Pruco Life Insurance Company Review (2025)

Embark on financial security with Pruco Life Insurance Company, offering diverse coverage options, competitive rates, and customizable policies for your family's future and peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we delve into Pruco Life Insurance Company, an established and reputable insurance provider with a rich history dating back to 1875. Pruco offers a diverse array of life insurance products, including term, whole, universal, and variable life policies, tailored to meet the unique needs of individuals and families.

Recognized for its unwavering financial stability and high customer satisfaction, Pruco stands out as a trusted choice for those seeking lifelong financial security. We explore the advantages of choosing Pruco, from competitive rates to customizable policies, and guide readers through the process of applying for coverage.

With a focus on clarity and accessibility, this article is a valuable resource for anyone considering Pruco Life Insurance Company for their insurance needs.

What You Should Know About Pruco Life Insurance Company

Rates: Pruco Life Insurance Company’s rates are competitive and vary based on individual factors, ensuring personalized and affordable coverage options for policyholders.

Discounts: Pruco provides a spectrum of discounts, offering policyholders opportunities to tailor coverage to their unique needs while enjoying potential savings, enhancing the overall value of their insurance products.

Complaints/Customer Satisfaction: Pruco demonstrates a commitment to customer satisfaction, with positive feedback outweighing complaints, showcasing their dedication to providing excellent service and addressing customer concerns promptly.

Claims Handling: Pruco prioritizes a hassle-free claims process, offering multiple convenient avenues for filing claims and striving to expedite processing times, ensuring policyholders receive timely assistance during challenging circumstances. Positive customer feedback reflects Pruco’s reliability and customer-centric approach in handling claims.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pruco Life Insurance Company Insurance Coverage Options

Pruco Life Insurance Company and its comprehensive range of insurance coverage options. From term life insurance to whole life, universal life, and variable life policies, Pruco offers a diverse array of solutions designed to meet your unique needs. Here is a bullet list that discusses the coverage options offered by Pruco Life Insurance Company:

- Term Life Insurance: Provides affordable coverage for a specified period, offering financial protection to your loved ones during that time.

- Whole Life Insurance: Ensures lifelong coverage and includes a cash value component that can grow over time, providing both protection and a potential source of savings.

- Universal Life Insurance: Offers flexibility in premium payments and death benefit options, allowing you to adjust your coverage as your needs change.

- Variable Life Insurance: Allows policyholders to invest in their policy by offering a range of investment options, potentially increasing the policy’s cash value and death benefit.

Pruco Life Insurance Company’s insurance coverage options, one thing becomes abundantly clear: the power of choice in securing your financial future. These coverage options cater to different financial goals and needs, providing individuals and families with the flexibility to choose the insurance that best suits their circumstances.

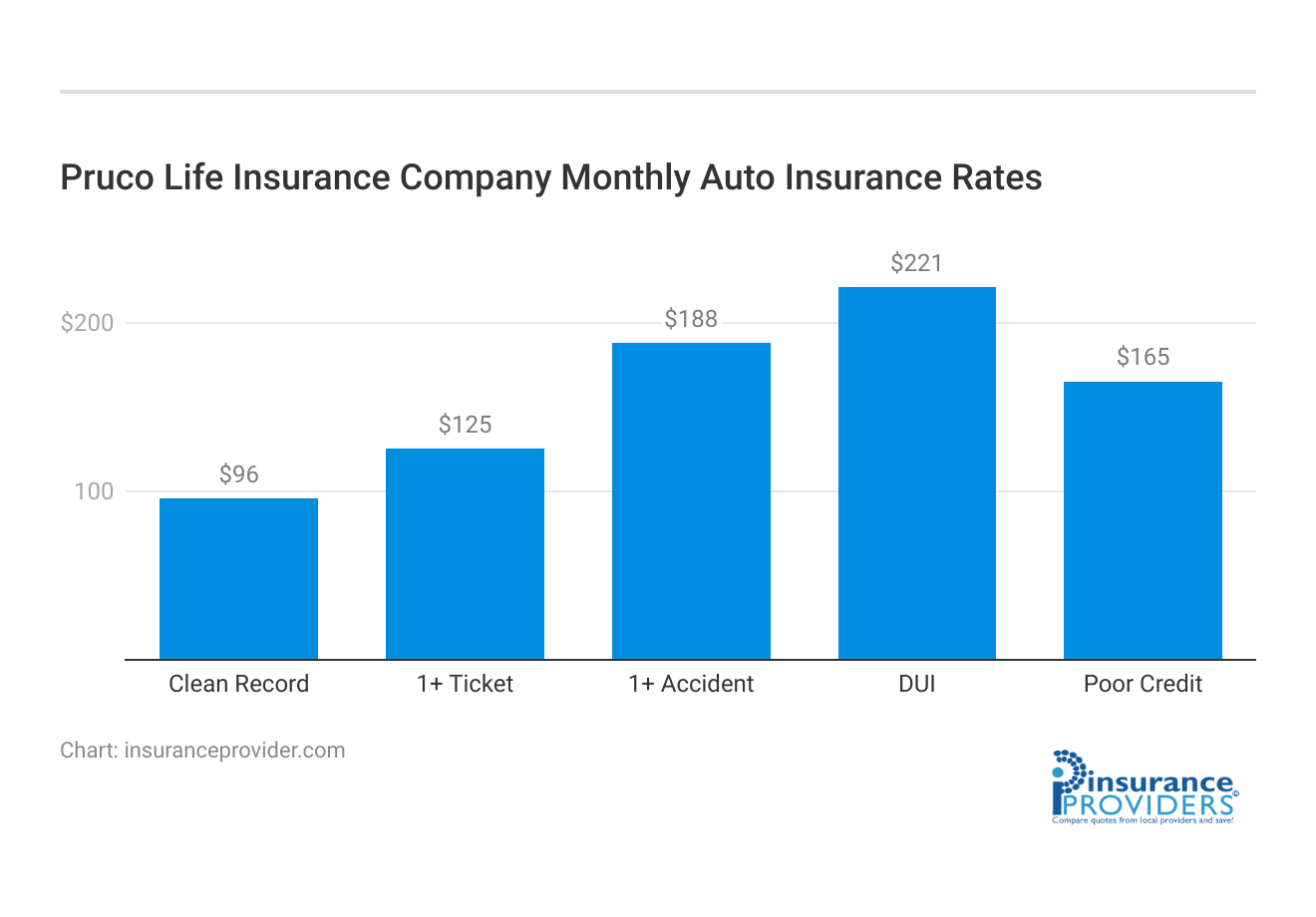

Pruco Life Insurance Company Insurance Rates Breakdown

| Driver Profile | Pruco Life Insurance | National Average |

|---|---|---|

| Clean Record | $96 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $188 | $173 |

| DUI | $221 | $209 |

| Poor Credit | $165 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Pruco Life Insurance Company Discounts Available

| Discounts | Pruco Life Insurance |

|---|---|

| Anti Theft | 19% |

| Good Student | 16% |

| Low Mileage | 18% |

| Paperless | 8% |

| Safe Driver | 28% |

| Senior Driver | 14% |

Let’s unveil the diverse range of discounts available with Pruco, providing you with insights into how you can maximize the value of your life insurance policy. Discounts in the context of life insurance might include:

- Multi-Policy Discount: Some insurance companies offer discounts if you bundle life insurance with other insurance products, such as home or auto insurance.

- Non-Smoker Discount: Insurance providers often offer lower premiums to individuals who do not smoke or use tobacco products.

- Healthy Lifestyle Discount: Some insurers may provide discounts to policyholders who maintain a healthy lifestyle, such as regular exercise and a balanced diet.

- Safe Hobbies Discount: Engaging in safe hobbies and activities may lead to lower premiums.

- Group Coverage Discount: Employers or organizations sometimes offer group life insurance coverage to employees or members at a discounted rate.

As our journey through Pruco Life Insurance Company’s available discounts comes to an end, we are reminded of the importance of smart financial planning and protection. Pruco offers not only a spectrum of life insurance options but also opportunities to tailor your coverage to your unique needs while enjoying potential savings.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Pruco Life Insurance Company Ranks Among Providers

When it comes to securing your financial future and protecting your loved ones, choosing the right life insurance provider is paramount. In this comprehensive exploration, we embark on a journey to understand how Pruco Life Insurance Company ranks among insurance providers. Here are some of the main competitors that Prudential typically faces:

- Metlife: Metlife is one of the largest life insurance companies in the United States and offers various life insurance products, including term life, whole life, and universal life policies.

- New York Life Insurance Company: New York Life is one of the oldest and largest mutual life insurance companies in the country, providing a wide range of life insurance and financial products.

- Northwestern Mutual: Known for its financial planning services, Northwestern Mutual offers life insurance, disability income insurance, and investment products.

- Massmutual: Massachusetts Mutual Life Insurance Company, or MassMutual, provides life insurance, retirement planning, and investment solutions to individuals and businesses.

- Lincoln Financial Group: Lincoln Financial Group offers life insurance, annuities, and retirement solutions, competing in both individual and group markets.

- AIG (American International Group): AIG offers a broad spectrum of insurance products, including life insurance, and is known for its global presence.

- State Farm: State Farm is a leading provider of individual life insurance policies and is known for its extensive network of insurance agents.

- Guardian Life Insurance: Guardian Life Insurance Company offers life, disability, and dental insurance, along with employee benefits and retirement products.

- Primerica: Primerica focuses on term life insurance and financial services, often selling its policies through a network of independent representatives.

- Transamerica: Transamerica offers a range of insurance and investment products, including term life, whole life, and retirement solutions.

As we conclude our exploration of Pruco Life Insurance Company’s rankings among providers, it becomes evident that their commitment to financial stability, diverse range of coverage options, and unwavering dedication to customer satisfaction set them apart.

Read more: Primerica Life Insurance Company Review

Made Easy Claims Process for Pruco Life Insurance Company

Ease of Filing a Claim

Pruco Life Insurance Company understands the importance of a hassle-free claims process. They offer multiple convenient avenues for filing a claim, ensuring that policyholders can choose the method that suits them best.

Whether you prefer the convenience of online submissions, the personal touch of over-the-phone assistance, or the efficiency of mobile apps, Pruco has you covered.

Average Claim Processing Time

Time is of the essence when it comes to insurance claims. Pruco strives to expedite the claim processing procedure to minimize any additional stress during difficult times. We’ll explore Pruco’s average claim processing time to give you a better understanding of how quickly you can expect to receive assistance when it’s needed most.

Customer Feedback on Claim Resolutions and Payouts

The true measure of an insurance company’s commitment to its policyholders lies in the satisfaction of those who have made claims. We’ll delve into customer feedback and testimonials to gauge how Pruco Life Insurance Company performs when it comes to resolving claims and disbursing payouts.

Real-world experiences provide valuable insights into the company’s reliability and customer-centric approach.

Digital and Technological Features for Pruco Life Insurance Company

Mobile App Features and Functionality

In today’s digital age, having a robust mobile app can greatly enhance the insurance experience. Pruco recognizes this and has invested in creating a user-friendly mobile app that offers a range of features and functionalities. We’ll explore what the app has to offer, from policy management to claims tracking, ensuring that you have the information you need at your fingertips.

Online Account Management Capabilities

Convenience and accessibility are paramount when managing your insurance policies. Pruco provides an online portal for policyholders to manage their accounts efficiently.

We’ll examine the online account management capabilities, including policy updates, premium payments, and document retrieval, to assess how Pruco makes it easy for customers to stay in control of their coverage.

Digital Tools and Resources

In addition to a mobile app and online account management, Pruco offers various digital tools and resources to empower policyholders in making informed decisions. These resources could include educational materials, calculators, and interactive features.

We’ll delve into the digital tools and resources Pruco provides to help you navigate the complexities of life insurance and financial planning.

Frequently Asked Questions

What types of life insurance does Pruco Life Insurance Company offer?

Pruco Life Insurance Company provides a comprehensive range of life insurance products, including term life, whole life, universal life, and variable life policies, tailored to meet the unique needs of individuals and families.

How does Pruco Life Insurance Company rank among other insurance providers?

Pruco stands out for its unwavering financial stability, high customer satisfaction, and a diverse array of coverage options, making it a trusted choice for those seeking lifelong financial security.

What is the average monthly rate for healthy individuals with Pruco Life Insurance Company?

The average monthly rate varies based on factors such as coverage type and individual health, and the rates are determined by considering both minimum and full coverage options for a 45-year-old male driver.

How does Pruco simplify the claims process for policyholders?

Pruco Life Insurance Company prioritizes a hassle-free claims process, offering multiple convenient avenues for filing claims, including online submissions, over-the-phone assistance, and efficient mobile apps, ensuring flexibility for policyholders.

What digital tools and resources does Pruco provide for policyholders?

Pruco recognizes the importance of digital convenience and offers a user-friendly mobile app, online account management capabilities, and various digital tools and resources, empowering policyholders to make informed decisions and manage their coverage efficiently.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.