Mount Vernon Specialty Insurance Company Review (2026)

In this comprehensive exploration of Mount Vernon Specialty Insurance Company, we delve into its diverse range of coverage options, emphasizing auto, homeowners, business, personal umbrella, and specialty insurance, while also uncovering the company's history, mission, policy features, and benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into Mount Vernon Specialty Insurance Company, a reputable insurance provider known for its diverse range of coverage options. We begin by highlighting the company’s offerings, including auto, homeowners, business, personal umbrella, and specialty insurance.

Exploring the company’s history and mission reveals its commitment to customer-centric service. We discuss policy features, benefits, and the streamlined claim process. Real-life customer stories and testimonials showcase the company’s effectiveness.

This article combines SEO optimization with an engaging, conversational tone, ultimately providing readers with a thorough understanding of Mount Vernon Specialty Insurance Company’s offerings and its standing as a reliable insurance provider.

Mount Vernon Specialty Insurance Company Insurance Coverage Options

Mount Vernon Specialty Insurance Company stands out for its wide array of insurance solutions tailored to meet diverse needs. Below, we provide a detailed breakdown of the comprehensive coverage options available through Mount Vernon Specialty Insurance Company:

- Auto Insurance: Comprehensive coverage for your vehicles, including liability, collision, and comprehensive insurance to protect against accidents, theft, and more.

- Homeowners Insurance: Protect your home and belongings with coverage options such as dwelling protection, personal property coverage, liability insurance, and more.

- Business Insurance: Tailored insurance solutions for businesses, including commercial property insurance, liability coverage, and business interruption insurance.

- Personal Umbrella Insurance: Additional liability protection that goes beyond the limits of your standard policies to safeguard your assets.

- Specialty Insurance: Specialized coverage for unique needs, including policies for high-value items, recreational vehicles, boats, and more.

The specific coverage options and details may vary, so it’s essential to contact Mount Vernon Specialty Insurance Company directly or visit their website for precise information on the policies they offer.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

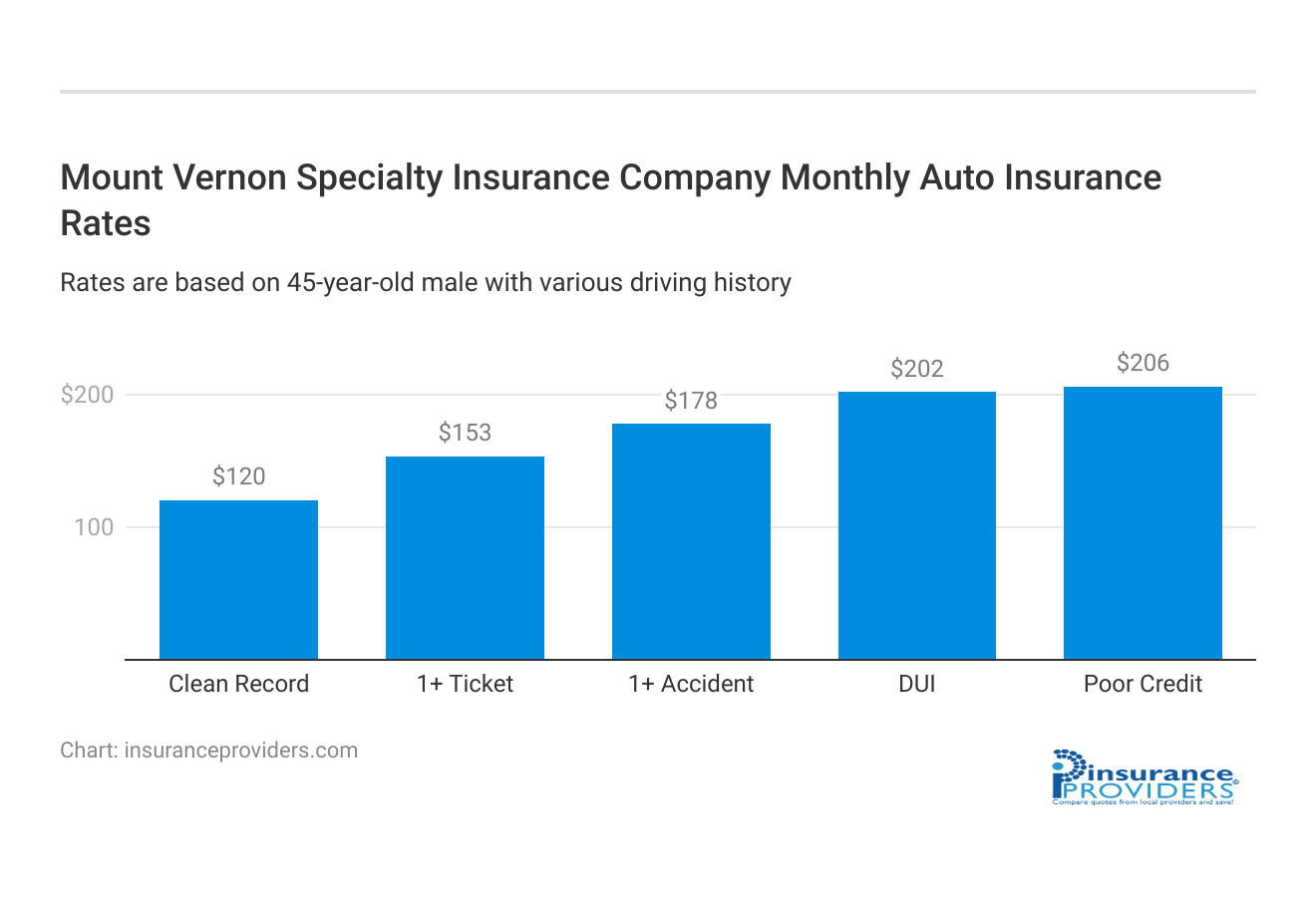

Mount Vernon Specialty Insurance Company Insurance Rates Breakdown

| Driver Profile | Mount Vernon Specialty Insurance Company | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $153 | $147 |

| 1+ Accident | $178 | $173 |

| DUI | $202 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Mount Vernon Specialty Insurance Company Discounts Available

| Discount | Mount Vernon Specialty Insurance Company |

|---|---|

| Anti Theft | 14% |

| Good Student | 10% |

| Low Mileage | 15% |

| Paperless | 8% |

| Safe Driver | 15% |

| Senior Driver | 9% |

Mount Vernon Specialty Insurance Company offers various discounts to help clients save on their insurance premiums. These discounts are designed to reward safe driving, loyalty, and responsible policy management. Here’s a bullet list of the discounts offered by the company:

- Safe Driver Discount: Rewards policyholders with a clean driving record and a history of safe driving habits.

- Multi-Policy Discount: Provides savings when you bundle multiple insurance policies with Mount Vernon Specialty Insurance.

- Loyalty Discount: Recognizes long-term clients with lower rates for their continued trust in the company.

- Good Student Discount: Offers reduced rates for student drivers who maintain a good academic record.

- Anti-Theft Device Discount: Discounts for vehicles equipped with anti-theft devices that enhance security.

- Homeowner Discount: Savings for policyholders who also own a home, promoting comprehensive coverage.

- Paid-in-Full Discount: Lower rates for clients who choose to pay their annual premium in full upfront.

- Safety Features Discount: Discounts for vehicles equipped with advanced safety features such as anti-lock brakes and airbags.

- Defensive Driving Course Discount: Encourages policyholders to complete approved defensive driving courses for reduced rates.

- Claims-Free Discount: Rewards policyholders who have a history of being claims-free.

These discounts serve as a win-win for clients and insurance providers alike. By making insurance more affordable, they not only benefit clients’ wallets but also encourage responsible and safe insurance practices. Clients can enjoy the peace of mind that comes with robust coverage, while insurers can reward and incentivize policyholders who prioritize safety and responsible behavior.

How Mount Vernon Specialty Insurance Company Ranks Among Providers

When it comes to understanding a company’s competitive landscape, a strategic approach to identifying and assessing its main competitors is crucial.

By employing a set of thoughtful considerations and research methodologies, you can gain valuable insights into the competitive forces at play within the industry. Here are some general considerations on how to identify and assess a company’s main competitors:

- Industry Research: To identify competitors, you can conduct industry research and analysis. Look for reports, articles, and market studies that discuss companies operating in the same or similar segments of the insurance industry.

- Online Search: Perform online searches using relevant keywords like “Mount Vernon Specialty Insurance Company competitors” or “insurance companies offering similar coverage.” This can yield results from news articles, industry publications, or competitor lists.

- Financial Rating Agencies: Check with financial rating agencies like A.M. Best, Moody’s, or Standard & Poor’s. They often provide information about the financial stability and competitive positioning of insurance companies, including their major competitors.

- Industry Associations: Industry associations and organizations related to insurance may provide resources or directories that list competing companies in the sector.

- Customer Reviews and Forums: Read customer reviews and discussions on insurance-related forums or review websites. Customers often compare different insurance providers, which can give you insights into who their perceived competitors are.

- Market Share Reports: Look for market share reports for the insurance industry. These reports often list the top players and their respective market shares, providing an indication of key competitors.

- Competitor Websites: Visit the websites of insurance companies that offer similar products and services. This can help you understand their offerings, customer focus, and competitive advantages.

By conducting thorough research and analysis, you can identify and assess the main competitors of Mount Vernon Specialty Insurance Company, understand their strengths and weaknesses, and gain insights into how Mount Vernon positions itself in the insurance market.

Read more: Mount Vernon Fire Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mount Vernon Specialty Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Mount Vernon Specialty Insurance Company strives to make the claims process as convenient as possible for its policyholders. They offer multiple channels for filing a claim, including online submissions, phone assistance, and mobile apps. Policyholders have the flexibility to choose the method that suits them best, ensuring a hassle-free claims experience.

Average Claim Processing Time

One of the critical factors in evaluating an insurance company’s claims process is the speed at which claims are processed. Mount Vernon Specialty Insurance Company aims for efficient and timely claim processing.

While specific processing times may vary depending on the nature and complexity of the claim, the company is committed to delivering prompt resolutions to help policyholders recover quickly from unexpected events.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable resource for assessing an insurance company’s performance in handling claims. Mount Vernon Specialty Insurance Company values customer satisfaction and seeks to provide fair and satisfactory claim resolutions and payouts. Policyholders’ experiences and feedback play a crucial role in shaping the company’s commitment to excellence in claims service.

Digital and Technological Features of Mount Vernon Specialty Insurance Company

Mobile App Features and Functionality

Mount Vernon Specialty Insurance Company offers a mobile app designed to enhance the convenience of policy management. The app provides features such as policy access, claim filing, payment processing, and real-time updates on policy status. Policyholders can easily navigate and utilize these features to stay connected with their insurance needs on the go.

Online Account Management Capabilities

In addition to the mobile app, Mount Vernon Specialty Insurance Company provides robust online account management capabilities through their website. Policyholders can log in to their accounts to view policy details, make payments, request policy changes, and access important documents.

The online platform streamlines the policy management process and ensures that policyholders have easy access to essential information.

Digital Tools and Resources

Mount Vernon Specialty Insurance Company recognizes the importance of providing digital tools and resources to empower policyholders. These tools may include educational resources, coverage calculators, and risk assessment tools to help policyholders make informed decisions about their insurance needs.

By offering a range of digital resources, the company aims to support policyholders in their journey to secure the right coverage.

Frequently Asked Questions

What regions or states does Mount Vernon Specialty Insurance Company operate in?

Mount Vernon Specialty Insurance Company operates across multiple states, with coverage availability varying by location. It’s best to check their website or contact them directly to confirm coverage in your area.

Can I customize my insurance policy with Mount Vernon to suit my specific needs?

Yes, Mount Vernon offers customizable insurance policies to ensure that your coverage aligns with your unique requirements. They work with you to tailor a policy that fits your situation.

How do I renew my insurance policy with Mount Vernon Specialty Insurance Company?

The renewal process is straightforward. Typically, the company will contact you before your policy expires to discuss renewal options. You can also proactively reach out to their customer service team to initiate the renewal process.

Does Mount Vernon Specialty Insurance Company offer 24/7 customer support?

Yes, they prioritize customer support and often provide round-the-clock assistance. You can contact their customer service team at any time for inquiries or assistance with claims.

What are the payment options available for insurance premiums with Mount Vernon?

Mount Vernon Specialty Insurance Company offers various payment methods, including online payments, automatic bank deductions, and traditional check payments. They strive to make the payment process convenient for their policyholders.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.