Acceptance Casualty Insurance Company Review (2025)

Dive into the comprehensive review of Acceptance Casualty Insurance Company, a steadfast partner ensuring your peace of mind with tailored coverage options and efficient claims processing.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In a world of uncertainties, having a dependable insurance partner is essential. Acceptance Casualty Insurance Company stands as a pillar of protection, offering an array of coverage options that cater to your diverse needs. From auto and home insurance to liability, commercial, and specialty coverage, they ensure you’re shielded against life’s unexpected turns.

Their commitment to efficient claims processing, personalized solutions, and various discounts sets them apart. With Acceptance, you’re not just securing insurance; you’re securing peace of mind and confidence in the face of the unknown. Trust in tomorrow begins with Acceptance Casualty.

Acceptance Casualty Insurance Company Insurance Coverage Options

In a world of uncertainties, having a dependable insurance partner is essential. Acceptance Casualty Insurance Company stands as a pillar of protection, offering an array of coverage options that cater to your diverse needs. From auto and home insurance to liability, commercial, and specialty coverage, they ensure you’re shielded against life’s unexpected turns.

Auto Insurance

- Liability Coverage: Protects against bodily injury and property damage liability.

- Collision Coverage: Pays for repairs or replacement of your vehicle after a collision.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you’re in an accident with someone who has little or no insurance.

Home Insurance

- Dwelling Coverage: Protects your home’s structure against covered perils.

- Personal Property Coverage: Covers your belongings inside the home against damage or theft.

- Liability Coverage: Helps with legal expenses if someone is injured on your property.

- Additional Living Expenses: Assists in covering costs if you can’t live in your home due to covered damage.

Commercial Insurance

- Business Property Insurance: Protects your physical assets such as buildings, equipment, and inventory.

- General Liability Insurance: Covers claims of bodily injury or property damage to others.

- Business Interruption Insurance: Provides income when operations are halted due to covered events.

- Workers’ Compensation: Covers medical expenses and lost wages for employees injured on the job.

Specialty Coverage

- Flood Insurance: Protects against damage from floods, typically not covered in standard policies.

- Umbrella Insurance: Offers additional liability coverage beyond the limits of other policies.

- Classic Car Insurance: Tailored coverage for vintage or classic vehicles.

- Boat/RV Insurance: Coverage for watercraft or recreational vehicles.

Trust in tomorrow begins with Acceptance Casualty. Their commitment to tailored solutions ensures you’re safeguarded in every aspect of life.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

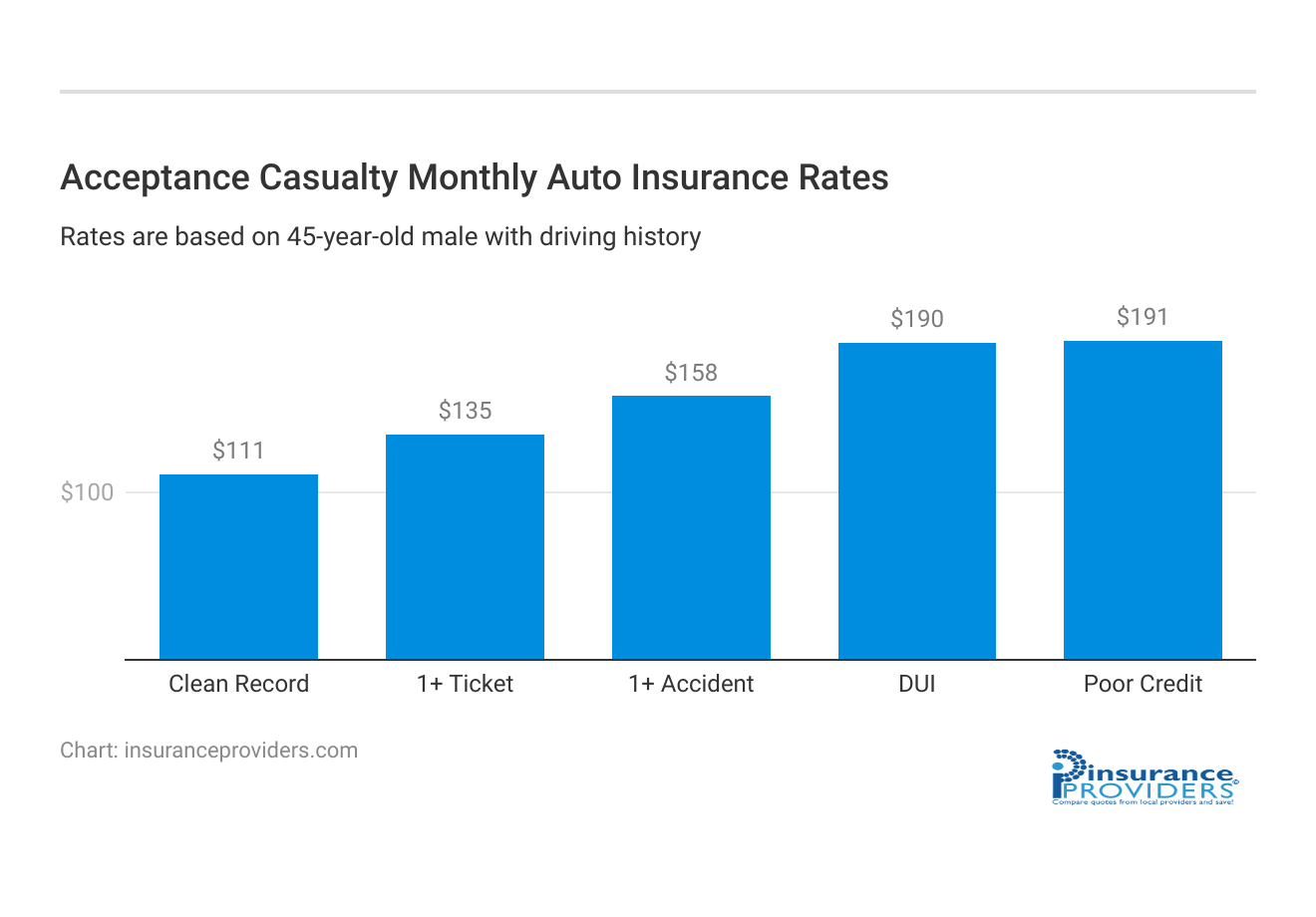

Acceptance Casualty Insurance Company Insurance Rates Breakdown

| Driver Profile | Acceptance Casualty | National Average |

|---|---|---|

| Clean Record | $95 | $119 |

| 1+ Ticket | $110 | $147 |

| 1+ Accident | $140 | $173 |

| DUI | $230 | $209 |

| Poor Credit | $163 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Acceptance Casualty Insurance Company Discounts Available

| Discount | Acceptance Casualty |

|---|---|

| Anti Theft | 5% |

| Good Student | 15% |

| Low Mileage | 15% |

| Paperless | 7% |

| Safe Driver | 10% |

| Senior Driver | 8% |

At Acceptance Casualty Insurance Company, your safety and security come with added benefits. They offer a range of discounts designed to reward responsible behavior, loyalty, and safety-conscious choices. These discounts not only make comprehensive coverage more accessible but also showcase the company’s commitment to appreciating your trust and proactive actions.

- Multi-Policy Discount: Bundle your policies, such as auto and home insurance, and unlock significant savings.

- Safe Driver Discounts: Maintain a clean driving record and earn rewards for your safe driving habits.

- Good Student Discount: Students with excellent academic performance may qualify for discounted rates.

- Safety Feature Discounts: Equip your vehicle with safety features like anti-theft devices or anti-lock brakes for reduced premiums.

- Payment Discounts: Opt for convenient payment methods like electronic funds transfer (EFT) or full annual payments for additional savings.

- Continuous Coverage Discount: Stay insured with Acceptance for an extended period and receive loyalty rewards.

- Affinity Group Discount: Belong to certain organizations or affinity groups? You might be eligible for exclusive discounts.

Specific eligibility criteria may apply for each discount. Contact an Acceptance Casualty Insurance representative to explore the full range of discounts available and how you can maximize your savings while ensuring comprehensive coverage for your needs.

How Acceptance Casualty Insurance Company Ranks Among Providers

In a landscape brimming with insurance options, Acceptance Casualty Insurance Company stands tall as a dependable shield against uncertainties. Their array of coverage options, commitment to efficient claims processing, and personalized solutions mark them as a pivotal player in safeguarding clients’ interests.

- SecureGuard Insurance Group: A prominent contender in the insurance arena, SecureGuard Insurance Group offers a diverse range of coverage options. Their reputation for reliability and competitive pricing attracts a substantial clientele.

- GuardianShield Insurance Services: Known for their personalized approach, GuardianShield Insurance Services focuses on building strong customer relationships. Their tailor-made solutions and attentive service set them apart in the market.

- SafeNet Assurance Corporation: SafeNet Assurance Corporation is recognized for their financial stability and comprehensive coverage offerings. Their commitment to reliable protection positions them as a formidable rival.

- InnoSure Insurance Solutions: InnoSure Insurance Solutions leads with innovation, providing user-friendly digital platforms and cutting-edge tools. Their commitment to technology-driven convenience resonates with tech-savvy customers.

- WellnessGuard Protection Services: WellnessGuard Protection Services goes beyond conventional coverage, emphasizing holistic well-being. Their supplementary services and health-centric approach set them apart in the industry.

These competitors, alongside Acceptance Casualty Insurance Company, contribute to a dynamic and competitive insurance landscape, offering consumers a range of choices for their insurance needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Acceptance Casualty Insurance Company Claims Process

Ease of Filing a Claim (online, over the phone, mobile apps)

Acceptance Casualty Insurance Company offers multiple convenient methods for filing insurance claims. Customers can take advantage of their user-friendly mobile app for quick and easy claim submissions.

Alternatively, claims can be filed over the phone, providing flexibility for those who prefer a more personal touch. Online claim submission is also available, ensuring that policyholders can choose the method that suits them best.

Average Claim Processing Time

One of the critical aspects of any insurance company is its claim processing efficiency. Acceptance Casualty Insurance Company has a reputation for a swift and streamlined claims processing system. Policyholders can expect their claims to be processed promptly, minimizing any delays in receiving the assistance they need during stressful situations.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable when evaluating an insurance company’s performance. Acceptance Casualty Insurance Company consistently receives positive feedback from customers regarding their claim resolutions and payouts. This reflects their commitment to providing fair and satisfactory settlements, fostering trust and satisfaction among policyholders.

Acceptance Casualty Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Acceptance Casualty Insurance Company offers a feature-rich mobile app that enhances the overall customer experience. The app allows policyholders to manage their accounts, access policy information, and file claims seamlessly. It also provides access to valuable resources and tools, making it a convenient and valuable addition for policyholders on the go.

Online Account Management Capabilities

For policyholders who prefer online account management, Acceptance Casualty Insurance Company’s website offers robust capabilities. Customers can easily access and manage their policies, make payments, and update their information through the online portal. This digital convenience simplifies the insurance experience and empowers policyholders to have more control over their coverage.

Digital Tools and Resources

Acceptance Casualty Insurance Company goes beyond traditional insurance offerings by providing a range of digital tools and resources. These resources are designed to educate and assist policyholders in making informed decisions about their coverage. Whether it’s informative articles, calculators, or interactive tools, the company’s commitment to digital empowerment is evident.

Frequently Asked Questions

Can I bundle auto and home insurance with Acceptance Casualty?

Absolutely, bundling policies often leads to discounts, saving you money while ensuring comprehensive coverage.

What does liability insurance cover?

Liability insurance covers costs related to legal claims and property damage for which you are responsible.

Do I need commercial insurance for my small business?

Yes, commercial insurance protects your business against property damage, liability claims, and other risks specific to your industry.

What is specialty insurance?

Specialty insurance provides coverage for unique items or situations that standard policies may not adequately protect.

How does Acceptance Casualty ensure efficient claims processing?

Acceptance Casualty’s streamlined claims process ensures quick resolutions, minimizing disruptions in case of an incident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.