Farmers Insurance Exchange Review (2026)

Discover the versatility of Farmers Insurance Exchange as it stands out in the insurance landscape, providing customizable coverage for home, auto, life, and more, competing with established players and earning its place as a contender for your insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the comprehensive protection offered by Farmers Insurance Exchange, a trusted name in the insurance industry. With a diverse array of coverage options, including home, auto, life, and business insurance, Farmers caters to a wide range of needs. Their commitment to personalized service is reflected in the availability of local agents and innovative solutions.

From safeguarding homes and vehicles to planning for the future with life insurance, Farmers’ customizable policies provide peace of mind. Explore their discounts for added affordability and consider how their coverage stacks up against key competitors like State Farm, Allstate, and others.

With a rich history, solid financial ratings, and a focus on responsive claims handling, Farmers Insurance Exchange stands ready to protect what matters most.

Farmers Insurance Exchange Insurance Coverage Options

When it comes to securing your assets and providing peace of mind for the future, Farmers Insurance Exchange stands out with its diverse range of coverage options. Whether you’re safeguarding your home, hitting the road, planning for your family’s financial security, or protecting your business.

Farmers Insurance Exchange provides a comprehensive range of coverage options to meet various insurance needs. Here is a breakdown of the coverage options they offer:

Home Insurance Coverage:

- Dwelling Protection: Safeguarding your home’s physical structure against damage.

- Personal Belongings: Coverage for your possessions within your home.

- Liability Coverage: Protection in case someone is injured on your property.

- Additional Living Expenses: Coverage for temporary accommodations if your home becomes uninhabitable.

Auto Insurance Coverage:

- Collision Coverage: Pays for repairs when your vehicle collides with another object.

- Comprehensive Coverage: Protection against non-collision incidents like theft or natural disasters.

- Liability Coverage: Covers injuries and damages if you’re at fault in an accident.

- Uninsured/Underinsured Motorist: Protects you from drivers with insufficient coverage.

Life Insurance Coverage:

- Term Life Insurance: Provides coverage for a specified term to support your dependents.

- Whole Life Insurance: Offers lifelong coverage with an investment component that accumulates cash value.

Business Insurance Coverage:

- Property Insurance: Protects your business premises and assets from various risks.

- Liability Coverage: Safeguards against legal liabilities arising from business operations.

- Workers’ Compensation: Provides coverage for employee injuries sustained on the job.

Specialized Policies:

- Boat and Watercraft Insurance: Protects your aquatic vehicles against damages and liabilities.

- Vacation Property Insurance: Safeguards your secondary properties, such as vacation homes.

From shielding your home to safeguarding your business, Farmers Insurance Exchange’s coverage options encompass the spectrum of insurance needs. With their reliable policies and dedication to customer satisfaction, you can rest assured that Farmers has your back when it matters most.

Explore their range of coverage options to find the insurance solutions that resonate with your goals and priorities.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Insurance Exchange Insurance Rates Breakdown

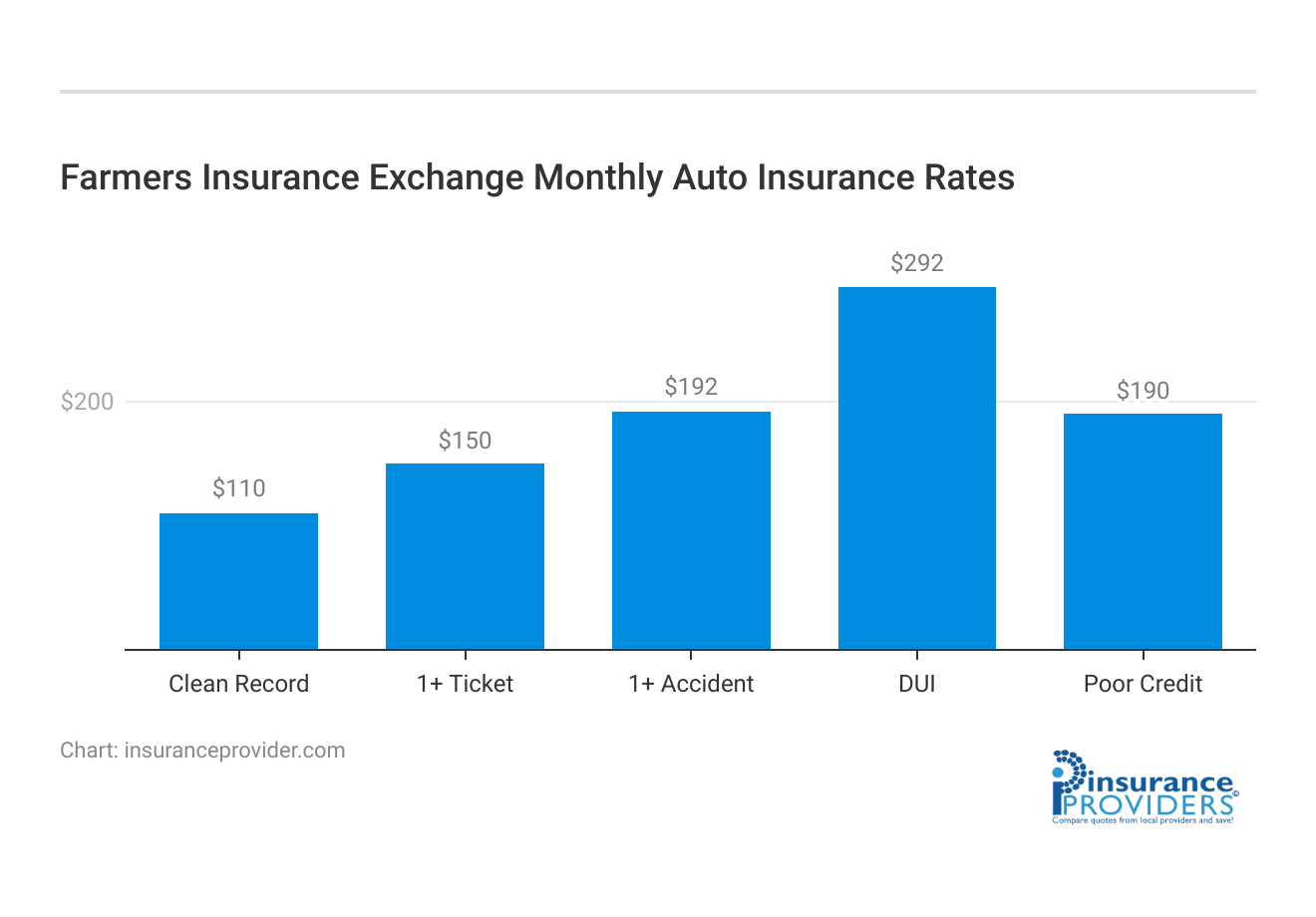

| Driver Profile | Farmers Insurance | National Average |

|---|---|---|

| Clean Record | $110 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $192 | $173 |

| DUI | $292 | $209 |

| Poor Credit | $190 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Farmers Insurance Exchange Discounts Available

| Discounts | Farmers Insurance |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 10% |

| Paperless | 7% |

| Safe Driver | 19% |

| Senior Driver | 12% |

At Farmers Insurance Exchange, providing exceptional value to their policyholders goes beyond comprehensive coverage. The company understands that affordability is a significant factor when choosing insurance. With this in mind, Farmers offers an array of discounts designed to help you save while ensuring you have the protection you need.

- Multi-Policy Discount: Save by bundling multiple policies, such as home and auto insurance.

- Safe Driver Discount: Rewards policyholders with a clean driving record and safe driving habits.

- Good Student Discount: Available to young drivers who maintain good grades in school.

- Home Security Discount: Offers savings for having security systems or measures in place at your home.

- Electronic Funds Transfer (EFT) Discount: Receive a discount when you set up automatic premium payments.

- Pay-in-Full Discount: Enjoy savings by paying your premium in a single payment.

- Affinity Group Discount: Exclusive savings for being a member of certain organizations or groups.

- Renewal Discount: Get rewarded for staying loyal and renewing your policy with Farmers.

- Green Discount: Save if you choose to receive policy documents electronically.

- Mature Homeowner Discount: Offers savings for policyholders of a certain age who own their home.

- Multi-Car Discount: Save when you insure multiple vehicles under the same policy.

- Signal® App Discount: Earn rewards for safe driving habits using the Signal app.

These discounts not only make insurance more affordable but also reflect Farmers’ commitment to recognizing and rewarding responsible behavior and customer loyalty. Be sure to inquire about these discounts when obtaining a quote from Farmers Insurance Exchange to maximize your savings.

Each discount is tailored to reward responsible behavior, loyalty, and safety-conscious habits, making Farmers Insurance Exchange an attractive option for those seeking both quality coverage and savings.

How Farmers Insurance Exchange Ranks Among Providers

In a world where insurance needs are as diverse as the individuals seeking coverage, Farmers Insurance Exchange faces competition from several prominent insurance providers. These competitors offer their own strengths and specialties, creating a landscape where customers can explore a range of options tailored to their unique requirements. Here are some of the company’s main competitors:

State Farm:

- A well-known and established insurer offering a wide range of insurance products.

- An extensive network of agents for personalized customer service.

- Recognized for its strong customer satisfaction and claims process.

Allstate:

- Offers comprehensive coverage options and a range of discounts.

- Known for innovative tools and technology, such as Drivewise for safe driving rewards.

- Nationwide presence and a reputation for customer-centric solutions.

Geico:

- Known for its competitive pricing and user-friendly online experience.

- Offers a variety of discounts and specialized coverage options.

- Emphasizes simplicity and efficiency in its policies and claims process.

Progressive:

- Renowned for its “Name Your Price” tool that helps customers find coverage within their budget.

- Offers Snapshot for personalized auto insurance rates based on driving habits.

- Strong online presence and focus on digital interactions.

Liberty Mutual:

- Offers a broad range of coverage options, including unique add-ons.

- Known for its customizable policies and comprehensive protection.

- Offers a variety of resources for customers, including safety tips and tools.

USAA:

- Serves military personnel and their families with specialized coverage options.

- Known for exceptional customer service and financial stability.

- Offers a range of discounts and benefits tailored to military members.

Nationwide:

- Offers diverse insurance options and the ability to bundle policies for savings.

- Known for its Vanishing Deductible® feature and accident forgiveness program.

- Emphasizes its “On Your Side” commitment to customer service.

While Farmers Insurance Exchange stands as a reputable insurance provider, the presence of formidable competitors demonstrates the rich diversity of the insurance market. Whether it’s personalized service, competitive pricing, innovative technology, or specialized offerings, these competitors contribute to an environment where customers can find tailored solutions.

By exploring the offerings of these industry players, individuals can make informed decisions about the coverage that aligns best with their unique circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Insurance Exchange Claims Process

Ease of Filing a Claim

Farmers Insurance Exchange provides a user-friendly claims process that offers multiple avenues for policyholders to report and file their claims. Whether you prefer the convenience of online submissions, making a phone call, or utilizing their mobile apps, Farmers ensures that the process is accessible and accommodating to your preferences.

Average Claim Processing Time

One of the key aspects of a claims process is the speed at which claims are processed. Farmers Insurance Exchange is known for its commitment to responsive claims handling. Policyholders can expect efficient processing times, minimizing the stress and inconvenience that often accompanies insurance claims.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a vital component in evaluating an insurance provider’s claims process. Farmers Insurance Exchange strives for customer satisfaction in their claims resolutions and payouts. By examining customer experiences and testimonials, you can gain valuable insights into how Farmers delivers on their promises when it matters most.

Farmers Insurance Exchange Digital and Technological Features

Mobile App Features and Functionality

Farmers Insurance Exchange offers a feature-rich mobile app designed to enhance your insurance experience. From policy management to claims tracking, the app provides a seamless interface for policyholders to access their insurance information, submit claims, and stay informed about their coverage.

Online Account Management Capabilities

Managing your insurance policies and accounts online is made easy with Farmers Insurance Exchange’s digital platform. You can conveniently access and update your policy details, view billing information, and make payments, all from the comfort of your online account.

Digital Tools and Resources

In today’s digital age, having access to tools and resources is essential for making informed insurance decisions. Farmers Insurance Exchange provides a range of digital tools and resources, such as insurance calculators and educational materials, to help policyholders understand their coverage options and make the right choices for their needs.

These digital and technological features contribute to Farmers Insurance Exchange’s commitment to providing policyholders with a modern and convenient insurance experience, making it a competitive choice in the insurance landscape.

Frequently Asked Questions

What types of insurance does Farmers Insurance Exchange offer?

Farmers Insurance Exchange provides a diverse range of insurance options, including home, auto, life, business, boat, watercraft, and vacation property insurance.

How can I save on my insurance premiums with Farmers Insurance Exchange?

You can save on insurance premiums with Farmers Insurance Exchange through various discounts such as multi-policy, safe driver, good student, home security, and more. These discounts can help lower your insurance costs.

Can I bundle different types of insurance policies with Farmers Insurance Exchange?

Yes, Farmers Insurance Exchange allows you to bundle multiple policies like home and auto insurance, potentially saving you money through their multi-policy discount.

How does the claims process work with Farmers Insurance Exchange?

Farmers Insurance Exchange’s claims process involves reporting the incident, assessment of damages, and a resolution plan. Their responsive claims handling aims to minimize stress during difficult times.

What are the benefits of choosing Farmers Insurance Exchange over other insurance providers?

Farmers Insurance Exchange offers customizable coverage, a strong financial foundation, responsive claims processing, local agents for personalized service, and innovative solutions to evolving risks.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.