Lincoln Benefit Life Company Review (2026)

Discover the comprehensive offerings of Lincoln Benefit Life Company, an insurance stalwart with over 80 years of experience, providing a diverse range of products and a steadfast commitment to securing your financial future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into the world of Lincoln Benefit Life Company, a trusted name in the insurance industry with over eight decades of experience. We explore their diverse range of insurance products, including life insurance, annuities, long-term care insurance, final expense insurance, and supplemental health insurance.

With a commitment to competitive rates, policy customization, and potential incentives for healthy living, Lincoln Benefit Life Company offers solutions tailored to safeguarding your financial future.

We also highlight their rich history, strong financial stability, and dedication to exceptional customer service, all factors that contribute to their reputation as a reliable partner in securing your financial well-being.

Lincoln Benefit Life Company Insurance Coverage Options

When it comes to securing your financial future and protecting your loved ones, Lincoln Benefit Life Company has you covered. With a commitment to providing tailored insurance solutions, they offer a diverse range of coverage options to meet your unique needs.

- Life Insurance: Lincoln Benefit Life Company offers various types of life insurance policies, including term life, whole life, and universal life insurance, tailored to different financial needs and life stages.

- Annuities: The company provides annuity products, which offer a reliable source of income during retirement, helping individuals secure their financial future.

- Long-Term Care Insurance: Lincoln Benefit Life Company offers long-term care insurance policies to assist policyholders in covering the costs of extended healthcare services, such as nursing home care or home health care.

- Final Expense Insurance: This coverage option ensures that end-of-life expenses, such as funeral costs and burial expenses, are covered, alleviating financial burdens for loved ones.

- Supplemental Health Insurance: The company offers supplemental health insurance to fill gaps in traditional health coverage, helping policyholders manage unexpected healthcare expenses.

Lincoln Benefit Life Company’s diverse range of coverage options reflects their commitment to providing innovative and reliable insurance solutions. Whether you’re planning for the future, securing your retirement, or safeguarding against unforeseen healthcare costs, they are here to support you on your financial journey.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Benefit Life Company Insurance Rates Breakdown

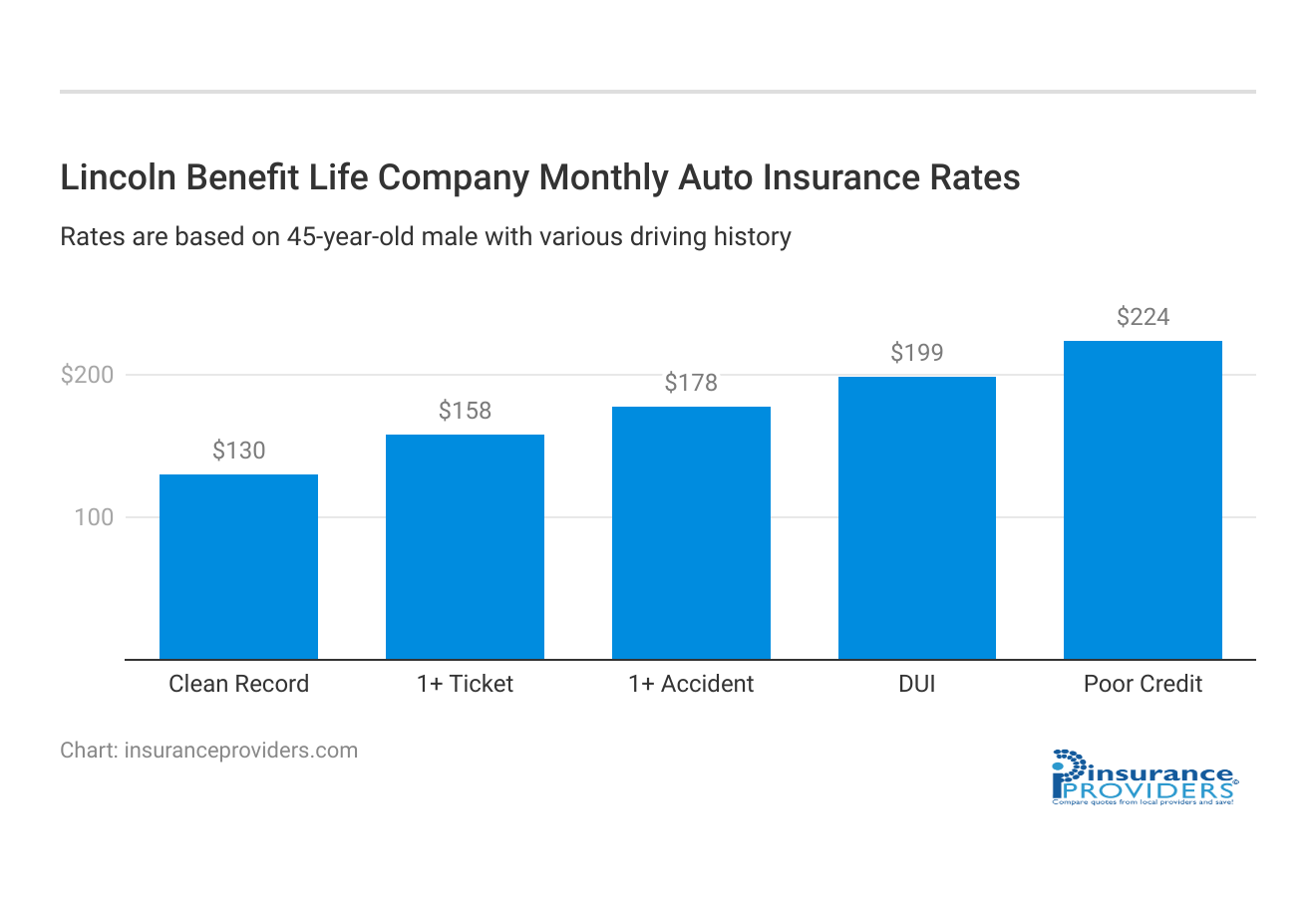

| Driver Profile | Lincoln Benefit Life Company | National Average |

|---|---|---|

| Clean Record | $130 | $119 |

| 1+ Ticket | $158 | $147 |

| 1+ Accident | $178 | $173 |

| DUI | $199 | $209 |

| Poor Credit | $224 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Lincoln Benefit Life Company Discounts Available

| Discount | Lincoln Benefit Life Company |

|---|---|

| Anti Theft | 11% |

| Good Student | 10% |

| Low Mileage | 12% |

| Paperless | 8% |

| Safe Driver | 15% |

| Senior Driver | 10% |

At Lincoln Benefit Life Company, your financial well-being is their priority. While they primarily specialize in life insurance and related financial products, they offer a range of advantages and benefits that can help policyholders save and secure their financial future.

- Competitive Rates: Lincoln Benefit Life Company is committed to providing competitive rates on their life insurance and annuity products, ensuring that you get the most value for your premium dollars.

- Policy Customization: They understand that one size doesn’t fit all. While not traditional discounts, their policies can be customized to align with your specific needs and budget, allowing you to tailor your coverage to what matters most to you.

- Healthy Lifestyle Incentives: Some policies may offer incentives or better rates to individuals who lead a healthy lifestyle, such as non-smokers or those with good overall health. These incentives can lead to lower premiums.

- Multi-Policy Benefits: Although Lincoln Benefit Life Company primarily focuses on life insurance, if they offer additional financial products, bundling them together can potentially result in savings for policyholders.

When you choose Lincoln Benefit Life Company, you’re not just selecting an insurance provider; you’re choosing a partner in securing your financial future. Their competitive rates, policy flexibility, and potential incentives for healthy living all contribute to the overall value they offer to policyholders. Feel confident knowing that they are dedicated to helping you achieve your financial goals.

How Lincoln Benefit Life Company Ranks Among Providers

In the competitive landscape of the life insurance industry, Lincoln Benefit Life Company stands as a trusted provider of life insurance and financial products. However, they share the market with several formidable competitors, each with its own strengths and offerings. Let’s take a closer look at some of the key competitors in the sector.

- Prudential Financial, Inc.: Prudential is a heavyweight in the life insurance arena, known for its extensive range of life insurance and annuity products, as well as its broad customer base.

- New York Life Insurance Company: With a rich history and a strong emphasis on financial stability, New York Life offers diverse life insurance and retirement planning options.

- Metlife, Inc.: Metlife is a global insurance giant providing life insurance and an array of other financial services, serving a wide and diverse clientele.

- Northwestern Mutual: Renowned for its financial planning services, Northwestern Mutual offers life insurance and investment products, supported by a vast network of financial advisors.

- AIG (American International Group): AIG is a global leader in insurance and financial services, offering life insurance and retirement solutions to customers worldwide.

- State Farm: State Farm, a household name, extends its insurance offerings to include life insurance, backed by a vast network of agents and a trusted brand.

- MassMutual (Massachusetts Mutual Life Insurance Company): MassMutual, as a mutual company, emphasizes policyholder dividends and offers life insurance, retirement, and investment products.

- Guardian Life Insurance Company: Guardian is known for its strong customer service and customizable life insurance and disability insurance policies.

- Principal Financial Group: Principal provides a comprehensive suite of life insurance, retirement, and investment solutions, assisting individuals and businesses in achieving financial security.

- Transamerica: With a long history in the industry, Transamerica offers life insurance, retirement planning, and investment products.

In the ever-evolving landscape of life insurance, Lincoln Benefit Life Company competes with these respected giants and others in the sector. Each competitor brings its own strengths and unique offerings to the table, ensuring that customers have a variety of choices to meet their life insurance and financial planning needs.

As you explore your options, it’s essential to consider what each company can provide to secure your financial future.

Read more:

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lincoln Benefit Life Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Lincoln Benefit Life Company strives to provide a convenient and hassle-free claims process for its policyholders. They offer multiple channels for filing a claim, including online submission through their user-friendly website, over the phone with their dedicated customer service team, and even through their mobile app.

This accessibility ensures that policyholders can choose the method that best suits their needs and preferences.

Average Claim Processing Time

One crucial aspect of the claims process is the speed at which claims are processed. Lincoln Benefit Life Company understands the importance of prompt claim settlements. While specific processing times may vary depending on the nature and complexity of the claim, they are committed to efficient processing.

Customers can expect a reasonable turnaround time for their claims to be reviewed and resolved.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable in assessing the effectiveness of an insurance company’s claims process. Lincoln Benefit Life Company places a high value on customer satisfaction and aims to deliver fair and transparent claim resolutions. Policyholders’ experiences with claim payouts and resolutions play a significant role in shaping the company’s commitment to providing reliable service.

Digital and Technological Features of Lincoln Benefit Life Company

Mobile App Features and Functionality

Lincoln Benefit Life Company recognizes the importance of staying connected with policyholders through digital means. Their mobile app offers a range of features and functionalities designed to enhance the customer experience.

Policyholders can access their accounts, view policy details, make payments, and even initiate the claims process directly from the app. The intuitive interface ensures ease of use and convenience.

Online Account Management Capabilities

Managing insurance policies online has become increasingly important in today’s digital age. Lincoln Benefit Life Company provides robust online account management capabilities through their website. Policyholders can log in to their accounts, review policy information, update personal details, and track the status of claims.

This online portal simplifies policy management and puts control in the hands of the customer.

Digital Tools and Resources

To empower their policyholders with knowledge and resources, Lincoln Benefit Life Company offers a variety of digital tools and resources on their website. These resources may include educational articles, calculators, and guides to help customers make informed decisions about their insurance coverage.

By providing these digital tools, the company aims to assist policyholders in planning for their financial future effectively.

Frequently Asked Questions

What types of insurance does Lincoln Benefit Life Company offer?

Lincoln Benefit Life Company provides a diverse range of insurance options, including life insurance, annuities, long-term care insurance, final expense insurance, and supplemental health insurance.

How can I customize my life insurance policy with Lincoln Benefit Life Company?

Lincoln Benefit Life Company offers policy customization options to align with your specific needs and budget. You can work with their agents to tailor coverage to what matters most to you.

Do they offer discounts for leading a healthy lifestyle?

Some policies may offer incentives or better rates to individuals who lead a healthy lifestyle, such as non-smokers or those with good overall health. These incentives can result in lower premiums.

Can I bundle multiple insurance products with Lincoln Benefit Life Company for savings?

While they primarily focus on life insurance, if they offer additional financial products, bundling them together can potentially result in savings for policyholders.

How do I get started with Lincoln Benefit Life Company?

To get started, you can contact their knowledgeable agents, explore their website, or visit a local branch to discuss your insurance needs and find the perfect policy for you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.