Celtic Insurance Company Review (2026)

Celtic Insurance Company, a standout in the insurance landscape, offers tailored coverage solutions across health, homeowners, life, auto, and travel insurance, prioritizing individual needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Celtic Insurance Company emerges as a reliable partner, offering an extensive spectrum of coverage options to safeguard various aspects of life. With a diverse range of policies including health, homeowners, life, auto, and travel insurance, the company ensures comprehensive protection tailored to individual needs.

The article highlights Celtic’s commitment to customization, efficient claims processing, and a team of experienced professionals. Prospective clients are greeted with positive client reviews and straightforward enrollment procedures.

With a focus on affordability and client satisfaction, Celtic Insurance Company presents a compelling choice in a competitive market, promising peace of mind in an unpredictable world.

Celtic Insurance Company Insurance Coverage Options

Celtic Insurance Company extends a comprehensive range of coverage options to address a variety of needs, ensuring you’re prepared for life’s uncertainties. Here’s a closer look at the coverage they provide:

- Comprehensive Medical Coverage: From routine check-ups to major medical procedures, Celtic’s health insurance ensures you’re covered for a wide range of medical expenses.

- Prescription Drug Coverage: Access to prescribed medications is made affordable and convenient through their prescription drug coverage.

- Dwelling Coverage: Protect your home’s structure from unforeseen events like fire, storm damage, and more.

- Personal Property Protection: Safeguard your belongings, including furniture, electronics, and more, against theft, damage, and loss.

- Liability Coverage: Get coverage for legal and medical expenses if someone gets injured on your property.

- Term Life Insurance: Celtic offers flexible term life insurance plans to provide coverage for a specific period, offering financial protection during critical life stages.

- Whole Life Insurance: This lifelong coverage option provides not only a death benefit but also the opportunity to accumulate cash value over time.

- Beneficiary Protection: Ensure your loved ones’ financial security with designated beneficiaries receiving the policy’s benefits.

- Liability Coverage: Protects you from legal and financial repercussions in case you’re responsible for causing bodily injury or property damage to others.

- Collision Coverage: Covers the cost of repairing your vehicle in case of collisions, regardless of who’s at fault.

- Comprehensive Coverage: Offers protection against non-collision events like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Protection: In case you’re involved in an accident with an uninsured or underinsured driver, Celtic’s coverage has you covered.

- Personal Injury Protection (PIP): Covers medical expenses and even lost wages for you and your passengers, regardless of fault.

- Trip Cancellation and Interruption: If your trip plans are disrupted due to covered events, Celtic’s travel insurance reimburses your non-refundable expenses.

- Emergency Medical and Dental Coverage Abroad: Be prepared for unexpected health issues while traveling with coverage for medical and dental emergencies.

- Lost Baggage and Personal Belongings: In case your luggage is lost or stolen during your trip, Celtic ensures you’re compensated for your personal belongings.

- Travel Delay Reimbursement: If your trip is delayed due to covered reasons, they offer reimbursement for additional expenses like accommodations and meals.

- 24/7 Travel Assistance: Celtic’s travel insurance provides round-the-clock support for emergencies, helping you navigate unexpected situations during your travels.

Celtic Insurance Company’s wide-ranging coverage options cater to the specific needs of individuals and families, offering tailored solutions that provide both financial security and peace of mind.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Celtic Insurance Company Insurance Rates Breakdown

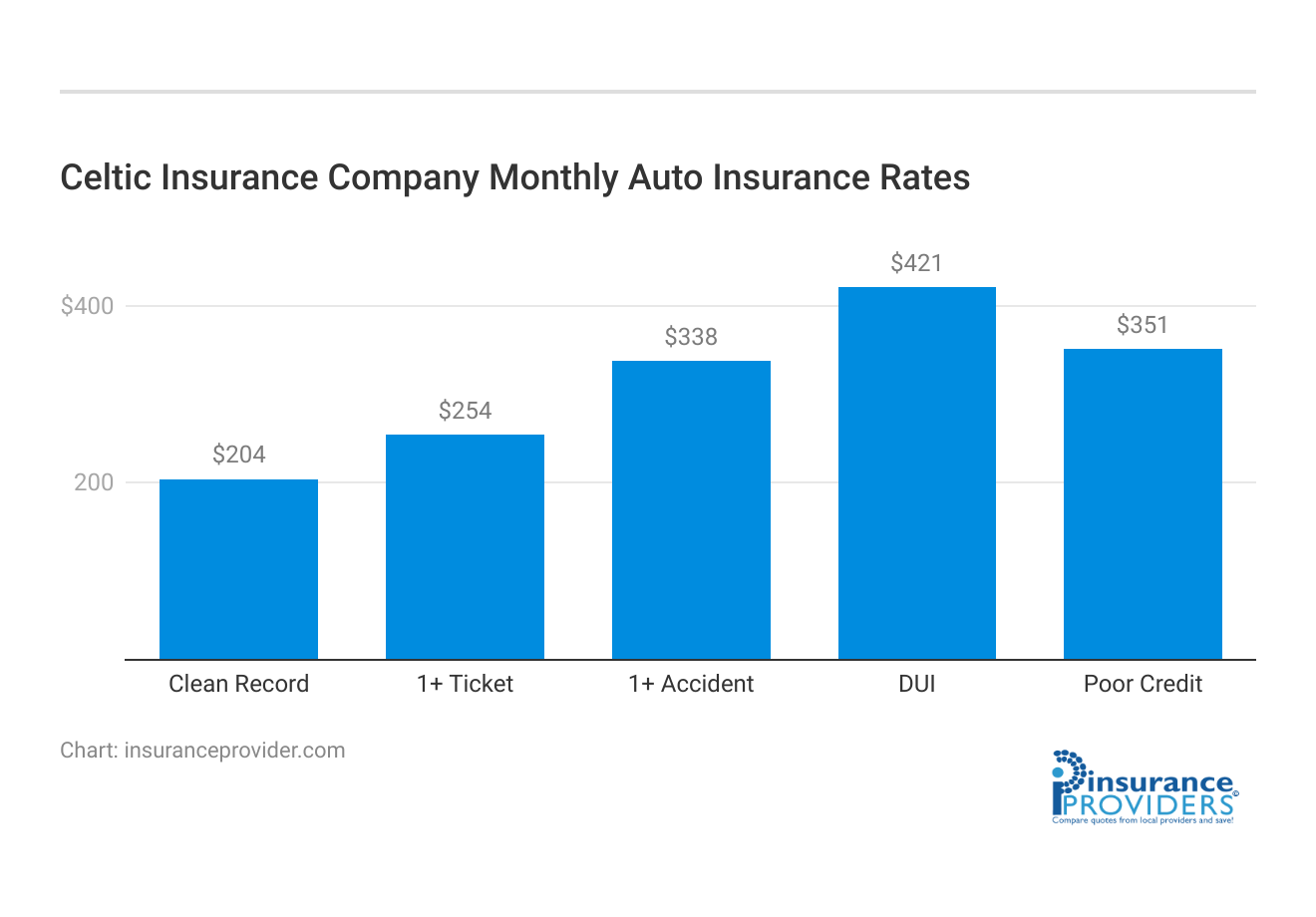

| Driver Profile | Celtic Insurance | National Average |

|---|---|---|

| Clean Record | $204 | $119 |

| 1+ Ticket | $254 | $147 |

| 1+ Accident | $338 | $173 |

| DUI | $421 | $209 |

| Poor Credit | $351 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Celtic Insurance Company Discounts Available

| Discounts | Celtic Insurance |

|---|---|

| Anti Theft | 14% |

| Good Student | 17% |

| Low Mileage | 12% |

| Paperless | 11% |

| Safe Driver | 16% |

| Senior Driver | 12% |

Celtic Insurance Company understands the importance of making insurance coverage affordable without compromising quality. They offer a variety of discounts to help you save on your premiums. Here are the discounts you can take advantage of:

- Multi-Policy Discount: Bundle multiple insurance policies with Celtic to enjoy reduced rates across your coverage portfolio.

- Safe Driver Discount: Maintain a clean driving record without accidents or traffic violations to unlock savings on your auto insurance.

- Good Student Discount: If you’re a student with good grades, Celtic rewards your academic achievements with discounted rates on auto insurance.

- Home Security Discount: Secure your home with safety features like alarm systems and smoke detectors to earn discounts on homeowners insurance.

- Loyalty Discount: Stay loyal to Celtic Insurance Company and enjoy discounts that increase over time as you renew your policies.

- Safe Homeowner Discount: If you’ve maintained your home well and haven’t filed claims, you’re eligible for discounts on homeowners insurance.

- Payment Discounts: Opt for paperless billing and automatic payments to receive additional savings on your premiums.

- Multi-Car Discount: Insure multiple vehicles under Celtic to receive discounted rates on your auto insurance policies.

- Renewal Discounts: Renew your policies with Celtic, and you’ll qualify for renewal discounts as a token of appreciation for your continued trust.

Celtic Insurance Company’s range of discounts reflects their commitment to offering competitive rates and rewarding responsible behavior. By tailoring their discounts to various aspects of your life, they make insurance more accessible and affordable for you.

How Celtic Insurance Company Ranks Among Providers

Celtic Insurance Company operates in a competitive insurance landscape where several prominent players vie for customers’ attention. Here are some of its main competitors:

- Horizon Insurance Group: Known for its comprehensive coverage options and excellent customer service, Horizon Insurance Group offers a wide range of insurance solutions, including health, auto, home, and life insurance. They emphasize personalized policies and competitive rates.

- Shieldguard Insurance Services: Shieldguard stands out for its innovative approach to insurance, incorporating technology to streamline processes and enhance customer experiences. They provide diverse coverage options, including health, home, auto, and specialty insurance.

- Eagle Assurance Company: Eagle Assurance is recognized for its commitment to customer satisfaction and transparent policies. They offer a variety of insurance products, including health, auto, home, and life insurance, with a focus on tailored solutions.

- Guardian United Insurance: Guardian United Insurance is a strong competitor with a reputation for comprehensive coverage plans and efficient claims processing. They offer a wide spectrum of insurance options, including health, home, auto, and specialty insurance.

- Sentinel Coverage Group: Sentinel Coverage Group sets itself apart through its emphasis on community engagement and personalized service. They offer a range of insurance policies, including health, home, auto, and life insurance, tailored to individual needs.

- Safetynet Insurance Solutions: Safetynet Insurance Solutions is recognized for its user-friendly approach and flexible policies. They provide various insurance offerings, including health, auto, home, and specialty coverage, focusing on affordability and ease of access.

- Vanguard Assurance Corporation: Vanguard Assurance Corporation is a strong contender in the insurance market, offering diverse coverage options with a reputation for reliability and stability. They cover areas such as health, auto, home, and life insurance.

These competitors, along with Celtic Insurance Company, contribute to a dynamic insurance industry where consumers can choose from a range of providers, each offering unique strengths and benefits.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Celtic Insurance Company Claims Process

Ease of Filing a Claim

Celtic Insurance Company has streamlined the claims filing process to provide convenience to policyholders. You can file a claim through various channels, including their user-friendly online platform, over the phone with their dedicated claims team, or through their mobile app. This flexibility ensures that you can report a claim in the way that suits you best, making the process hassle-free.

Average Claim Processing Time

One of the key factors that set Celtic Insurance Company apart is its efficient claims processing. On average, they strive to process claims swiftly, minimizing delays and ensuring that policyholders receive the support they need when they need it most. Their commitment to timely claim resolution adds to their reputation as a reliable insurance provider.

Customer Feedback on Claim Resolutions and Payouts

Celtic Insurance Company values customer feedback and continuously works to enhance its claims resolution process. They take pride in their ability to provide fair and prompt claim payouts. Positive customer reviews often highlight the company’s dedication to delivering on its promises, solidifying its reputation as a trustworthy insurance partner.

Celtic Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Celtic Insurance Company offers a mobile app with a range of features designed to simplify the insurance experience. Through the app, policyholders can access their insurance information, file claims, view policy documents, and even make payments. The user-friendly interface and intuitive design make managing insurance on the go a breeze.

Online Account Management Capabilities

Managing your insurance policies has never been easier with Celtic Insurance Company’s online account management capabilities. Policyholders can log in to their accounts via the company’s website to view and update policy details, track claims, and review billing information. This online portal provides a centralized hub for all your insurance-related needs.

Digital Tools and Resources

Celtic Insurance Company offers a wealth of digital tools and resources to empower policyholders. These resources include educational materials, articles, and guides to help you make informed insurance decisions.

Additionally, they provide online calculators and interactive tools that enable you to explore coverage options and estimate premiums, ensuring you have access to valuable information at your fingertips.

Frequently Asked Questions

What types of insurance does Celtic Insurance Company offer?

Celtic Insurance Company provides a diverse range of insurance options, including health insurance, homeowners insurance, life insurance, auto insurance, and travel insurance.

Are Celtic Insurance Company’s policies customizable?

Yes, Celtic Insurance Company understands the uniqueness of individual needs and offers customizable insurance plans to align with the specific requirements and preferences of their clients.

What benefits come with Celtic Insurance Company’s policies?

Celtic Insurance Company’s policies come with a range of benefits, including financial protection, personalized plans, efficient claims processing, and access to expert guidance throughout the insurance journey.

Does Celtic Insurance Company offer nationwide coverage?

Celtic Insurance Company extends its services across the entire nation, ensuring comprehensive insurance options are accessible regardless of your location.

How do I file a claim with Celtic Insurance Company?

Filing a claim with Celtic Insurance Company is a straightforward process. Simply get in touch with their claims department, and their team will guide you through the necessary steps to ensure a smooth claims experience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.