ARI Insurance Company Review (2026)

Discover ARI Insurance Company, an industry stalwart offering tailored coverage for auto, home, health, life, and travel insurance, standing out with customizable policies, innovative tech integration, and a reputation for seamless claims handling.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In conclusion, ARI Insurance Company stands as a steadfast pillar in the ever-evolving landscape of insurance. With a commitment to safeguarding what matters most, ARI’s comprehensive coverage options offer a shield of protection tailored to individual needs.

The company’s competitive edge is further honed by its dedication to customer satisfaction, demonstrated through a streamlined claims process, exceptional customer support, and a range of enticing discounts. ARI’s pursuit of excellence extends beyond the conventional, venturing into the realm of innovation.

In a world increasingly shaped by technology, ARI’s seamless integration of digital solutions ensures that customers can access their policies, manage claims, and make informed decisions with ease. As the industry continues to witness disruptive forces, ARI Insurance Company remains agile and adaptable.

The dynamic competitors, ranging from established giants to innovative insurtech startups, serve as a testament to the industry’s diverse landscape. By navigating this competitive terrain with unwavering determination, ARI secures its position as a provider of choice for those seeking protection, peace of mind, and a partner committed to their financial well-being.

ARI Insurance Company Insurance Coverage Options

ARI Insurance Company offers a diverse range of coverage options to cater to the unique needs of individuals and families. These comprehensive policies are designed to provide peace of mind and protection in various aspects of life. Here are the coverage options offered by ARI Insurance:

- Auto Insurance: ARI’s auto insurance policies cover not only the standard liability and collision aspects but also offer options for uninsured motorist coverage, comprehensive coverage, and roadside assistance.

- Home Insurance: ARI’s home insurance policies protect your dwelling and personal belongings, while also providing liability coverage. Additional options include coverage for valuable items, flood insurance, and additional living expenses.

- Health Insurance: ARI’s health insurance plans offer a range of coverage levels, including preventive care, hospitalization, prescription drug coverage, and wellness programs.

- Life Insurance: ARI’s life insurance policies provide financial security for your loved ones in the event of your passing. Options include term life, whole life, and universal life insurance.

- Travel Insurance: ARI’s travel insurance covers unexpected events during trips, including trip cancellations, medical emergencies, lost luggage, and more.

Each coverage option can be tailored to individual needs and circumstances, allowing policyholders to create a plan that aligns perfectly with their requirements. ARI’s commitment to customization ensures that customers receive the protection they need without unnecessary overlaps, making it a reliable choice for comprehensive coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

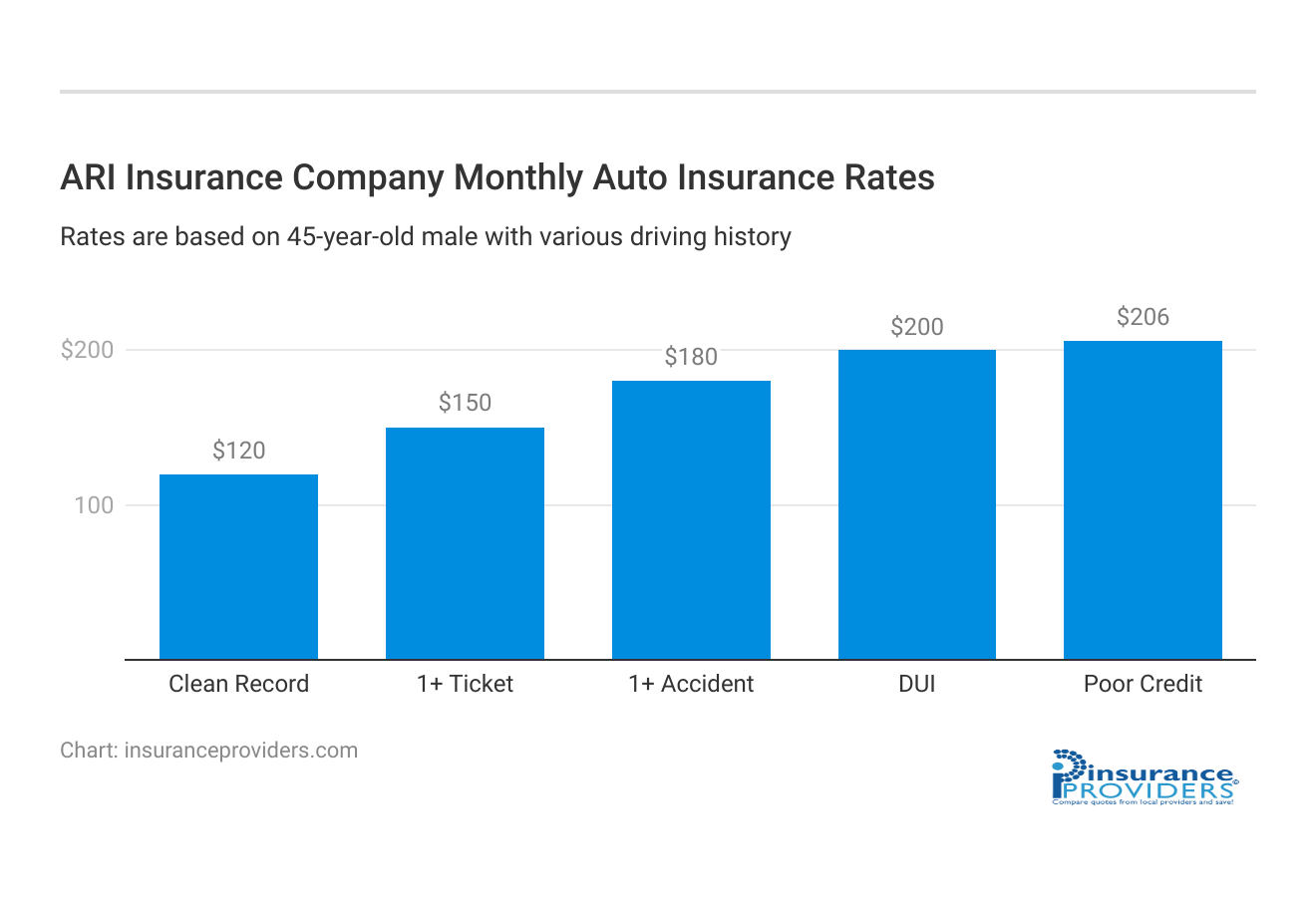

ARI Insurance Company Insurance Rates Breakdown

| Driver Profile | ARI Insurance Company | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $180 | $173 |

| DUI | $200 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

ARI Insurance Company Discounts Available

| Discount | ARI Insurance Company |

|---|---|

| Anti Theft | 5% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 7% |

| Safe Driver | 10% |

| Senior Driver | 5% |

ARI Insurance Company is dedicated to providing its customers with the best value, and to that end, it offers a range of attractive discounts that make quality coverage even more affordable. These discounts reflect the company’s commitment to meeting the diverse needs of its policyholders. Here are some of the discounts offered by ARI Insurance:

- Safe Driver Discount: ARI rewards responsible drivers with a safe driving history, offering reduced premiums for those who have maintained a clean record over time.

- Multi-Policy Discount: Customers who choose to bundle multiple insurance policies, such as auto and home insurance, can enjoy a significant discount on their premiums.

- Good Student Discount: Students who excel academically are recognized with lower insurance rates, incentivizing both good grades and responsible behavior.

- Multi-Vehicle Discount: Families or individuals with multiple vehicles can benefit from this discount, which lowers premiums for insuring more than one vehicle under the same policy.

- Anti-Theft Discount: Vehicles equipped with anti-theft devices or tracking systems are eligible for this discount, reflecting ARI’s commitment to vehicle security.

- Safe Vehicle Discount: ARI acknowledges safety-conscious vehicle choices by offering discounts to policyholders with vehicles equipped with advanced safety features.

- Renewal Discount: Loyalty is rewarded at ARI. Customers who renew their policies with the company receive a discount as a token of appreciation for their continued trust.

- Good Credit Discount: ARI recognizes the importance of good financial habits and offers discounts to policyholders with strong credit scores.

- Affinity Group Discount: Members of certain organizations, alumni associations, or affinity groups can enjoy exclusive discounts tailored to their affiliations.

These discounts exemplify ARI’s dedication to fostering a supportive and cost-effective insurance experience for its customers, encouraging responsible choices and building long-lasting relationships.

How ARI Insurance Company Ranks Among Providers

Navigating the competitive arena of the insurance industry, ARI Insurance Company faces a dynamic landscape of rivals vying for market dominance. An insightful exploration of its main competitors sheds light on the challenges and opportunities within this domain:

- Guardianshield Insurance Group: Guardianshield emerges as a prominent contender, renowned for its extensive suite of coverage options and robust financial stability. Catering to a diverse clientele seeking reliability, Guardianshield offers an array of insurance products spanning auto, home, health, and life insurance. Its solid reputation and wide-ranging offerings position it as a substantial rival to ARI’s market presence.

- Regionalsure Insurance: With a localized focus on the Midwest region, Regionalsure establishes itself as a formidable adversary. Its deep understanding of regional dynamics, coupled with personalized customer service, creates a competitive advantage. By offering competitive rates aligned with regional norms, Regionalsure carves out a niche within its target market, challenging ARI’s local foothold.

- Insuretech Innovators: Pioneering the digital wave, startups like Coverwave Insurance and Sureguard Solutions redefine the insurance landscape. Leveraging technology for streamlined processes, they resonate with tech-savvy customers seeking seamless experiences. These agile players disrupt traditional insurance paradigms, compelling established insurers like ARI to embrace digital transformation to remain competitive.

- Nicheguard Specialty Insurance: Nicheguard’s specialization in unique coverage niches elevates it as a distinct competitor. Tailoring policies for collectibles, rare artwork, and specialized items, Nicheguard captures a niche audience seeking bespoke coverage. Its tailored approach gives it an edge in catering to specific needs that might not be addressed by broader insurers like ARI.

- Safedrive Mutual Insurance: Safedrive’s community-centric ethos sets it apart, resonating with customers seeking a personalized touch. As a mutual insurer, it engages policyholders with member ownership and shared profits. This approach resonates with those valuing a sense of community engagement, urging ARI to emphasize its customer-centric approach.

- Ecoinsure Sustainable Coverage: Ecoinsure leads the eco-conscious charge with coverage tailored to environmentally responsible living. With offerings for energy-efficient homes, electric vehicles, and sustainable lifestyles, EcoInsure capitalizes on the growing environmentally conscious market. Its eco-friendly stance attracts a niche audience and serves as a reminder for ARI to consider green coverage options.

- Quickcover Aggregator: Quickcover, an online insurance aggregator, influences customer decisions through unbiased policy comparisons. While not a direct competitor, its role in guiding customer choices demands ARI’s strategic adaptation. Maintaining visibility on such platforms becomes crucial to keep ARI’s offerings at the forefront of potential policyholders’ minds.

A comprehensive analysis of ARI Insurance Company’s main competitors reveals the multifaceted nature of the insurance sector. By embracing innovation, tailoring offerings, and emphasizing customer-centricity, ARI can adeptly navigate this competitive landscape and cement its position as an industry frontrunner.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

ARI Insurance Company Claims Process

Ease of Filing a Claim

ARI Insurance Company offers multiple convenient options for filing insurance claims. Policyholders can file claims online through the company’s user-friendly website or mobile app. Additionally, they have the option to initiate claims over the phone, ensuring flexibility in the claims reporting process.

ARI’s commitment to technology integration makes it easy for customers to choose the method that suits them best.

Average Claim Processing Time

The speed at which insurance claims are processed is a crucial factor for policyholders. ARI Insurance Company is dedicated to a swift and efficient claims process. While specific processing times may vary depending on the nature and complexity of the claim, ARI strives to handle claims promptly. Policyholders can expect a reasonably quick turnaround time for their claims to be resolved.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance. ARI Insurance Company has garnered positive reviews for its claim resolutions and payouts. Customers appreciate the company’s commitment to addressing their needs efficiently and fairly. ARI’s reputation for seamless claim handling reflects its dedication to providing peace of mind to policyholders.

ARI Insurance Company’s Digital and Technological Features

Mobile App Features and Functionality

ARI Insurance Company places a strong emphasis on technological innovation, and this is evident in its mobile app. The company’s mobile app offers a range of features and functionalities designed to enhance the customer experience.

Policyholders can use the app to access their insurance policies, file claims, make payments, and receive important updates in real time. The app’s user-friendly interface makes managing insurance on the go a breeze.

Online Account Management Capabilities

Managing insurance policies online has become a standard expectation for customers, and ARI Insurance Company delivers on this front. Policyholders can easily access and manage their accounts through the company’s website.

From updating personal information to reviewing policy details and making changes, ARI’s online account management capabilities empower customers to have full control over their insurance.

Digital Tools and Resources

In addition to its mobile app and online account management, ARI Insurance Company provides a suite of digital tools and resources to assist policyholders. These tools may include insurance calculators, educational resources, and informative articles to help customers make informed decisions about their coverage.

ARI’s commitment to digital empowerment ensures that policyholders have access to the information they need when they need it.

Frequently Asked Questions

What types of insurance does ARI Insurance offer?

ARI Insurance offers a comprehensive range of coverage options, including auto, home, health, life, and travel insurance. Each policy is carefully crafted to provide tailored protection to suit individual needs.

How can I customize my insurance policy with ARI?

ARI Insurance understands that every customer is unique. You can customize your policy by choosing from various coverage options, deductibles, and add-ons to create a plan that aligns perfectly with your requirements.

What discounts does ARI Insurance offer?

ARI Insurance provides several discounts to help you save on your premiums. These include safe driver discounts, multi-policy discounts, good student discounts, multi-vehicle discounts, and more. Contact ARI’s customer support for specific details on available discounts.

How do I file a claim with ARI Insurance?

Filing a claim with ARI Insurance is straightforward. You can reach out to their dedicated customer support team, either through phone or online channels, to initiate the claims process. They will guide you through the necessary steps and assist throughout.

Does ARI Insurance have a good reputation for customer service?

Yes, ARI Insurance takes pride in its exceptional customer service. With a dedicated support team, they aim to address your inquiries, concerns, and claims promptly and professionally, ensuring a positive customer experience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.