Admiral Indemnity Company Review (2025)

Admiral Indemnity Company actively safeguards what matters most, offering diverse coverage options in the insurance realm.

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Admiral Indemnity Company

Average Monthly Rate For Good Drivers

$79A.M. Best Rating:

A+Complaint Level:

LowPros

- Diverse Insurance Offerings: Admiral Indemnity Company stands out with its wide range of insurance options, covering vehicles, homes, lives, and businesses. Tailored policies meet diverse needs effectively.

- Affordable Premiums: The company’s competitive pricing ensures comprehensive coverage without straining your wallet, making insurance accessible to many.

- Exceptional Customer Service: Knowledgeable agents provide top-notch customer service, guiding you through complexities and ensuring well-informed decisions.

- Efficient Claims Processing: Admiral Indemnity’s swift claims handling offers reassurance during stressful times, reflecting their commitment to customer satisfaction.

- Customizable Policies: Personalization is key. Policies can be tailored to fit your specific circumstances, preventing unnecessary costs.

Cons

- Online Focus: While convenience is present, limited physical branches might not suit those preferring face-to-face interactions.

- Discount Range: While competitive, Admiral Indemnity might not offer as extensive a discount range as some competitors. Comparing options is wise for discount enthusiasts.

In the realm of insurance, Admiral Indemnity Company emerges as a steadfast guardian, offering a diverse range of coverage options designed to safeguard what matters most. From auto and home insurance to life and business coverage, their versatile policies cater to individual and commercial needs alike.

With a commitment to affordability, exceptional customer service, and efficient claims processing, Admiral Indemnity stands as a beacon of security in an uncertain world.

While their primarily online presence and discount offerings may differ from some competitors, their dedication to personalized coverage and unwavering protection sets them apart. Whether it’s shielding your vehicle, home, loved ones, or business, Admiral Indemnity Company is poised to be a reliable partner on life’s unpredictable journey.

Admiral Indemnity Company Insurance Coverage Options

Admiral Indemnity Company takes pride in providing a versatile selection of coverage options that cater to various aspects of life. Their commitment to safeguarding what matters most is evident through the following comprehensive coverage offerings:

- Auto Insurance: From cautious drivers to thrill-seekers, Admiral Indemnity Company offers tailored auto insurance policies that fit your driving habits and provide peace of mind on the road.

- Home Insurance: Protecting your biggest investment is paramount. Their customizable home insurance plans ensure that your home and possessions are shielded against unexpected perils.

- Life Insurance: Ensuring the financial well-being of your loved ones is made easy with Admiral Indemnity’s life insurance plans. Secure their futures with options that suit your circumstances.

- Business Insurance: Businesses face diverse challenges, but Admiral Indemnity’s business insurance coverage stands as a bulwark against uncertainties, ensuring your enterprise’s continuity.

- Travel Insurance: Embark on journeys worry-free with Admiral Indemnity’s travel insurance. Covering unforeseen disruptions, it lets you explore with confidence.

- Specialty Coverage: Unique needs are addressed with specialty coverage options. Whether it’s flood insurance or other specialized protection, Admiral Indemnity has you covered.

Embracing a holistic approach, Admiral Indemnity Company empowers individuals, families, and businesses with tailored coverage solutions, enhancing the security and resilience of those they serve.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

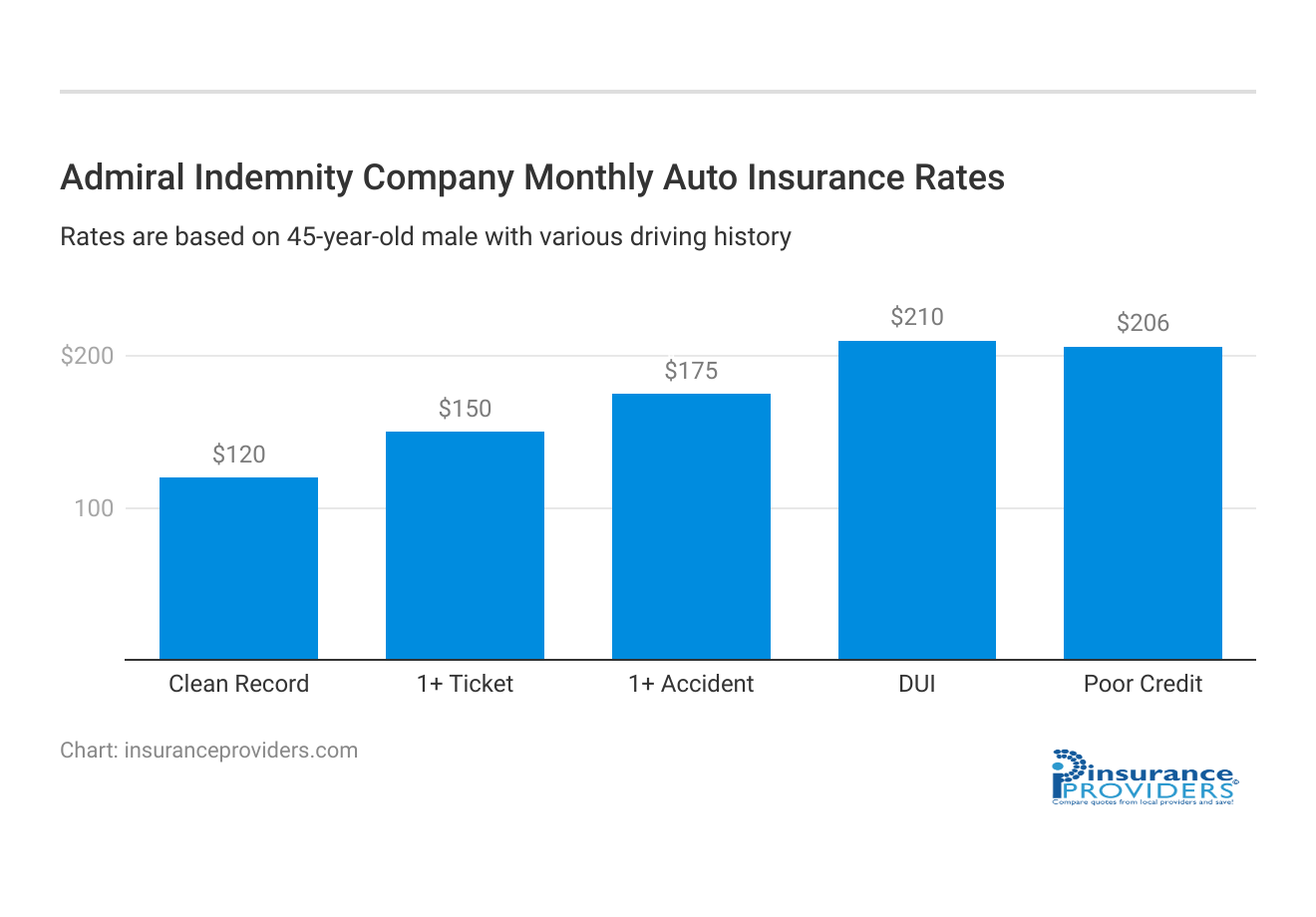

Admiral Indemnity Company Insurance Rates Breakdown

| Driver Profile | Admiral Indemnity Company | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $175 | $173 |

| DUI | $210 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Admiral Indemnity Company Discounts Available

| Discount | Admiral Indemnity Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 20% |

| Low Mileage | 15% |

| Paperless | 8% |

| Safe Driver | 20% |

| Senior Driver | 10% |

Admiral Indemnity Company values affordability and offers a range of discounts to help you save on your insurance premiums. These discounts are designed to reward responsible behavior and promote customer loyalty. Here’s a look at the discounts you can take advantage of:

- Multi-Policy Discounts: Bundle multiple insurance policies with Admiral Indemnity and enjoy significant savings on your overall premiums.

- Safe Driving Discounts: Safe driving habits are rewarded. Maintain a clean driving record and enjoy discounts that reflect your responsible behavior on the road.

- Good Student Discounts: Students excelling in their studies can benefit from reduced insurance rates, encouraging academic achievement.

- Safety Features Discounts: Equipping your vehicle with safety features such as airbags, anti-lock brakes, and anti-theft systems can lead to lower insurance costs.

- Payment Plan Discounts: Opt for certain payment plans, like paying in full or through automated deductions, to unlock additional savings.

- Renewal Discounts: Loyalty is recognized. Renew your policy with Admiral Indemnity, and you may qualify for renewal discounts.

These discounts make insurance more accessible and affordable, reflecting Admiral Indemnity Company’s commitment to rewarding responsible choices and building lasting relationships with their policyholders.

How Admiral Indemnity Company Ranks Among Providers

Here’s the list of the main competitors of Admiral Indemnity Company:

- Guardian Assurance Group: Known for their comprehensive coverage options and excellent customer service, Guardian Assurance Group offers a range of insurance products similar to Admiral Indemnity Company.

- SecureShield Insurance: SecureShield Insurance is a strong competitor in the insurance market, offering a wide array of coverage options at competitive rates. Their emphasis on digital innovation and user-friendly online platforms provides a convenient experience for tech-savvy customers.

- Unity Insurance Services: Unity Insurance Services competes by focusing on affordability without compromising coverage quality. They are particularly popular among budget-conscious customers looking for essential coverage options at a competitive price point.

- Sentinel Coverage Group: Sentinel Coverage Group is a direct competitor, known for their comprehensive range of insurance products spanning auto, home, life, and more.

- Reliant Protection Agency: Reliant Protection Agency is another significant competitor, lauded for their specialized coverage options and attentive customer support.

These competitors, along with Admiral Indemnity Company, contribute to a dynamic insurance landscape, providing customers with a variety of choices when it comes to selecting the insurer that aligns best with their needs and preferences.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

Claims Process with Admiral Indemnity Company

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Admiral Indemnity Company understands the importance of a hassle-free claims process for its policyholders. They offer multiple convenient options for filing a claim, ensuring that you can choose the method that suits you best. Whether you prefer the ease of online submissions, the personal touch of phone interactions, or the convenience of mobile apps, Admiral Indemnity has you covered.

Average Claim Processing Time

When it comes to handling claims, Admiral Indemnity Company excels in providing timely assistance. Their commitment to efficiency means that you won’t be left waiting when you need support the most. They strive to process claims swiftly, helping you get back on track without unnecessary delays.

Customer Feedback on Claim Resolutions and Payouts

Admiral Indemnity Company values customer feedback and works diligently to ensure fair and satisfactory claim resolutions and payouts. Customer experiences play a vital role in shaping their claims handling process. Policyholders’ opinions and reviews help them continually improve and refine their services, ensuring that you receive the support and compensation you deserve.

Admiral Indemnity Company’s Cutting-Edge Digital and Technological Features

Mobile App Features and Functionality

Admiral Indemnity Company offers a user-friendly mobile app designed to enhance your insurance experience. Their app provides a range of features and functionalities, allowing you to access policy information, file claims, make payments, and even receive real-time updates on the status of your claims. The mobile app is a convenient tool for managing your insurance needs on the go.

Online Account Management Capabilities

Managing your insurance policies and accounts online has never been easier with Admiral Indemnity. Their online account management platform empowers you to review and update your policies, view billing information, track claims, and access important documents from the comfort of your own home. It’s a user-friendly interface designed to simplify your insurance-related tasks.

Digital Tools and Resources

Admiral Indemnity Company goes the extra mile by providing a variety of digital tools and resources to support their policyholders. From educational resources that help you understand your coverage options to interactive tools that assist in calculating policy costs, they offer a wealth of information at your fingertips.

These digital resources are designed to empower you to make informed insurance decisions. With Admiral Indemnity Company’s commitment to a seamless claims process and their array of digital and technological features, you can confidently navigate life’s uncertainties while enjoying the benefits of modern insurance services.

Frequently Asked Questions

How can I obtain a quote for Admiral Indemnity Company’s insurance policies?

Getting a quote is simple; you can visit their website or contact their customer service to initiate the process.

Does Admiral Indemnity Company offer discounts for bundling multiple insurance policies?

Yes, Admiral Indemnity Company provides multi-policy discounts, allowing you to save on your premiums by bundling different types of coverage.

What is the typical claims processing time with Admiral Indemnity Company?

Their claims processing is swift, focusing on providing assistance promptly when needed the most.

Does Admiral Indemnity Company offer specialized coverage, like flood insurance, for unique needs?

Absolutely, they offer various specialized coverage options, including flood insurance, catering to specific and unique needs.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.