Mount Vernon Fire Insurance Company Review (2026)

Mount Vernon Fire Insurance Company, a longstanding presence in the insurance industry, delivers a comprehensive range of coverage options for homes, autos, businesses, health, and life.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Mount Vernon Fire Insurance Company, a well-established player in the insurance industry, offers a comprehensive suite of insurance options to protect homes, vehicles, businesses, health, and loved ones. With a rich history dating back to the early 20th century, they’ve earned a reputation for financial stability, commitment to customer satisfaction, and customizable policies.

Their coverage includes home insurance safeguarding against disasters, auto insurance providing peace of mind on the road, business insurance shielding against unforeseen challenges, health insurance prioritizing well-being, and life insurance securing family futures.

The company’s dedication to efficient claims processing and satisfied customers is evident, making them a reliable choice for diverse insurance needs.

While the article doesn’t delve into specific financial ratings or discounts, Mount Vernon Fire Insurance Company’s strong track record and commitment to tailored coverage make them a noteworthy insurance provider.

Mount Vernon Fire Insurance Coverage Options

Mount Vernon Fire Insurance Company extends a wide range of insurance coverage options designed to safeguard your valuable assets and provide financial protection in various aspects of life. Here is a bullet list of coverage options offered by Mount Vernon Fire Insurance Company:

- Home Insurance: Protection for your residence against various perils, including damage from natural disasters and accidents.

- Auto Insurance: Coverage for your vehicles, offering financial protection in case of accidents, theft, or damage.

- Business Insurance: Safeguard your business operations from potential risks, liabilities, and unforeseen challenges.

- Health Insurance: Comprehensive health coverage, ensuring your well-being and helping with medical expenses.

- Life Insurance: Policies designed to secure your family’s financial future in the event of your passing.

The specific coverage options and details may vary, and it’s advisable to contact Mount Vernon Fire Insurance Company directly or visit their website for precise information on their insurance offerings and customization options.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

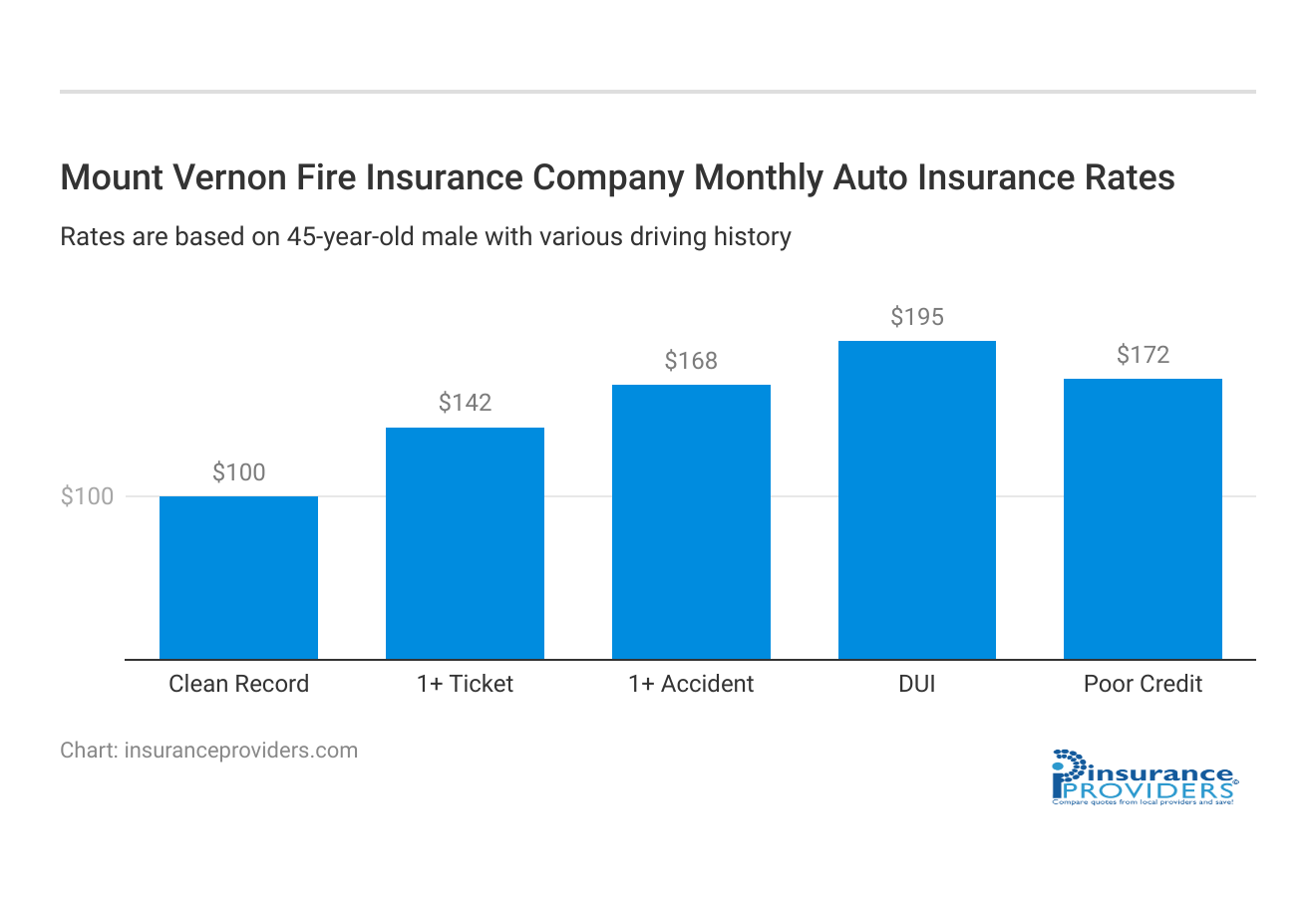

Mount Vernon Fire Insurance Rates Breakdown

| Driver Profile | Mount Vernon Fire Insurance Company | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $142 | $147 |

| 1+ Accident | $168 | $173 |

| DUI | $195 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Mount Vernon Fire Insurance Discounts Available

| Discount | Mount Vernon Fire Insurance Company |

|---|---|

| Anti Theft | 10% |

| Good Student | 8% |

| Low Mileage | 12% |

| Paperless | 5% |

| Safe Driver | 12% |

| Senior Driver | 7% |

One of the key benefits of choosing Mount Vernon Fire Insurance Company (MVFIC) as your insurance provider is the array of discounts available. MVFIC believes in rewarding responsible policyholders and offering opportunities to save on insurance premiums.

Let’s explore the discounts they provide to help you make an informed decision. Here’s the discounts Offered by MVFIC:

- Multi-Policy Discount: Enjoy savings by bundling your home and auto insurance policies with MVFIC.

- Safe Driver Discount: If you maintain a clean driving record, MVFIC offers discounts for safe driving habits.

- Multi-Car Discount: Insure multiple vehicles with MVFIC, and you’ll receive a discount on each policy.

- Home Security Discount: Secure your home with advanced security systems, and MVFIC rewards you with reduced premiums.

- Good Student Discount: Students with excellent academic records can benefit from lower insurance rates.

- Claim-Free Discount: For policyholders who haven’t filed a claim in a specified period, MVFIC offers additional savings.

- Anti-Theft Discount: Installing anti-theft devices in your vehicle can lead to reduced auto insurance premiums.

- Renewal Discount: Loyalty pays off with MVFIC; renew your policy with them to enjoy discounts.

Mount Vernon Fire Insurance Company goes the extra mile to ensure that responsible policyholders are rewarded with savings. With a range of discounts covering everything from safe driving to home security, MVFIC makes it easier for you to protect what matters most while keeping your budget in mind. Take advantage of these discounts and experience the benefits of being an MVFIC policyholder.

How Mount Vernon Fire Insurance Ranks Among Providers

Competitors can vary by location and the specific insurance market they target. Here are some general categories of competitors that Mount Vernon Fire Insurance Company might face:

- National Insurance Carriers: These are large insurance companies with a national presence and a wide range of insurance products. Examples include State Farm, Allstate, and Progressive.

- Regional Insurance Companies: Some insurers focus on specific regions or states and may have a strong local presence. They often cater to the unique needs of customers in those areas.

- Specialty Insurance Providers: Some companies specialize in specific types of insurance, such as Geico for auto insurance or Blue Cross Blue Shield for health insurance. These companies may offer competitive rates and tailored coverage.

- Online-Only Insurance Providers: Digital-first insurance companies have gained popularity in recent years. They often offer competitive rates and a streamlined online experience. Examples include Geico, Lemonade, and Root Insurance.

- Mutual Insurance Companies: Mutual insurers are owned by their policyholders and often focus on providing excellent customer service and stable rates. Companies like USAA (for military personnel) and Amica Mutual are examples of mutual insurers.

- Local or Independent Agents: Independent insurance agents or agencies represent multiple insurance companies and help customers find the best coverage options. These agents may work with a variety of insurers, depending on customer needs.

The competitive landscape in the insurance industry can change over time, and specific competitors may vary by location and market conditions. To get a clear understanding of Mount Vernon Fire Insurance Company’s main competitors in your area and their offerings, you may want to conduct a local market analysis or consult with an insurance expert.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mount Vernon Fire Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Mount Vernon Fire Insurance Company offers multiple convenient options for filing a claim. Policyholders can choose to file a claim online through the company’s user-friendly website. Additionally, they can opt for over-the-phone claim submissions, where experienced customer service representatives assist in initiating the claims process.

For those who prefer mobile solutions, the company provides a dedicated mobile app that streamlines the claim reporting process, allowing customers to upload necessary documents and photos directly from their smartphones.

Average Claim Processing Time

Mount Vernon Fire Insurance Company is committed to efficient claim processing. While specific processing times may vary depending on the complexity of the claim, the company strives to expedite the process as much as possible.

Policyholders can expect timely responses and updates throughout the claim journey. To obtain precise information on average claim processing times for different types of claims, customers are encouraged to reach out to the company directly.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on claim resolutions and payouts is a crucial aspect of evaluating an insurance provider’s performance. Mount Vernon Fire Insurance Company places a strong emphasis on customer satisfaction.

While the article does not provide specific customer testimonials or feedback, the company’s commitment to providing a high level of service and efficient claims handling suggests that they prioritize fair and timely claim resolutions.

Customers are encouraged to review the company’s customer testimonials or contact their customer service department for more detailed information on claim experiences.

Digital and Technological Features of Mount Vernon Fire Insurance Company

Mobile App Features and Functionality

Mount Vernon Fire Insurance Company offers a comprehensive mobile app that enhances the customer experience. The app provides a range of features and functionality, including the ability to file claims, access policy information, view payment history, and even request roadside assistance for auto insurance policyholders.

Additionally, customers can use the app to view and download policy documents, making it a valuable tool for managing insurance on the go.

Online Account Management Capabilities

The company’s online account management capabilities empower policyholders to take control of their insurance policies. Through the user-friendly online portal, customers can easily access and update their policy information, make payments, review coverage details, and track claims in real-time.

The online account management system ensures that policyholders have convenient 24/7 access to their insurance information, streamlining the insurance management process.

Digital Tools and Resources

Mount Vernon Fire Insurance Company provides a wealth of digital tools and resources to assist policyholders in making informed decisions. These resources may include informative articles, guides, and interactive tools to help customers understand their insurance options better.

Additionally, the company’s website is a valuable resource for obtaining insurance quotes, policy information, and educational materials to support customers in navigating the insurance landscape.

Frequently Asked Questions

Is Mount Vernon Fire Insurance Company a national provider, or are their services limited to specific regions?

Mount Vernon Fire Insurance Company primarily operates in select regions. While they have a broad coverage area, it’s essential to check if they offer services in your specific location.

What factors influence the cost of insurance policies with Mount Vernon Fire Insurance Company?

Several factors can affect your insurance premium, including your location, coverage type, deductible amount, and your personal history, such as your driving record for auto insurance or health history for health insurance.

How does Mount Vernon Fire Insurance Company handle claims for severe events like natural disasters or major accidents?

In cases of major events, Mount Vernon Fire Insurance Company has a dedicated claims response team trained to handle such situations efficiently. They work closely with policyholders to expedite claims and provide the necessary support during challenging times.

Are there any discounts or special offers available for long-term policyholders?

Mount Vernon Fire Insurance Company values loyalty. They often have loyalty programs or discounts for policyholders who renew their policies with them over an extended period. Be sure to inquire about any available incentives.

What is the process for canceling a policy with Mount Vernon Fire Insurance Company?

If you need to cancel your policy for any reason, you can usually do so by contacting their customer service team. They will guide you through the necessary steps and explain any potential implications, such as refunds or fees associated with policy cancellations.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.