Erie Auto Insurance Review [2026]

Erie Auto Insurance stands out as a reliable choice for drivers, offering competitive rates and diverse coverage options; however, limited availability in only 12 states and a somewhat restricted mobile app functionality should be considered when making an informed decision.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Updated April 2024

If you are looking into Erie for car insurance, the regional provider has great rates and various coverage options and is one of the best companies for cheap auto insurance.

However, Erie is only available in 12 states. If you move, you may not be able to keep your Erie insurance coverage. Erie’s mobile app is also limited in function compared to other competitors’ apps, as you can’t file claims online.

To learn more about all the pros and cons of Erie car insurance, continue reading our Erie auto insurance review. We cover everything from Erie’s rates to its coverage options, so you can make an informed decision about whether the company is right for you.

What You Should Know About erie insurance group

Customer reviews and ratings from trustworthy sites are one of the best ways to gauge a car insurance company’s customer service and financial health. We’ve gone over the important Erie auto insurance reviews and ratings that you should be aware of below.

Erie Customer Satisfaction and Complaints

Erie Insurance has a great A+ rating from the Better Business Bureau (BBB). The BBB looks at customer complaints to formulate its rating, as well as factors like business transparency and time in business. On the BBB website, Erie has had 114 customer complaints closed in the last three years and 36 complaints closed in the last year.

This isn’t a terrible number of customer complaints, but on the National Association of Insurance Commissioners (NAIC), Erie scored slightly above average for its number of customer complaints. So while it didn’t do terribly, it was still a little worse than other companies’ customer complaint ratios.

However, Erie received fantastic customer satisfaction rating scores from J.D. Power in a number of regions:

- Mid-Atlantic Region: 867 out of 1,000 (region average is 839)

- North Central Region: 876 out of 1,000 (region average is 838)

- Southeast Region: 868 out of 1,000 (region average is 849)

Erie received the highest rating out of all the car insurance companies in both the Mid-Atlantic and North Central regions.

Erie also ranked highly in J.D. Power’s claim satisfaction study, coming in third place with a score of 893 out of 1,000, well above the industry average of 873. So while Erie may have a slightly higher number of customer complaints, it still has a high level of general customer satisfaction and claim satisfaction.

Erie A.M. Best Rating

A.M. Best gave Erie a rating of A+ (Superior). This means Erie can meet its ongoing financial obligations, such as paying claims, without financial hardship. If you buy Erie insurance, you don’t need to worry about the company facing financial hardship shortly.

Erie Mobile App Reviews

If you prefer to use your smartphone for tasks like filing claims or paying bills, then the company you choose must have a good mobile app.

You can do all of the following on Erie’s mobile insurance app:

- View and download your policy documents

- View and download your ID cards

- View your billing activity and make payments

- View your claim status

The app received the following ratings on the Apple Store and Google Play:

- Apple Store: 3.0 out of five stars (based on 129 reviews)

- Google Play: 3.2 out of five stars (based on 227 reviews)

Common complaints were that the Apple Wallet wasn’t supported by the app, preventing customers from conveniently saving their ID cards to their mobile wallets. You also can’t request roadside assistance or file a car insurance claim through the mobile app at Erie.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Auto Insurance Pros and Cons

There are plenty of pros to Erie auto insurance, but there are also some cons that shoppers should be aware of. Below, we go over the main pros and cons of Erie auto insurance.

Erie Auto Insurance Pros

Erie’s competitively low rates are one of its biggest pros, but it also has the following perks in addition to great rates for customers:

- Erie has low average rates for all types of drivers.

- Erie offers several auto insurance coverages and coverage perks.

- Erie has an A+ financial rating from A.M. Best.

- Erie scored highly in J.D. Power’s latest customer satisfaction survey.

Some of Erie’s other pros are that it has a solid financial standing and some great coverage options for customers.

Erie Auto Insurance Cons

The main cons of Erie insurance are as follows:

- Erie only sells auto insurance in 12 states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

- Erie had a slightly higher level of customer complaints compared to the national average.

- Erie’s mobile app doesn’t let customers file claims or request roadside assistance.

We will go more in-depth into Erie’s customer complaints and ratings further on.

Read more: Erie Insurance Company of New York Review

Erie Auto Insurance Contact Information

Erie offers plenty of ways to contact the company for various services, from calling roadside assistance to filing a claim. You can email Erie online or call one of the phone numbers listed below.

- General Assistance Phone Number: (800) 458-0811

- Claims Phone Number: (800) 367-3743

- Glass Claim Phone Number: (800) 552-3743

- Fraud Hotline Phone Number: (800) 368-6696

- Fraud Hotline Email: fraud.finders@erieinsurance.com

Erie also has offices for each state it services, each with its own mailing address and phone number.

Overall, Erie makes it easy for customers to get a hold of a representative, which is great. The last thing you want is a company with only one number to call with a line that is always busy.

erie insurance group Insurance Coverage Options

Erie has a number of great auto insurance coverages, although bear in mind availability may vary from state to state.

The car insurance coverages offered at Erie are as follows:

- Better car protection insurance: This coverage will replace your totaled car with a car that is two years newer.

- Bodily injury and property damage liability insurance: Standard liability insurance coverage will pay for other parties’ medical bills and property damage if you cause an accident but not your or your passengers’ damages.

- Collision auto insurance: This coverage will pay for repairs to your vehicle if you collide with another car or object.

- Comprehensive auto insurance: This coverage will pay for repairs to your vehicle if you crash into an animal or your vehicle is damaged by weather, fire, theft, or vandalism.

- New car protection insurance: This coverage will replace your new car (less than two years old) if it is totaled with a new vehicle of the latest model year.

- Non-owner auto insurance: This coverage provides non-owners with liability insurance when they borrow others’ cars.

- Personal injury protection (PIP) insurance: This coverage will pay for your and your passengers’ medical bills if you are injured in an accident, as well as lost wages and more.

- Pet injury insurance: This coverage will help pay your pet’s medical bills if they are injured in an accident, up to $500 per pet and $1,000 total.

- Rental car reimbursement insurance: This coverage will help cover the cost of a rental car if your car is in the shop for a while.

- Rideshare insurance: This coverage is for rideshare drivers and covers them when they are driving passengers.

- Roadside assistance insurance: This coverage provides assistance if your car breaks down, such as jumping batteries and changing tires. Learn about which companies offer the best roadside assistance.

- Underinsured motorist insurance: This coverage helps pay for the remainder of your accident bills if the driver who hit you doesn’t have enough insurance coverage to cover your bills completely.

- Uninsured motorist insurance: This coverage will pay your accident bills if the driver who hit you doesn’t have auto insurance.

Erie offers several great car insurance coverage options that drivers can choose from. It also has a number of great perks that come along with certain coverages. For example, you get locksmith services and glass repair as perks if you purchase comprehensive insurance.

Erie Auto Plus Package

Erie offers an Auto Plus package for $35 or less a year, where you can get multiple perks and benefits added to your insurance policy.

These perks are the following:

- Additional coverage for transportation expenses

- Death benefit ($10,000)

- Diminishing deductible up to $500

- Increased coverage limits for certain coverages

- Waived deductibles in some cases

You can add this package to your auto insurance quote at Erie or add it to an existing policy at any time.

Other Insurance Types Offered at Erie

Erie offers much more than just car insurance. You can also purchase the following insurance from Erie.

- ATV, snowmobile, and golf cart insurance

- Boat insurance

- Business insurance

- Collector and classic car insurance

- Commercial insurance

- Condo insurance

- Flood insurance

- Homeowners insurance

- Identity theft recovery insurance

- Life insurance

- Long-term care rider insurance

- Medicare supplement insurance

- Mobile home insurance

- Motorcycle insurance

- Recreational vehicle insurance

- Renters insurance

- Restaurant insurance

- Retirement insurance

- Risk control services insurance

- Personal umbrella insurance

- Personal valuables insurance

- Wholesale distribution insurance

- Workers’ compensation insurance

Erie offers an extensive list of insurance coverages, which means you can get almost all of your insurance policies in one place if you desire. Check out our Erie homeowners insurance review for more about the homeowner’s insurance provided by the company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

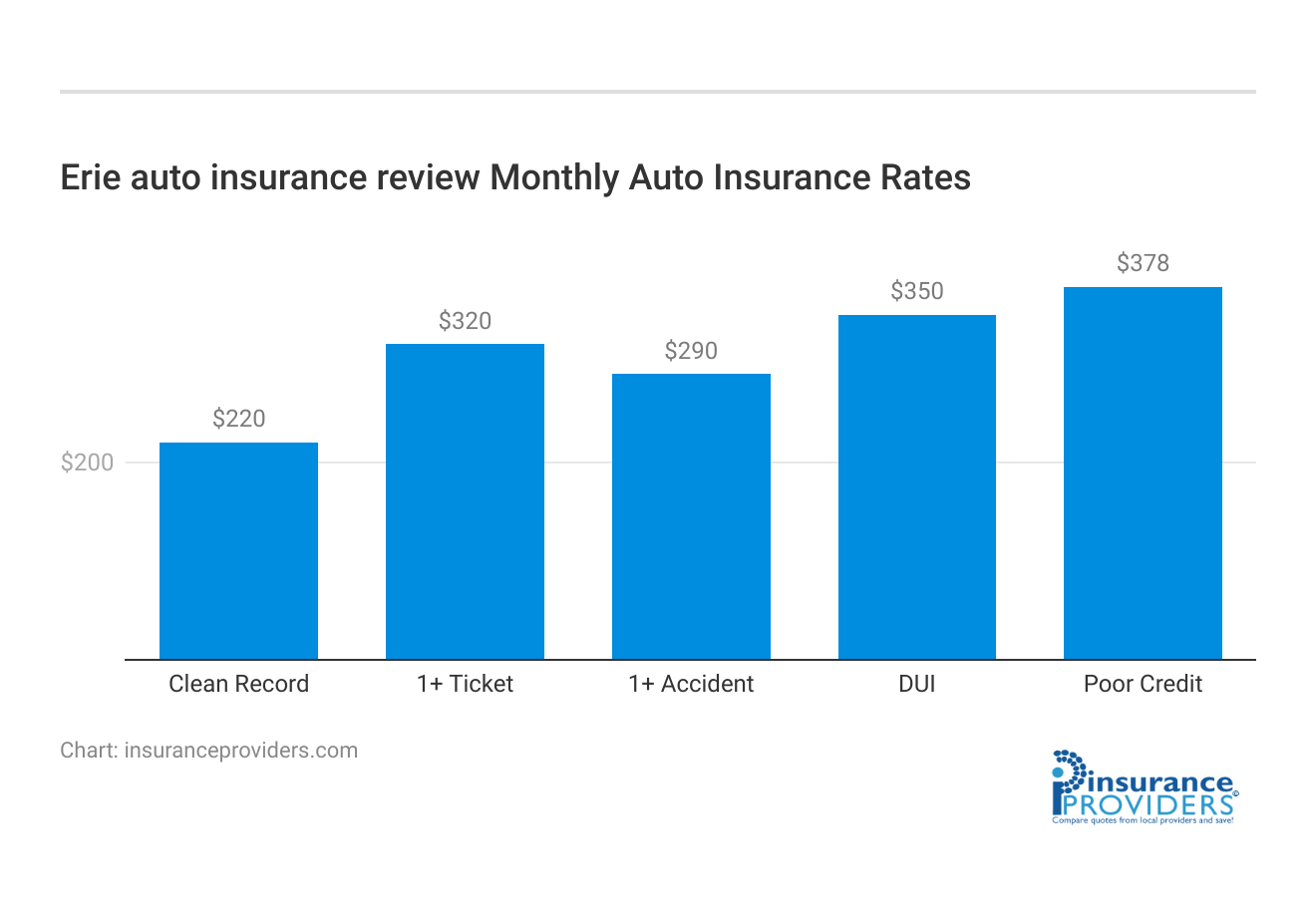

erie insurance group Insurance Rates Breakdown

| Driver Profile | Erie auto insurance review | National Average |

|---|---|---|

| Clean Record | $220 | $200 |

| 1+ Ticket | $320 | $300 |

| 1+ Accident | $290 | $280 |

| DUI | $350 | $330 |

| Poor Credit | $378 | $344 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

One of the best pros to Erie is its auto insurance rates. Take a look below to see its average rates for full coverage or liability insurance.

Erie Average Monthly Auto Insurance Rates by Age and Gender

| Age and Gender | Erie's Average Minimum Coverage Rates | Erie's Average Full Coverage Rates |

|---|---|---|

| 25-year-old male with a clean record | $26.67 | $70.51 |

| 25-year-old female with a clean record | $25.66 | $67.76 |

| 45-year-old male with a clean record | $22.28 | $58.40 |

| 45-year-old female with a clean record | $22.40 | $58.67 |

| 65-year-old male with a clean record | $21.93 | $57.16 |

| 65-year-old female with a clean record | $22.05 | $57.43 |

Erie has some great rates on average for basic policies, and it also offers some of the best rates for young drivers. Compare Erie auto insurance rates by driver and record in the sections below.

Erie Auto Insurance Rates for Young Drivers

Take a look at Erie’s average rates by driver age in the table below.

Average Monthly Full Coverage Rates for Teenage Drivers for Erie vs. The National Average

| Driver's Age and Gender | Erie Rates | National Average |

|---|---|---|

| 16-year-old male with a clean record | $232.68 | $618.49 |

| 16-year-old female with a clean record | $217.96 | $566.05 |

| 18-year-old male with a clean record | $189.18 | $501.45 |

| 18-year-old female with a clean record | $160.70 | $416.15 |

Erie’s rates for teenage drivers are some of the cheapest on the market, as are its rates for all ages of drivers. Of course, your driving record is going to affect your rates at Erie, so let’s take a look at Erie’s rates for drivers with bad driving records.

Erie Auto Insurance Rates by Driving Record

Moving violations, including traffic tickets, can raise your insurance rates. Your rates will be even higher if you have accidents or DUIs on your record. Fortunately, Erie offers affordable auto insurance for high-risk drivers.

Compare Erie car insurance rates by driving record to the national average in the table below:

Average Monthly Full Coverage Rates by Driving Record for Erie vs. the National Average

| Driving Record | Erie Rates | National Average |

|---|---|---|

| Clean Record | $58.40 | $119.27 |

| With One Speeding Ticket | $69.78 | $146.83 |

| With One Accident | $82.36 | $172.68 |

| With One DUI | $107.11 | $208.94 |

Erie still has some of the cheapest rates for drivers with bad driving records. Its car insurance rates for a DUI are half the price of the national average at $40 monthly.

While your rates will vary from the averages shown based on a variety of factors, you can expect Erie to have competitive rates for the majority of drivers.

erie insurance group Discounts Available

| Discount | Erie auto insurance review |

|---|---|

| Anti Theft | 10% |

| Good Student | 10% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 12% |

Erie offers a handful of auto insurance discounts for customers. These auto insurance discounts are as follows:

- Car safety features discount: Erie offers a discount for drivers who have vehicles with certain safety features, such as anti-theft devices and anti-lock brakes.

- Diminishing deductible discount: Erie will reduce a deductible by $100 for each claim-free year (up to $500 maximum).

- Multi-car discount: Erie offers a discount for customers who insure more than one car at the company.

- Multi-policy discount: Erie offers a discount for customers who purchase more than one type of insurance at the company, such as homeowners and auto insurance.

- Payment-in-full discount: Erie offers a discount for customers who pay in full for their coverage rather than month by month.

- Reduced-usage discount: Erie offers a discount for customers who haven’t driven in 90 consecutive days.

- Safe driver discount: Erie offers a discount for safe drivers who are claim-free and violation free.

- Young driver discount: Erie offers a discount to unmarried drivers under 21 who still live at home with their parents.

In addition to these auto insurance discounts, Erie offers accident forgiveness and a rate lock perk. Accident forgiveness will apply if you have been a customer at Erie for at least three years, and Erie’s rate lock means your car insurance rates won’t rise each year unless you’ve had a major change to your car insurance policy.

For example, if you have an accident or add or drop a driver or car, you will see a change in your rates. The rate lock simply means you won’t see an increase in rates due to an increased number of claims paid out to other customers, which would typically raise everyones’ rates if the company has a high number of claims for a year or more.

How erie insurance group Ranks Among Providers

Just because a company is cheaper than the national average doesn’t mean it’s the cheapest car insurance company on the market. Take a look at the table below to see how Erie stacks up to the competition:

Average Monthly Auto Insurance Rates by Coverage Level

| Companies | Monthly Rates for Minimum Auto Insurance Requirements | Monthly Rates for Medium Coverage Levels (50/100/50) | Monthly Rates for High Coverage Levels (100/300/100) |

|---|---|---|---|

| USAA | $200 | $212 | $222 |

| Geico | $250 | $268 | $286 |

| State Farm | $255 | $272 | $288 |

| American Family | $281 | $295 | $285 |

| Nationwide | $283 | $287 | $292 |

| Progressive | $311 | $335 | $363 |

| Farmers | $327 | $347 | $375 |

| Travelers | $352 | $372 | $385 |

| Allstate | $386 | $408 | $428 |

| Liberty Mutual | $484 | $505 | $530 |

If Erie is available in your state, it might be a better option price-wise than the cheaper big-name companies — Erie car insurance rates are cheaper than both Geico and State Farm.

However, if Erie isn’t available in your state, you may want to look into our list of the top 10 auto insurance companies in the United States for car insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to File a Claim at Erie

Even the safest drivers may have to eventually file a claim at Erie, which is why it is important to make sure a company has an easy claim-filing process.

Contact your Erie agent or the Erie claims department to file a claim. You can call Erie’s claims department at (800) 367-3743, which is available 24/7. The agent will review all the accident details and damages so you can start your claim. You can check the status of your claim online to see how it is progressing.

Once the claims adjuster has reviewed your case and determined a payout amount for repairs, you simply sign any necessary paperwork accepting the claim and can get back on the road once your car is repaired. Bear in mind that minor accidents will be processed more quickly than major accidents.

Read more: Trustage Auto Insurance Review

How to Cancel Erie Auto Insurance

If you decide Erie is no longer right for you, Erie states that you need to contact your Erie agent to cancel. Erie doesn’t state that it has any cancellation fees on its website, but some companies may charge a small fee if you cancel before the end of your coverage period.

However, you are eligible for a refund of any unused premiums if you cancel before the end of your policy period and have prepaid for coverage. Be sure to read the fine print on your Erie auto insurance policy to see the details of possible cancellation fees and refunds.

When canceling, it is also important to make sure that you have your new car insurance policy started before your Erie cancellation date.

For example, if your new policy doesn’t start for a week, set your cancellation date for the day after your new policy starts. Even a lapse of coverage for a few days can raise your rates, as driving without insurance is illegal.

The Final Word on Erie Auto Insurance

Erie has cheap auto insurance rates, multiple coverage options, and great customer satisfaction reviews. It also has a strong financial rating from A.M. Best. T

The downside of Erie is that its mobile app is just rated okay and doesn’t let drivers file claims online. Erie is also only available in 12 states, so you won’t be able to keep Erie if you move to a state where it doesn’t service.

All in all, Erie is a great choice of insurance company for drivers due to its good ratings and affordable rates. However, you can still find cheap rates if you don’t live in a state with Erie auto insurance. Use our free quote comparison tool to find the best rates from car insurance companies in your area.

Frequently Asked Questions

What sets Erie Auto Insurance apart from other providers?

Erie Auto Insurance distinguishes itself with competitive rates, diverse coverage options, and a strong A+ rating from A.M. Best, indicating financial stability and reliability.

In how many states is Erie Auto Insurance available?

Erie Auto Insurance is currently available in 12 states. It’s essential to verify its availability in your specific location before considering it as your insurance provider.

How does Erie Auto Insurance perform in terms of customer satisfaction?

Despite a slightly higher-than-average number of customer complaints, Erie Auto Insurance boasts an A+ rating from the Better Business Bureau and impressive customer satisfaction scores from J.D. Power, reflecting positive overall customer experiences.

What are the notable pros and cons of choosing Erie Auto Insurance?

Erie’s pros include competitively low rates, solid financial standing, and attractive coverage options. However, limitations such as availability in only 12 states and a somewhat restricted mobile app, where claims can’t be filed online, should be considered.

What discounts and additional perks does Erie Auto Insurance offer?

Erie provides various discounts, including multi-policy discounts, safe driver discounts, and unique offerings like accident forgiveness and rate lock perks. These features contribute to making Erie an appealing choice for cost-conscious and safety-conscious drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.