Accordia Life and Annuity Company Review (2025)

Accordia Life and Annuity Company actively tailors a diverse range of coverage options to meet various financial needs and aspirations.

William Lemmon

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Accordia Life and Annuity Company

Average Monthly Rate For Good Drivers

N/AA.M. Best Rating:

A (Excellent)Complaint Level:

LowPros

- Diverse range of insurance products

- Customer-centric approach

- Investment-linked insurance options

- Smooth claims process

- Positive customer reviews

Cons

- Rates can vary based on individual factors

- Limited information on specific premium rates in the article

Accordia Life and Annuity Company, a trusted name in the insurance industry, offers a diverse range of tailored insurance solutions that cater to a variety of needs and financial aspirations.

From comprehensive life insurance coverage and annuities that provide secure retirement income to accident and health insurance and innovative investment-linked policies, Accordia stands out with its commitment to customer-centricity and excellence.

The company’s flexible coverage options, emphasis on financial security, and investment-linked insurance possibilities ensure a comprehensive approach to securing individuals’ financial futures.

With a smooth application process and a focus on personalized customer service, Accordia combines reliable coverage with potential wealth accumulation, making it a top choice for those seeking peace of mind and financial growth.

Accordia Life and Annuity Company Insurance Coverage Options

Accordia Life and Annuity Company stands out by offering an array of insurance products designed to meet the unique requirements of different individuals. Their policies include:

- Life Insurance: Accordia provides comprehensive life insurance coverage, ensuring that your loved ones are financially protected in case of the unexpected. Their various life insurance options allow you to choose the best-fit policy for your family’s needs.

- Annuities: Accordia offers annuity solutions that serve as reliable income sources during retirement. With different annuity types available, you can customize your retirement plan to align with your financial objectives.

- Accident and Health Insurance: Accordia’s accident and health insurance policies provide coverage for medical expenses, ensuring that you’re prepared for unexpected health-related costs.

- Investment-Linked Insurance: These innovative policies combine insurance coverage with investment opportunities, allowing you to potentially grow your wealth while staying protected.

Remember that the availability of these coverage options can vary based on the specific products offered by Accordia Life and Annuity Company Insurance

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

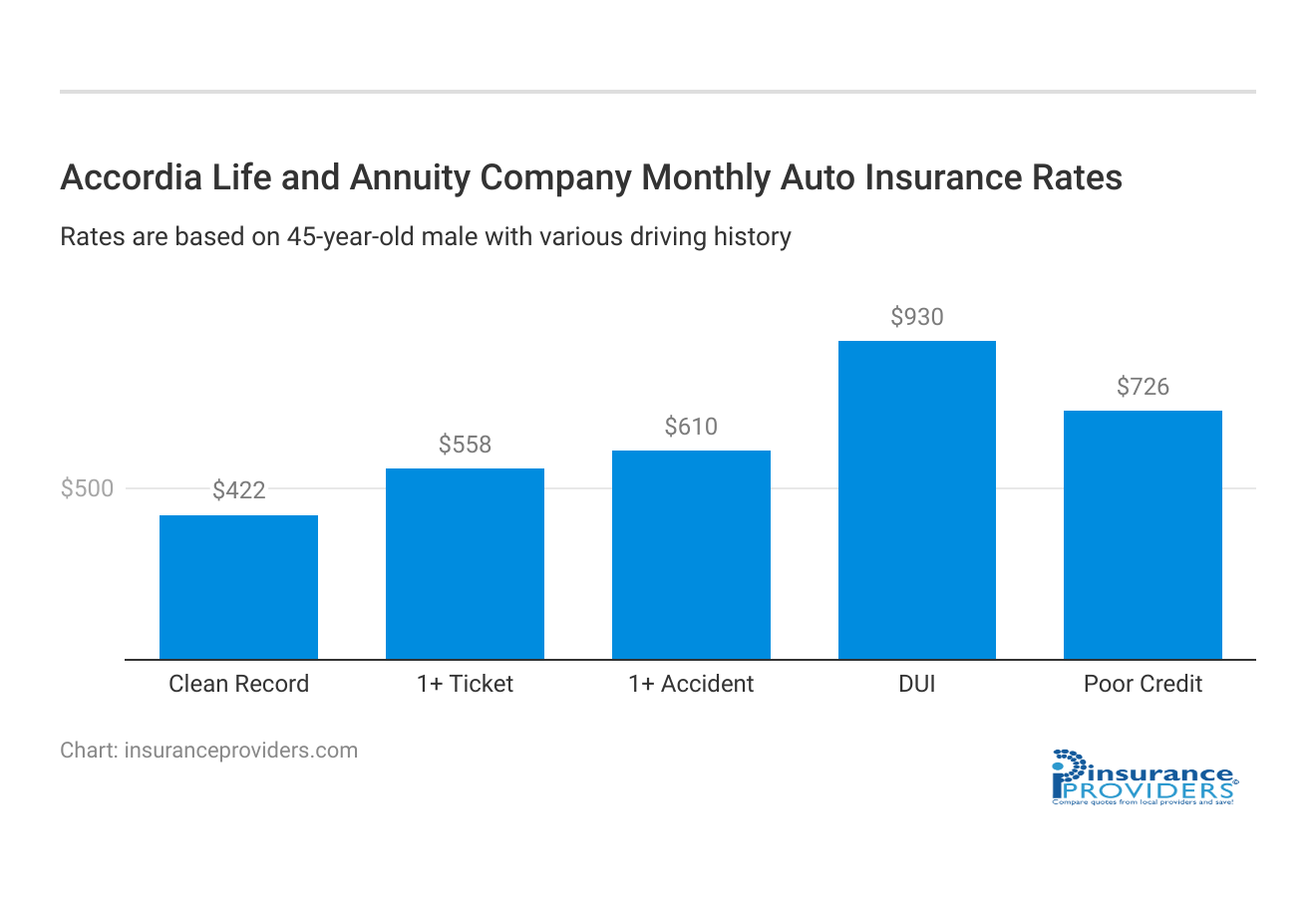

Accordia Life and Annuity Company Insurance Rates Breakdown

| Driver Profile | Accordia Life and Annuity Company | National Average |

|---|---|---|

| Clean Record | $422 | $119 |

| 1+ Ticket | $558 | $147 |

| 1+ Accident | $610 | $173 |

| DUI | $930 | $209 |

| Poor Credit | $726 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Accordia Life and Annuity Company Discounts Available

| Discount | Accordia Life and Annuity Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 12% |

| Paperless | 8% |

| Safe Driver | 20% |

| Senior Driver | 10% |

Accordia Life and Annuity Company is committed to providing value to its policyholders through various discounts that can make insurance coverage even more affordable. Here are some of the discounts they offer:

- Multi-Policy Discount: Save by bundling multiple insurance policies, such as life insurance and annuities, with Accordia.

- Safe Driver Discount: Enjoy reduced rates if you have a clean driving record and demonstrate responsible driving habits.

- Multi-Year Premium Payment Discount: Receive a discount when you choose to pay your premiums in advance for multiple years.

- Good Health Discount: Qualify for lower rates by maintaining good health and meeting certain health criteria.

- Early Purchase Discount: Get rewarded for early planning by securing your insurance policy well in advance.

- Preferred Customer Discount: Accordia values customer loyalty and offers discounts to long-term policyholders.

These discounts can significantly contribute to your overall savings while ensuring that you receive the quality coverage Accordia is known for. It’s important to discuss these options with an Accordia representative to determine which ones you may be eligible for and how they can enhance your insurance experience.

How Accordia Life and Annuity Company Ranks Among Providers

In the competitive landscape of the insurance industry, Accordia Life and Annuity Company stands out with its diverse range of insurance products and customer-centric approach. However, it’s essential to be aware of the company’s main competitors, each bringing their unique strengths to the table. Here are some of Accordia’s primary competitors:

- Prudential Financial: Prudential is a well-established insurance giant with a broad spectrum of insurance offerings, including life insurance and annuities. They are known for their strong financial stability and comprehensive coverage options.

- Metlife: MetLife is another prominent competitor that offers a wide array of insurance products, including life insurance and annuities. They are recognized for their global presence and extensive customer base.

- New York Life: New York Life is renowned for its long-standing history in the insurance industry and its focus on mutual life insurance. They emphasize financial strength and customer service, making them a noteworthy competitor.

- Pacific Life: Pacific Life is a leading contender in the annuity market, offering a range of annuity solutions for retirement planning. Their emphasis on annuities sets them apart from broader insurance providers.

- AIG (American International Group): AIG is a global insurance company that provides a variety of insurance products, including life insurance and annuities. They are known for their wide international reach and diverse range of financial services.

- Northwestern Mutual: Northwestern Mutual is recognized for its strong financial ratings and extensive network of financial advisors. They primarily focus on life insurance, investment, and financial planning.

- Massmutual: MassMutual offers a range of insurance and financial products, with a focus on mutual life insurance policies. They are known for their policyowner dividends and long-term policyholder benefits.

It’s important to note that while these companies are competitors, they also have their distinct strengths and areas of specialization. When choosing an insurance provider, it’s advisable to carefully consider your specific needs, preferences, and the offerings of each competitor to make an informed decision that aligns with your financial goals.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

Accordia Life and Annuity Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Accordia Life and Annuity Company, a trusted name in the insurance industry, offers a diverse range of tailored insurance solutions that cater to a variety of needs and financial aspirations. The company’s flexible coverage options, emphasis on financial security, and investment-linked insurance possibilities ensure a comprehensive approach to securing individuals’ financial futures.

With a smooth application process and a focus on personalized customer service, Accordia combines reliable coverage with potential wealth accumulation, making it a top choice for those seeking peace of mind and financial growth.

Average Claim Processing Time

In the competitive landscape of the insurance industry, Accordia Life and Annuity Company stands out with its diverse range of insurance products and customer-centric approach. However, it’s essential to be aware of the company’s main competitors, each bringing their unique strengths to the table.

When choosing an insurance provider, it’s advisable to carefully consider your specific needs, preferences, and the offerings of each competitor to make an informed decision that aligns with your financial goals.

Customer Feedback on Claim Resolutions and Payouts

Accordia Life and Annuity Company takes customer feedback seriously when it comes to claim resolutions and payouts. The company aims to provide fair and transparent claim assessments, and their commitment to customer satisfaction is reflected in the feedback they receive.

Many policyholders have reported positive experiences with the company’s claims team, citing efficient communication, fair evaluations, and prompt payouts. This dedication to customer-centric claim resolutions has earned the company a reputation for reliability in times of need.

Accordia Life and Annuity Company Digital and Technological Features

Mobile App Features and Functionality

Accordia Life and Annuity Company offers a user-friendly and streamlined claims process to make it convenient for policyholders to file a claim. Customers have multiple options for initiating a claim, including online submission through their official website, over the phone with dedicated customer service representatives, and via their mobile app.

This variety of channels ensures that customers can choose the method that suits them best, whether they prefer the ease of online filing, the personal touch of speaking to an agent, or the convenience of a mobile app.

Online Account Management Capabilities

The company’s online account management capabilities provide policyholders with a secure and user-friendly platform to manage their insurance policies. Through their online accounts, customers can view policy details, update personal information, make premium payments, and track the status of their claims.

This digital self-service option adds convenience and flexibility to the customer experience, allowing policyholders to have greater control over their insurance affairs.

Digital Tools and Resources

Accordia Life and Annuity Company goes beyond traditional insurance services by offering a range of digital tools and resources to assist policyholders. These include calculators to estimate coverage needs, informative articles on accident prevention and safety, and online chat support for quick assistance.

These digital resources not only help customers make informed decisions but also contribute to Accordia Life and Annuity Company’s commitment to proactive customer support in accident prevention and recovery.

Frequently Asked Questions

What sets Accordia’s investment-linked insurance apart from traditional policies?

Investment-linked insurance offers the unique benefit of potential wealth growth while being insured, providing a dual advantage.

Can I personalize my life insurance coverage with Accordia?

Yes, Accordia offers flexible life insurance options that can be customized to suit your family’s specific needs.

Are Accordia’s annuities suitable for early retirement planning?

Absolutely, Accordia’s annuity options are designed to offer steady income, even in cases of early retirement.

How do I begin a claim process with Accordia?

Contact Accordia’s customer support, who will guide you through the claims process efficiently and with care.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

William Lemmon

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.