Best Life Insurance Policies for Cancer Patients in 2026 (Top 10 Companies)

Explore the best life insurance policies for cancer patients with the top companies like American Family, Allstate, and Progressive. Unique coverage, competitive premiums, and tailored policies provide financial security and peace of mind in health challenges

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated February 2024

11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews- American Family, Allstate, and Progressive offer tailored life insurance options for cancer patients.

- Cancer patients can choose from whole life, term life, and guaranteed issue life insurance policies.

- Working with experienced insurance brokers, maintaining a healthy lifestyle, and comparing quotes can improve coverage affordability.

Whether you’re currently undergoing treatment, in remission, or a survivor, this guide is designed to provide clarity on the available options, factors to consider, and practical tips for a smoother application process.

Our Top 10 Best Companies: Best Life Insurance Policies for Cancer Patients

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | American Family | Up to 29% | Up to 20% | Student Savings | |

| #2 | Allstate | Up to 25% | Up to 22% | Add-on Coverages | |

| #3 | Progressive | Up to 10% | Up to 31% | Online Convenience | |

| #4 | Chubb | Up to 10% | Up to 10% | Policy Options | |

| #5 | State Farm | Up to 17% | Up to 30% | Many Discounts | |

| #6 | Liberty Mutual | Up to 30% | Up to 30% | Customizable Policies |

| #7 | AAA | Up to 10% | Up to 20% | Local Agents |

| #8 | USAA | Up to 25% | Up to 20% | Military Savings | |

| #9 | Travelers | Up to 13% | Up to 30% | Accident Forgiveness |

| #10 | Farmers | Up to 10% | Up to 20% | Local Agents |

Life insurance is not just a financial instrument; it’s a means to ensure that your loved ones are supported, even in the face of health challenges.

#1 – American Family: Student-centric Savings

American Family stands out as a top choice for life insurance for cancer patients, offering a unique student-centric policy tailored to provide financial protection while overcoming health challenges.Dani Best Licensed Insurance Producer

Pros

- Student-friendly discounts: American Family offers attractive discounts specifically tailored for students, helping them save on their insurance premiums.

- Customizable policies: The company provides a range of policy options, allowing students to tailor their coverage to meet their unique needs and budget.

- Educational resources: American Family offers educational resources to help students and their families understand insurance terms and make informed decisions.

Cons

- Limited availability: American Family’s coverage may not be available in all regions, limiting access for some students.

- Price competitiveness: While student savings are emphasized, the overall price competitiveness may vary, and students may find more cost-effective options with other providers.

Read more: American Family Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Personalized Protection With Add-on Coverages

Pros

- Extensive add-on options: Allstate offers a wide array of add-on coverages, allowing customers to customize their policies for specific needs and preferences.

- Accident forgiveness: The company provides accident forgiveness, a feature that prevents premium increases after the first at-fault accident.

- User-friendly mobile app: Allstate’s mobile app provides convenient access to policy information, claims, and roadside assistance.

Cons

- Higher premiums: While add-on coverages enhance policy flexibility, they may contribute to higher overall premiums.

- Discount limitations: While Allstate offers discounts, there may be limitations, and some customers might find other insurers with more generous discount programs.

Read more: Allstate Insurance Company Review

#3 – Progressive: Seamless Experience With Online Convenience

Pros

- User-friendly online platform: Progressive excels in online convenience with a user-friendly website and a robust mobile app, making it easy for customers to manage policies and file claims.

- Snapshot program: The Snapshot program allows customers to save on premiums by demonstrating safe driving habits through a telematics device or mobile app.

- Competitive pricing: Progressive is known for competitive pricing, and the online model often translates into cost savings for tech-savvy customers.

Cons

- Limited local agents: Progressive’s emphasis on online services may result in limited access to in-person assistance, which some customers may prefer.

- Snapshot privacy concerns: While the Snapshot program offers savings, some customers may have privacy concerns related to the tracking of driving habits.

Read more: Progressive Auto Insurance Review

#4 – Chubb: Tailored Excellence in Policy Options

Pros

- Tailored policy options: Chubb stands out for providing high-net-worth individuals with tailored insurance solutions, including coverage for unique assets and risks.

- Exceptional customer service: The company is known for its exceptional customer service, offering personalized attention and prompt claims processing.

- Global coverage: Chubb’s policies often extend beyond domestic boundaries, providing global coverage for individuals with international lifestyles.

Cons

- High premiums: Chubb’s focus on specialized coverage and high-net-worth clients may result in higher premiums compared to standard insurance providers.

- Limited accessibility: Chubb’s services may be limited in certain geographic areas, limiting access for potential customers.

Read more: Chubb Auto Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Unlock Savings With Many Discounts

Pros

- Extensive discount options: State Farm offers a variety of discounts, catering to a wide range of policyholders, including safe drivers, homeowners, and students.

- Local agent network: With a vast network of local agents, State Farm provides in-person assistance, making it convenient for customers who prefer face-to-face interactions.

- Variety of coverage options: State Farm offers a comprehensive range of coverage options, allowing customers to find policies that suit their specific needs.

Cons

- Potentially higher premiums: While discounts are available, State Farm’s premiums may still be higher for some customers compared to other providers.

- Policy complexity: The extensive range of coverage options may lead to policy complexity, potentially confusing customers in understanding their coverage.

Read more: State Farm Life Insurance Review

#6 – Liberty Mutual: Your Policy, Your Way

Pros

- Flexibility in coverage: Liberty Mutual excels in providing customizable policies, allowing customers to tailor their coverage to meet specific needs.

- Discount opportunities: The company offers various discounts, providing potential savings for customers who qualify.

- Online tools: Liberty Mutual provides online tools and resources to help customers understand and customize their policies easily.

Cons

- Premium costs: While customization is a strength, the flexibility in policies might come with higher premiums, and customers should carefully balance coverage and costs.

- Limited local agents: Liberty Mutual’s emphasis on online services might result in limited access to local agents, which some customers may prefer.

Read more: Liberty Mutual Insurance Company Review

#7 – AAA: Local Agents, Personal Touch

Pros

- Extensive network of agents: AAA boasts a wide network of local agents, providing in-person support and guidance for customers.

- Member benefits: AAA offers additional benefits beyond insurance, including roadside assistance, travel discounts, and member perks.

- Community presence: Local agents contribute to AAA’s community presence, offering personalized service and understanding local needs.

Cons

- Membership fees: While AAA provides various benefits, customers need to pay membership fees in addition to insurance premiums.

- Coverage limitations: AAA’s insurance offerings might not be as extensive or customizable as those of some competitors.

Read more: AAA Life Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Honoring Service With Military Savings

Pros

- Exclusive military benefits: USAA is dedicated to serving military members and their families, offering exclusive benefits, discounts, and tailored policies.

- Top-rated customer service: USAA consistently receives high marks for its exceptional customer service, providing support to military members worldwide.

- Financial services: In addition to insurance, USAA offers a range of financial services, creating a one-stop shop for military members’ financial needs.

Cons

- Limited eligibility: USAA membership is limited to military members, veterans, and their families, restricting access for the general public.

- Limited physical presence: While USAA offers online and phone services, its physical branch presence is limited, potentially affecting customers who prefer face-to-face interactions.

Read more: USAA Life Insurance Company Review

#9 – Travelers: Forgiveness Matters – Accident Forgiveness Program

Pros

- Accident forgiveness program: Travelers offers accident forgiveness, preventing premium increases after the first at-fault accident, providing a valuable benefit to safe drivers.

- Customizable policies: Customers can tailor their policies with various coverage options, allowing flexibility in meeting individual needs.

- Discount opportunities: Travelers provide discounts for safe driving habits, further incentivizing responsible behavior on the road.

Cons

- Varied availability: Some features, including accident forgiveness, may not be available in all states or with all policy types.

- Potentially higher premiums: While accident forgiveness is a beneficial feature, policyholders should be aware of potential premium increases even with this program.

Read more: Travelers Auto Insurance Review

#10 – Farmers: Community Connection With Local Agents

Pros

- Local agent network: Farmers emphasize a local agent network, providing customers with in-person assistance and a personalized touch.

- Wide range of coverage: Farmers offers a diverse range of insurance products, allowing customers to bundle policies and potentially save on premiums.

- Discount programs: The company provides various discount programs, offering opportunities for customers to reduce their insurance costs.

Cons

- Potentially higher premiums: While discount programs are available, Farmers’ premiums may still be comparatively higher for certain customers.

- Policy complexity: The extensive range of coverage options may lead to policy complexity, requiring careful consideration and understanding by customers.

Read more: Farmers Auto Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

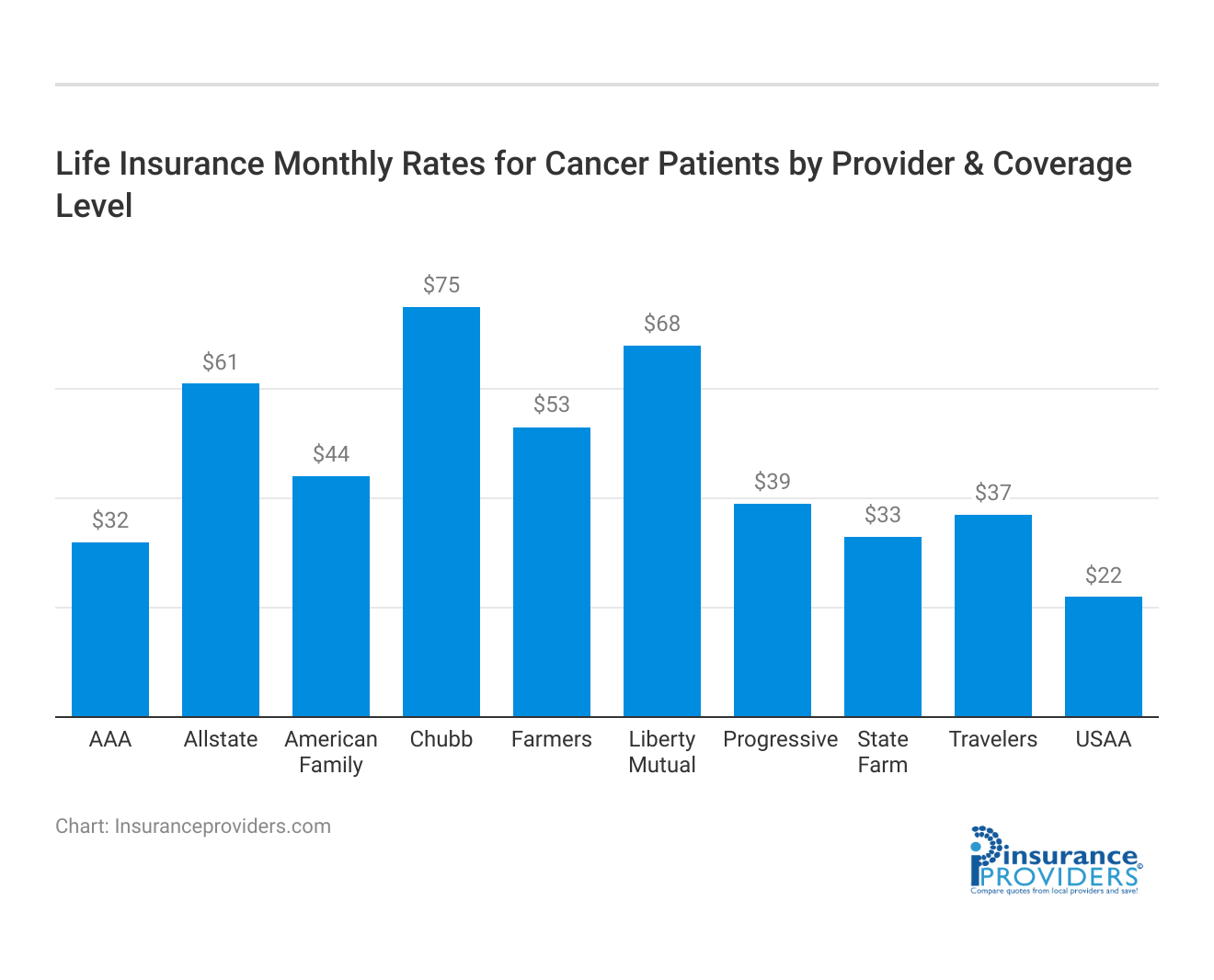

Life Insurance Rates for Cancer Patients: A Comprehensive Overview

When considering life insurance for cancer patients, understanding coverage rates is paramount. The top 10 insurance companies showcase varying rates for both minimum and full coverage.

Average Monthly Life Insurance Rates for Cancer Patients

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $44 | $117 |

| Allstate | $61 | $160 |

| Progressive | $39 | $105 |

| Chubb | $75 | $185 |

| State Farm | $33 | $86 |

| Liberty Mutual | $68 | $174 |

| AAA | $32 | $86 |

| USAA | $22 | $59 |

| Travelers | $37 | $99 |

| Farmers | $53 | $139 |

American Family offers a minimum coverage rate of $44 per month and a full coverage rate of $117 per month. State Farm presents rates of $33 for minimum coverage and $86 for full coverage.

Allstate features a minimum coverage rate of $61 per month and a full coverage rate of $160 per month. Progressive provides a minimum coverage rate of $39 per month and a full coverage rate of $105 per month.

Chubb offers a minimum coverage rate of $75 per month and a full coverage rate of $185 per month. Liberty Mutual showcases a minimum coverage rate of $68 per month and a full coverage rate of $174 per month. AAA presents a minimum coverage rate of $32 per month and a full coverage rate of $86 per month.

USAA features a minimum coverage rate of $22 per month and a full coverage rate of $59 per month. Travelers provide a minimum coverage rate of $37 per month and a full coverage rate of $99 per month. Farmers offer a minimum coverage rate of $53 per month and a full coverage rate of $139 per month.

This comprehensive summary enables cancer patients to assess and compare coverage rates across the top 10 insurance companies, aiding in informed decision-making for the financial well-being of their loved ones.

Understanding Life Insurance for Cancer Patients

When it comes to life insurance, cancer patients may face some unique challenges. However, it’s important to understand that having cancer shouldn’t prevent you from obtaining a life insurance policy. Life insurance can provide financial protection for your loved ones after you’re gone, and there are several options available to cancer patients. In this guide, we’ll explore what life insurance is, why it’s important for cancer patients, factors to consider when choosing a policy, top insurance policies for cancer patients, how to apply for life insurance as a cancer patient, and tips for finding the right policy.

Understanding Life Insurance

Life insurance is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurance company agrees to pay a death benefit to the policy’s beneficiaries upon the insured person’s death. This money can be used to cover funeral expenses, pay off debts, or provide financial security for loved ones.

But life insurance is not just about financial security. It is also about peace of mind. Knowing that your loved ones will be taken care of even after you’re gone can bring a sense of comfort and relief. It allows you to live your life to the fullest, knowing that you have taken steps to protect your family’s future.

When considering life insurance, it’s important to understand the different types of policies available. There are term life insurance policies, which provide coverage for a specific period of time, typically 10, 20, or 30 years. These policies are often more affordable and can be a good option for those who only need coverage for a certain period, such as when their children are young or when they have a mortgage.

On the other hand, there are also permanent life insurance policies, such as whole life or universal life insurance. These policies provide coverage for the entire lifetime of the insured person, as long as the premiums are paid. They also have a cash value component, which can grow over time and be used for various purposes, such as borrowing against it or supplementing retirement income.

Why is Life Insurance Important for Cancer Patients?

Cancer is a serious illness that can have significant financial implications for both the patient and their family. From medical expenses to loss of income, the costs can quickly add up. The emotional toll of a cancer diagnosis is already overwhelming, and the last thing anyone wants to worry about is the financial burden it may bring.

Life insurance can provide peace of mind, knowing that your loved ones will be taken care of financially if the worst were to happen. It can help cover outstanding medical bills, replace lost income, and provide support for your family’s future needs.

For cancer patients, obtaining life insurance may pose some challenges. Insurance companies typically assess the risk of insuring someone based on their health condition. However, there are specialized life insurance policies available specifically for cancer patients. These policies may have certain restrictions or higher premiums, but they can still provide the necessary coverage.

In addition to financial protection, life insurance for cancer patients can also offer other benefits. Some policies may include access to support services, such as counseling or assistance with navigating the healthcare system. These services can be invaluable for both the patient and their family, providing emotional support and guidance during a difficult time.

It’s important to note that life insurance for cancer patients is not limited to those currently undergoing treatment. Even if you have successfully overcome cancer, it’s still possible to obtain life insurance coverage. The availability and terms of coverage may vary depending on factors such as the type of cancer, the stage of treatment, and the length of remission.

When considering life insurance as a cancer patient, it’s essential to work with an experienced insurance agent who specializes in this area. They can guide you through the process, help you understand your options, and find a policy that meets your specific needs.

Factors to Consider When Choosing a Life Insurance Policy

When selecting a life insurance policy as a cancer patient, there are several factors to consider to ensure you get the best coverage:

Coverage

Determine the amount of coverage you need by considering your financial obligations, such as outstanding debts, mortgages, and future expenses. It’s crucial to strike a balance between the coverage you require and the cost of the premiums.

When assessing your financial obligations, take into account not only your current debts but also any potential future expenses. This could include college tuition for your children, medical bills, or even funeral costs. By carefully considering these factors, you can ensure that your life insurance policy provides adequate coverage to protect your loved ones.

Premiums

Life insurance premiums can vary significantly depending on your age, health condition, coverage amount, and the type of policy. As a cancer patient, you may face higher premiums. Shop around and compare quotes from different insurance providers to find the most affordable option.

It’s important to note that while you may face higher premiums as a cancer patient, it doesn’t mean that affordable options are not available. By thoroughly researching and comparing quotes, you can find insurance providers that specialize in covering individuals with pre-existing medical conditions, offering competitive rates that fit within your budget.

Policy Terms

Understand the policy’s terms and conditions, including the length of coverage, renewal options, and any exclusions. Take the time to read and comprehend the fine print to avoid any surprises later on.

When reviewing the policy terms, pay close attention to the length of coverage. Some policies may only provide coverage for a specific period, while others offer coverage for the entire duration of your life. Additionally, be aware of any exclusions that may limit coverage for certain medical conditions or activities. By fully understanding the policy terms, you can make an informed decision and choose a policy that aligns with your specific needs and circumstances.

In addition to the policy terms, it’s also important to inquire about the renewal options available. Some policies may offer automatic renewal, while others require you to reapply at the end of the term. Understanding the renewal process will ensure that your coverage remains in effect without any interruptions.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Policies for Cancer Patients

While each individual’s circumstances are unique, there are three types of life insurance policies that often cater to the needs of cancer patients:

1. Whole Life Insurance Policies

Whole life insurance provides lifelong coverage and builds cash value over time. These policies can be more accessible for cancer patients as they do not typically require a medical exam. However, it’s important to note that the premiums for whole life insurance policies may be higher compared to other options.

Whole life insurance policies offer a range of benefits for cancer patients. Firstly, they provide coverage for the entire duration of the insured’s life, ensuring that their loved ones are financially protected in the event of their passing. Additionally, the cash value that builds up over time can serve as a valuable asset, offering flexibility and potential financial support during the insured’s lifetime.

Moreover, some whole life insurance policies may offer the option to accelerate the death benefit if the insured is diagnosed with a terminal illness, including cancer. This feature allows the insured to access a portion of the death benefit while they are still alive, providing financial assistance for medical expenses or other needs that may arise during their battle against cancer.

2. Term Life Insurance Policies

Term life insurance provides coverage for a specific term, such as 10 or 20 years. These policies can be more affordable for cancer patients, but they often require a medical exam and may have coverage limitations for pre-existing conditions.

Term life insurance policies offer a straightforward and cost-effective solution for cancer patients seeking life insurance coverage. With a fixed term, these policies can be tailored to align with the specific needs of cancer patients, providing coverage during the critical years when financial protection is most important.

It’s important to note that while term life insurance policies may require a medical exam, they still offer viable options for cancer patients. The medical exam serves as an opportunity for the insurance provider to assess the current health status of the applicant, which can help determine the appropriate coverage and premiums. While coverage limitations for pre-existing conditions may exist, it’s crucial to explore different insurance providers and policies to find the best fit for individual circumstances.

3. Guaranteed Issue Life Insurance Policies

Guaranteed issue life insurance is specifically designed for individuals with serious health conditions, including cancer. These policies have no medical exams or health questions. While they offer guaranteed acceptance, they may have lower coverage amounts and higher premiums.

For cancer patients who may face challenges in obtaining traditional life insurance coverage, guaranteed issue life insurance policies can be a viable option. The absence of medical exams and health questions ensures that individuals with cancer can secure coverage without facing potential roadblocks due to their health condition.

However, it’s important to consider that guaranteed issue life insurance policies may have certain limitations. These policies often offer lower coverage amounts compared to other types of life insurance, and the premiums may be higher as a result. It’s crucial for cancer patients to carefully evaluate their financial needs and explore different insurance providers to find the best balance between coverage and affordability.

Ultimately, when it comes to choosing a life insurance policy for cancer patients, it’s essential to carefully assess individual needs and circumstances. Consulting with a knowledgeable insurance professional can provide valuable guidance and help cancer patients make informed decisions to protect their loved ones and secure their financial future.

How to Apply for Life Insurance as a Cancer Patient

Applying for life insurance as a cancer patient can be a complex process, but with the right preparation and understanding of the underwriting process, you can navigate it successfully. In this guide, we will provide you with valuable information on how to apply for life insurance as a cancer patient and what to expect during the application process.

Preparing Your Medical Records

When applying for life insurance as a cancer patient, be prepared to provide detailed medical records to the insurance company. These records play a crucial role in the underwriting process as they help the insurance company assess your current health status and the risk involved in insuring you.

Your medical records should include information about your diagnosis, treatment plan, and current health status. It’s essential to gather all relevant documents, such as pathology reports, imaging results, and treatment summaries. Having these documents readily available can streamline the application process and ensure that you provide accurate and comprehensive information to the insurance company.

Additionally, it’s advisable to consult with your oncologist or medical team to ensure that you have all the necessary medical records for your life insurance application. They can guide you on which documents are essential and help you gather them efficiently.

Understanding the Underwriting Process

The underwriting process is a crucial step in applying for life insurance as a cancer patient. It is the process insurance companies use to assess the risk of insuring an individual and determine the premium rates.

As a cancer patient, you may undergo a more thorough underwriting process compared to individuals without a history of cancer. This is because the insurance company needs to evaluate your current health status, the stage and type of cancer you had, the treatment received, and the likelihood of recurrence or complications.

During the underwriting process, the insurance company may request additional medical information, such as recent test results, follow-up appointments, or consultations with specialists. It’s crucial to be patient and provide accurate information to the insurance company to ensure the best possible outcome.

It’s also important to note that each insurance company may have different underwriting guidelines for cancer patients. Some companies may be more lenient and offer better rates for individuals who have been in remission for a certain period, while others may have stricter criteria. Therefore, it’s advisable to compare multiple insurance providers and their underwriting policies to find the best fit for your specific situation.

In conclusion, applying for life insurance as a cancer patient requires careful preparation and understanding of the underwriting process. By gathering all necessary medical records and providing accurate information, you can increase your chances of obtaining life insurance coverage that meets your needs.

Tips for Cancer Patients Seeking Life Insurance

Working with an Insurance Broker

Consider working with an experienced insurance broker who specializes in finding coverage for individuals with pre-existing conditions like cancer. They can help navigate the complex insurance landscape, work with multiple insurance providers, and find the best policy to meet your unique needs.

Maintaining a Healthy Lifestyle

Adopting a healthy lifestyle can improve your overall health and potentially lower your insurance premiums. Focus on eating a balanced diet, engaging in regular physical activity, and following your healthcare provider’s recommendations.

Regularly Reviewing Your Policy

Life insurance needs can change over time, especially for cancer patients. Regularly review your policy to ensure it still aligns with your financial goals and provides adequate coverage for your loved ones. Consider consulting with a financial advisor to help you make informed decisions.

In conclusion, finding the best life insurance policy as a cancer patient involves understanding your options, considering key factors, and taking proactive steps. While it may require additional effort, obtaining life insurance can provide financial security and peace of mind for you and your loved ones. Remember, you don’t have to face the challenges alone – consult with professionals and take control of your financial future.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Real Case Studies: Tailored Life Insurance Solutions from Top Providers

Case Study One: Unveiling Financial Horizons – Student-Centric Savings

Sarah, a 30-year-old cancer survivor, is a graduate student pursuing a Ph.D. in environmental science. Despite overcoming cancer, she faces challenges in obtaining life insurance due to her medical history.

American Family offers a unique student-centric life insurance policy tailored for individuals like Sarah. The policy takes into account her student status and provides coverage at a rate of $50 per month for a $100,000 death benefit. The coverage ensures financial protection for Sarah’s loved ones while she completes her education and builds a career in her field.

Case Study Two: Crafting Security – Personalized Protection With Add-On Coverages

John, a 45-year-old father of two, is in remission from colon cancer. He is concerned about securing comprehensive life insurance coverage to protect his family’s financial future.

Allstate’s personalized protection policies offer John the flexibility to tailor his coverage. He opts for a term life insurance policy with a $500,000 death benefit. Additionally, he adds critical illness and disability riders to the policy to enhance protection. This ensures that in case of a cancer recurrence or a disability preventing him from working, the policy provides additional benefits.

Case Study Three: Navigating Tomorrow – Seamless Experience With Online Convenience

Michael, a 35-year-old tech entrepreneur, has a busy lifestyle and prefers an insurance provider that offers a seamless online experience.

Progressive’s online convenience aligns perfectly with Michael’s preferences. He explores Progressive’s term life insurance options, completes the application process online, and receives instant quotes. The policy, offering a $1 million death benefit, caters to Michael’s financial responsibilities as a business owner.

Frequently Asked Questions

What is life insurance for cancer patients?

Life insurance for cancer patients is a type of insurance policy that provides coverage specifically designed for individuals who have been diagnosed with cancer. It offers financial protection to the policyholder and their loved ones in the event of the policyholder’s death.

Can cancer patients get life insurance?

Yes, cancer patients can get life insurance. However, the availability and terms of life insurance policies may vary depending on factors such as the stage of cancer, treatment history, and current health condition of the individual. It is recommended to consult with insurance providers specializing in policies for cancer patients to explore available options.

What are the best life insurance policies for cancer patients?

The best life insurance policies for cancer patients would typically be those that offer coverage despite the cancer diagnosis. These policies may include guaranteed issue life insurance, simplified issue life insurance, or graded death benefit life insurance. Each policy type has its own eligibility criteria and features, so it’s important to compare and choose the one that suits individual needs.

What is guaranteed issue life insurance?

Guaranteed issue life insurance is a type of life insurance policy that guarantees coverage for individuals without requiring a medical exam or health questions. It is specifically designed for individuals with pre-existing health conditions, including cancer. While it provides coverage, it may have limited death benefits and higher premiums compared to traditional life insurance policies.

What is simplified issue life insurance?

Simplified issue life insurance is a type of life insurance policy that requires a simplified application process, often without a medical exam. However, it may still involve answering a few health-related questions. This type of policy can be suitable for cancer patients who may not qualify for traditional life insurance but are in relatively stable health conditions.

What is graded death benefit life insurance?

Graded death benefit life insurance is a type of life insurance policy that provides a limited death benefit during the initial years of the policy. For example, if the policyholder passes away within the first two years, the beneficiaries may receive a percentage of the full death benefit. This type of policy is often available to individuals with higher health risks, including cancer patients.

How does the underwriting process work for cancer patients seeking life insurance?

The underwriting process for cancer patients involves a thorough assessment of the individual’s health status, including the type of cancer, treatment received, and the likelihood of recurrence. Detailed medical records are crucial during this process. Each insurance company may have different underwriting guidelines, so it’s essential to work with experienced professionals who specialize in finding coverage for individuals with pre-existing conditions.

Are there specific life insurance options for students, high-net-worth individuals, or military members who are cancer survivors?

Yes, there are tailored life insurance options for various groups, including students, high-net-worth individuals, and military members who are cancer survivors. Companies like American Family, Chubb, and USAA offer policies with features and benefits catering to the unique needs of these groups. Student-centric savings, high-net-worth coverage, and exclusive military benefits are among the features provided by these specialized policies.

How can cancer patients improve their chances of obtaining affordable life insurance coverage?

Cancer patients can improve their chances of obtaining affordable life insurance coverage by working with experienced insurance brokers specializing in pre-existing conditions. Maintaining a healthy lifestyle, regularly reviewing policies, and considering policies with flexible options are also recommended. Shopping around and comparing quotes from different insurance providers can help find the most affordable and suitable coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.