Best Life Insurance Policies for Children in 2026 (Top 10 Companies)

Discovering the best life insurance policies for children with the top companies like American Family, Progressive, and USAA, can be a crucial decision. Their commitment to providing comprehensive coverage and flexible options makes them the top choices for safeguarding your child's future.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Dorothea Hudson has been professionally writing in many spheres since 2013. She has written on entertainment, insurance, finance, travel, technology, AI, renewable energy, crypto, fundraising, and real estate for many websites. Her work has been published for British retailer Marks and Spencer, Kroger Magazine, the Vision Group, and more. Her passions include writing, music, running, travel, te...

Dorothea Hudson

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Updated February 2024

13,283 reviews

13,283 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsSafeguard the financial well-being with the best life insurance policies for children from top companies like American Family, Progressive, and USAA. Explore tailored policies, debunking misconceptions, with Progressive standing out for affordability and comprehensive benefits.

In today’s uncertain world, it is essential to protect our loved ones financially. While life insurance is typically associated with adults, many parents are now considering investing in life insurance policies for their children as well.

Our Top 10 Best Companies: Best Life Insurance Policies for Children

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | American Family | Up to 29% | Up to 20% | Student Savings | |

| #2 | Progressive | Up to 5% | Up to 10% | Online Convenience | |

| #3 | USAA | Up to 10% | Up to 10% | Military Savings | |

| #4 | State Farm | Up to 17% | Up to 30% | Many Discounts | |

| #5 | Allstate | Up to 25% | Up to 15% | Add-on Coverages | |

| #6 | Nationwide | Up to 20% | Up to 40% | Usage Discount |

| #7 | Farmers | Up to 5% | Up to 10% | Local Agents | |

| #8 | Liberty Mutual | Up to 30% | Up to 15% | Customizable Polices |

| #9 | Travelers | Up to 13% | Up to 10% | Accident Forgiveness |

| #10 | Erie | Up to 25% | Up to 10% | 24/7 Support |

In this article, we will explore the importance of life insurance for children, debunk common myths, discuss the different types of policies available, highlight the top providers in the industry, and provide some factors to consider when choosing the best policy for your child’s future.

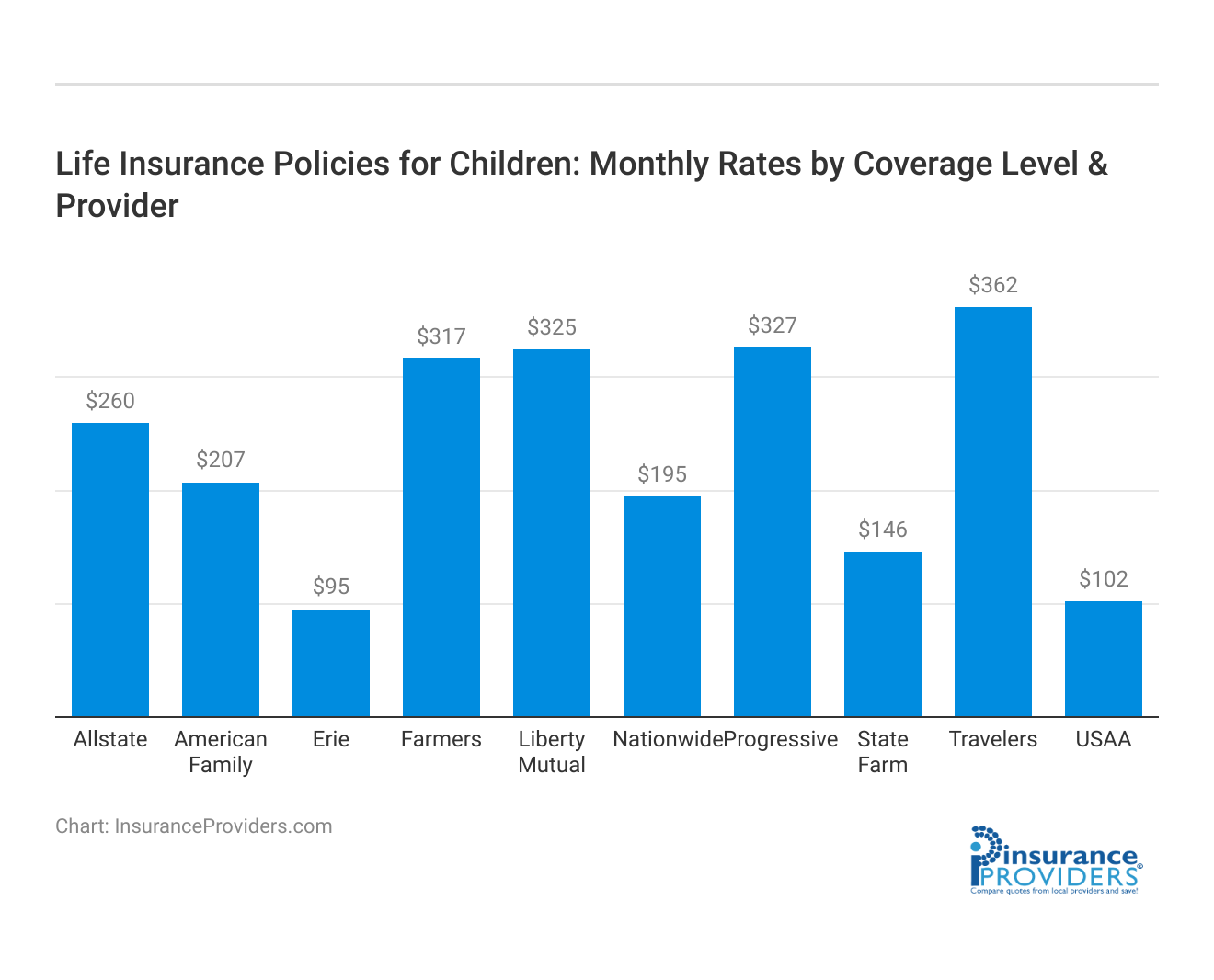

Average Monthly Life Insurance Policies for Children

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $207 | $509 |

| Progressive | $327 | $814 |

| USAA | $102 | $249 |

| State Farm | $146 | $349 |

| Allstate | $260 | $638 |

| Nationwide | $195 | $476 |

| Farmers | $317 | $773 |

| Liberty Mutual | $325 | $785 |

| Travelers | $362 | $910 |

| Erie | $95 | $233 |

Understanding the Importance of Life Insurance for Children

Life insurance for children is a topic that often sparks debate and confusion. But before we delve into the details, let’s take a moment to understand why parents should consider this option.

When it comes to protecting our loved ones, we often think of life insurance as a way to provide financial security for our spouse or dependents in the event of our own untimely passing. However, the idea of getting life insurance for children may seem puzzling to some. After all, children are not typically breadwinners, so why would they need life insurance?

The answer lies in the financial safety net that life insurance provides. While it may be true that children do not contribute to the family income, unexpected events such as accidents or critical illnesses can have a significant impact on a family’s finances. A life insurance policy ensures that you have funds readily available to cover medical expenses, funeral costs, and even counseling services in case the unimaginable happens. It also protects against potential future health issues that may lead to higher premiums or denial of coverage.

Why Consider Life Insurance for Your Child?

Contrary to popular belief, the primary purpose of life insurance for children is not to protect their income, as they are not typically breadwinners. Rather, the key benefit lies in the financial safety net it provides.

Unexpected events such as accidents or critical illnesses can have a significant impact on a family’s finances. A life insurance policy ensures that you have funds readily available to cover medical expenses, funeral costs, and even counseling services in case the unimaginable happens. It also protects against potential future health issues that may lead to higher premiums or denial of coverage.

Furthermore, life insurance for children can also serve as a valuable tool for their future. By starting a policy at a young age, parents can lock in affordable premiums that will remain the same throughout their child’s life. This not only provides long-term savings but also ensures that the child will have access to life insurance coverage even if they develop health conditions or genetic factors that may affect their insurability in the future.

Debunking Myths About Children’s Life Insurance

Before making a decision, it’s essential to separate fact from fiction by dispelling common myths surrounding children’s life insurance.

Myth 1: Children’s life insurance is unnecessary because they don’t have any dependents. While true, the main purpose of this type of insurance is to provide financial security and cover potential future health risks.

Myth 2: Children’s life insurance is expensive. In reality, premiums for children’s policies are generally affordable and can be locked in at a low rate, ensuring long-term savings.

Myth 3: Children can easily qualify for life insurance as adults. Unfortunately, health conditions or genetic factors that may affect your child’s insurability in the future can make obtaining coverage more challenging or expensive.

By debunking these myths, we can see that life insurance for children is not only a practical choice but also a proactive approach to safeguarding their financial future. It provides peace of mind for parents, knowing that they have taken steps to protect their child’s well-being, regardless of what the future may hold.

Types of Life Insurance Policies for Children

When it comes to choosing a life insurance policy for your child, several options are available. Let’s explore the most common ones:

Whole Life Insurance Policies

Whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid. These policies accumulate cash value over time, which can be borrowed against or used to fund future premiums. Whole life policies offer a combination of protection and savings, making them an attractive option for parents looking to secure their child’s financial future.

With a whole life insurance policy, parents can provide their children with a safety net that will last a lifetime. The cash value that accumulates can be used for various purposes, such as funding their child’s education or helping them start a business later in life. This type of policy also offers the peace of mind that comes with knowing that their child will be financially protected, regardless of what the future holds.

Furthermore, whole life insurance policies often come with additional benefits, such as the option to add riders for critical illness or disability coverage. These riders can provide extra protection in case the child faces unexpected health challenges, ensuring that they have the necessary resources to overcome any obstacles that come their way. (For more information, read our “Best Life Insurance Policies for Children with Disabilities“)

Term Life Insurance Policies

Term life insurance policies provide coverage for a specific period, usually 10, 15, 20, or 30 years. These policies do not accumulate cash value but offer higher coverage amounts at lower premiums. Term life insurance is an excellent choice for parents who want financial protection during their child’s formative years, such as covering education expenses or mortgage payments.

By opting for a term life insurance policy, parents can ensure that their child is protected during critical stages of their life. For example, if the child is planning to pursue higher education, the policy can be structured to provide coverage for the duration of their college years. This way, parents can have peace of mind knowing that their child’s education expenses will be taken care of, even if they are no longer around.

Term life insurance policies also offer flexibility, allowing parents to choose the coverage period that aligns with their child’s specific needs. Whether it’s a shorter term to cover mortgage payments or a longer term to secure their child’s financial stability until they become financially independent, term life insurance provides a customizable solution.

Child Riders on Parent’s Policy

Some parents opt to add a child rider to their existing life insurance policy. Child riders extend coverage to all children in the family, offering a cost-effective solution. However, it’s essential to carefully review the limits and coverage terms to ensure they align with your specific needs.

By adding a child rider to their policy, parents can extend the benefits of their life insurance coverage to their children. This means that in the unfortunate event of a child’s passing, the family will receive a death benefit to help them cope with the financial burden that comes with such a loss.

Child riders also provide an affordable option for parents who want to protect their children without purchasing a separate policy for each child. By adding this rider, parents can ensure that all their children are covered under a single policy, simplifying the insurance process and potentially saving on premiums.

It’s important to note that child riders typically have age restrictions and coverage limits, so it’s crucial to review the terms and conditions of the rider carefully. Additionally, parents should consider the long-term financial implications of adding a child rider, as it may affect the overall coverage and benefits of their policy.

Read more: Best Life Insurance Policies for Parents

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Providers for Children

Life insurance for children is an important investment in their future. It provides financial security and peace of mind for parents, ensuring that their child’s needs will be taken care of in the event of an unforeseen tragedy. There are various types of life insurance policies available for children, each with their own unique features and benefits. Let’s take a closer look at some of the top providers in the market:

Provider 1 Review and Policy Details

Provider 1 is a reputable company that offers affordable whole life insurance policies specifically tailored for children. These policies come with flexible premiums and a wide range of coverage amounts, allowing parents to choose the plan that best suits their needs. With Provider 1, parents can have peace of mind knowing that their child’s future is secure, no matter what life may bring.

In addition to the financial protection it provides, Provider 1’s whole life insurance policies also offer other benefits. For example, some policies may accumulate cash value over time, which can be used as a source of funds for the child’s education or other expenses in the future. This feature makes Provider 1 an attractive option for parents who want to not only protect their child but also build a financial nest egg for them.

Provider 2 Review and Policy Details

Provider 2 specializes in term life insurance policies for children. These policies offer customizable coverage options to meet varying needs and budgets. With Provider 2, parents have the flexibility to choose the coverage period that suits them best, whether it’s a few years or up to a certain age.

One of the standout features of Provider 2 is their excellent customer service. They understand the importance of providing support and guidance to parents throughout the life insurance process. Their knowledgeable agents are available to answer any questions and help parents make informed decisions about the coverage they need for their child.

Another advantage of choosing Provider 2 is their competitive premiums. They strive to offer affordable protection without compromising on the quality of their policies. This makes Provider 2 a reliable choice for parents who want to ensure their child’s financial security without breaking the bank.

Provider 3 Review and Policy Details

Provider 3 sets itself apart from other providers with an innovative child rider option. This option allows parents to extend their own life insurance coverage to their children without the need for an additional policy. This means that parents can provide financial protection for their children while also protecting themselves.

In addition to the child rider option, Provider 3 offers comprehensive benefits and affordable rates. Their policies are designed to meet the unique needs of families, providing coverage for various situations such as accidents, illnesses, and even educational expenses. With Provider 3, parents can have peace of mind knowing that their child is protected from the uncertainties of life.

Provider 3 also understands the importance of flexibility in life insurance policies. They offer various riders and add-ons that parents can choose from to enhance their child’s coverage. These additional options can provide extra benefits such as critical illness coverage or even the ability to convert the policy into a permanent one in the future.

Choosing the right life insurance provider for your child is an important decision. It’s crucial to consider factors such as coverage options, premiums, and customer service. By exploring the offerings of Provider 1, Provider 2, and Provider 3, parents can make an informed choice that will provide their child with the financial protection they deserve.

Factors to Consider When Choosing a Policy

While there are numerous life insurance providers in the market, selecting the right policy for your child requires careful consideration. Here are a few key factors to keep in mind:

Coverage Amount

Determine the desired coverage amount based on your specific needs. Consider factors such as potential medical expenses, funeral costs, and long-term financial support.

When calculating the coverage amount, it’s essential to assess your child’s current and future needs. Consider their age, health condition, and any potential risks they may face. For example, if your child has a pre-existing medical condition, you might want to opt for a higher coverage amount to ensure their medical expenses are adequately covered.

Additionally, think about the long-term financial support your child might need. Will they require funds for higher education, starting a business, or purchasing a home? Taking these factors into account will help you determine the appropriate coverage amount for your child’s life insurance policy.

Premium Costs

Compare premium rates across different providers and policies. Look for options with affordable rates that suit your budget while providing adequate coverage.

When considering premium costs, it’s crucial to strike a balance between affordability and coverage. While it may be tempting to choose the cheapest policy available, it’s essential to ensure that it provides sufficient protection for your child. Remember, the purpose of life insurance is to provide financial security, so compromising on coverage for the sake of lower premiums may not be the best decision.

Consider obtaining quotes from multiple providers and carefully evaluate the coverage and benefits offered by each. Look for policies that offer competitive rates while providing comprehensive coverage, ensuring that your child’s future is well-protected.

Policy Terms and Conditions

Thoroughly read and understand the policy terms and conditions, including any exclusions or limitations. Ensure that the policy aligns with your requirements and offers the necessary protections.

Policy terms and conditions can vary significantly between different life insurance providers. It’s crucial to read the fine print and understand the details of the policy you are considering. Pay close attention to any exclusions or limitations that may affect the coverage.

For example, some policies may have exclusions for certain medical conditions or activities. If your child participates in high-risk sports or has a family history of a specific medical condition, make sure the policy covers these situations. Additionally, look for policies that offer flexibility, such as the option to convert the policy into a different type of coverage as your child grows older.

By thoroughly understanding the policy terms and conditions, you can ensure that you are choosing a policy that meets your child’s specific needs and provides the necessary protections.

In conclusion, life insurance for children is a valuable investment that provides financial security and peace of mind. Understanding the importance of such coverage, debunking misconceptions, exploring various policy types, and researching top providers will empower parents to make an informed decision. By considering factors such as coverage amount, premium costs, and policy terms and conditions, parents can choose the best life insurance policy for their children’s future, safeguarding their well-being and financial stability.

Frequently Asked Questions

What is the purpose of life insurance policies for children?

Life insurance policies for children serve as a financial safety net and can provide funds for future expenses such as education, marriage, or even starting a business.

What are the benefits of purchasing life insurance for children?

There are several benefits of purchasing life insurance for children. It allows for locking in lower premiums at a young age, builds cash value over time, and can provide financial protection in case of unexpected medical conditions or accidents.

What types of life insurance policies are available for children?

There are typically two types of life insurance policies available for children: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage and builds cash value.

What factors should parents consider when choosing a life insurance policy for their children?

Parents should consider factors such as the coverage amount needed, the duration of coverage required, the premium cost, the policy’s cash value accumulation potential, and the reputation and financial stability of the insurance company.

Can parents use the cash value accumulated in a child’s life insurance policy?

Yes, parents can typically use the cash value accumulated in a child’s life insurance policy. They can withdraw the cash, borrow against it, or even transfer the policy’s ownership to the child when they reach adulthood.

Is it possible to convert a child’s term life insurance policy into a permanent life insurance policy?

Yes, many insurance companies offer the option to convert a child’s term life insurance policy into a permanent life insurance policy without requiring a medical exam. This allows for extending the coverage beyond the initial term period.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.