American Agricultural Insurance Company Review (2025)

Explore how American Agricultural Insurance Company provides tailored coverage empowering farmers against uncertainties in the agricultural landscape.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

American Agricultural Insurance Company emerges as an indispensable guardian for farmers and agribusinesses. Offering an array of meticulously crafted insurance coverage options, this company stands as a stalwart partner in safeguarding against the uncertainties that beset the farming landscape.

From shielding crops and livestock against nature’s capriciousness to fortifying properties and equipment against unforeseen mishaps, their comprehensive portfolio caters to the unique challenges of the agricultural sector.

Through specialized coverage for diverse farming practices, dedicated customer support, and a commitment to competitive rates, American Agricultural Insurance Company not only mitigates risks but empowers agricultural pursuits, ensuring that every harvest and endeavor is nurtured with the security it deserves.

American Agricultural Insurance Company Insurance Coverage Options

American Agricultural Insurance Company stands as a steadfast partner. As the realm of farming remains susceptible to numerous uncertainties, possessing the appropriate insurance coverage can spell the difference between success and setback.

Here’s a breakdown of the coverage options offered by American Agricultural Insurance Company:

- Crop Insurance: Protects your crops against a variety of risks, including adverse weather conditions, disease, and pests.

- Livestock Insurance: Offers coverage for your livestock, including cattle, poultry, and other animals, safeguarding against illness, accidents, and other perils.

- Property Insurance: Provides coverage for your agricultural property, including buildings, equipment, and machinery, against damages caused by events like fires, storms, and theft.

- Farm Liability Insurance: Protects you against liability claims arising from accidents or injuries that occur on your farm premises.

- Equipment Breakdown Insurance: Covers the costs of repairing or replacing essential farm equipment that breaks down due to mechanical or electrical failure.

- Business Interruption Insurance: Offers compensation for lost income and operating expenses if your farm operations are interrupted due to covered perils.

- Agribusiness Insurance: Provides comprehensive coverage for various aspects of your agricultural business, including liability, property, and other specialized coverage needs.

- Farm Auto Insurance: Covers your farm vehicles, including tractors and other vehicles used for farming purposes, against accidents and damages.

American Agricultural Insurance Company tailors these coverage options to address the unique challenges faced by the agricultural sector, ensuring that your farm operations are adequately protected from unforeseen events.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

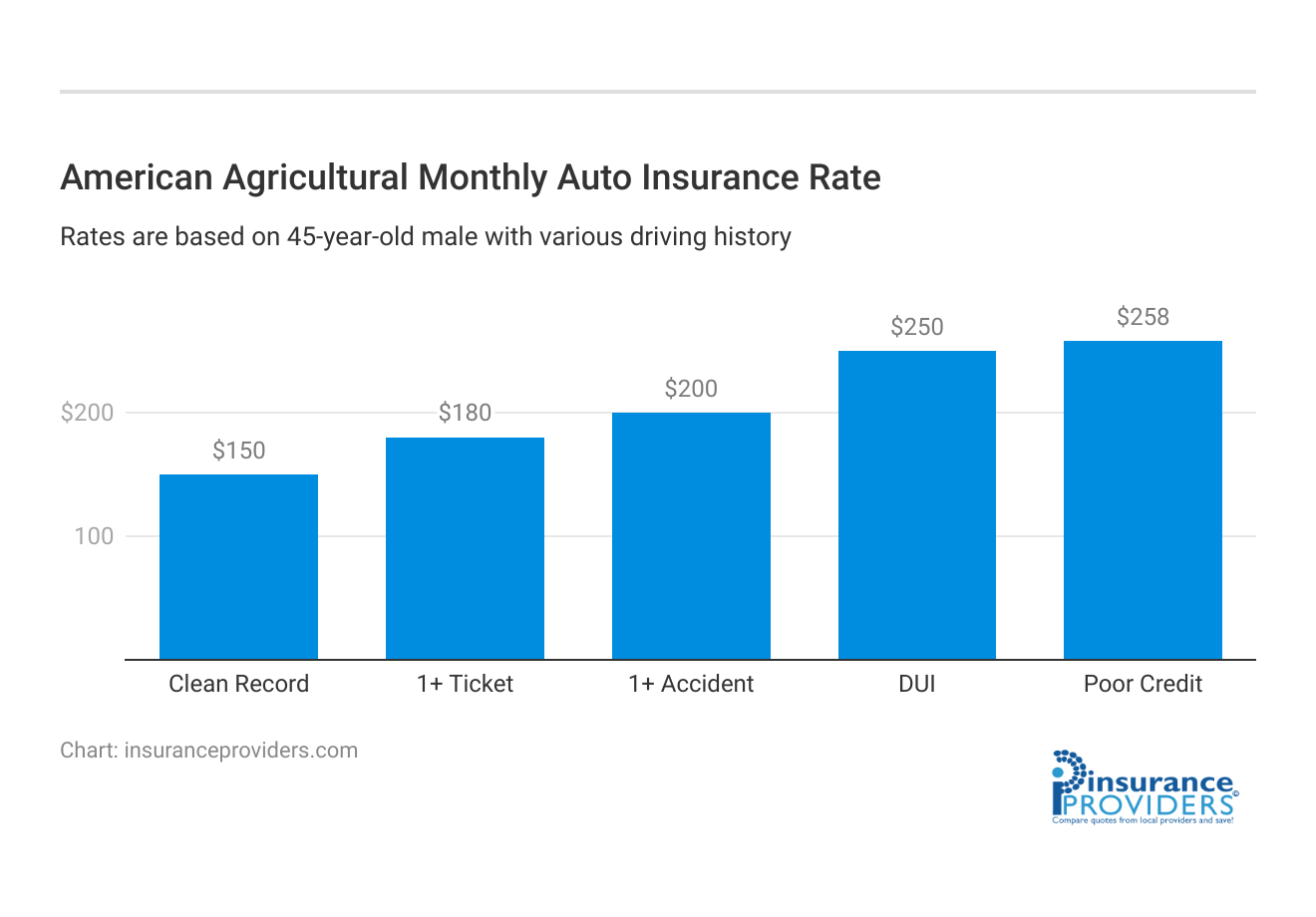

American Agricultural Insurance Company Insurance Rates Breakdown

| Driver Profile | American Agricultural | National Average |

|---|---|---|

| Clean Record | $150 | $119 |

| 1+ Ticket | $180 | $147 |

| 1+ Accident | $200 | $173 |

| DUI | $250 | $209 |

| Poor Credit | $258 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

American Agricultural Insurance Company Discounts Available

| Discount | American Agricultural |

|---|---|

| Anti Theft | 10% |

| Good Student | 5% |

| Low Mileage | 8% |

| Paperless | 3% |

| Safe Driver | 15% |

| Senior Driver | 5% |

American Agricultural Insurance Company values its customers and offers a range of discounts to help farmers secure comprehensive coverage at competitive rates. Here are some of the discounts you can take advantage of:

- Multi-Policy Discount: Save by bundling multiple insurance policies, such as crop insurance, property insurance, and liability insurance, under one comprehensive coverage plan.

- Claims-Free Discount: Enjoy reduced rates if you have a history of few or no insurance claims, demonstrating your commitment to safe and responsible farming practices.

- Loyalty Discount: Benefit from being a long-term customer with American Agricultural Insurance Company, as they often offer loyalty discounts to reward your continued business.

- Safety Measures Discount: Implement safety measures on your farm, such as security systems, fire prevention measures, and safe equipment handling practices, to qualify for lower insurance rates.

- Professional Association Discount: If you’re a member of a recognized agricultural association or organization, you may be eligible for a special discount.

- Good Driving Record Discount: For policies that include farm vehicles, maintain a clean driving record for these vehicles to access discounted rates.

- Early Sign-Up Discount: Secure your coverage well in advance and receive a discount for proactively preparing for the upcoming farming season.

- Green Practices Discount: If you’re practicing environmentally sustainable farming methods, you might qualify for a discount as a recognition of your eco-friendly efforts.

- Renewal Discount: Renew your policy with American Agricultural Insurance Company and enjoy a renewal discount as a token of appreciation for your continued partnership.

Please note that the availability of discounts may vary based on your location and the specific policies you choose. Contact the company’s customer service for personalized information on the discounts you may qualify for.

How American Agricultural Insurance Company Ranks Among Providers

American Agricultural Insurance Company operates in a niche market, focusing on providing insurance solutions tailored to the unique needs of the agricultural industry. Here are some of the company’s main competitors:

- Farmers Insurance Group: Farmers Insurance offers a range of insurance products, including coverage for farms and ranches. They provide customizable policies that address the specific needs of agricultural operations. While they may not exclusively focus on agriculture, their experience in rural insurance makes them a noteworthy competitor.

- Nationwide Agribusiness: Nationwide specializes in agribusiness insurance, offering coverage for farms, ranches, and related operations. They provide a variety of policies designed to protect farming assets and income, making them a strong contender in the agricultural insurance market. (For more information, read our “Nationwide Agribusiness Insurance Company Review“).

- Country Financial: Country Financial provides insurance and financial services to rural and agricultural communities. They offer coverage for farms, homes, and vehicles, along with options for crop and livestock insurance, catering to the insurance needs of farmers.

- Rural Mutual Insurance Company: Rural Mutual specializes in serving the rural community, offering insurance products for farms, agribusinesses, and rural homes. Their localized approach and emphasis on community connections make them a competitor in the agricultural insurance sector.

- QBE North America: QBE offers specialized insurance solutions for the agriculture industry, including crop insurance, farm liability, and commercial agribusiness coverage. Their focus on risk management and tailored policies puts them in competition with American Agricultural Insurance Company.

It’s important to note that while these companies may offer some overlap in terms of coverage, American Agricultural Insurance Company distinguishes itself with its deep understanding of the intricacies of farming and its commitment to providing specialized coverage options to meet the diverse needs of agricultural businesses.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Agricultural Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

American Agricultural Insurance Company offers multiple convenient options for filing a claim, ensuring that policyholders can choose the method that suits them best.

You can file a claim online through their user-friendly website, making the process quick and hassle-free. Alternatively, policyholders can file a claim over the phone by contacting the company’s dedicated claims hotline.

For those who prefer mobile solutions, American Agricultural Insurance Company provides a mobile app that streamlines the claims submission process. This flexibility in claim submission channels ensures that customers can report incidents in the most convenient way for them, enhancing their overall experience.

Average Claim Processing Time

The speed at which an insurance company processes claims is a critical factor for policyholders. American Agricultural Insurance Company is committed to efficient claim processing. While the specific processing times may vary depending on the nature and complexity of the claim, policyholders generally experience relatively fast turnaround times.

Customers appreciate the company’s efforts to minimize delays, allowing them to receive their claim settlements promptly. The company’s commitment to swift processing reflects its dedication to providing responsive service to policyholders.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. American Agricultural Insurance Company has consistently received positive feedback from its policyholders regarding the resolution of claims and payout experiences.

Customers have praised the company for its fairness, transparency, and professionalism in handling claims. The prompt and equitable settlements provided by the company have contributed to a high level of customer satisfaction. This positive feedback serves as a testament to the company’s commitment to meeting its obligations to policyholders.

American Agricultural Insurance Company Digital and Technological Features

Mobile App Features and Functionality

American Agricultural Insurance Company offers a feature-rich mobile app that enhances the digital experience for its policyholders. The app provides easy access to policy information, allows users to view and manage their policies, and facilitates the submission of claims directly from a mobile device.

Additionally, the app offers features such as bill payment, policy document access, and personalized notifications. The user-friendly interface and comprehensive functionality of the mobile app make it a valuable tool for policyholders seeking convenience and efficiency in managing their insurance needs.

Online Account Management Capabilities

Policyholders of American Agricultural Insurance Company can take advantage of robust online account management capabilities through the company’s website.

Customers can log in to their accounts to view policy details, make updates, and access important documents. The online platform also offers tools for estimating insurance premiums, exploring coverage options, and generating quotes. This empowers policyholders to have greater control over their insurance accounts and make informed decisions about their coverage.

Digital Tools and Resources

In addition to its mobile app and online account management, American Agricultural Insurance Company provides a variety of digital tools and resources to support its policyholders. These resources include informative articles, guides, and calculators to help customers understand their insurance needs better.

The company’s website offers a wealth of information on insurance topics, making it a valuable educational resource. Policyholders can rely on these digital tools and resources to make informed choices about their insurance coverage and gain a deeper understanding of their policies.

Frequently Asked Questions

How does American Agricultural Insurance Company cater its coverage to the unique challenges of the agricultural sector?

American Agricultural Insurance Company tailors its coverage options to address the specific needs of farmers and agribusinesses. From protecting crops and livestock against nature’s uncertainties to fortifying properties and equipment, their comprehensive portfolio is designed to meet the diverse challenges faced in agriculture.

What discounts does American Agricultural Insurance Company offer for farmers seeking comprehensive coverage?

The company values its customers and offers various discounts to help farmers secure comprehensive coverage at competitive rates. These discounts can vary based on location and specific policies chosen. Customers are encouraged to reach out to the company’s customer service for personalized information on available discounts.

How does American Agricultural Insurance Company stand out among its competitors in the insurance market for farmers?

While some competitors might offer overlapping coverage, American Agricultural Insurance Company distinguishes itself with its deep understanding of farming intricacies. It’s committed to providing specialized coverage options, aligning with the diverse needs of agricultural businesses.

What channels does American Agricultural Insurance Company offer for filing claims, and what is the average claim processing time?

The company provides multiple convenient options for filing claims, including online submission through their user-friendly website, over-the-phone submissions via their dedicated claims hotline, and a mobile app. While claim processing times can vary based on claim complexity, customers generally experience relatively fast turnaround times, ensuring prompt settlements.

What digital tools and resources does American Agricultural Insurance Company offer to support its policyholders?

The company offers a feature-rich mobile app for easy policy management, bill payment, and claims submission. Additionally, their online account management platform provides access to policy details, important documents, and tools for estimating premiums and exploring coverage options. These digital resources empower policyholders to make informed decisions about their insurance coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.