurance Company) is a popular choice among veterans for several reasons. Firstly, GEICO offers special discounts and benefits specifically for military personnel and veterans. Additionally, GEICO is known for its competitive rates, user-friendly online tools and mobile apps, and excellent customer service. They have a strong reputation for promptly handling claims, which is particularly important for individuals with busy military lifestyles.

What are the unique features of Armed Forces Insurance (AFI) that make it appealing to veterans?

Armed Forces Insurance (AFI) is a specialized insurance provider exclusively serving the military community, including veterans. AFI differentiates itself by offering customized coverage options designed to meet the unique needs of military members and veterans. They understand the specific challenges faced by those who have served and provide tailored solutions accordingly. AFI also offers various discounts and benefits to military personnel and veterans, making it an attractive choice for auto insurance coverage.

Are there any other auto insurance providers that cater specifically to veterans?

While USAA, GEICO, and AFI are often considered the top auto insurance providers for veterans, there are other companies that may also cater to this demographic. It is recommended to research and compare different insurance providers to find the one that best suits your needs. Some additional companies that may offer specialized coverage for veterans include Navy Federal Credit Union, American Family Insurance, and The Hartford.

Do auto insurance rates for veterans differ from standard rates?

Yes, auto insurance rates for veterans can differ from standard rates. Many insurance providers offer exclusive discounts and benefits specifically tailored to military personnel, acknowledging their service. Providers like USAA, Progressive, and Farmers provide competitive rates and specialized coverage options for veterans.

How do auto insurance providers accommodate veterans during deployment?

Auto insurance providers often accommodate veterans during deployment by offering options like storage protection plans. This allows veterans to temporarily adjust their coverage, ensuring their vehicles are protected while they’re away. Providers like Geico and USAA offer specific benefits for those storing vehicles during deployment.

Can veterans save on auto insurance by comparison shopping?

Yes, veterans can save on auto insurance by comparison shopping. While certain providers like USAA and Geico are known for catering to military personnel, it’s essential for veterans to explore various options. Comparison shopping allows veterans to find the best rates, coverage, and benefits that align with their unique circumstances.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.