Fortitude Us Reinsurance Company Review (2026)

Ensuring security in an ever-changing world, Fortitude US Reinsurance Company stands as a stalwart in the insurance landscape, offering diverse coverage options tailored to individuals, businesses, and investors, backed by a commitment to innovation, personalized service, and swift claims processing.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the fortified protection offered by Fortitude US Reinsurance Company, a leader in the insurance landscape. With a comprehensive range of insurance options, including life, property, liability, and specialty coverage, Fortitude stands as a pillar of security for individuals, businesses, and investors alike.

Backed by a commitment to innovation, underwriting expertise, and financial stability, Fortitude offers tailored solutions that adapt to the dynamic nature of life. From rapid claims processing to a reputation for excellence, Fortitude ensures a secure future while rewarding responsible behavior through an array of discounts.

As a distinguished player in the industry, Fortitude’s competition is met with a comprehensive and customer-centric approach, reflecting its dedication to safeguarding what truly matters.

Fortitude US Reinsurance Company Insurance Coverage Options

At Fortitude US Reinsurance Company, we understand that different aspects of life require tailored insurance coverage. That’s why we offer a comprehensive portfolio of insurance options to provide you with the protection you need in various areas.

From safeguarding your loved ones’ financial well-being to protecting your property investments and mitigating potential liabilities, Fortitude’s coverage options are designed to meet your evolving needs.

- Life Insurance: Protect your loved ones’ financial future with a range of life insurance policies, including term life, whole life, and universal life options.

- Property Insurance: Safeguard your property investments with comprehensive property insurance coverage, including homeowner’s insurance, renter’s insurance, and property damage coverage.

- Liability Insurance: Shield yourself from potential liabilities with liability insurance solutions, such as general liability insurance, professional liability insurance, and product liability coverage.

- Specialty Insurance: Tailored to unique risks, specialty insurance options include coverage for niche industries, events, and situations. This can include things like event insurance, collector’s item insurance, and more.

In a world full of uncertainties, having the right insurance coverage can provide you with peace of mind and a sense of security. Fortitude US Reinsurance Company’s diverse range of coverage options ensures that you’re equipped to face life’s challenges head-on, knowing that your future and investments are well-protected.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fortitude US Reinsurance Company Insurance Rates Breakdown

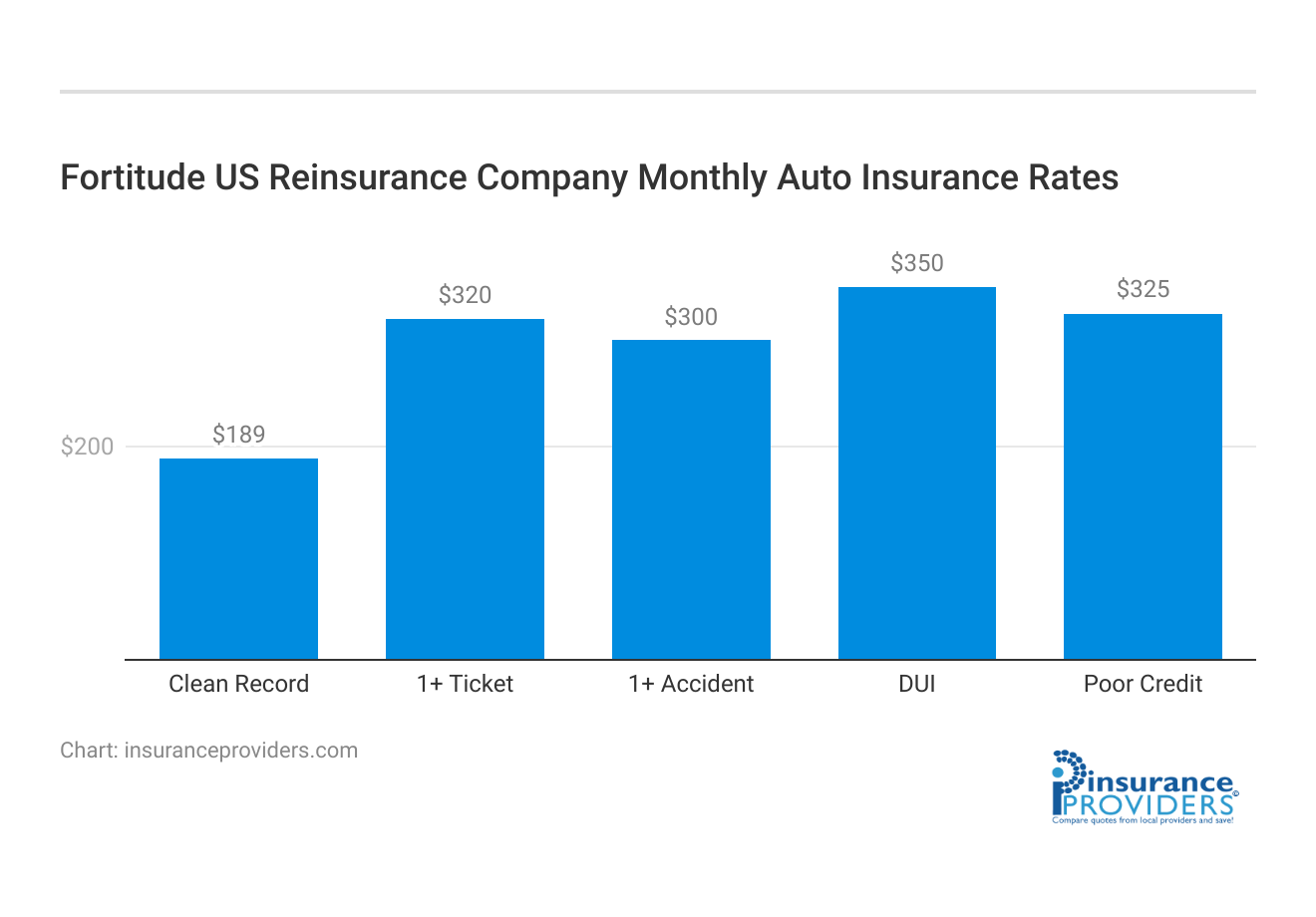

| Driver Profile | Fortitude US Reinsurance Company | National Average |

|---|---|---|

| Clean Record | $189 | $220 |

| 1+ Ticket | $320 | $300 |

| 1+ Accident | $300 | $280 |

| DUI | $350 | $330 |

| Poor Credit | $325 | $378 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Fortitude US Reinsurance Company Discounts Available

| Discount | Fortitude US Reinsurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 15% |

| Low Mileage | 8% |

| Paperless | 5% |

| Safe Driver | 20% |

| Senior Driver | 12% |

At Fortitude US Reinsurance Company, we believe in rewarding responsible behavior and providing value to our customers. That’s why we offer a range of discounts to help you save on your insurance premiums while maintaining the high level of coverage you deserve. Explore the various discounts available:

- Safe Driver Discount: Rewarding individuals with a clean driving record and a history of responsible driving behavior.

- Multi-Policy Discount: Save by bundling multiple insurance policies, such as auto and home insurance, with Fortitude.

- Good Student Discount: Recognizing the efforts of students who maintain good grades while pursuing their education.

- Safe Home Discount: Lower premiums for homeowners who have implemented safety features, such as security systems and fire alarms.

- Loyalty Discount: Long-term customers can enjoy discounts as a token of appreciation for their continued trust in Fortitude.

- Group Discount: If you belong to a specific group or organization affiliated with Fortitude, you could qualify for additional savings.

- Pay-in-Full Discount: Receive a discount by paying your annual premium in full upfront.

- Electronic Funds Transfer (EFT) Discount: Opt for automatic premium payments through EFT and enjoy a cost-saving advantage.

- Paperless Billing Discount: Choose to receive your bills and policy documents electronically to reduce paper usage and earn a discount.

- New Vehicle Safety Discount: Enjoy savings if your vehicle is equipped with advanced safety features.

- Renewal Discount: Stay with Fortitude and renew your policy to unlock ongoing loyalty benefits.

We understand that responsible behavior should be recognized, and affordability should be attainable. By choosing Fortitude, you’re not only securing your future but also accessing opportunities to save and thrive.

How Fortitude US Reinsurance Company Ranks Among Providers

In the dynamic landscape of insurance, Fortitude US Reinsurance Company faces competition from several prominent players within the industry. These competitors, each with their unique strengths and offerings, contribute to a vibrant marketplace that benefits customers. Here are some of Fortitude’s main competitors:

- Vanguard Insurance Group: Known for its comprehensive coverage options and competitive pricing, Vanguard Insurance Group has built a strong reputation for delivering quality insurance solutions across various lines.

- Guardian Assurance Services: Guardian Assurance Services is recognized for its customer-centric approach and a wide range of coverage options, making it a top choice for those seeking personalized insurance solutions.

- Sentinel Insurance Agency: With a focus on innovative technologies and customer convenience, Sentinel Insurance Agency stands as a strong contender, offering user-friendly digital platforms and tailored coverage plans.

- Pinnacle Reinsurance Corporation: Pinnacle Reinsurance Corporation is noted for its underwriting expertise and risk management strategies, appealing to those who seek in-depth analysis and customized insurance packages.

- Securelife Assurance: Securelife Assurance is a competitor that emphasizes financial stability and transparent policies, making it an attractive option for individuals and businesses looking for reliable coverage.

- Harbor Insurance Solutions: Harbor Insurance Solutions boasts a diverse portfolio of insurance offerings and a commitment to outstanding customer service, positioning itself as a key rival in the insurance market.

- Evergreen Coverage Group: Evergreen Coverage Group is known for its responsive claims processing and a strong track record of customer satisfaction, making it a go-to choice for those who prioritize hassle-free insurance experiences.

While Fortitude US Reinsurance Company maintains its unique strengths and values, the presence of these competitors underscores the importance of continuous innovation and customer-focused solutions. The diverse range of options ensures that customers have the opportunity to select the insurance provider that best aligns with their needs and preferences.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fortitude Us Reinsurance Company Claims Process

Ease of Filing a Claim

Fortitude US Reinsurance Company strives to make the claims process as convenient as possible for its customers. You can file a claim with Fortitude through multiple channels, including online, over the phone, and via their mobile app.

Average Claim Processing Time

One of the key factors that sets Fortitude apart is its commitment to swift claims processing. While specific processing times may vary depending on the nature and complexity of the claim, Fortitude is known for its efficiency in handling claims.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance. Fortitude US Reinsurance Company has received positive reviews from customers regarding their claim resolutions and payouts.

Fortitude Us Reinsurance Company Digital and Technological Features

Mobile App Features and Functionality

Fortitude’s mobile app offers a range of features and functionalities that enhance the customer experience. With the app, policyholders can easily access their insurance information, initiate claims, track the progress of their claims, and even make policy updates.

Online Account Management Capabilities

Fortitude US Reinsurance Company provides robust online account management capabilities. Through their website, policyholders can log in to their accounts, view policy details, make premium payments, and access important documents.

Digital Tools and Resources

In addition to the mobile app and online account management, Fortitude offers a range of digital tools and resources to assist customers in making informed decisions. These resources may include educational materials, calculators, and informative articles to help policyholders better understand their coverage options and insurance-related topics.

Frequently Asked Questions

What types of insurance does Fortitude US Reinsurance Company offer?

Fortitude offers a diverse range of insurance coverage options, including life insurance, property insurance, liability insurance, and specialty insurance tailored to meet the unique needs of individuals, businesses, and investors.

How does Fortitude ensure a personalized approach to insurance?

Fortitude’s commitment to a personalized approach involves understanding your unique circumstances. This allows us to create bespoke insurance packages that mitigate risks and maximize opportunities, ensuring you receive coverage tailored to your specific requirements.

What advantages do I gain by choosing Fortitude?

By choosing Fortitude US Reinsurance, you gain access to benefits such as comprehensive coverage options, underwriting expertise, rapid claims processing, and a reputation for excellence. Our dedication to innovation and financial stability further solidifies our position as a trusted insurance provider.

Can I save on premiums with Fortitude?

Yes, Fortitude US Reinsurance offers various discounts to reward responsible behavior and help you save on premiums. These include safe driver discounts, multi-policy discounts, good student discounts, loyalty discounts, and more, making insurance more affordable without compromising on coverage.

How does Fortitude handle claims processing?

Fortitude takes pride in its swift and efficient claims processing. In times of distress, we’re committed to standing by you, ensuring a streamlined claims process that facilitates your recovery and minimizes stress during challenging times.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.