Fred Loya Auto Insurance Review [2026]

Fred Loya Auto Insurance, a prominent player in the insurance market, stands out for offering affordable coverage options, especially catering to high-risk drivers across multiple U.S. states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated April 2024

You may be overwhelmed by your options if you’re searching for auto insurance. Some states and areas have countless insurance companies willing to offer standard coverage to drivers. Still, it’s best to take your time and compare coverages and insurance rates from several companies to get a good idea of what you want.

Fred Loya is one option many drivers choose in certain states. Fred Loya offers car insurance coverage to drivers in several states in the U.S. With Fred Loya, you have several coverage options. Additionally, the company offers discounts to help policyholders save money on their monthly or annual auto insurance rates.

Fred Loya is known for offering cheap car insurance rates. In addition, the company offers coverage options to many high-risk drivers who may have difficulty finding coverage with other insurance companies.

Unfortunately, Fred Loya isn’t known for stellar customer service. Fred Loya receives around five times as many customer complaints as the typical insurance company of its size.

What You Should Know About Fred Loya Insurance

Fred Loya Auto Insurance offers auto insurance for high-risk drivers and non-standard drivers in the U.S. Car insurance coverage with Fred Loya is available in Alabama, Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Nevada, New Mexico, Ohio, and Texas. If you live elsewhere, you’ll need to consider other auto insurance companies to meet your needs.

With Fred Loya, high-risk drivers can purchase minimum coverage, and many customers state rates with Fred Loya are cheaper than those with other well-known auto insurance companies. In addition, Fred Loya offers SR-22 filings for policyholders who need SR-22 coverage in their state. If you need an SR-22, you’ll have to pay a small fee, and you may find that your insurance rates increase as a result. (For more information, read our “Understanding SR-22 Insurance: What is it and who is it for?“).

EP Loya Group, an insurance company based in Texas, owns and operates Fred Loya, along with Loya Insurance Company, Young America Insurance, Rodney D. Young Insurance, and National Insurance. Depending on where you live, you may find that Fred Loya operates under one of the other company names.

Fred Loya is known for cheap rates, but the company also offers unique coverage features, like a complimentary rental car service. Fred Loya policies are available in many supermarkets, and the company offers quotes and services in Walmart stores.

Unfortunately, many Fred Loya policyholders say the company’s policies are confusing. Customers say that Fred Loya uses confusing language to introduce policy exclusions without customers’ knowledge.

Fred Loya also receives far more than the standard number of customer complaints for a company of its size. These facts make Fred Loya undesirable to potential policyholders who value transparency and customer service.

Customers that appreciate Fred Loya cite the ability to purchase a policy with the company when they couldn’t get coverage with other insurance companies in their area. Still, high-risk drivers have multiple options.

So if you’re shopping for coverage as a high-risk driver or want cheap car insurance in your area, find and compare quotes from several insurance companies before you make a final decision.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fred Loya Insurance Coverage Options

Fred Loya offers the standard coverage types you would expect with any car insurance company. These coverages include:

- Bodily injury liability: Bodily injury liability insurance helps if you cause an accident and one or more people get hurt. Bodily injury liability coverage is mandatory in most states.

- Property damage liability: Property damage liability coverage helps if you cause an accident and damage someone’s vehicle or personal property. Property damage liability coverage is mandatory in most states.

- Personal injury protection (PIP): Personal injury protection insurance coverage helps with medical bills, lost wages, and funeral costs after a covered event. Certain states require PIP coverage.

- Medical payments (MedPay): MedPay covers medical bills like hospital stays and visits to the doctor after a covered event. Certain states require MedPay insurance.

- Uninsured/underinsured motorist: Uninsured/underinsured motorist coverage helps if you’re in an accident and someone else is at fault but doesn’t carry proper coverage. Your insurance will pay for repairs to your vehicle. Certain states require uninsured/underinsured motorist coverage.

- Collision insurance: Collision auto insurance pays for repairs to your vehicle if you were at fault in an accident and your car gets damaged.

- Comprehensive insurance: Comprehensive insurance would pay for repairs to your vehicle if wild animals, theft, vandalism, or inclement weather damaged your car.

You must carry minimum coverage in your state to drive legally. Depending on where you live, you may need PIP, MedPay, or uninsured/underinsured motorist insurance, alongside property damage and bodily injury liability.

Collision and comprehensive coverage aren’t required, but you may need to carry this insurance if you have a loan or lease on your car. Learn more about the difference between comprehensive and collision auto insurance coverage here.

In addition to the coverage options listed above, Fred Loya offers add-on coverages that policyholders can purchase for additional peace of mind on the road. One of the company’s most popular add-on coverage options is rental reimbursement. With rental reimbursement, you get reimbursed if you need to rent a car while yours is in the shop following a covered event.

Does Fred Loya offer SR-22 coverage?

The subject may be confusing if you’ve heard of SR-22 insurance before. SR-22 isn’t a type of car insurance. Rather, certain drivers may need to file an SR-22 form with their state’s Department of Motor Vehicles to drive legally.

Some insurance companies won’t file an SR-22 form on your behalf because, typically, an SR-22 suggests that you pose more of a risk on the road because of one or more blemishes on your driving record. Some of the main reasons you may need to file an SR-22 form in your state include:

- Driving with a suspended license

- Driving without a license

- Driving under the influence of drugs or alcohol

- Multiple speeding tickets

- Multiple traffic tickets

- More than one at-fault accident

- Failure to pay child support

If you need to file an SR-22 with your state, you should be able to do so with Fred Loya. However, you may find that your car insurance rates increase due to filing an SR-22 with the company, and Fred Loya likely charges a small fee for filing the document.

Finding and comparing car insurance quotes with several companies in your area is important. If you need an SR-22, check with several insurance companies to see which is willing to file on your behalf while still offering the coverage you need at a price that works with your budget. Doing so will help you find your area’s top SR-22 auto insurance coverage options.

Does Fred Loya use exclusions in car insurance policies?

When purchasing car insurance coverage with Fred Loya, it’s important to read the fine print. Unfortunately, many Fred Loya policies use confusing language and include exclusions many overlook.

One example of an exclusion with Fred Loya is its full coverage policies. If you purchase full coverage auto insurance — or what the company calls “complete coverage” — you may assume that collision and comprehensive insurance cover your vehicle without any exclusions. However, Fred Loya stipulates in its contracts that its complete coverage only applies if your vehicle is free of any damage.

Before purchasing a policy, you should speak with a Fred Loya representative to discuss potential exclusions. Since Fred Loya doesn’t offer quotes online, you’ll have to purchase auto insurance with the company over the phone or in person at certain stores and shopping centers.

Fred Loya Insurance Rates Breakdown

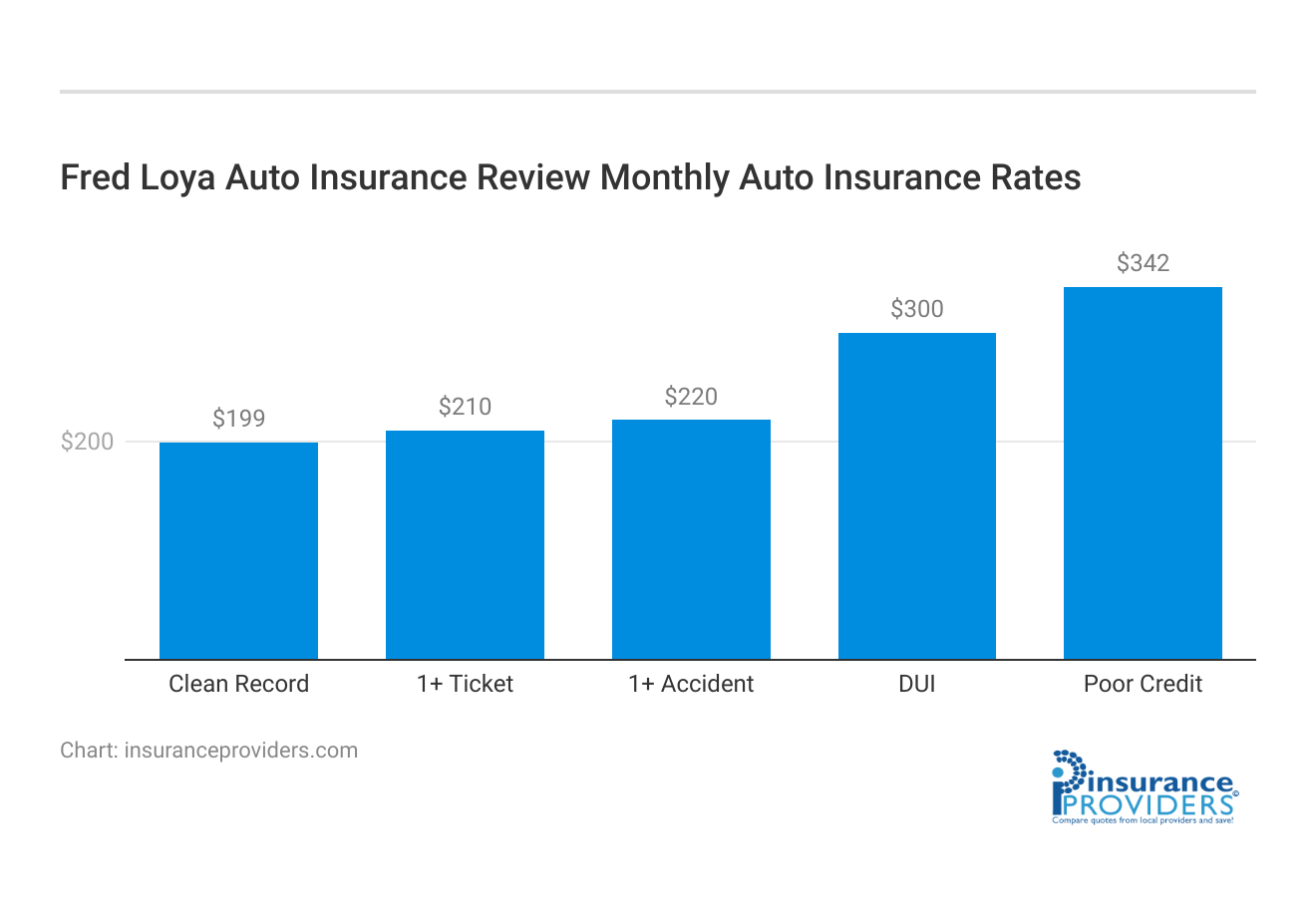

| Driver Profile | Fred Loya Auto Insurance Review | National Average |

|---|---|---|

| Clean Record | $199 | $230 |

| 1+ Ticket | $210 | $240 |

| 1+ Accident | $220 | $250 |

| DUI | $300 | $350 |

| Poor Credit | $342 | $396 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Car insurance rates vary for several reasons. Many companies consider specific factors when determining a person’s car insurance rates. However, you may find that some companies offer cheaper rates for coverage because of how your specific information gets used.

Some of the most important factors when determining a person’s car insurance rates include the following:

- Age

- Location

- Gender

- Marital status

- Driving history

- Credit score

- Coverage type

As you compare quotes, you’ll likely notice that some companies charge more based on your unique factors while some charge less. As a result, it’s important to get quotes from several companies in your area. Otherwise, you may overpay for your car insurance coverage.

Does Fred Loya offer cheap full coverage auto insurance?

Fred Loya policyholders typically pay around $2,889 annually or $241 per month for a full coverage car insurance policy. Full coverage rates with Fred Loya exceed the national average for coverage. The national average for a full coverage policy in the U.S. is $1,428 annually or $119 per month.

Average Monthly Full Coverage Auto Insurance Rates by Age and Gender

| Companies | 18-Year-Old Female | 18-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 65-Year-Old Female | 65-Year-Old Male |

|---|---|---|---|---|---|---|

| Allstate | $448.45 | $518.62 | $168.42 | $176.48 | 158.33 | 156.53 |

| Farmers | $597.48 | $628.61 | $160.08 | $167.16 | 136.18 | 135.62 |

| Geico | $219.55 | $253.62 | $89.87 | $86.79 | 78.16 | 78.45 |

| Liberty Mutual | $521.90 | $625.59 | $174.23 | $199.56 | 167.43 | 170.04 |

| Nationwide | $302.66 | $387.17 | $124.10 | $136.19 | 110.55 | 112.22 |

| Progressive | $590.85 | $661.74 | $130.78 | $136.05 | 109.30 | 102.84 |

| State Farm | $229.17 | $283.98 | $93.53 | $102.85 | 84.15 | 84.15 |

| Travelers | $530.19 | $739.74 | $99.18 | $107.67 | 95.53 | 96.76 |

| USAA | $180.43 | $202.79 | $74.09 | $79.42 | 57.68 | 57.39 |

If you’re looking for full coverage, you may consider another company in your area. You can find and compare auto insurance quotes to determine which company offers full coverage at an affordable price. Comparing quotes can help you get the coverage you need on your vehicle without paying too much for car insurance.

Does Fred Loya offer cheap minimum coverage auto insurance?

While the company’s full coverage rates may seem steep, Fred Loya offers minimum coverage to its policyholders for a fraction of the cost. For example, with Fred Loya, you can purchase a minimum coverage car insurance policy for just $449 annually or $37 per month. The national average for a minimum coverage policy is around $540 annually or $45 per month.

Average Monthly Liability-Only vs. Full Coverage Auto Insurance Rates by Company

| Companies | Monthly Liability-Only Coverage Auto Insurance Rates | Monthly Full Coverage Auto Insurance Rates |

|---|---|---|

| Allstate | $162 | $318 |

| American Family | $114 | $224 |

| Farmers | $147 | $288 |

| Geico | $91 | $179 |

| Liberty Mutual | $203 | $398 |

| Nationwide | $117 | $229 |

| Progressive | $144 | $283 |

| State Farm | $120 | $235 |

| Travelers | $147 | $287 |

| USAA | $82 | $161 |

| National Average | $133 | $260 |

Fred Loya may be a good option if you’re looking for minimum coverage. Still, consider the number of customer complaints before committing to Fred Loya as your auto insurance company. In addition, many companies in your area may offer minimum coverage car insurance rates below the national average.

How does Fred Loya coverage compare to the national average for high-risk drivers?

Fred Loya will likely offer you car insurance coverage if you’re a high-risk driver. But, unfortunately, high-risk drivers will pay rates much higher than the national average with Fred Loya.

Average Monthly Auto Insurance Rates by Driving Record and Company

| Companies | Monthly Rates with a Clean Driving Record | Monthly Rates w/ One Speeding Violation | Monthly Rates w/ One Accident | Monthly Rates w/ One DUI Conviction |

|---|---|---|---|---|

| Geico | $179 | $220 | $266 | $406 |

| American Family | $224 | $252 | $310 | $361 |

| Nationwide | $229 | $259 | $283 | $379 |

| State Farm | $235 | $266 | $283 | $303 |

| Progressive | $283 | $334 | $398 | $331 |

| Travelers | $287 | $355 | $357 | $478 |

| Farmers | $288 | $340 | $377 | $393 |

| Allstate | $318 | $374 | $416 | $522 |

| Liberty Mutual | $398 | $475 | $517 | $634 |

If you have a speeding ticket on your driving record, you will pay around $2,863 annually or $239 per month for a full coverage car insurance policy with Fred Loya. The national average for someone with a speeding ticket on their driving record is $1,764 annually or $147 per month for full coverage.

Individuals with an at-fault accident on their driving record will pay around $3,430 annually or $286 per month for a full coverage car insurance policy with Fred Loya. The national average for a full coverage policy if you have an at-fault accident on your record is around $2,076 annually or $173 per month. Learn about how long an accident stays on your record.

Lastly, teen drivers will pay significantly higher rates for a full coverage policy with Fred Loya. The average cost of a full coverage policy with Fred Loya for a 16-year-old driver is $7,747 annually or $646 each month. The national average for a full coverage car insurance policy for a teen driver is $7,104 annually or $592 per month.

Before committing to a policy with Fred Loya, shop and compare quotes from several insurance companies in your area.

Fred Loya Insurance Discounts Available

| Discount | Fred Loya Auto Insurance Review |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 8% |

| Safe Driver | 10% |

| Senior Driver | 5% |

Fred Loya offers specific auto insurance discounts to its policyholders. Some of the company’s most significant discounts include:

- Multi-vehicle discount: If you insure more than one car with Fred Loya, you may get a discount on your coverage.

- Safety features discount: Save money if your vehicle has certain safety features like air bags and automatic seat belts.

- Anti-theft device discount: Save money on your coverage if your vehicle comes with anti-theft devices.

- Defensive driving discount: If you complete a defensive driving course, you may qualify for a discount on your car insurance coverage.

- Driver’s education discount: Save money if you take an approved driver’s education course.

- Alcohol and drug awareness discount: Save money on your Fred Loya car insurance coverage if you pass an approved alcohol and drug awareness course.

Discounts can help you save up to 25% on car insurance coverage. If you believe you qualify for one or more discounts with Fred Loya, call and speak with a company representative to learn how much you could save on your monthly or annual premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Fred Loya Insurance Ranks Among Providers

In the competitive arena of auto insurance, Fred Loya contends with several key players vying for the attention of drivers seeking comprehensive and cost-effective coverage. Here’s a glimpse of some prominent competitors challenging Fred Loya in the dynamic insurance landscape.

- State Farm: One of the largest insurers in the U.S., State Farm is known for its extensive agent network, providing personalized service and a wide range of insurance products, including auto, home, and life insurance.

- Allstate: Allstate is a well-established insurer offering a variety of insurance options. It’s recognized for its commitment to customer satisfaction, innovative policies, and features like accident forgiveness.

- Geico: Government Employees Insurance Company (Geico) is renowned for its direct-to-consumer model, cost-effective policies, and clever advertising campaigns. It’s often praised for its user-friendly online interface.

- Progressive: Progressive is known for its forward-thinking approach to insurance, introducing innovations like usage-based insurance and providing a range of coverage options. It’s recognized for being a leader in technology-driven insurance solutions.

- Nationwide: Nationwide is a diversified insurance and financial services company. It’s known for its range of insurance products and its strong emphasis on customer relationships and community involvement.

- Farmers Insurance: Farmers Insurance Group offers a variety of insurance products, known for its personalized service and comprehensive coverage options. It emphasizes building long-term relationships with its policyholders.

- Liberty Mutual: Liberty Mutual is a global insurer with many insurance products. It’s recognized for its focus on customer-centric services, risk management solutions, and a global presence.

- USAA: The United Services Automobile Association (USAA) primarily serves military members and their families. It’s highly regarded for its commitment to serving the unique needs of military personnel, offering a range of financial services.

- Travelers: Traveler is a multinational insurer known for its broad range of insurance products and services. It emphasizes risk management solutions for businesses and individuals, including auto, home, and business insurance.

- Esurance: Esurance, owned by Allstate, is an online-focused insurance provider known for its streamlined processes and digital-first approach. It aims to provide modern, convenient solutions for tech-savvy consumers.

Exploring the meanings and unique features of each company can assist individuals in making informed decisions when selecting auto insurance coverage.

Read more: Geico SR-22 Insurance Review

Does Fred Loya have good ratings and reviews?

According to the National Association of Insurance Commissioners (NAIC), Fred Loya receives far more than the expected number of customer complaints for a company of its size. For many potential policyholders, this is a red flag that they should look elsewhere for auto insurance coverage.

Fred Loya doesn’t have a good reputation regarding customer service. The company often receives complaints about its poor customer service department, how long it takes for payouts, and deceptive language and exclusions in its car insurance policies.

Fred Loya paid significant fines in Texas in 2012 because it didn’t adhere to specific underwriting guidelines for customer discounts. Instead, the company imposed additional requirements on its policyholders’ car insurance contracts to increase their monthly or annual premiums.

Information from the NAIC shows Fred Loya receives 47% more complaints than expected based on its size. In addition, Fred Loya reviews on the Better Business Bureau (BBB) website and Reddit suggest the company needs to improve its customer service, claims handling, and policy language.

Frequently Asked Questions

What is Fred Loya Auto Insurance?

Fred Loya Auto Insurance is a provider of auto insurance coverage in the United States. They offer various insurance products to protect individuals and their vehicles against financial loss resulting from accidents, theft, and other covered events.

How long has Fred Loya Auto Insurance been in business?

Fred Loya Auto Insurance was established in 1974. They have over four decades of experience in the insurance industry and have grown to become one of the largest Hispanic-owned auto insurance companies in the U.S.

What types of auto insurance coverage does Fred Loya offer?

Fred Loya Auto Insurance provides a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP) coverage.

How can I obtain a quote from Fred Loya Auto Insurance?

To get a quote from Fred Loya Auto Insurance, you can visit their official website or call their customer service hotline. Provide the necessary information about yourself, your vehicle, and your desired coverage, and they will provide you with a personalized quote.

How do customers generally rate Fred Loya Auto Insurance?

Customer ratings and reviews for Fred Loya Auto Insurance can vary. It is advisable to research and read reviews from multiple sources to gain a comprehensive understanding of the experiences shared by customers. Factors such as customer service, claims handling, and pricing can influence individual opinions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.