Best Life Insurance Policies for Children with Disabilities in 2026 (Top 10 Companies)

Progressive, American Family, and USAA are the top companies for the best life insurance policies for children with disabilities. Their dedication to providing specialized coverage and exceptional customer support distinguishes them, guaranteeing a secure future for your child.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, Vitacost, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Comp...

Melissa Morris

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2024

2,235 reviews

2,235 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsEmbark on the quest for the best life insurance policies for children with disabilities, where Progressive, American Family, and USAA shine as top companies. Uncover how factors like credit score, mileage, coverage level, and driving record influence rates, ensuring families make informed choices for their child’s financial security.

Children with disabilities often require additional care and support, which can put a financial strain on their families. An essential aspect of ensuring their well-being is securing the right life insurance policy.

Our Top 10 Best Companies: Best Life Insurance Policies for Children with Disabilities

| Company | Rank | See Pros/Cons | Maximum Multi-Policy Discount | Maximum Low-Mileage Discount | Best For |

|---|---|---|---|---|---|

| #1 | Progressive | Up to 10% | Up to 30% | Online Convenience | |

| #2 | American Family | Up to 29% | Up to 20% | Student Savings | |

| #3 | USAA | Up to 10% | Up to 30% | Military Savings | |

| #4 | State Farm | Up to 17% | Up to 30% | Many Discounts | |

| #5 | Allstate | Up to 25% | Up to 20% | Add-on Coverages | |

| #6 | Nationwide | Up to 20% | Up to 20% | Usage Discount |

| #7 | Farmers | Up to 10% | Up to 15% | Local Agents | |

| #8 | Liberty Mutual | Up to 25% | Up to 20% | 24/7 Support |

| #9 | Travelers | Up to 13% | Up to 10% | Accident Forgiveness |

| #10 | Erie | Up to 25% | Up to 30% | Customizable Polices |

This article aims to provide a comprehensive guide on the best life insurance policies available for children with disabilities.

By understanding the importance of life insurance and evaluating different policy options, families can make informed decisions that cater to the specific needs of their children.

#1 – Progressive: Online Convenience

Progressive stands out as a top choice for life insurance for children with disabilities, offering a balanced approach and exceptional customer support.Jeff Root Licensed Life Insurance Agent

Pros

- Up to 10% multi-policy discount: Savings for parents bundling life insurance policies for children with disabilities.

- Up to 30% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Online convenience: User-friendly online platform for policy management.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Student Savings

Pros

- Up to 29% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 20% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Student savings: Additional discounts or benefits for student-related factors.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: American Family Insurance Company Review

#3 – USAA: Military Savings

Pros

- Up to 10% multi-policy discount: Savings for military families bundling life insurance policies for children with disabilities.

- Up to 30% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Military savings: Additional discounts or benefits for military families.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: USAA Life Insurance Company Review

#4 – State Farm: Many Discounts

Pros

- Up to 17% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 30% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Many discounts: State Farm offers a variety of discounts, providing extensive savings opportunities.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: State Farm Life Insurance Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Add-on Coverages

Pros

- Up to 25% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 15% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Add-on coverages: Allstate offers additional coverage options, allowing customization based on specific needs.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Allstate Insurance Company Review

#6 – Nationwide: Usage Discount

Pros

- Up to 20% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 40% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Usage discount: Nationwide provides discounts based on the frequency of vehicle usage.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Nationwide General Insurance Company: Customer Ratings & Reviews

#7 – Farmers Insurance: Local Agents

Pros

- Up to 10% multi-policy discount: Savings for parents bundling life insurance policies for children with disabilities.

- Up to 15% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Local agents: Farmers Insurance has a network of local agents for personalized service.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Farmers New World Life Insurance Company: Customer Ratings & Reviews

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Customizable Polices

Pros

- Up to 25% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 30% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Customizable policies: Liberty Mutual allows policyholders to tailor coverage to their specific requirements.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Liberty Mutual Insurance Company Review

#9 – Travelers: Accident Forgiveness

Pros

- Up to 13% multi-policy discount: Savings for parents bundling life insurance policies for children with disabilities.

- Up to 10% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- Accident forgiveness: Travelers offers forgiveness for accidents, preventing rate increases.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Travelers Casualty and Surety Company of America

#10 – Erie Insurance: 24/7 Support

Pros

- Up to 25% multi-policy discount: Substantial savings for parents bundling life insurance policies for children with disabilities.

- Up to 10% low-mileage discount: Significant savings for families with children who have lower transportation needs.

- 24/7 support: Erie Insurance provides around-the-clock customer support.

Cons

- Varied multi-policy discount: The discount percentage may vary based on specific policies.

- Varied low-mileage discount: Discount rates may differ for different policyholders.

Read more: Erie Family Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

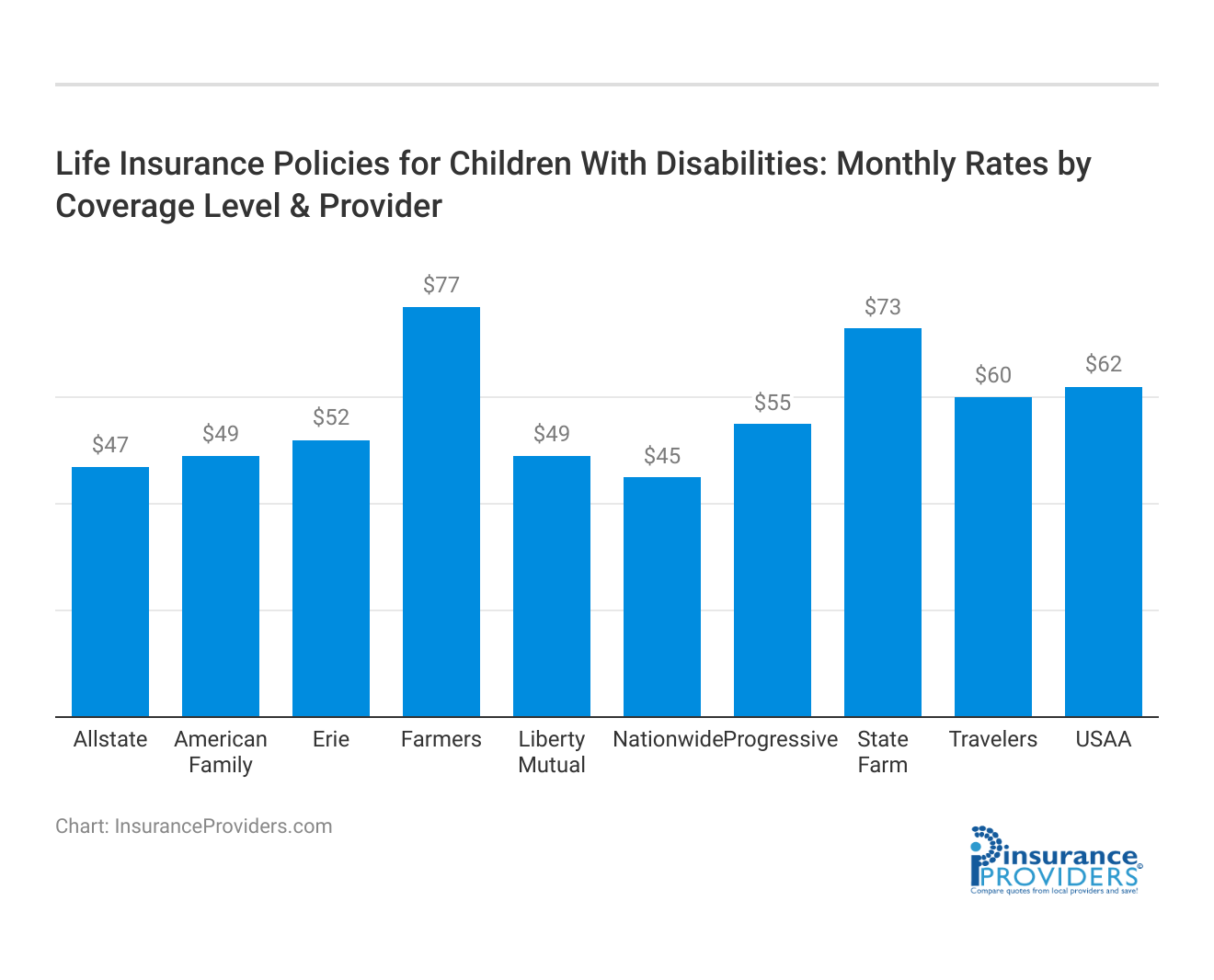

Exploring Coverage Rates for Children With Disabilities

Understanding the life insurance landscape for children with disabilities involves examining coverage rates provided by various insurance companies. These rates can significantly impact the financial commitment families undertake to ensure their child’s future security.

Average Monthly Life Insurance Rates for Children with Disabilities

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $55 | $132 |

| American Family | $49 | $115 |

| USAA | $62 | $168 |

| State Farm | $73 | $192 |

| Allstate | $47 | $145 |

| Nationwide | $45 | $102 |

| Farmers | $77 | $205 |

| Erie | $52 | $138 |

| Travelers | $60 | $176 |

| Liberty Mutual | $49 | $155 |

We find that American Family and Liberty Mutual offer competitive rates for minimum coverage, with American Family standing out at $49 per month.

For those seeking broader protection with full coverage, Farmers and State Farm present higher rates at $205 and $192, respectively. USAA, a trusted name, falls in the mid-range with $168 for full coverage, providing a balanced option for families.

Understanding the Need for Life Insurance for Children with Disabilities

The Importance of Life Insurance

Life insurance plays a crucial role in providing financial security to a child with disabilities and their family. It acts as a safety net, ensuring that in the unfortunate event of the child’s death, their loved ones will receive financial support to cover funeral expenses, outstanding debts, and ongoing living costs. Life insurance offers peace of mind, allowing families to focus on providing the best possible care for their child without added financial burden.

But what are some of the specific reasons why life insurance is so important for children with disabilities? Let’s delve deeper into the topic and explore the various aspects that make it a necessity.

Specific Needs of Children with Disabilities

Children with disabilities often require specialized care and additional medical attention. As a result, their families may face increased expenses related to therapy, medication, assistive devices, and other necessary services. These additional costs can quickly add up, putting a strain on the family’s finances.

Imagine a child with a physical disability that requires regular physical therapy sessions. Each session can cost a significant amount, and without proper insurance coverage, the family may struggle to afford the necessary care. However, with a comprehensive life insurance policy in place, the financial burden can be alleviated, ensuring that the child receives the required therapy without any compromise.

Furthermore, children with disabilities may also need assistive devices such as wheelchairs, hearing aids, or communication devices. These devices are essential for their daily functioning and overall well-being. However, they can be quite expensive, making it challenging for families to provide their child with the necessary tools. Life insurance can help bridge this gap by providing the financial means to acquire these devices, enabling the child to lead a more independent and fulfilling life.

In addition to medical and assistive device expenses, families of children with disabilities may also face higher education costs. Specialized education programs tailored to meet the unique needs of children with disabilities can come with a hefty price tag. Life insurance can help ensure that the child’s educational needs are met, opening doors to a brighter future.

It’s important to note that the needs of children with disabilities can vary greatly depending on the type and severity of their condition. Therefore, when selecting a life insurance policy for a child with disabilities, it is crucial to consider the unique needs of the child and opt for a policy that provides comprehensive coverage to ensure their ongoing care is adequately supported.

Evaluating Different Life Insurance Policies

When it comes to choosing a life insurance policy for your child, it’s important to understand the different options available. Each policy type offers its own set of advantages and considerations. Let’s take a closer look at three popular types of life insurance policies: whole life insurance, term life insurance, and universal life insurance.

Whole Life Insurance

Whole life insurance is a permanent policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit and accumulates cash value over time. This means that as long as the premiums are paid, the policy remains in force and will pay out a death benefit to the beneficiaries upon the insured’s passing.

One of the key advantages of whole life insurance is its lifelong protection. Regardless of changes in the child’s health status, the policy guarantees coverage for their entire life. However, it’s important to note that whole life insurance is often more expensive compared to other policy types. Families should carefully consider their budget and long-term financial goals before committing to this type of policy.

Term Life Insurance

Term life insurance, on the other hand, provides coverage for a specific period, typically ranging from five to thirty years. It offers a death benefit but does not accumulate cash value like whole life insurance. Term life insurance premiums are generally more affordable, which can be advantageous for families on a tight budget.

When considering term life insurance for your child, it’s crucial to evaluate their long-term needs. The coverage period should align with their expected lifespan and any financial obligations you want to protect them against. While term life insurance may not provide lifelong coverage, it can be a cost-effective solution for families who need temporary protection.

Universal Life Insurance

Universal life insurance combines the features of whole life insurance and term insurance. It offers flexible premiums and death benefit options, providing families with more control over their policy. Additionally, universal life insurance policies accumulate cash value over time, allowing families to access funds if needed.

This type of policy may be suitable for families seeking a balance between lifelong coverage and more flexibility in premium payments. Universal life insurance offers the advantage of adjusting the death benefit and premium amounts to meet changing needs. However, it’s important to carefully review the policy terms and conditions, as the flexibility may come with additional costs or risks.

When evaluating different life insurance policies, it’s essential to consider your child’s unique circumstances, your budget, and long-term financial goals. Consulting with a qualified insurance professional can help you navigate the options and make an informed decision that provides the necessary protection for your child’s future.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Providers for Children with Disabilities

When it comes to securing the financial future of children with disabilities, finding the right life insurance provider is crucial. Fortunately, there are several top providers in the market that specialize in offering comprehensive coverage and tailored policies for this specific demographic. Let’s take a closer look at three of the leading providers in this field:

Provider 1 Review

Provider 1 has gained recognition for its commitment to providing comprehensive coverage and specialized policies designed specifically for children with disabilities. They understand the unique needs of these families and have crafted their offerings accordingly. Whether families are looking for whole life or term life insurance, Provider 1 ensures that they have a policy that suits their requirements.

One of the key reasons why Provider 1 stands out is their exceptional customer service. They have built a strong reputation for going above and beyond to assist families in navigating the complexities of life insurance. From answering queries to guiding families through the claims process, Provider 1 is known for its prompt and reliable support.

Provider 2 Review

Provider 2 is another notable player in the market, known for its competitive rates and customizable policies. They understand that every family’s situation is unique, and therefore offer a range of options suitable for families with children with disabilities. Whether families require a specific coverage amount or flexible payment terms, Provider 2 ensures that families have the freedom to tailor their policies accordingly.

What sets Provider 2 apart is the additional benefits they offer. Recognizing that families with children with disabilities often require additional support, Provider 2 provides access to support networks and resources specifically tailored to their needs. This holistic approach ensures that families not only have financial protection but also the necessary guidance and assistance throughout their journey.

Provider 3 Review

Provider 3 brings extensive experience and expertise in catering to the life insurance needs of children with disabilities. They understand that flexibility is of utmost importance when it comes to policy terms, and strive to accommodate the specific requirements of each family they serve.

With Provider 3, families have a wide range of coverage options to choose from. Whether families prefer whole life, term life, or universal life insurance policies, Provider 3 ensures that families have access to comprehensive coverage that suits their unique circumstances.

Moreover, Provider 3 recognizes that navigating the world of life insurance can be overwhelming for families, especially those with children with disabilities. To ease this burden, they have established a team of dedicated professionals who are well-versed in the intricacies of this niche market. These experts are on hand to provide personalized guidance and support to families every step of the way.

In conclusion, when it comes to securing life insurance for children with disabilities, it is essential to choose a provider that understands their unique needs. Providers 1, 2, and 3 have all established themselves as leaders in this field, offering comprehensive coverage, tailored policies, and exceptional support. Families can rest assured that by selecting one of these top providers, they are taking a significant step towards securing their child’s future.

Factors to Consider When Choosing a Policy

Choosing a life insurance policy for a child with disabilities requires careful consideration of several factors. By taking the time to evaluate these factors, families can make an informed decision that will provide financial security for their child’s future.

Coverage Amount

One of the most important aspects to consider when selecting a life insurance policy is the coverage amount. It is crucial to determine the appropriate amount of coverage that will adequately address the child’s current and future needs. This includes considering medical expenses, therapy costs, educational requirements, and any potential ongoing caregiving expenses. Consulting with an insurance professional who specializes in policies for children with disabilities can help assess the optimal coverage amount tailored to the child’s specific circumstances.

For example, if the child requires ongoing therapy sessions, it is essential to factor in the cost of these sessions when determining the coverage amount. Additionally, considering the potential need for assistive devices or specialized educational programs can help ensure that the chosen policy provides sufficient coverage.

Premium Costs

Affordability is another crucial aspect to consider when choosing a life insurance policy. Families must evaluate their budget and select a policy with premiums that they can comfortably afford over the long term. It is important to strike a balance between coverage and financial sustainability so that the premiums do not become a financial burden on the family.

When assessing premium costs, it is essential to consider the child’s ongoing medical expenses and any other financial obligations the family may have. By carefully examining the budget, families can determine the maximum premium amount they can afford without compromising their financial stability.

Policy Terms and Conditions

Thoroughly reviewing the terms and conditions of any life insurance policy is crucial before making a decision. Paying close attention to any exclusions, limitations, or waiting periods that may affect the child’s coverage is essential. It is advisable to seek clarification from the insurance provider regarding any doubts or concerns to ensure full understanding and avoid potential surprises later on.

For instance, some policies may have specific exclusions for pre-existing conditions or limitations on coverage for certain types of therapies. By carefully reviewing the policy terms and conditions, families can make an informed decision and select a policy that aligns with their child’s unique needs.

Additionally, families should consider the flexibility of the policy, such as the ability to increase coverage or add additional riders in the future. This can be particularly important as the child’s needs may change over time, requiring adjustments to the policy to ensure continued adequate coverage.

In conclusion, securing the best life insurance policy for children with disabilities is of utmost importance for their families. Understanding the need for life insurance, evaluating different policy options, and considering factors such as coverage amount, premium costs, and policy terms and conditions will guide families towards making an informed choice. By choosing a reputable insurance provider that caters specifically to the unique needs of children with disabilities, families can achieve peace of mind, knowing they have taken the necessary steps to secure their child’s financial future.

Frequently Asked Questions

What are the best life insurance policies for children with disabilities?

The best life insurance policies for children with disabilities may vary depending on the specific needs of the child. However, some common options include whole life insurance, term life insurance, or guaranteed issue life insurance policies.

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a death benefit as well as a cash value component that grows over time.

What is term life insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit but does not accumulate cash value.

What is guaranteed issue life insurance?

Guaranteed issue life insurance is a type of life insurance that is typically available to individuals regardless of their health condition or disabilities. It does not require a medical exam or health questionnaire, making it easier to obtain coverage.

What factors should be considered when choosing a life insurance policy for a child with disabilities?

When choosing a life insurance policy for a child with disabilities, factors to consider include the child’s specific needs, the coverage amount required, the affordability of premiums, the policy’s flexibility, and any additional riders or benefits that may be beneficial for the child’s situation.

Can a child with disabilities be denied life insurance coverage?

In some cases, children with disabilities may face challenges in obtaining traditional life insurance coverage due to their health condition. However, guaranteed issue life insurance policies are designed to provide coverage without medical underwriting, ensuring that children with disabilities can still obtain life insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.