Canal Indemnity Company Review (2026)

Canal Indemnity Company: A steadfast insurance guardian, offering a diverse array of coverage options spanning home, auto, health, and business insurance, characterized by top-tier ratings, competitive rates, and a commitment to tailored protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Canal Indemnity Company emerges as a reliable guardian, offering a diverse array of insurance solutions that extend protection and peace of mind to individuals and businesses alike.

From the sanctuary of home insurance shielding against the unpredictable forces of nature, to the robust coverage of auto insurance safeguarding journeys on the road, Canal Indemnity’s commitment is unwavering. Health insurance takes center stage, prioritizing well-being through comprehensive medical services, prescriptions, and wellness benefits.

For businesses, Canal Indemnity stands as a steadfast partner, providing tailored coverage against potential setbacks, ensuring enterprises thrive without undue worries. With top-tier A.M. Best ratings, competitive rates, and a range of discounts, Canal Indemnity Company proves itself as more than just an insurance provider; it’s a dependable ally in the face of life’s uncertainties.

Canal Indemnity Company Insurance Coverage Options

Canal Indemnity Company offers a comprehensive array of coverage options designed to meet various insurance needs. Here’s a breakdown of their coverage offerings:

- Home Insurance: Canal Indemnity’s home insurance provides comprehensive coverage for homeowners, safeguarding against natural disasters, theft, and damage to personal belongings. Liability coverage is also included for injuries occurring on your property.

- Auto Insurance: Canal Indemnity’s auto insurance offers a range of coverage options, including liability coverage for injuries and property damage, comprehensive coverage for damages from theft and other events, collision coverage for accidents, and uninsured/underinsured motorist coverage.

- Health Insurance: Canal Indemnity’s health insurance plans prioritize access to quality healthcare, covering medical expenses, doctor visits, hospital stays, and prescriptions. Some plans may include preventive care services and flexible options for choosing healthcare providers.

- Business Insurance: Canal Indemnity provides diverse insurance solutions. This encompasses property insurance for physical assets, liability insurance for legal protection, and business interruption insurance to replace lost income during disruptions. Specialized coverage options, like professional liability and cyber liability insurance, cater to specific needs.

These coverage options reflect Canal Indemnity Company’s commitment to providing a comprehensive suite of insurance solutions, ensuring individuals and businesses have the protection they need in various aspects of their lives and operations.

Read more: Canal Insurance Company Review

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canal Indemnity Company Insurance Rates Breakdown

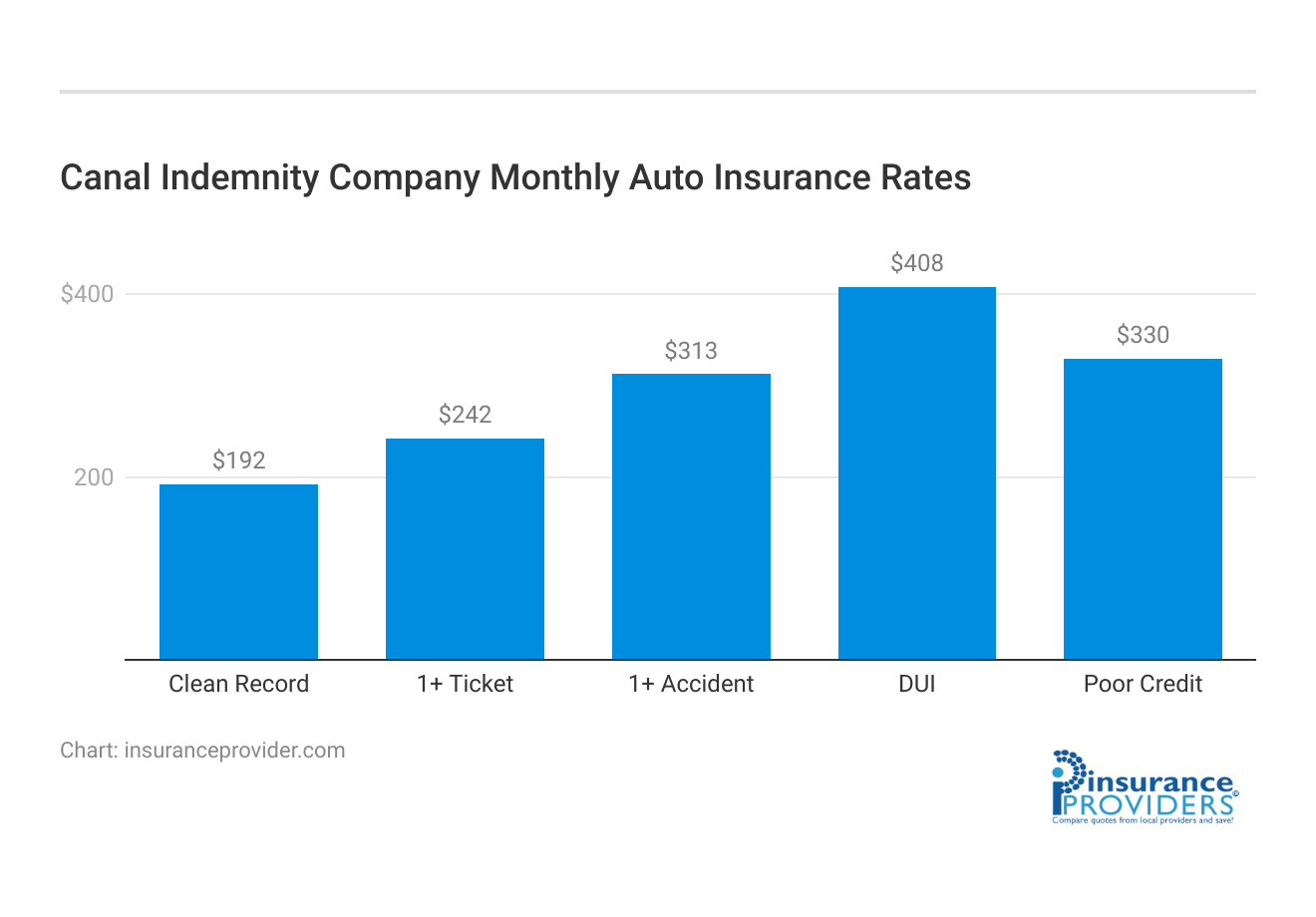

| Driver Profile | Canal Indemnity | National Average |

|---|---|---|

| Clean Record | $192 | $119 |

| 1+ Ticket | $242 | $147 |

| 1+ Accident | $313 | $173 |

| DUI | $408 | $209 |

| Poor Credit | $330 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Canal Indemnity Company Discounts Available

| Discounts | Canal Indemnity Company |

|---|---|

| Anti Theft | 13% |

| Good Student | 16% |

| Low Mileage | 11% |

| Paperless | 10% |

| Safe Driver | 15% |

| Senior Driver | 10% |

Canal Indemnity Company understands the importance of making insurance coverage more affordable for their policyholders. To that end, they offer a variety of discounts that can help you save on your insurance premiums:

- Multi-policy Discount: Bundling multiple insurance policies, such as home and auto insurance, with Canal Indemnity can lead to substantial discounts on both policies.

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you can qualify for a safe driver discount, showcasing your responsible driving habits.

- Good Student Discount: Students who maintain good grades might be eligible for a discount, reflecting Canal Indemnity’s commitment to encouraging academic excellence.

- Safety Features Discount: Vehicles equipped with safety features like anti-lock brakes, airbags, and anti-theft systems can qualify for discounts due to their reduced risk profile.

- Home Security Discount: Installing security systems, smoke detectors, and other safety measures in your home can lead to savings on your homeowners’ insurance premiums.

- Loyalty Discount: Staying with Canal Indemnity over an extended period can make you eligible for loyalty discounts, rewarding your commitment as a long-term policyholder.

- Pay-in-full Discount: Opting to pay your insurance premium in full at the beginning of the policy term often qualifies you for a discount.

- Paperless Billing and Auto-pay Discounts: Choosing paperless billing and setting up automatic payments can lead to additional savings.

- Affinity Group Discounts: Canal Indemnity may partner with certain organizations, employers, or associations to offer exclusive discounts to their members.

- Renewal Discounts: Renewing your policies with Canal Indemnity can sometimes result in renewal discounts as a token of appreciation for your continued business.

These discounts reflect Canal Indemnity’s commitment to making insurance coverage accessible to a broader range of individuals while also rewarding responsible behaviors and long-term relationships with their policyholders.

How Canal Indemnity Company Ranks Among Providers

Canal Indemnity Company operates in a competitive landscape within the insurance industry, facing several prominent rivals. These competitors offer similar insurance solutions and vie for the attention of individuals and businesses seeking coverage. Some of Canal Indemnity’s main competitors include:

- Global Insurance Group: With a robust range of insurance options spanning from personal to commercial coverage, Global Insurance Group is known for its extensive network and diverse policy offerings. They emphasize personalized plans tailored to individual needs, much like Canal Indemnity.

- Shieldsure Insurance: Shieldsure Insurance is a formidable competitor, standing out for its user-friendly digital platform that simplifies policy management and claims processing. They focus on providing seamless experiences, attracting tech-savvy customers seeking convenience.

- Secureguard Assurance: Known for their comprehensive business insurance solutions, Secureguard Assurance competes head-on with Canal Indemnity in the commercial insurance segment. They offer specialized coverage options catering to specific industries and business types.

- Welllife Insurance: In the health insurance realm, Welllife Insurance poses a challenge. They’re renowned for their emphasis on preventive care and wellness initiatives, aligning with Canal Indemnity’s commitment to prioritizing health and holistic well-being.

- Nexacoverage Solutions: Nexacoverage Solutions stands out for its innovative approach, incorporating AI-driven underwriting and digital claims processes. This positions them as a tech-forward rival, appealing to those seeking cutting-edge insurance experiences.

- Eversecure Insurers: Eversecure Insurers, like Canal Indemnity, places a strong emphasis on customer service and personalized coverage options. They’re particularly competitive in the auto insurance sector, offering unique add-ons and benefits.

These competitors, while sharing similarities with Canal Indemnity in terms of the insurance products offered, often differentiate themselves through factors such as digital capabilities, specialized coverage options, or distinctive customer service approaches.

This dynamic landscape keeps Canal Indemnity Company motivated to continuously enhance its offerings and maintain its competitive edge in the industry.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canal Indemnity Company Claims Process

Ease of Filing a Claim

Canal Indemnity Company prioritizes a hassle-free claims process for its policyholders. Customers have multiple convenient options for filing a claim, including online submissions, phone assistance, and mobile apps. This flexibility allows individuals to choose the method that best suits their preferences and needs.

Whether you prefer the convenience of filing a claim through the company’s user-friendly website, speaking with a representative over the phone, or using their mobile app, Canal Indemnity ensures a seamless experience when you need to make a claim.

Average Claim Processing Time

One of the key factors that contribute to customer satisfaction in the insurance industry is the speed at which claims are processed. Canal Indemnity Company is committed to delivering efficient service.

While the exact processing time can vary depending on the nature of the claim, the company consistently strives to expedite the process. Policyholders can expect a reasonably swift turnaround time, ensuring that their claims are handled promptly, providing peace of mind during challenging situations.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in evaluating an insurance company’s performance. Canal Indemnity Company has garnered positive reviews for its commitment to fair and prompt claim resolutions and payouts.

The company’s dedication to providing policyholders with the support they need during difficult times has resulted in high customer satisfaction ratings. Policyholders often express appreciation for the smooth and efficient claims handling process, which contributes to their overall confidence in Canal Indemnity’s services.

Digital and Technological Features of Canal Indemnity Company

Mobile App Features and Functionality

Canal Indemnity Company offers a robust mobile app that enhances the insurance experience for its customers. The app provides a range of features and functionality, allowing policyholders to manage their insurance policies, file claims, access policy documents, and make payments conveniently from their mobile devices.

The intuitive and user-friendly design of the app ensures that customers can easily navigate and access the information they need, making it a valuable tool for on-the-go insurance management.

Online Account Management Capabilities

In addition to the mobile app, Canal Indemnity offers comprehensive online account management capabilities through their website. Policyholders can log in to their accounts to review policy details, update information, and track claims status.

The online portal provides a secure and efficient way for customers to have full control over their insurance policies, making it easy to make changes and stay informed about their coverage.

Digital Tools and Resources

Canal Indemnity Company is committed to providing policyholders with access to digital tools and resources that promote insurance literacy and understanding. These resources include educational articles, calculators, and FAQs to help customers make informed decisions about their insurance coverage.

Additionally, the company’s digital resources offer insights into various insurance products and provide guidance on selecting the right coverage options for individual and business needs. Overall, Canal Indemnity Company’s digital and technological features are designed to enhance the customer experience by offering convenient, accessible, and informative tools and resources.

Frequently Asked Questions

What sets Canal Indemnity apart from other insurance providers?

At Canal Indemnity, it’s not just about policies; it’s about personalized protection. Each coverage is tailored to your unique needs, ensuring comprehensive security that fits like a glove.

How can I determine the right insurance type for my business?

Canal Indemnity’s expert advisors work closely with you to understand your business’s intricacies. Through detailed consultations, they’ll guide you towards the insurance solution that aligns perfectly with your enterprise.

Are there any additional benefits to Canal Indemnity’s Health Insurance?

Absolutely. Aside from medical coverage, Canal Indemnity’s Health Insurance often includes wellness programs, preventive care initiatives, and discounted health services, fostering your holistic well-being.

Can I modify my Home Insurance coverage as my needs change?

Canal Indemnity acknowledges that life evolves. Their flexible Home Insurance policies can be adjusted to accommodate changes in your living situation, ensuring you’re always adequately protected.

What’s the process for filing a claim with Canal Indemnity?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.