Best Life Insurance Policies for People With Disability in 2026 (Top 10 Companies)

AIG, Guardian Life, and Prudential are stand out providers with the best life insurance policies for people with disability. These companies offer extensive coverage and cater to the distinctive requirements of people facing disabilities.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2024

0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsThis guide focuses on the best life insurance policies for people with disability, highlighting top providers such as AIG, Guardian Life, and Prudential. Providing a detailed analysis of these companies, the guide discusses their pros and cons, financial stability, coverage options, and competitive pricing.

Life insurance is a vital financial tool that provides security and peace of mind for individuals and their loved ones. For people with disabilities, finding the right life insurance policy can be a crucial step in protecting their financial future.

Our Top 10 Best Companies: Best Life Insurance Policies For People With Disability

| Company | Rank | See Pros/Cons | Disability Insurance Discount | Disability Income Rider Discount | Best For |

|---|---|---|---|---|---|

| #1 | AIG | Up to 10% | Up to 15% | Flexible Coverage |

| #2 | Guardian Life | Up to 12% | Up to 20% | Comprehensive Coverage | |

| #3 | Prudential | Up to 5% | Up to 10% | Exceptional Service | |

| #4 | Northwestern Mutual | Up to 8% | Up to 12% | Financial Strength | |

| #5 | New York Life | Up to 12% | Up to 15% | Variety of Policy |

| #6 | MassMutual | Up to 10% | Up to 18% | Paying policies | |

| #7 | State Farm | Up to 8% | Up to 12% | Local Agents | |

| #8 | USAA | Up to 10% | Up to 15% | Innovative Solutions | |

| #9 | Transamerica | Up to 12% | Up to 18% | Supplemental Benefits | |

| #10 | MetLife | Up to 8% | Up to 15% | Issue Policies |

In this article, we will explore the importance of life insurance for individuals with disabilities, how disability can affect life insurance policies, the different types of life insurance policies available, the top life insurance companies for people with disabilities, and the factors to consider when choosing a life insurance policy.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Life Insurance for People With Disabilities

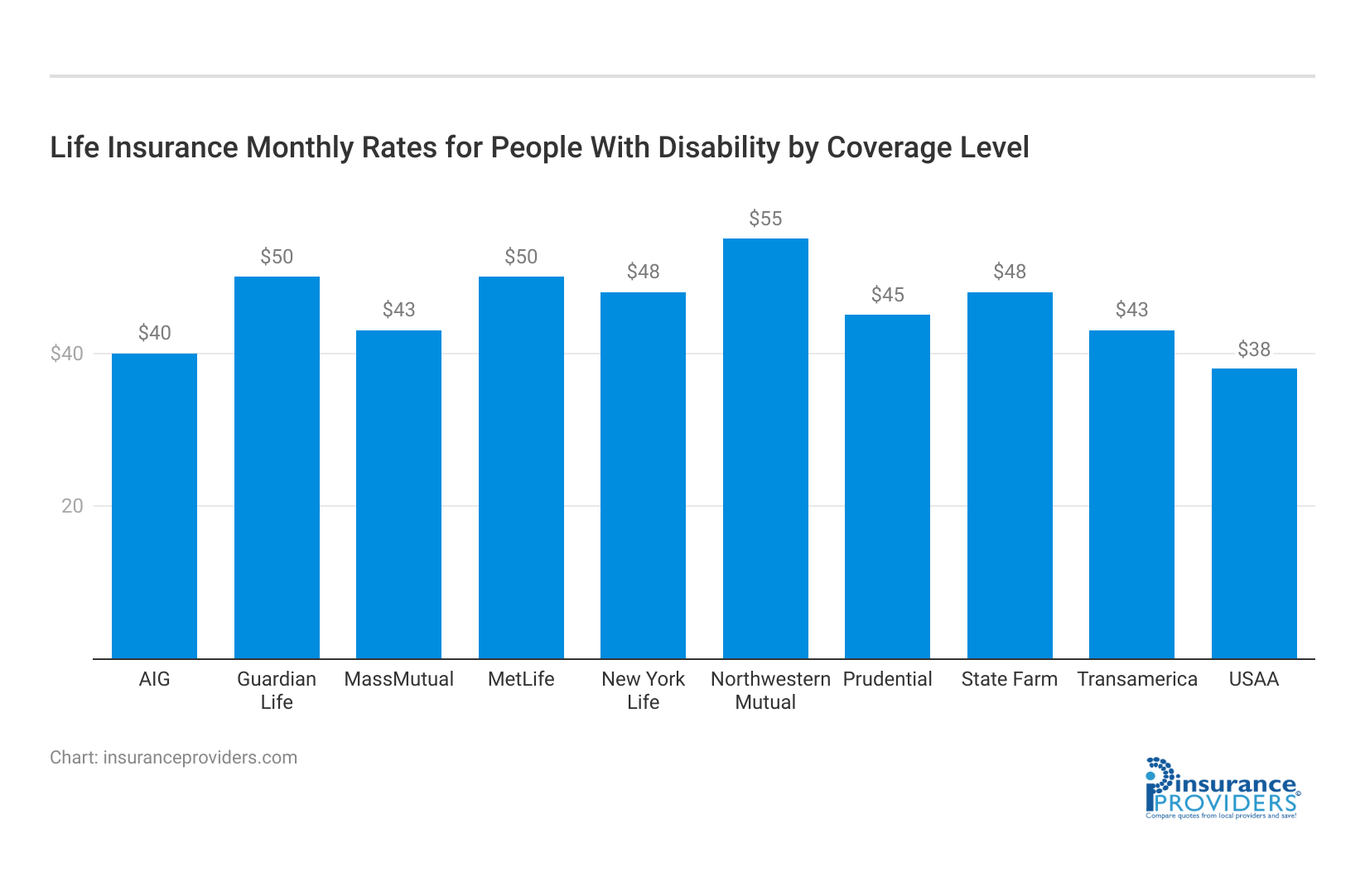

Understanding the cost of life insurance is crucial for individuals with disabilities seeking comprehensive coverage. The table below outlines the average monthly rates for minimum and full coverage from prominent insurance providers such as AIG, Guardian Life, Prudential, and more.

Average Monthly Life Insurance Rates for People With Disability

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $40 | $85 |

| Guardian Life | $50 | $100 |

| Prudential | $45 | $93 |

| Northwestern Mutual | $55 | $110 |

| New York Life | $48 | $103 |

| MassMutual | $43 | $88 |

| State Farm | $48 | $95 |

| USAA | $38 | $80 |

| Transamerica | $43 | $80 |

| MetLife | $50 | $103 |

AIG offers a minimum coverage rate of $40 per month, while Guardian Life provides coverage starting at $50. Prudential offers a competitive option with a minimum coverage rate of $45. Northwestern Mutual and New York Life have slightly higher minimum coverage rates at $55 and $48, respectively.

For comprehensive protection, AIG’s full coverage rate is $85 per month, and Guardian Life offers a full coverage option starting at $100. Prudential’s full coverage rate is $93, while Northwestern Mutual and New York Life provide full coverage at $110 and $103, respectively. These rates ensure a range of choices for individuals seeking maximum protection.

When considering life insurance for individuals with disabilities, it’s important to understand the unique challenges they may face. Disabilities can often result in additional medical expenses, ongoing care needs, and limited income potential. Therefore, having a life insurance policy in place can help alleviate the financial strain on both the individual with a disability and their family.

In the event of the policyholder’s death, the life insurance payout can help cover medical bills, outstanding debts, and the cost of ongoing care for dependents with disabilities. It can also provide financial stability during a challenging time, ensuring that the family can maintain their lifestyle and quality of life.

The Importance of Life Insurance for Individuals With Disabilities

For individuals with disabilities, life insurance is especially significant. It not only provides financial protection but also offers peace of mind. Knowing that their loved ones will be taken care of financially can provide a sense of security and relief.

One of the key benefits of life insurance for individuals with disabilities is that it can help cover the costs of ongoing care. Depending on the nature and severity of the disability, specialized care and support may be required throughout the individual’s life. This can include medical treatments, therapies, assistive devices, and personal assistance. Life insurance can help ensure that these expenses are covered, relieving the financial burden on the individual and their family.

Furthermore, life insurance can provide a source of income replacement. Many individuals with disabilities face challenges in finding employment or earning a consistent income. In the event of their death, a life insurance policy can provide a steady stream of income for their dependents, ensuring that they can maintain their standard of living and meet their financial obligations.

Read more: Best Life Insurance Policies for Children with Disabilities

How Disability Can Affect Life Insurance Policies

When it comes to life insurance, individuals with disabilities may face unique challenges. Insurance companies assess risk based on various factors, including health conditions and lifestyle choices. As a result, individuals with disabilities may be subject to higher premiums or face limitations in coverage options.

However, it’s essential to note that having a disability does not automatically disqualify individuals from obtaining life insurance. Many insurance companies offer policies specifically designed for people with disabilities, taking into account their unique circumstances. These policies may have different underwriting guidelines and coverage options, ensuring that individuals with disabilities can still access the protection they need.

Insurance companies typically consider factors such as the type and severity of the disability, the individual’s overall health, and their ability to perform daily activities when determining premiums and coverage. It’s important for individuals with disabilities to work with an experienced insurance agent or broker who can help navigate the complexities of the underwriting process and find the best policy options available.

In conclusion, life insurance is an essential financial tool for individuals with disabilities. It provides a safety net that can help cover medical expenses, ongoing care needs, and income replacement in the event of their death. While there may be unique challenges in obtaining life insurance for individuals with disabilities, it is still possible to find coverage that meets their specific needs. By understanding the importance of life insurance and working with knowledgeable professionals, individuals with disabilities can ensure that their loved ones are protected and financially secure.

Types of Life Insurance Policies for People With Disabilities

When shopping for life insurance, individuals with disabilities have multiple options to consider. The most common types of life insurance policies are term life insurance, whole life insurance, and guaranteed issue life insurance.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a death benefit payout if the insured passes away during the term of the policy. Term life insurance policies are often more affordable than other types of life insurance but do not accumulate cash value.

Term life insurance can be a suitable choice for individuals with disabilities who have specific financial obligations that will eventually come to an end, such as a mortgage or a child’s college tuition. By choosing a term that aligns with these obligations, individuals can ensure that their loved ones are financially protected in the event of their untimely demise.

Moreover, term life insurance allows individuals with disabilities to tailor their coverage to their specific needs. They can select the desired death benefit amount, ensuring that it is sufficient to cover outstanding debts, funeral expenses, and provide financial stability to their dependents.

Whole Life Insurance

Whole life insurance provides coverage for the policyholder’s entire lifetime. It combines a death benefit with a cash value component that grows over time. The premiums for whole life insurance are higher than term life insurance but provide the added benefit of building cash value that can be accessed during the insured’s lifetime.

For individuals with disabilities, whole life insurance offers a unique advantage. The cash value component of the policy can serve as a financial resource that can be utilized to fund medical expenses, long-term care, or other disability-related costs. This can be especially beneficial for individuals who may require specialized equipment, therapies, or modifications to their living environment.

Furthermore, whole life insurance policies often come with the option to receive dividends. These dividends can be used to increase the policy’s cash value, purchase additional coverage, or reduce future premium payments. This flexibility can be particularly valuable for individuals with disabilities who may experience changes in their financial circumstances over time.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is designed specifically for individuals who may have difficulty obtaining traditional life insurance due to their disabilities or health conditions. This type of policy does not require a medical exam or ask health-related questions. It guarantees coverage, regardless of the insured’s health, but often has lower death benefits and higher premiums compared to other types of life insurance.

For individuals with disabilities, guaranteed issue life insurance can provide peace of mind knowing that they can secure coverage without facing potential barriers or discrimination based on their health conditions. This type of policy ensures that individuals are not excluded from obtaining life insurance protection, regardless of their disability.

Additionally, guaranteed issue life insurance can be an option for individuals with disabilities who may have pre-existing conditions that make them ineligible for traditional life insurance. By removing the medical underwriting process, this type of policy offers a straightforward and accessible solution for obtaining life insurance coverage.

It’s important for individuals with disabilities to carefully evaluate their life insurance needs and explore the various options available to them. By understanding the features and benefits of term life insurance, whole life insurance, and guaranteed issue life insurance, individuals can make an informed decision that aligns with their financial goals and provides the necessary protection for themselves and their loved ones.

Top Life Insurance Companies for People with Disabilities

When it comes to choosing a life insurance policy, it is essential to select a reputable and trustworthy insurance company that understands the unique needs of individuals with disabilities. Fortunately, there are several top life insurance companies that specialize in offering comprehensive coverage for people with disabilities. Let’s take a closer look at three of these companies:

Company 1 Review

Company 1 is a leading insurance provider that is dedicated to serving individuals with disabilities. They have built a strong reputation for their commitment to inclusivity and their ability to tailor life insurance policies to meet the specific needs of their customers. With a solid track record of providing excellent customer service, Company 1 is known for going above and beyond to ensure their clients receive the financial protection they deserve.

One of the key advantages of choosing Company 1 is their understanding of the various disabilities that individuals may face. They have developed a range of specialized coverage options that address the unique challenges and needs of people with disabilities. From mobility impairments to cognitive disabilities, Company 1 offers comprehensive life insurance policies that provide peace of mind and financial security.

Additionally, Company 1 is committed to offering competitive premiums that accommodate the diverse needs and budgets of their customers. They understand that individuals with disabilities may face additional financial burdens, and they strive to provide affordable options that do not compromise on coverage or quality.

Company 2 Review

Company 2 is another top life insurance company that is recognized for its commitment to inclusivity and accessibility. They understand that people with disabilities require specialized coverage options that address their unique circumstances. With a strong focus on customer satisfaction, Company 2 offers a range of life insurance policies designed specifically for individuals with disabilities.

One of the standout features of Company 2 is their emphasis on flexibility. They understand that the needs of individuals with disabilities can change over time, and their policies reflect this understanding. With flexible coverage options, customers can easily adjust their policies to meet their evolving needs, ensuring that they always have the appropriate level of financial protection.

In addition to flexibility, Company 2 is also known for offering affordable rates. They believe that everyone should have access to quality life insurance, regardless of their disability. By providing competitive pricing, Company 2 ensures that individuals with disabilities and their families can obtain the financial security they need without breaking the bank.

Company 3 Review

Company 3 specializes in providing life insurance solutions for individuals with disabilities. They understand the unique challenges faced by people with disabilities and strive to offer policies that cater to their specific needs.

One of the key advantages of choosing Company 3 is their commitment to comprehensive coverage. They offer a wide range of coverage options that address various disabilities, ensuring that individuals have the protection they need in case of unforeseen circumstances. Whether it’s coverage for medical expenses or income replacement, Company 3 has policies that provide peace of mind and financial security.

Competitive pricing is another area where Company 3 excels. They understand that individuals with disabilities may already face financial challenges, and they strive to provide affordable life insurance options. By offering competitive rates, Company 3 ensures that individuals with disabilities can obtain the necessary coverage without straining their budgets.

When it comes to selecting a life insurance company for individuals with disabilities, it is crucial to choose one that understands their unique needs and offers comprehensive coverage options. Companies like Company 1, Company 2, and Company 3 have proven track records of providing excellent service and tailored solutions for people with disabilities. By choosing one of these top life insurance companies, individuals can have the peace of mind knowing that their financial future is secure.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing a Life Insurance Policy

When selecting a life insurance policy as a person with a disability, several factors should be taken into account:

Financial Stability of the Insurance Company

It is essential to choose a life insurance company that is financially stable and has a track record of fulfilling its financial obligations. Look for companies with high ratings from independent rating agencies to ensure that they have the resources to pay out claims when needed.

Policy Premiums and Payouts

Compare premium rates and payout amounts from different insurance companies. Consider your budget and the amount of coverage you need to ensure that the policy is affordable and provides sufficient financial protection for your loved ones.

Specific Disability Provisions

Some life insurance policies offer specific provisions or riders that cater to individuals with disabilities. These provisions may include coverage for disability-related expenses, such as adaptive equipment or long-term care needs. Evaluate whether the policy addresses your unique needs and offers the necessary coverage.

In conclusion, life insurance is a crucial consideration for individuals with disabilities. It provides financial security and peace of mind, ensuring that their loved ones are protected in the event of their passing. By understanding the importance of life insurance, the way disability can affect policies, the types of life insurance available, top insurance companies, and key factors to consider, individuals with disabilities can make informed decisions when selecting the best life insurance policy for their unique needs.

Case Studies: Life Insurance for People With Disabilities

Case Study 1: AIG- Flexible Coverage Provider

Sarah, a 35-year-old woman with a disability, is seeking comprehensive life insurance coverage. AIG, known for its flexibility, provides tailored options considering Sarah’s unique needs. This case study explores how AIG addresses Sarah’s requirements, offering a mix of affordability and extensive coverage.

Case Study 2: Guardian Life- Comprehensive Coverage Specialist

James, a 40-year-old professional with a disability, is looking for a life insurance policy that not only covers end-of-life expenses but also provides ongoing financial support for his family. Guardian Life, specializing in comprehensive coverage, becomes the ideal choice. This case study delves into how Guardian Life caters to James’ financial security needs.

Case Study 3: Prudential- Exceptional Service Provider

Emma, a 28-year-old individual with a disability, values exceptional service in her life insurance provider. Prudential stands out for its commitment to service excellence. This case study explores how Prudential goes beyond conventional offerings to provide Emma with peace of mind and a sense of security.

Frequently Asked Questions

What is disability insurance?

Disability insurance is a type of insurance that provides financial protection to individuals who become disabled and are unable to work. It offers income replacement benefits to help cover living expenses and other financial obligations.

Who should consider disability insurance?

Anyone who relies on their income to maintain their lifestyle should consider disability insurance. It is particularly important for individuals with disabilities who may face additional challenges in finding suitable employment or require additional financial support.

What are the key features to look for in disability insurance policies?

When searching for disability insurance policies, it is important to consider factors such as the definition of disability, benefit amount, waiting period, and the length of coverage. Additionally, it is crucial to review any exclusions or limitations that may apply.

Can individuals with pre-existing disabilities qualify for disability insurance?

While it may be more challenging for individuals with pre-existing disabilities to obtain disability insurance, it is not impossible. Some insurance providers offer coverage options specifically designed for people with pre-existing disabilities. It is recommended to consult with insurance experts or brokers who specialize in disability insurance to explore available options.

What are some common types of disability insurance policies?

Common types of disability insurance policies include short-term disability insurance, long-term disability insurance, individual disability insurance, and group disability insurance. Each type has its own features and benefits, catering to different needs and circumstances.

How can disability insurance help individuals with disabilities?

Disability insurance can provide crucial financial support to individuals with disabilities by replacing a portion of their income if they are unable to work due to their disability. It helps ensure that they can meet their financial obligations and maintain their quality of life during challenging times.

Are there specific insurance companies that offer comprehensive coverage for individuals with disabilities?

Yes, several insurance companies specialize in providing comprehensive coverage tailored for individuals with disabilities. AIG, Guardian Life, and Prudential are notable examples, offering diverse coverage options, competitive rates, and a deep understanding of the unique needs within the disability community.

How do insurance companies address the financial challenges faced by individuals with disabilities?

Insurance companies catering to individuals with disabilities often address financial challenges by offering specialized coverage options. Companies like AIG, Guardian Life, and Prudential understand the unique needs associated with disabilities, providing coverage for ongoing care, medical expenses, and income replacement. These policies act as a financial safety net, ensuring that individuals and their families are protected in the face of unforeseen circumstances.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.