Campmed Casualty & Indemnity Company, Inc Review (2026)

Campmed Casualty & Indemnity Company, Inc., a trusted insurance ally, stands as a beacon of trust in the insurance domain, offering an extensive array of policies that cater to diverse needs and ensure security is both attainable and affordable.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Campmed Casualty & Indemnity Company, Inc. emerges as a beacon of trust in the insurance domain, offering an extensive array of policies that cater to diverse needs. With an unwavering commitment to customer well-being, Campmed provides comprehensive coverage that brings peace of mind to individuals and businesses alike.

From Health and Auto Insurance to Home and Business Liability coverage, Campmed’s offerings address the full spectrum of life’s uncertainties. With a legacy built on reliability, responsive customer service, and a range of exclusive discounts, Campmed ensures that security is both attainable and affordable.

Step into a world where protection meets personalized care – step into the realm of Campmed.

Campmed Casualty & Indemnity Company, Inc. Insurance Coverage Options

Campmed’s commitment to addressing diverse needs is reflected in the breadth of our insurance portfolio. Our policies are meticulously crafted to align with the ever-evolving demands of modern life. Let’s delve into the range of insurance types offered by Campmed and uncover how they can be your pillar of support:

- Health Insurance: Your well-being is non-negotiable. Campmed’s Health Insurance policies extend a helping hand when you need it most. From routine medical expenses to unexpected health crises, we’re here to ensure that your health remains a top priority.

- Auto Insurance: Your vehicle is more than just a mode of transport; it’s an integral part of your journey. Campmed’s Auto Insurance provides a safety net against the uncertainties of the road. Accidents, thefts, and damages – we’re here to navigate these challenges with you.

- Home Insurance: Your home is your sanctuary, and protecting it is paramount. Campmed’s Home Insurance policies are designed to shield your abode from unforeseen perils. Fire, theft, natural disasters – let us be the safeguard for your haven.

- Business Liability Insurance: Businesses operate in a realm of possibilities, and some risks are inevitable. Campmed’s Business Liability Insurance stands as a shield against legal and financial liabilities. We understand the intricacies of business, and our policies are tailored to ensure your enterprise thrives.

- Travel Insurance: Adventures enrich our lives, but even the best-laid plans can encounter hiccups. Campmed’s Travel Insurance ensures that your voyages are filled with excitement rather than worries. Whether it’s a flight cancellation or a medical emergency in a foreign land, we’re here to ease your journey.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

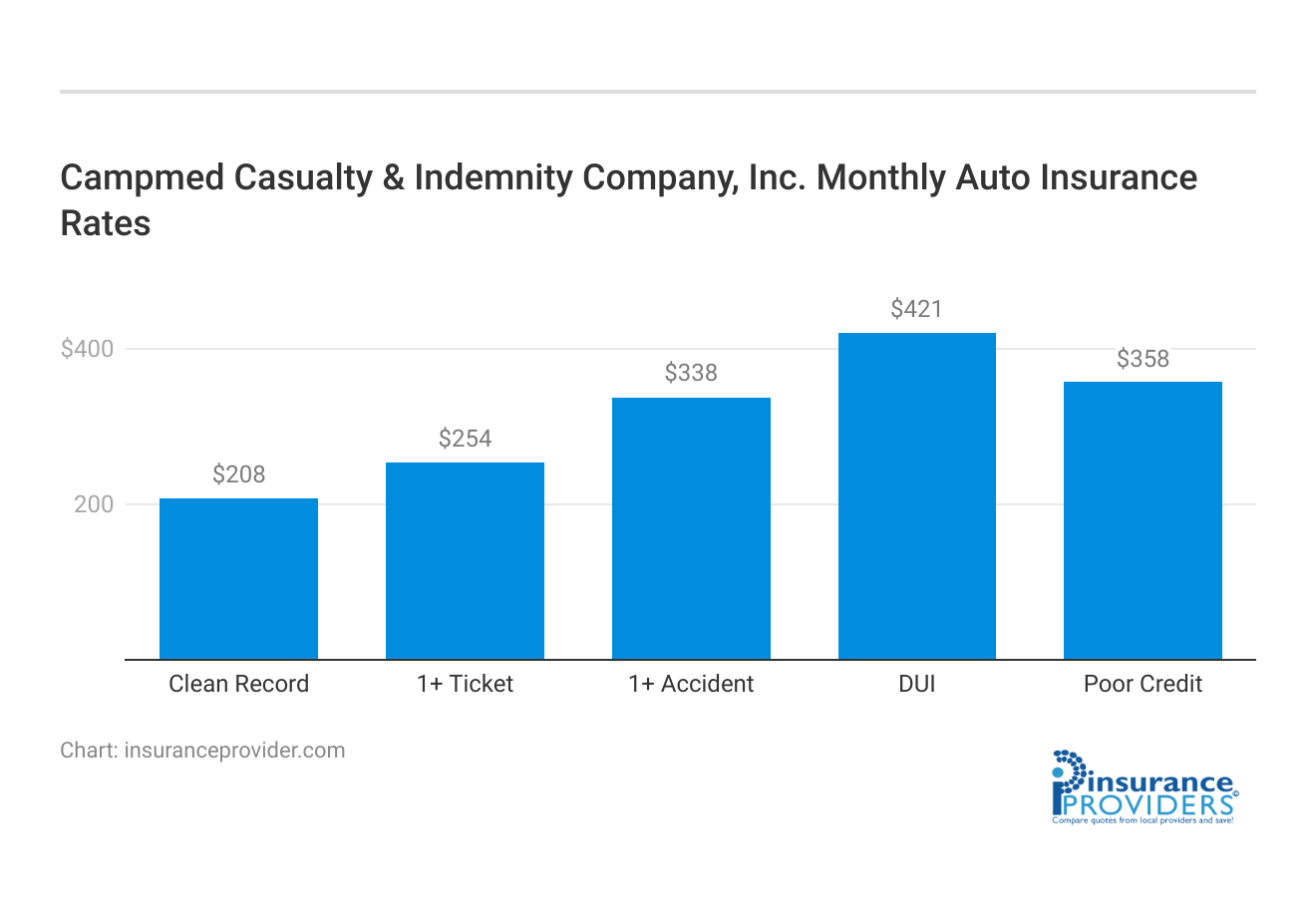

Campmed Casualty & Indemnity Company, Inc. Insurance Rates Breakdown

| Driver Profile | Campmed Casualty & Indemnity | National Average |

|---|---|---|

| Clean Record | $208 | $119 |

| 1+ Ticket | $254 | $147 |

| 1+ Accident | $338 | $173 |

| DUI | $421 | $209 |

| Poor Credit | $358 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Campmed Casualty & Indemnity Company, Inc. Discounts Available

| Discounts | Campmed Casualty & Indemnity |

|---|---|

| Anti Theft | 13% |

| Good Student | 15% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 14% |

| Senior Driver | 10% |

Campmed Casualty & Indemnity Company, we prioritizes both your peace of mind and financial well-being. Our commitment extends beyond comprehensive coverage, offering exclusive discounts for a rewarding insurance experience. Discover how you can save with Campmed:

- Multi-policy Discount: Embrace the power of bundling. When you combine multiple insurance policies with Campmed, you’ll unlock a special discount that helps you save substantially on your premiums.

- Safe Driver Discount: Responsible driving deserves recognition. Campmed rewards safe drivers with lower premiums, making it a win-win for your wallet and your peace of mind.

- Home and Auto Bundle: Protecting your home and vehicle is a double investment in security. Combine your Home and Auto Insurance policies with Campmed to enjoy a discount that reflects your commitment to comprehensive protection.

- Good Student Discount: Education and responsibility go hand in hand. If you’re a student with excellent academic performance, you’re eligible for a discount that acknowledges your dedication to both your studies and your future.

- Anti-theft Device Discount: Safeguarding your vehicle against theft is a priority. Equip your car with an approved anti-theft device, and Campmed will reward you with a discount that reflects your proactive approach.

- Pay-in-full Discount: Simplify your insurance journey and enjoy savings by opting to pay your annual premium in full. Campmed rewards your commitment to seamless coverage with this valuable discount.

- Paperless Billing Discount: Embrace eco-friendliness and streamline your insurance management. Opt for paperless billing and receive a discount that’s not just easy on the environment but also on your budget.

- Renewal Discount: Loyalty deserves appreciation. When you renew your policy with Campmed, you’ll find that our renewal discount reflects our gratitude for your trust in us.

At Campmed, we’re more than just insurance; we’re your partner in navigating life’s uncertainties. With these exclusive discounts, we’re here to ensure that your journey to security is also a journey to savings. Your financial well-being matters, and with Campmed, you can protect what you cherish without breaking the bank.

Explore our diverse range of insurance policies and discover how these discounts can elevate your insurance experience. Let us show you how protection and affordability can coexist, all under the trusted umbrella of Campmed Casualty & Indemnity Company, Inc.

How Campmed Casualty & Indemnity Company, Inc. Ranks Among Providers

In the bustling arena of insurance, Campmed Casualty & Indemnity Company, Inc. stands strong as a provider of comprehensive coverage and unwavering commitment. As you consider your insurance options, it’s natural to explore the landscape and understand how Campmed fares against its competitors. Here’s a glimpse of some of Campmed’s main competitors:

- Secureshield Insurance Group: Secureshield, a notable player in the insurance realm, prides itself on tailor-made coverage that adapts to individual needs. Their strengths lie in robust customer service and a wide network of agents, ensuring personalized guidance throughout your insurance journey.

- Globalsafe Assurance Corporation: Globalsafe Assurance Corporation boasts a global reach, offering a range of insurance products that cater to various demographics. Their competitive advantage lies in their international coverage options, making them an appealing choice for those who frequently travel.

- Sureguard Mutual Insurance: Sureguard Mutual Insurance focuses on innovative technology integration to simplify the insurance process. Their user-friendly digital tools and interfaces make policy management and claims processing a seamless experience.

- Shieldplus Coverage Inc.: Shieldplus Coverage Inc. is known for its innovative bundling options. Their streamlined approach to combining different types of coverage has attracted customers looking for convenience and potential cost savings.

- Securehaven Indemnity Services: Securehaven Indemnity Services takes pride in its community-driven approach. With a strong emphasis on local outreach and support, they’ve built a loyal customer base that values a personal touch.

- Assuranceguard Group: Assuranceguard Group is recognized for its comprehensive educational resources. Their commitment to empowering customers with knowledge about their policies and options sets them apart as an educator in the insurance industry.

While these competitors each have their unique strengths, Campmed distinguishes itself through its diverse range of insurance offerings, personalized customer service, and a commitment to comprehensive coverage. With a focus on serving diverse needs and a legacy of reliability, Campmed has earned the trust of countless individuals and businesses seeking security.

As you traverse the insurance landscape, ensure your choice aligns with your needs. Campmed is committed to your well-being and future, a reliable contender in your quest for the ideal insurance partner. Explore, weigh, and choose with confidence.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Campmed Casualty & Indemnity Company, Inc Claims Process

Ease of Filing a Claim

Campmed Casualty & Indemnity Company, Inc offers multiple channels for filing insurance claims, ensuring convenience for policyholders. Whether you prefer online, phone, or mobile app options, Campmed has you covered. Their user-friendly approach makes it easy for customers to initiate the claims process using their preferred method.

Average Claim Processing Time

The efficiency of an insurance company’s claims processing can significantly impact a policyholder’s experience. Campmed strives to provide timely claim resolutions. While specific processing times may vary depending on the nature of the claim, Campmed’s commitment to responsive service aims to minimize delays and streamline the claims process.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in assessing an insurance company’s performance in handling claims. Campmed’s dedication to customer satisfaction is evident in the feedback it receives. Policyholders have provided insights into their claim resolutions and payouts, shedding light on the company’s reliability and commitment to meeting its obligations.

Digital and Technological Features of Campmed Casualty & Indemnity Company, Inc

Mobile App Features and Functionality

Campmed’s mobile app enhances the overall insurance experience by offering a range of features and functionalities. Policyholders can manage their policies, file claims, access important documents, and even receive real-time updates on their coverage—all from the convenience of their smartphones. The user-friendly interface ensures a seamless mobile experience.

Online Account Management Capabilities

Campmed’s online account management capabilities empower policyholders to take control of their insurance accounts. Through a secure online portal, customers can review policy details, make payments, update personal information, and track the status of their claims. The online platform provides a comprehensive and accessible way to manage insurance needs.

Digital Tools and Resources

In today’s digital age, access to relevant information and resources is crucial. Campmed recognizes this need and offers a suite of digital tools and resources to assist policyholders.

These resources may include educational materials, calculators, and guides to help customers make informed decisions about their insurance coverage and financial well-being. Campmed’s commitment to digital empowerment enhances the value it provides to policyholders.

Frequently Asked Questions

How do I choose the right insurance policy from Campmed?

Campmed’s customer service experts can guide you through policy selection, considering your specific needs and budget.

What is the claims process like with Campmed?

Campmed has a streamlined claims process. Contact their claims department, provide necessary details, and they’ll guide you through the rest.

Can I bundle multiple insurance policies with Campmed?

Yes, Campmed often offers bundle discounts. Inquire about combining policies to maximize your coverage and savings.

Is Campmed insurance only available for individuals, or do they cover businesses too?

Campmed provides insurance solutions for both individuals and businesses, tailoring policies to suit each segment’s requirements.

Are there any additional benefits to Campmed’s policies beyond financial coverage?

Absolutely, Campmed strives to offer holistic benefits. Some policies might include perks like roadside assistance, wellness programs, and more.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.