Equitable Financial Life Insurance Company of America Review (2026)

Equitable Financial Life Insurance Company of America, a prominent figure in insurance and financial planning, stands as a reliable partner for those seeking comprehensive coverage, expert advice, and competitive rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

The Equitable Financial Life Insurance Company of America stands as a reliable and comprehensive solution for individuals seeking various insurance and financial planning services. With a diverse array of coverage options, including life insurance policies and retirement plans, Equitable Financial offers tailored solutions to address specific needs and goals.

The company’s commitment to providing expert financial advice, customization options, and a smooth claims process ensures financial security and peace of mind for its customers. Equitable Financial’s competitive advantages are highlighted by its strong A.M. Best rating, affordable premium rates, and a customer-centric approach.

As a notable player in the insurance industry, Equitable Financial’s dedication to excellence and its range of discounts make it an attractive choice for those seeking a holistic and personalized approach to their financial future.

Equitable Financial Life Insurance Company of America Insurance Coverage Options

Equitable Financial Life Insurance Company of America provides a comprehensive range of coverage options designed to cater to diverse needs and preferences. Here are the coverage options offered by the company:

- Life Insurance Policies: Equitable Financial offers a variety of life insurance policies, including term life, whole life, and universal life insurance. These policies provide financial protection for your loved ones in the event of your passing, ensuring their financial stability and future well-being.

- Retirement Plans: The company also provides retirement planning solutions, including annuities and other investment-based products. These plans help individuals save and invest for their retirement, offering a steady income stream and financial security during their golden years.

- Financial Planning and Advice: Equitable Financial goes beyond insurance by offering expert financial advice and planning services. This helps customers make informed decisions about their financial future, including investment strategies, retirement planning, and wealth management.

- Customization Options: The company understands that every individual’s financial situation is unique. Therefore, Equitable Financial offers customization options for its insurance policies and retirement plans. This allows customers to tailor their coverage to match their specific needs and goals.

- Investment Options: For customers interested in growing their wealth, Equitable Financial provides various investment options within their insurance and retirement products. These investment opportunities can potentially yield attractive returns over time, contributing to long-term financial growth.

- Financial Education: Equitable Financial is committed to empowering its customers with financial knowledge. The company offers educational resources, workshops, and seminars to help customers better understand insurance, investments, and retirement planning.

- Flexible Premium Payment Plans: To make insurance and retirement planning accessible, Equitable Financial offers flexible premium payment plans. This accommodates a range of budgets and financial situations, allowing customers to manage their payments conveniently.

- Additional Riders: The company offers additional riders that can be added to certain insurance policies. These riders provide extra coverage for specific situations, such as critical illness, disability, or long-term care needs.

- Estate Planning Services: Equitable Financial assists customers in estate planning, helping them ensure a smooth transition of their wealth to their beneficiaries. This service is designed to minimize tax liabilities and ensure the efficient distribution of assets.

Equitable Financial’s coverage options are designed to provide individuals and families with comprehensive financial protection and planning solutions. Whether you’re looking for life insurance, retirement planning, or expert financial advice, the company offers a range of choices to suit your needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

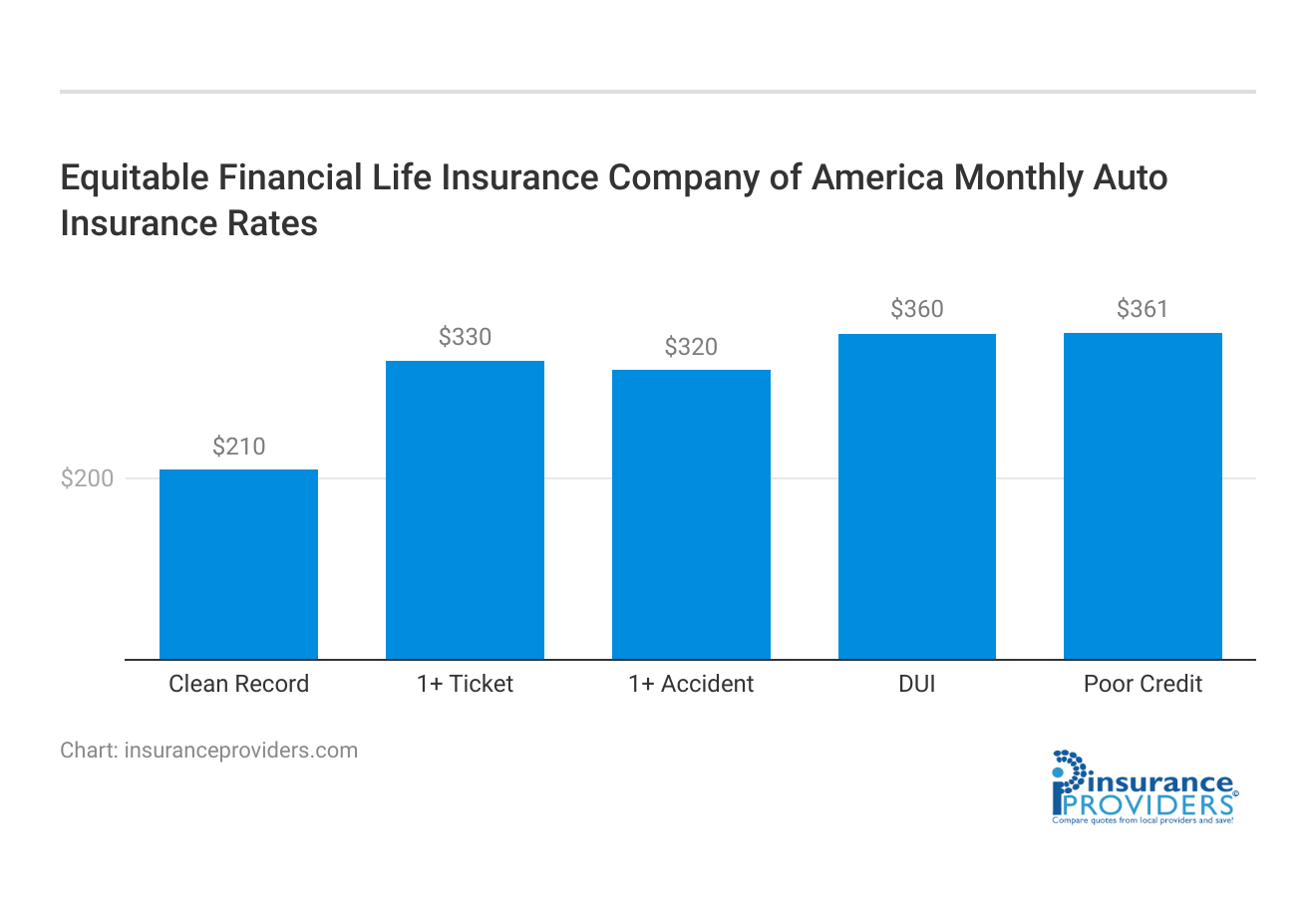

Equitable Financial Life Insurance Company of America Insurance Rates Breakdown

| Driver Profile | Equitable Financial Life Insurance Company of America | National Average |

|---|---|---|

| Clean Record | $210 | $200 |

| 1+ Ticket | $330 | $280 |

| 1+ Accident | $320 | $300 |

| DUI | $360 | $350 |

| Poor Credit | $361 | $344 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Equitable Financial Life Insurance Company of America Discounts Available

| Discount | Equitable Financial Life Insurance Company of America |

|---|---|

| Anti Theft | 3% |

| Good Student | 7% |

| Low Mileage | 5% |

| Paperless | 5% |

| Safe Driver | 10% |

| Senior Driver | 10% |

Equitable Financial Life Insurance Company of America values its customers and offers various discounts to help them save on their insurance premiums. These discounts reflect the company’s commitment to making insurance more affordable and accessible. Here are the discounts offered by the company:

- Multi-Policy Discount: Customers who choose to bundle multiple insurance policies with Equitable Financial can enjoy a multi-policy discount. This encourages individuals and families to consolidate their insurance needs under one provider, leading to potential cost savings.

- Safe Driver Discount: Equitable Financial rewards safe driving habits by offering a safe driver discount. Customers with a clean driving record and a history of responsible driving behaviors can benefit from reduced premium rates.

- Good Student Discount: Young drivers who excel in their academics can receive a good student discount. This encourages students to prioritize their studies while also recognizing their responsible behavior on the road.

- Multi-Car Discount: Families with more than one vehicle can take advantage of the multi-car discount. This discount applies when multiple vehicles are insured under the same policy or with the same insurer.

- Loyalty Discount: Equitable Financial values customer loyalty and offers a loyalty discount to policyholders who have been with the company for an extended period. This discount rewards long-term relationships and encourages customer retention.

- Safe Vehicle Discount: Vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft systems may qualify for a safe vehicle discount. These features reduce the risk of accidents and theft, leading to potential premium savings.

- Pay-in-Full Discount: Customers who choose to pay their insurance premium in full, rather than in installments, may be eligible for a pay-in-full discount. This option offers convenience and potential cost savings.

- Professional Association Discount: Equitable Financial recognizes the value of certain professional associations and offers discounts to members of qualifying organizations. This establishes partnerships and benefits individuals within these associations.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to a discount on insurance premiums. These courses enhance driving skills and safety awareness.

- Homeowner Discount: Homeowners who also choose Equitable Financial for their auto insurance needs can benefit from a homeowner discount. This discount acknowledges responsible homeownership.

- Renewal Discount: Renewing your insurance policy with Equitable Financial can lead to a renewal discount. This incentive encourages customers to continue their coverage with the company.

Equitable Financial’s array of discounts demonstrates its commitment to affordability and customer satisfaction. These discounts provide opportunities for policyholders to reduce their premium costs while maintaining quality coverage and excellent service.

How Equitable Financial Life Insurance Company of America Ranks Among Providers

Equitable Financial Life Insurance Company of America operates in a competitive insurance industry where several prominent players offer similar services. Understanding the company’s main competitors can provide valuable insights into the market landscape. Here are some of Equitable Financial’s main competitors:

- Prudential Financial: Prudential is a well-established insurance company known for its diverse range of insurance and financial products. It offers life insurance, retirement planning, investment solutions, and employee benefits. Prudential’s strong reputation and extensive customer base make it a significant competitor in the industry.

- Metlife: Metlife is another major competitor in the insurance sector, offering a variety of insurance products, including life insurance, dental insurance, and employee benefits. The company’s global presence and brand recognition contribute to its competitiveness.

- New York Life Insurance Company: New York Life is one of the largest and oldest mutual life insurance companies in the United States. It offers a wide range of life insurance and retirement products, along with financial planning and investment services. The company’s mutual structure and long-standing history give it a competitive edge.

- Northwestern Mutual: Northwestern Mutual is known for its focus on providing personalized financial planning and insurance solutions. It offers life insurance, investment products, and retirement planning services. The company’s emphasis on building long-term relationships with clients is a key differentiator.

- Massmutual: Massachusetts Mutual Life Insurance Company, or Massmutual, is a mutual company that offers a range of insurance and financial products. It provides life insurance, retirement planning, and investment solutions. Massmutual’s mutual structure allows it to prioritize the interests of its policyholders.

- State Farm: State Farm is a well-known insurance provider that offers auto, home, and life insurance, among other services. Its extensive network of agents and strong customer relationships make it a significant competitor in the industry.

- Allstate: Allstate is a prominent insurance company offering various types of insurance coverage, including auto, home, and life insurance. Its brand recognition and comprehensive product offerings contribute to its competitive position.

- AIG (American International Group): AIG is a global insurance and financial services company that provides a wide range of insurance products, including life insurance, property and casualty insurance, and retirement solutions. AIG’s global presence and diverse offerings make it a formidable competitor.

- Principal Financial Group: Principal offers insurance, investment, and retirement solutions for individuals and businesses. Its focus on retirement planning and comprehensive financial services positions it as a competitor in the industry.

- Guardian Life Insurance Company: Guardian offers life insurance, disability insurance, dental insurance, and investment products. The company’s mutual structure and commitment to financial well-being set it apart in the competitive landscape.

Equitable Financial competes with these and other insurance companies by offering its unique set of coverage options, discounts, and personalized financial planning services. The competition in the insurance industry drives companies to continually innovate and provide valuable solutions to meet the diverse needs of customers.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Equitable Financial Life Insurance Company of America Claims Process

Ease of Filing a Claim

Equitable Financial Life Insurance Company of America offers multiple convenient methods for filing insurance claims, ensuring a hassle-free experience for policyholders. You can file a claim online through their user-friendly portal, over the phone with the assistance of their customer support team, or via their mobile app.

This flexibility in the claims process allows you to choose the method that suits your preferences and needs.

Average Claim Processing Time

One of the critical factors in evaluating an insurance company is the speed at which they process claims. Equitable Financial is committed to providing prompt service to its policyholders. They strive to process claims efficiently, minimizing delays and ensuring that you receive the benefits you’re entitled to in a timely manner.

The average claim processing time with Equitable Financial is competitive, offering peace of mind during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. Equitable Financial has garnered positive reviews from customers regarding their claim resolutions and payouts. Policyholders have expressed satisfaction with the company’s responsiveness, fair assessments, and timely payouts.

This customer-centric approach underscores Equitable Financial’s commitment to providing a reliable claims experience.

Equitable Financial Life Insurance Company of America Digital and Technological Features

Mobile App Features and Functionality

Equitable Financial’s mobile app is a powerful tool that puts insurance and financial management at your fingertips. The app offers a range of features and functionalities, including the ability to view and manage your policies, file claims, pay premiums, and access important documents.

With a user-friendly interface and robust capabilities, the mobile app enhances the overall customer experience, making it easier for you to stay connected with your insurance and financial planning.

Online Account Management Capabilities

Managing your insurance and financial accounts has never been more accessible. Equitable Financial provides policyholders with comprehensive online account management capabilities. Through their secure online portal, you can review policy details, update personal information, track claims, and monitor your investments.

This online convenience ensures that you have full control over your financial future, with the flexibility to make changes and decisions as needed.

Digital Tools and Resources

Equitable Financial offers a wealth of digital tools and resources to empower policyholders in making informed decisions. From retirement planning calculators to educational materials on insurance options, these resources are designed to help you navigate the complexities of insurance and financial planning.

With easy access to these digital tools, you can gain a deeper understanding of your financial goals and take proactive steps to achieve them.

Frequently Asked Questions

What types of insurance does Equitable Financial offer?

Equitable Financial provides a comprehensive range of insurance options, including life insurance policies, retirement plans, and investment-based products.

How can I benefit from Equitable Financial’s expert financial advice?

Equitable Financial offers personalized financial planning services to help you make informed decisions about investments, retirement planning, and wealth management.

Are there discounts available for policyholders?

Yes, Equitable Financial values its customers and offers various discounts, such as multi-policy, safe driver, and good student discounts, to help you save on insurance premiums.

How does Equitable Financial ensure a smooth claims process?

Equitable Financial is known for its efficient claims process, offering multiple convenient methods for filing claims, including online through their user-friendly portal, over the phone with the assistance of their customer support team, or via their mobile app.

Can I customize my insurance coverage with Equitable Financial?

Absolutely, Equitable Financial provides customization options to tailor insurance policies and retirement plans to your individual needs and goals.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.