Top Auto Insurance Providers for Seniors in 2026 (Top 10 Companies)

Discover the top auto insurance providers for seniors with State Farm, USAA, and Progressive. Securing their positions with diverse discounts, military savings, and online convenience.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated February 2024

Company Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Embark on the top auto insurance providers for seniors like State Farm, USAA, and Progressive. State Farm stands out for its competitive rates, comprehensive coverage, and specialized discounts, ensuring both affordability and reliability for seniors.

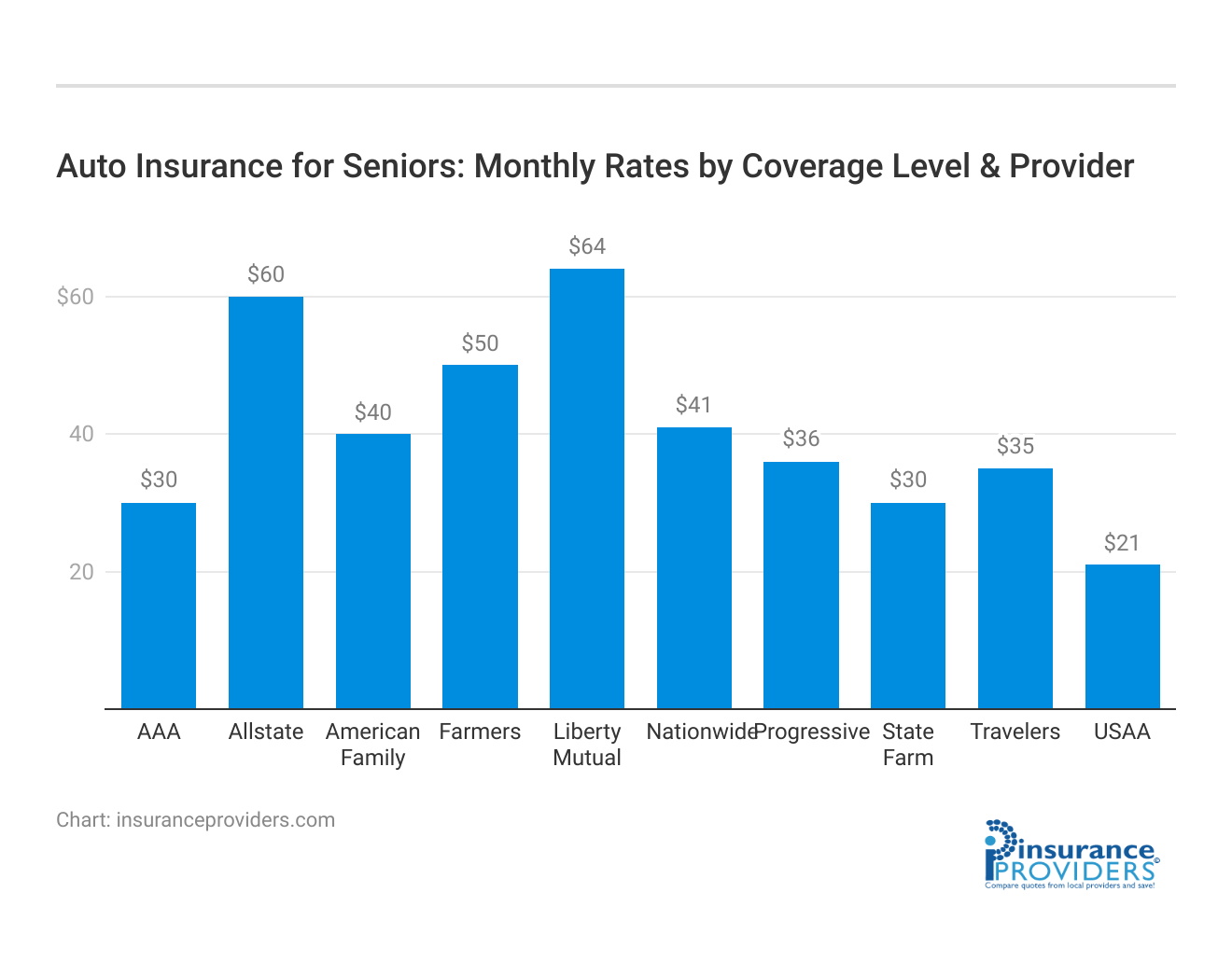

The older you get, the more you’ll pay for car insurance. Data from InsuranceProviders shows that auto insurance premiums tend to increase for senior drivers at age 65. In comparison, mid-life drivers aged 50-60 may be paying less than ever for car insurance. Additionally, if you’re over 55, you may be eligible for state discounts to help you save money on your policy.

Our Top 10 Best Companies: Auto Insurance Providers for Seniors

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | State Farm | Up to 16% | Up to 13% | Many Discounts | |

| #2 | USAA | Up to 22% | Up to 25% | Military Savings | |

| #3 | Progressive | Up to 13% | Up to 17% | Online Convenience | |

| #4 | Allstate | Up to 17% | Up to 25% | Add-on Coverages | |

| #5 | Nationwide | Up to 20% | Up to 25% | Usage Discount |

| #6 | Liberty Mutual | Up to 15% | Up to 20% | Customizable Polices |

| #7 | Farmers | Up to 14% | Up to 20% | Local Agents | |

| #8 | AAA | Up to 17% | Up to 25% | Local Agents |

| #9 | American Family | Up to 13% | Up to 13% | Student Savings | |

| #10 | Travelers | Up to 22% | Up to 20% | Accident Forgiveness |

If you’re looking for ways to save on car insurance, this guide will break down the nuances of buying auto insurance for seniors.

#1 – State Farm: Discounts and Coverage Excellence

State Farm leads as the top choice for seniors, offering competitive coverage with diverse discounts and military benefits.Zach Fagiano Licensed Insurance Broker

Pros

- Diverse discounts: State Farm offers a multitude of discounts, allowing seniors to customize their policies and potentially reduce costs significantly.

- Comprehensive coverage: Recognized for providing extensive coverage, State Farm ensures that seniors can tailor their policies to meet specific needs, fostering a sense of security on the road.

- Online convenience: State Farm’s seamless online accessibility enhances convenience for seniors, making it easier to manage policies and claims from the comfort of their homes.

Cons

- Average monthly rates: While competitive, State Farm’s average monthly rates for seniors may be slightly higher compared to some other providers on the list.

- Discount limitations: While offering diverse discounts, the maximum discount percentages may be relatively lower than those provided by some competitors.

Read more: State Farm Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Savings and Service Beyond Compare

Pros

- Military savings: USAA stands out with substantial discounts for military-affiliated seniors, recognizing and honoring their service.

- Exceptional customer service: Renowned for top-notch customer service, USAA ensures that seniors receive personalized attention and efficient support when dealing with their insurance needs.

- High discounts: USAA offers impressive maximum discounts, allowing seniors to maximize savings on both multi-policy and low-mileage considerations.

Cons

- Membership limitation: USAA is exclusively available to military members and their families, limiting accessibility for seniors without military affiliations.

- Limited local presence: While digital services excel, the lack of physical branches may pose a drawback for seniors who prefer in-person interactions.

Read more: USAA Car Insurance Review

#3 – Progressive: Convenience With Competitive Edge

Pros

- Online convenience: Progressive caters to tech-savvy seniors with an emphasis on online services, making it easy to manage policies and file claims digitally.

- Usage discount: Seniors with specific usage patterns benefit from Progressive’s usage-based discounts, providing potential savings for those who drive less.

- Competitive rates: While not the lowest, Progressive’s rates for seniors are competitive, offering good value for the coverage provided.

Cons

- Limited local agents: Progressive’s focus on online convenience may not be suitable for seniors who prefer face-to-face interactions with local agents.

- Discount caps: While offering discounts, the maximum percentages may not be as high as those provided by some competitors.

Read more: Progressive Car Insurance Review

#4 – Allstate: Tailored Plans and Extensive Discounts

Pros

- Add-on coverages: Allstate excels in providing a variety of add-on coverages, allowing seniors to tailor their policies with additional protections for a more comprehensive plan.

- High maximum discounts: Seniors can benefit from Allstate’s impressive maximum discounts, particularly for multi-policy bundling and low-mileage considerations.

- Nationwide availability: Allstate has a broad national presence, providing seniors with accessibility and the option to maintain coverage while relocating.

Cons

- Higher average monthly rates: Allstate’s average monthly rates for seniors may be on the higher side compared to some other providers on the list.

- Mixed customer service reviews: While some customers praise Allstate’s customer service, others express concerns, indicating a potential inconsistency in the customer experience.

Read more: Allstate Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Policies, Discounts, and Access

Pros

- Usage discount: Nationwide offers a usage-based discount, beneficial for seniors with specific driving patterns, potentially resulting in lower premiums.

- High maximum discounts: Nationwide provides substantial discounts, especially for multi-policy and low-mileage considerations, allowing seniors to maximize savings.

- Customizable policies: Seniors can enjoy flexibility in tailoring their policies with Nationwide, ensuring coverage aligns with their unique needs and preferences.

Cons

- Limited local agents: Nationwide’s reliance on online services may be a drawback for seniors who prefer in-person interactions with local agents.

- Average customer satisfaction: While generally satisfactory, Nationwide’s customer satisfaction ratings are average, with some customers expressing concerns about claim processing.

#6 – Liberty Mutual: Policies Tailored With Precision

Pros

- Customizable policies: Liberty Mutual stands out for offering customizable policies, allowing seniors to build coverage that precisely meets their individual requirements.

- Competitive rates: While not the lowest, Liberty Mutual provides seniors with competitive rates, offering a balance between affordability and coverage quality.

- Local presence: Liberty Mutual’s local agents provide in-person assistance, catering to seniors who value face-to-face interactions when managing their insurance needs.

Cons

- Discount limitations: While offering discounts, Liberty Mutual’s maximum discount percentages may be slightly lower than those provided by some competitors.

- Mixed customer reviews: Some customers express concerns about Liberty Mutual’s claims process and customer service, indicating a potential inconsistency in the customer experience.

Read more: Liberty Mutual Car Insurance Review

#7 – Farmers: Agents, Rates, and Discount Diversity

Pros

- Local agents: Farmers excels in providing a local agent network, offering seniors the option for in-person assistance and personalized service.

- Competitive rates: Farmers offers competitive rates, ensuring seniors get value for their money while maintaining quality coverage.

- Discount variety: Seniors can benefit from a range of discounts offered by Farmers, addressing various factors to potentially reduce insurance costs.

Cons

- Mixedcustomer service reviews: While some customers praise Farmers’ customer service, others express concerns, suggesting potential variations in the customer experience.

- Limited online convenience: Farmers’ emphasis on local agents may be less suitable for seniors who prefer the convenience of managing policies online.

Read more: Farmers Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Presence, Services, and Remarkable Discounts

Pros

- Local agents: AAA provides seniors with access to local agents, ensuring personalized assistance and in-person support for their insurance needs.

- High maximum discounts: Seniors can maximize savings with AAA’s impressive maximum discounts, especially for multi-policy bundling and low-mileage considerations.

- Wide range of services: AAA offers a variety of services beyond auto insurance, providing seniors with options for comprehensive coverage and assistance.

Cons

- Membership requirement: AAA’s services are typically available to members, limiting accessibility for seniors who are not members of the organization.

- Potentially higher rates: While offering discounts, AAA’s average rates for seniors may be relatively higher compared to some competitors on the list.

Read more: AAA Auto Insurance Review

#9 – American Family: Savings, Diversity and Customization

Pros

- Student savings: American Family stands out by offering savings for seniors with student drivers in their household, catering to the unique needs of families.

- Discount variety: Seniors can benefit from a variety of discounts offered by American Family, potentially reducing overall insurance costs.

- Customizable policies: American Family allows seniors to customize their policies, ensuring coverage aligns with their specific requirements and preferences.

Cons

- Average maximum discounts: While providing discounts, American Family’s maximum discount percentages may be slightly lower compared to some competitors.

- Limited local presence: American Family’s local presence may not be as extensive as some other providers, potentially limiting in-person assistance for certain seniors.

Read more: American Family Auto Insurance Review

#10 – Travelers: Accident Forgiveness and Maximum Discounts

Pros

- Accident forgiveness: Travelers stands out by offering accident forgiveness, providing seniors with peace of mind in the event of an unforeseen incident.

- High maximum discounts: Seniors can maximize savings with Travelers’ impressive maximum discounts, particularly for multi-policy bundling and low-mileage considerations.

- Customizable policies: Travelers allows seniors to tailor their policies, ensuring coverage meets their specific needs and preferences.

Cons

- Potentially higher rates: While offering discounts, Travelers’ average rates for seniors may be relatively higher compared to some competitors on the list.

- Limited local presence: Travelers’ emphasis on digital services may be less suitable for seniors who prefer in-person interactions with local agents.

Read more: Travelers Car Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Leading 10 Auto Insurance Providers Catering to Seniors

Navigating the auto insurance for seniors involves a careful consideration of the rates offered by leading providers. Among the top 10 insurance companies, State Farm emerges as a popular choice with monthly rates of $30 for minimum coverage and $76 for full coverage. For those eligible, USAA stands out with competitive rates at $21 for minimum coverage and $53 for full coverage.

Read more: Best Auto Insurance for Seniors

Average Monthly Auto Insurance Rates for Seniors

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| State Farm | $30 | $76 |

| USAA | $21 | $53 |

| Progressive | $36 | $95 |

| Allstate | $60 | $154 |

| Nationwide | $41 | $104 |

| Liberty Mutual | $64 | $159 |

| Farmers | $50 | $128 |

| AAA | $30 | $77 |

| American Family | $40 | $105 |

| Travelers | $35 | $90 |

Progressive, another prominent insurer, offers rates of $36 for minimum coverage and $95 for full coverage. Allstate, Nationwide, Liberty Mutual, Farmers, AAA, American Family, and Travelers each present varying rates, emphasizing the importance of seniors comparing these figures to find the most suitable and cost-effective coverage tailored to their driving needs and budget constraints.

Keeping abreast of these rates allows seniors to make informed decisions, ensuring they strike the right balance between affordability and comprehensive coverage as they navigate the roads in their golden years.

Is auto insurance higher for seniors?

The cost of car insurance for seniors may vary depending on various factors. For example, while drivers in their 50s and 60s may experience lower rates than most age brackets, auto insurance costs rise once you reach 65.

Drivers over 80 are often subject to even higher premiums due to their increased risk of accidents and the potential for more severe injuries resulting from crashes.

Seniors need to take advantage of any mature driver discounts available to help offset the rising cost of auto insurance.

In addition, senior drivers should shop around for the best rate, as prices can differ between providers. Finally, compare different coverage levels to ensure you receive the most cost-effective coverage for your needs.

What is the cheapest car insurance for seniors?

Geico is widely known for providing the cheapest car insurance for seniors. Minimum liability auto insurance coverage from Geico costs an average of $30 monthly, making it an ideal choice for those seeking to save money on automobile insurance.

For seniors who need more coverage than what a basic plan offers, a full coverage policy from Geico costs about $78 a month.

In addition to offering competitive rates, Geico provides numerous discounts and benefits tailored to seniors. Discount types may vary by state but generally consider age, years of driving experience, and safe driving habits.

Average Monthly Full Coverage Senior Auto Insurance Rates by Gender

| Insurance Company | 60-Year-Old Male With a Clean Record | 60-Year-Old Female With a Clean Record | 65-Year-Old Male With a Clean Record | 65-Year-Old Female With a Clean Record |

|---|---|---|---|---|

| Allstate | $153.92 | $149.75 | $156.50 | $158.33 |

| American Family | $99.17 | $97.92 | $107.58 | $106.33 |

| Farmers | $122.83 | $115.25 | $130.08 | $130.67 |

| Geico | $74.33 | $72.67 | $78.42 | $78.17 |

| Liberty Mutual | $157.50 | $146.50 | $168.50 | $165.92 |

| Nationwide | $104.42 | $99.08 | $112.25 | $110.58 |

| Progressive | $95.25 | $92.08 | $102.83 | $109.33 |

| State Farm | $76 | $76 | $84.17 | $84.17 |

| Travelers | $88.75 | $87.67 | $95.42 | $94.17 |

| National Average | $108 | $104.08 | $115.08 | $115.25 |

Additionally, many policies provide other perks, such as roadside assistance, rental car reimbursement, and towing coverage. Seniors can often save even more money on their policy by taking advantage of these discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any mandated car insurance discounts for seniors?

Do seniors qualify for government-mandated auto insurance discounts? In certain states, they may be eligible for a discount if they complete a state-approved driving course from organizations such as AARP, AAA, or The National Safety Council (NSC).

Check with your local DMV to learn more about this opportunity.

Why is car insurance more expensive for seniors?

Car insurance is more expensive for seniors because they typically pose a higher risk on the road. As people age, their reaction times and physical capabilities can diminish, leading to an increased likelihood of getting into accidents or other driving-related incidents.

Additionally, some car insurance providers consider seniors higher-risk drivers than young adults due to the long history of companies assessing premium rates based on statistics like age.

Furthermore, many car insurance companies recognize that senior citizens drive less frequently than young adults and thus don’t benefit from the same economies of scale when insuring them.

So, insurance providers charge more for coverage depending on how much risk they perceive with each customer. Senior drivers are also more likely to file claims than younger drivers, increasing the cost of insurance for seniors.

Additionally, since seniors typically live on fixed incomes and have limited resources available to pay for damages resulting from accidents they cause, they can be seen as more financially risky customers by car insurance providers.

Finally, many car insurance companies may also factor in the likelihood of medical expenses should an accident occur with a senior driver.

For these reasons, seniors often face higher premiums than younger drivers when purchasing auto insurance.

Ultimately, car insurance companies are simply trying to protect themselves financially against potential liabilities from insuring elderly drivers.

As such, older individuals must remain aware of the increased costs associated with their age when shopping for auto insurance.

By understanding the factors that come into play when car insurance companies assess their risk, seniors have the resources necessary to find the best deal and keep their premiums as low as possible.

How to Reduce Auto Insurance Rates for Seniors

Regardless of your age, there are several ways to lower your car insurance costs, such as taking advantage of senior discounts and following the tips listed below.

Participate in a Driving Class

Seniors can reduce their car insurance rates by participating in a driving class. A defensive driving course can provide seniors with the tools to become better, safer drivers and help them understand the risks associated with driving.

Many insurance companies offer discounts for those who take courses focusing on improving skills such as braking, turning, and navigating roads. In addition, some states have additional incentives for specific age groups, such as seniors, to take these classes.

Participating in a defensive driving class is an important step toward reducing car insurance rates for seniors. It also allows them to learn about new laws and regulations and refresh their knowledge of safe driving habits so they’re more aware when behind the wheel.

Read more: Defensive Driver Auto Insurance Discount

Additionally, many insurance providers offer discounts to those who complete an approved class.

You can find classes for seniors online or in person, and they usually only require about six hours of study. Before enrolling, check your state’s specific driving course requirements to be eligible for any discounts from your insurance provider.

Additionally, you should research their options carefully and ensure the program they choose has their accreditation by a reputable organization. Taking the time to do this homework will help ensure that the program meets their needs and leads to lower car insurance rates.

Select a Cheaper Vehicle to Insure

Another way for seniors to lower their car insurance rates is by selecting a car that’s cheaper to insure. Cars with a high safety rating, like those with anti-lock brakes or air bags, are generally more affordable to insure than cars without these features.

Additionally, cars with smaller engines and good fuel economy tend to be less expensive to insure. For example, a sedan may cost less to insure than an SUV or minivan.

When shopping for a vehicle, consider the total cost of ownership beyond just the purchase price. When comparing different vehicles, you should consider factors like maintenance cost, repair expenses, and replacement value.

The type of coverage selected will also affect the overall cost of car insurance. Seniors who are looking for a low-cost option should look at cars that are basic, reliable, and inexpensive to insure.

Finally, seniors can consider bundling their car insurance with other home or life insurance policies. Many insurers offer discounts when multiple policies come from the same company.

This type of bundled coverage can result in significant savings on car insurance rates for seniors. By shopping around and comparing different companies, you can find affordable policies to meet the needs of senior drivers.

Protect Your Vehicle

Seniors can also reduce car insurance rates by protecting their vehicles. Installing a car alarm or other anti-theft device is one way to protect a vehicle and make it less attractive to potential thieves.

Additionally, parking the car in a well-lit area or a garage whenever possible is another way to deter theft and keep premiums down.

It’s also vital for seniors to stay on top of regular vehicle maintenance, like getting oil changes regularly, checking tire pressure, and taking the car into an auto repair shop if any issue arises.

Consider Buying Pay-Per-Mile Auto Insurance

Next, you should consider pay-per-mile auto insurance designed to reward drivers who limit the distance they drive yearly. This policy calculates premiums based on how many miles a vehicle travels over a year, which can be especially beneficial for seniors who don’t drive as often as they used to.

Pay-per-mile insurance also helps seniors save money by charging them only for what they use. If someone drives fewer miles than expected in a given month, their rates will go down accordingly. Additionally, most pay-per-mile policies offer additional incentives such as cashback rewards or discounts on regularly scheduled maintenance.

Finally, pay-per-mile policies can also help seniors monitor their driving habits and ensure they are using fuel and money effectively.

These policies come with telematics devices that measure speed, braking, and acceleration to give drivers feedback about how their driving habits affect their car insurance rates.

Increase Your Deductible

Another way seniors can cut car insurance rates is to lower their deductible. When policyholders increase their deductible, they take on greater financial responsibility for any necessary repairs after an accident or other incident.

By doing this, the policyholder cuts down on the amount of money the insurer would have to spend out of pocket in such cases, leading to lower premiums in the long run.

The downside to increasing a deductible is that it could leave seniors with a larger bill if an accident occurs. If this is a concern, you should consider additional coverage options like gap insurance or roadside assistance.

These policies can help cover expenses up to the deductibles and provide peace of mind even when rates are lower.

Drop Unnecessary Coverages

In addition, seniors should consider dropping any coverage they no longer need. Our lifestyles and needs may change as we age, meaning some coverages you have now may not be necessary for a few years.

For example, if you’re an empty nester who no longer drives with children or other passengers regularly, you may want to drop medical payments coverage from your policy.

Also, suppose your vehicle depreciates in value significantly and is now worth less than what you owe. In that case, it may be unnecessary to maintain gap insurance coverage.

Seniors should review their policies every year or two and make changes to save money on car insurance without sacrificing essential coverage.

Shop Around for Different Policies

Finally, it would be best to shop for different policies to find the best possible rate. Different insurance companies offer varying levels of coverage at different prices, so it’s crucial to compare rates and ensure you’re getting the best deal.

Using an online comparison tool when shopping for car insurance is also a good idea. These tools allow you to quickly see quotes from multiple insurers in one place and sort by price or coverage level, making it easier to find the policy that best fits your budget and needs.

In addition, some insurers may offer discounts or unique benefits that target senior drivers specifically.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Will seniors pay more for car insurance after an auto accident?

Seniors may have to pay more for auto insurance after an accident because car insurance companies consider seniors a higher risk than younger drivers.

Insurance companies use various factors when determining rates, including age and driving history. So, if an older driver has had multiple accidents or violations on their record, they may be charged higher premiums.

The insurer may also assess a “surcharge” or penalty fee for any at-fault accident in the past three years. Learn how long an accident stays on your record.

Case Studies: Navigating Auto Insurance for Seniors

Case Study 1: The Golden Years Discount Program

Mr. Johnson, a 68-year-old retiree navigating the world of auto insurance. This case study explores how Mr. Johnson discovered a fictional “Golden Years Discount Program” offered by an innovative insurance provider. By completing a specialized safe-driving course tailored for seniors, he not only enhanced his driving skills but also enjoyed significant discounts on his auto insurance premium.

Case Study 2: Silver Shield – Geared Towards Senior Safety

Mrs. Anderson, an 73-year-old grandmother with a passion for safe driving. This examines how Mrs. Anderson opted for a unique insurance policy called “Silver Shield.” This policy, designed exclusively for seniors, not only rewarded her safe driving habits but also provided additional perks such as roadside assistance and coverage for minor repairs, ensuring a worry-free driving experience.

Case Study 3: The Wisdom Mobile Plan

Mr. and Mrs. Thompson, an adventurous couple in their late 60s, in this fictional case study. Seeking an auto insurance plan that aligns with their travel lifestyle, they stumbled upon the “Wisdom Mobile Plan.” This explores how this imaginative insurance option caters specifically to seniors who love exploring the open road, offering flexible coverage tailored to their unique needs and preferences.

Top Auto Insurance Providers for Seniors: The Bottom Line

Finding the right car insurance provider for seniors can be overwhelming. However, with the right research and comparison shopping, you can find a policy that offers the coverage you need at a price within your budget.

Some of the best auto insurance companies for seniors include Geico, Progressive, State Farm, Allstate, and USAA. Each one offers different discounts and benefits tailored to meet the unique needs of older drivers.

You should also consider additional coverage options like gap insurance or roadside assistance to ensure you’re fully protected on the road.

By following these steps, you can lower your car insurance rates and gain peace of mind knowing that you have taken all measures necessary to protect yourself financially in case of an accident.

Frequently Asked Questions

What are the top auto insurance providers for seniors?

The top auto insurance providers for seniors can vary based on individual needs and preferences. However, some reputable companies often recommended for seniors include GEICO, Allstate, State Farm, Progressive, and USAA (available to military personnel and their families).

What factors make these auto insurance providers suitable for seniors?

These auto insurance providers are considered suitable for seniors due to several factors. They typically offer competitive rates, excellent customer service, comprehensive coverage options, discounts for safe driving records and low mileage, and user-friendly technology for managing policies.

How can I determine which auto insurance provider is best for me as a senior?

To determine the best auto insurance provider as a senior, consider factors such as the company’s reputation, financial stability, coverage options, discounts available specifically for seniors, customer reviews, and the ease of filing claims. Comparing quotes and speaking with insurance agents can also help you make an informed decision.

Do these auto insurance providers offer specific discounts or benefits for seniors?

Yes, many auto insurance providers offer discounts and benefits tailored to seniors. These may include discounts for completing defensive driving courses, mature driver discounts, low mileage discounts, and bundling options for home and auto insurance. It’s important to inquire about these discounts when obtaining quotes.

Are there any specialized auto insurance providers exclusively for seniors?

While there are no exclusive auto insurance providers solely for seniors, some companies, such as The Hartford, have partnerships or specialized programs for AARP members, who are often seniors. These programs may offer additional discounts and benefits for AARP members.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.