Northstone Insurance Company Review (2026)

Unleash the assurance with Northstone Insurance Company, providing a spectrum of coverage options, from auto and home to health and life policies, all prioritizing customer satisfaction and featuring enticing discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Discover the world of Northstone Insurance Company, a trusted insurance provider offering a comprehensive array of coverage options. This article begins with a quick glance at the types of insurance they offer, including Auto, Home, Life, Business, and Specialty Insurance.

We explore Northstone’s rich history, commitment to customer satisfaction, and its unique selling points—comprehensive coverage, cutting-edge technology, and personalized service. Northstone Insurance Company shines as a beacon of reliability and security in the insurance realm. You’re not just getting coverage; you’re choosing peace of mind.

What You Should Know About Northstone Insurance Company

Rates: The Rates category evaluates Northstone Insurance Company’s pricing structure, considering factors such as average monthly rates, competitiveness in the market, and alignment with industry standards.

Discounts: In the Discounts category, we analyze the breadth and accessibility of cost-saving opportunities, including safe driving incentives, policy bundling discounts, and loyalty programs, to assess Northstone’s commitment to maximizing savings for policyholders.

Complaints/Customer Satisfaction: Customer satisfaction is assessed by examining feedback, complaints, and reviews, with a focus on Northstone’s responsiveness to customer concerns, efficiency in dispute resolution, and overall reported satisfaction levels.

Claims Handling: The Claims Handling category evaluates Northstone’s efficiency in processing claims, considering factors such as the ease of filing a claim, average processing time, and customer feedback on the resolution and payout experience, providing insight into the insurer’s effectiveness in this crucial aspect of insurance service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Northstone Insurance Company Insurance Coverage Options

Northstone Insurance Company is committed to providing a wide range of coverage options tailored to meet your unique needs. Whether you’re safeguarding your home, vehicle, health, or planning for the future, Northstone has you covered. Explore their comprehensive coverage offerings below:

Auto Insurance:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP) or Medical Payments Coverage

- Roadside Assistance

- Rental Car Reimbursement

Home Insurance:

- Dwelling Coverage (Structure of the Home)

- Personal Property Coverage (Belongings)

- Liability Coverage (Personal Liability)

- Additional Living Expenses (Loss of Use)

- Other Structures Coverage (Garage, Shed, etc.)

- Personal Liability Umbrella Policy (Optional)

Health Insurance:

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- Exclusive Provider Organization (EPO) Plans

- Point of Service (POS) Plans

- High Deductible Health Plans (HDHPs)

- Health Savings Accounts (HSAs)

- Dental and Vision Coverage (Optional)

Life Insurance:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Indexed Universal Life Insurance

- Accidental Death and Dismemberment (AD&D) Insurance

Business Insurance:

- General Liability Insurance

- Commercial Property Insurance

- Business Owners Policy (BOP)

- Commercial Auto Insurance

- Workers’ Compensation Insurance

- Professional Liability Insurance (Errors and Omissions)

- Cyber Liability Insurance

Please note that the specific coverage options and terms may vary depending on the insurance company and the policy you choose. It’s essential to consult with the insurance provider directly or review their policy documents to understand the details and options available to you.

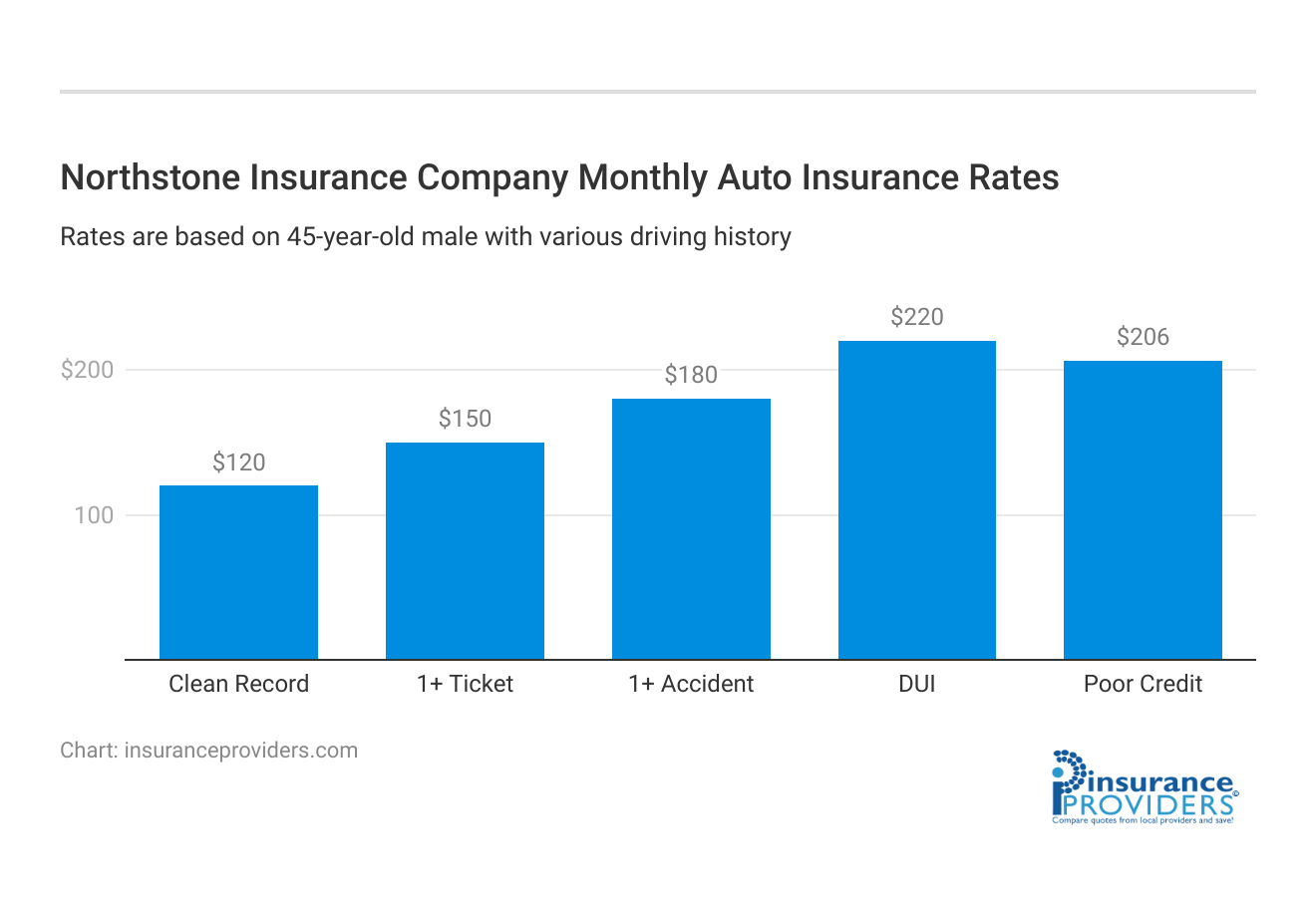

Northstone Insurance Company Insurance Rates Breakdown

| Driver Profile | Northstone | National Average |

|---|---|---|

| Clean Record | $120 | $119 |

| 1+ Ticket | $150 | $147 |

| 1+ Accident | $180 | $173 |

| DUI | $220 | $209 |

| Poor Credit | $206 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Northstone Insurance Company Discounts Available

| Discount | Northstone |

|---|---|

| Anti Theft | 6% |

| Good Student | 12% |

| Low Mileage | 5% |

| Paperless | 3% |

| Safe Driver | 16% |

| Senior Driver | 8% |

Northstone Insurance Company understands the importance of affordability and strives to make insurance coverage more accessible. They offer a variety of discounts to help policyholders save on their premiums. Here are some of the discounts available:

- Safe Driver Discount: If you have a clean driving record without accidents or traffic violations, you may qualify for a safe driver discount. This rewards responsible driving habits.

- Multi-Policy Discount: Bundling multiple insurance policies with Northstone, such as auto and home insurance, can lead to significant savings on your premiums.

- Good Student Discount: Students who maintain good grades in school may be eligible for a good student discount. This encourages academic excellence while reducing insurance costs for young drivers.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle can lower the risk of theft, making you eligible for a discount on your auto insurance. (For more information, read our “Why You Should Get an Anti-Theft Device for Your Car“).

- Home Safety Features Discount: If your home is equipped with safety features such as smoke detectors, security systems, or fire extinguishers, you may qualify for a discount on your homeowners or renters insurance.

- Claims-Free Discount: Staying claims-free over an extended period demonstrates responsible policy management and may lead to lower premiums.

- Multi-Car Discount: Insuring multiple vehicles under the same policy or with Northstone can result in a multi-car discount, reducing the overall cost of coverage.

- Senior Citizen Discount: Policyholders who are seniors may be eligible for discounts tailored to their age group, acknowledging their experience and safe driving habits.

- Affinity Group Discounts: Northstone collaborates with various organizations and associations to offer specialized discounts to their members. Check if you qualify through your affiliations.

- Renewal Discounts: Staying loyal to Northstone and renewing your policy may lead to renewal discounts as a token of appreciation for your continued business.

- Payment Discounts: Opting for certain payment methods, such as electronic funds transfer (EFT) or annual payments, can result in payment discounts.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a low mileage discount, as reduced mileage can lead to lower risk.

- Homeowner Discount: Owning a home may make you eligible for additional discounts on your auto insurance.

Northstone Insurance Company is dedicated to helping policyholders maximize their savings while maintaining comprehensive coverage. It’s important to consult with their representatives to understand which discounts apply to your specific situation and how they can best tailor your policy to suit your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Northstone Insurance Company Ranks Among Providers

In a competitive insurance industry, Northstone Insurance Company faces several formidable competitors, each vying for a share of the market. Here are some of the main competitors that Northstone may encounter:

- Allstate insurance: Allstate is a well-established insurance giant known for its wide range of coverage options, including auto, home, and life insurance. They have a strong presence in many regions and are known for their robust customer support and innovative insurance products.

- State farm insurance: State Farm is another major player in the insurance industry, offering a comprehensive suite of insurance products, including auto, home, and life insurance. They are known for their extensive network of agents and personalized customer service.

- Geico: Geico is known for its competitive pricing and clever advertising campaigns. They specialize in auto insurance and offer a user-friendly online platform for obtaining quotes and managing policies.

- Progressive insurance: Progressive is recognized for its innovative approach to auto insurance, particularly its Snapshot program that tracks driving habits to determine rates. They also offer various other insurance types and have a strong online presence.

- Liberty mutual insurance: Liberty Mutual offers a wide array of insurance products, including home, auto, and commercial insurance. They emphasize customized coverage options and are known for their strong financial stability.

- Farmers insurance: Farmers is a well-established insurer with a diverse range of coverage options, including home, auto, and specialty lines of insurance. They are known for their local agents and personalized service.

- Nationwide insurance: Nationwide offers a variety of insurance products and is particularly known for its pet insurance offerings. They have a strong emphasis on customer service and community involvement.

- Usaa: USAA primarily serves military members and their families, offering a wide range of financial services, including insurance. They are known for their exceptional customer service and dedication to their unique customer base.

- Travelers insurance: Travelers is a large, global insurance company offering a wide range of coverage options, including commercial insurance and personal lines. They are known for their risk management solutions.

- Chubb insurance: Chubb is renowned for its high-end insurance products, catering to individuals and businesses with more complex needs. They specialize in providing premium coverage and personalized service.

These competitors often differentiate themselves through various factors, including pricing, coverage options, customer service, and marketing strategies. Northstone Insurance Company would need to continually assess and adapt its offerings to remain competitive in this crowded marketplace, striving to provide unique value and meet the evolving needs of its customers.

Northstone Insurance Company Claims Process

Ease of Filing a Claim

Northstone Insurance Company offers a user-friendly claims process that caters to the convenience of its policyholders. Whether you prefer online submissions, over-the-phone assistance, or mobile app access, Northstone ensures that filing a claim is a hassle-free experience. With multiple options available, you can choose the method that suits you best.

Average Claim Processing Time

When it comes to claim processing, time is of the essence. Northstone Insurance Company understands the urgency of handling claims promptly. We delve into the average claim processing time, giving you insight into how quickly you can expect assistance in the event of an incident.

Customer Feedback on Claim Resolutions and Payouts

To gauge the effectiveness of Northstone’s claims process, we turn to customer feedback. Policyholders’ experiences and satisfaction levels play a crucial role in assessing the company’s claim resolutions and payout procedures. We provide an overview of what customers have to say about their claim experiences with Northstone Insurance Company.

Digital and Technological Features of Northstone Insurance Company

Mobile App Features and Functionality

In today’s digital age, insurance companies are leveraging technology to enhance customer experiences. Northstone Insurance Company is no exception. We explore the features and functionality of their mobile app, highlighting how it can simplify your insurance management tasks and keep you connected on the go.

Online Account Management Capabilities

Managing your insurance policies and accounts online has become a standard expectation. Northstone Insurance Company offers a robust online account management system. We delve into the capabilities it provides, such as policy updates, payment options, and document access, making your insurance management a breeze.

Digital Tools and Resources

In addition to mobile apps and online account management, Northstone Insurance Company provides various digital tools and resources to assist policyholders. We take a closer look at these resources, which may include educational materials, calculators, and other online tools designed to empower you with the information you need to make informed insurance decisions.

Frequently Asked Questions

What types of insurance does Northstone Insurance Company offer?

Northstone Insurance Company offers a comprehensive range of insurance coverage, including auto, home, health, life, business, and specialty insurance.

How does Northstone Insurance Company prioritize customer satisfaction?

Northstone Insurance Company places a strong emphasis on customer satisfaction by providing personalized service, cutting-edge technology, and attractive discounts to ensure a positive experience for policyholders.

What sets Northstone Insurance Company apart in the competitive insurance industry?

Northstone Insurance Company distinguishes itself through its commitment to comprehensive coverage, advanced technology, and personalized service, making it a reliable and secure choice in the insurance realm.

How does Northstone Insurance Company handle claims?

Northstone Insurance Company offers a user-friendly claims process, allowing policyholders to file claims conveniently through online submissions, over-the-phone assistance, or their mobile app. The company prioritizes a prompt and hassle-free claims experience.

What digital features does Northstone Insurance Company provide to enhance customer experience?

Northstone Insurance Company leverages technology to enhance customer experiences, offering a mobile app with features for simplified insurance management, robust online account management capabilities, and various digital tools and resources to empower policyholders with information for informed decision-making.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.