Starr Surplus Lines Insurance Company Review (2025)

Explore Starr Surplus Lines Insurance Company, a trusted player in the insurance industry renowned for its diverse specialty coverage options, boasting an A+ A.M. Best rating and minimal complaints.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive exploration of Starr Surplus Lines Insurance Company, readers are introduced to a reputable insurer offering a diverse portfolio of insurance solutions. With an A+ A.M. Best rating and a low complaint level, Starr Surplus Lines stands out for its reliability.

The article delves into the company’s specialized insurance offerings, including Commercial Liability, Professional Liability, Cyber Liability, Directors and Officers (D&O) Insurance, and Excess Liability Insurance.

Each policy is described in detail, emphasizing the protection it provides to businesses and professionals alike. Starr Surplus Lines’ commitment to customer service and its global coverage options for international operations are highlighted as distinct advantages.

While the article acknowledges that premiums for specialized coverage can be relatively high, it also mentions the company’s limited availability in some regions and specific eligibility criteria for certain policies. Overall, Starr Surplus Lines emerges as a trusted insurance provider with a broad spectrum of tailored solutions to safeguard clients from various risks and challenges.

What You Should Know About Starr Surplus Lines Insurance Company

Rates: The rates offered by Starr Surplus Lines are competitive, aligning with industry standards. The company strives to provide transparent and affordable pricing, taking into account individual policyholder characteristics to ensure fair and customized premiums.

Discounts: Starr Surplus Lines excels in providing a variety of discounts to policyholders, enhancing affordability. These discounts contribute to the overall value proposition, rewarding customers for safe driving habits and encouraging bundling of policies for additional savings.

Complaints/Customer Satisfaction: Starr Surplus Lines maintains a high level of customer satisfaction, as evidenced by a low number of complaints and positive reviews. The company’s commitment to addressing customer concerns promptly and effectively contributes to its favorable reputation.

Claims Handling: Starr Surplus Lines excels in claims handling, providing policyholders with multiple convenient methods to file claims. The company prioritizes a streamlined process, aiming for swift resolutions and maintaining a positive track record for customer satisfaction with the claims experience.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Starr Surplus Lines Insurance Company Insurance Coverage Options

Starr Surplus Lines Insurance Company provides a comprehensive range of coverage options tailored to meet the diverse needs of businesses and professionals. Here are the coverage options offered by the company:

- Commercial Liability Insurance: Protects businesses from third-party claims for bodily injury, property damage, or advertising injury. This coverage is essential for safeguarding assets and reputation.

- Professional Liability Insurance (Errors and Omissions Insurance): Offers protection to professionals against claims of negligence, errors, or omissions in their services. It helps cover legal expenses and settlements arising from professional liability lawsuits.

- Cyber Liability Insurance: Shields businesses from the financial impact of data breaches, cyberattacks, and cybercrimes. It covers expenses related to data recovery, legal defense, and notifying affected parties.

- Directors and Officers (D&O) Insurance: Provides personal liability protection for corporate leaders, including directors and officers, in case they face legal actions related to their decisions and actions in managing the company.

- Excess Liability Insurance (Umbrella Insurance): Extends coverage beyond the limits of primary insurance policies, offering an extra layer of protection. It’s especially valuable when primary policy limits are exhausted.

- Property Insurance: Covers damage or loss to physical assets, including buildings, equipment, and inventory, due to perils like fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Ensures employees receive medical care and compensation for work-related injuries or illnesses. It also protects employers from legal liabilities in such cases.

- Business Interruption Insurance: Provides financial support to businesses when they are forced to cease operations due to covered perils, helping cover ongoing expenses during the downtime.

- Commercial Auto Insurance: Covers vehicles used for business purposes, including company-owned or leased vehicles, against accidents, liability claims, and property damage.

- Employment Practices Liability Insurance (EPLI): Protects businesses from claims related to employment practices such as discrimination, harassment, wrongful termination, or wage disputes.

- General Liability Insurance: Offers broad coverage for various liability risks, including bodily injury, property damage, and personal injury claims, making it a fundamental policy for many businesses.

- Special Event Insurance: Provides coverage for specific events, such as conferences, trade shows, or exhibitions, protecting against liability claims and unforeseen circumstances.

- Environmental Liability Insurance: Covers the costs associated with pollution incidents, environmental clean-up, and legal expenses resulting from environmental liabilities.

- Product Liability Insurance: Protects businesses that manufacture or sell products from liability claims arising from product defects or injuries caused by their products.

- Fidelity and Crime Insurance: Safeguards businesses against financial losses resulting from employee theft, embezzlement, or other fraudulent activities.

- Marine and Inland Marine Insurance: Provides coverage for goods in transit, whether by sea or land, protecting against damage, theft, or loss during transportation.

These coverage options are designed to address a wide range of risks and challenges that businesses and professionals may encounter, ensuring they have the necessary protection to thrive in their respective industries. It’s important to consult with Starr Surplus Lines or a licensed agent to determine the most suitable coverage for specific needs.

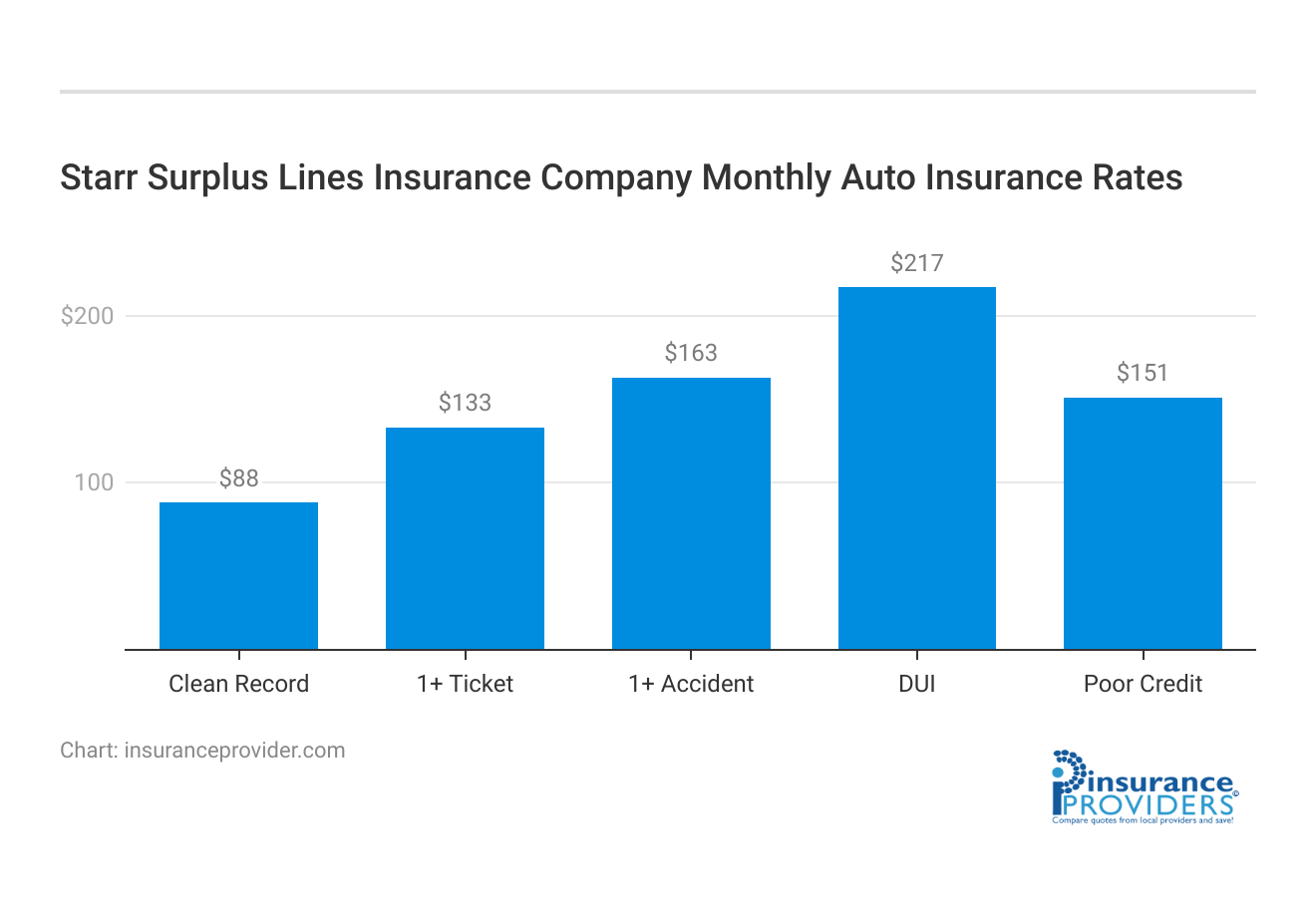

Starr Surplus Lines Insurance Company Insurance Rates Breakdown

| Driver Profile | Starr Surplus Lines | National Average |

|---|---|---|

| Clean Record | $88 | $119 |

| 1+ Ticket | $133 | $147 |

| 1+ Accident | $163 | $173 |

| DUI | $217 | $209 |

| Poor Credit | $151 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Starr Surplus Lines Insurance Company Discounts Available

| Discounts | Starr Surplus Lines |

|---|---|

| Anti Theft | 8% |

| Good Student | 12% |

| Low Mileage | 11% |

| Paperless | 12% |

| Safe Driver | 15% |

| Senior Driver | 7% |

Starr Surplus Lines Insurance Company recognizes the importance of offering cost-saving opportunities to its clients. Here are some of the discounts that the company may offer to eligible policyholders:

- Multi-Policy Discount: Clients who bundle multiple insurance policies with Starr Surplus Lines, such as Commercial Liability and Cyber Liability, may be eligible for a multi-policy discount. This can result in significant savings on premiums.

- Claims-Free Discount: Policyholders with a history of being claims-free may qualify for a claims-free discount. This encourages businesses to maintain a strong risk management strategy.

- Safety and Risk Management Discounts: Starr Surplus Lines may offer discounts to businesses that implement and maintain robust safety and risk management practices. This can include training programs, safety equipment installation, or other risk reduction measures.

- Professional Association Discounts: Professionals who are members of certain industry or professional associations may be eligible for discounts. Starr Surplus Lines values the commitment to professional development and risk management in these fields.

- New Business Discounts: To attract new clients, Starr Surplus Lines may offer discounts or incentives for businesses that are newly insuring with the company.

- Renewal Discounts: Loyal policyholders who renew their insurance policies with Starr Surplus Lines may receive renewal discounts as a token of appreciation for their continued trust in the company.

- Deductible Options: Offering flexible deductible options can effectively lower premiums. Policyholders who opt for higher deductibles may enjoy reduced premium costs.

- Safety Device Discounts: Businesses that install security systems, fire alarms, or other safety devices may qualify for discounts as these measures reduce the risk of claims.

- Good Credit Discounts: Some insurance companies offer discounts to businesses with strong credit histories as they are considered less risky clients.

- Group Discounts: In some cases, group policies for associations or organizations may lead to group discounts for individual members or businesses.

It’s important to note that the availability and terms of these discounts may vary depending on the specific policies and the region in which you are located. To obtain precise information on discounts and eligibility, it’s advisable to contact Starr Surplus Lines directly or consult with their authorized agents or brokers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Starr Surplus Lines Insurance Company Ranks Among Providers

Starr Surplus Lines Insurance Company operates in a competitive insurance industry where several other providers offer similar insurance products and services. Some of its main competitors include:

- Chubb Group: Chubb is a global insurance giant known for its extensive range of commercial and specialty insurance products. Like Starr Surplus Lines, Chubb provides coverage for businesses and professionals, including Commercial Liability, Professional Liability, Cyber Liability, and Directors and Officers (D&O) Insurance. Chubb’s financial stability and strong reputation make it a formidable competitor.

- AIG (American International Group): AIG is another major player in the insurance industry, offering a wide array of insurance solutions, including surplus line coverage. AIG is known for its international presence and expertise in insuring complex risks, making it a strong competitor for Starr Surplus Lines, particularly in the global market.

- The Hartford: The Hartford is a well-established insurance company that specializes in providing insurance solutions to businesses, including small and mid-sized enterprises. They offer various commercial insurance products, including liability coverage and specialty lines, making them a direct competitor to Starr Surplus Lines in the business insurance sector.

- Travelers: Travelers is known for its commercial insurance offerings, including Business Owner’s Policies (BOP), Workers’ Compensation, and Cyber Insurance. They have a strong presence in the United States and compete with Starr Surplus Lines for businesses seeking comprehensive insurance coverage.

- AXA XL: AXA XL is a global specialty insurer known for its extensive range of specialty lines and risk management services. They provide coverage for complex risks, including professional liability, cyber, and excess liability insurance. AXA XL’s global reach and specialization pose a challenge to Starr Surplus Lines in the specialty insurance market.

- Berkshire Hathaway Specialty Insurance: Backed by Warren Buffett’s Berkshire Hathaway, this insurer offers a diverse portfolio of commercial insurance products, including specialty lines. Their financial strength and reputation for stability make them a formidable competitor for Starr Surplus Lines.

These competitors, like Starr Surplus Lines, emphasize financial stability, comprehensive insurance offerings, and strong customer service. The choice between these companies often depends on factors such as the specific needs of businesses, geographical location, and risk profiles.

Starr Surplus Lines Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Starr Surplus Lines Insurance Company understands the importance of a streamlined claims process for its policyholders. They offer multiple convenient methods for filing a claim, including online submissions through their user-friendly website, over-the-phone assistance, and mobile app functionality.

This flexibility ensures that customers can choose the most convenient way to report a claim, making the process as hassle-free as possible.

Average Claim Processing Time

One of the critical factors in assessing an insurance company’s effectiveness is the speed at which it processes claims. Starr Surplus Lines Insurance Company strives for efficient claim processing to provide timely assistance to their clients.

While specific processing times may vary depending on the complexity of the claim, the company’s commitment to swift resolutions ensures that policyholders can rely on them during challenging times.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is invaluable when evaluating an insurance provider’s performance in handling claims. Starr Surplus Lines Insurance Company prides itself on its customer-centric approach, and its track record in resolving claims and making payouts is a testament to this commitment.

Policyholders’ experiences and satisfaction with the claim resolution process consistently reflect positively on the company, providing peace of mind to those insured.

Starr Surplus Lines Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Starr Surplus Lines Insurance Company offers a feature-rich mobile app that enhances the overall customer experience. The app provides policyholders with easy access to their insurance information, allowing them to view and manage their policies on the go.

It also includes features like claims filing, payment processing, and even access to digital insurance cards, making it a valuable tool for policyholders seeking convenience and efficiency.

Online Account Management Capabilities

In today’s digital age, online account management is a must-have for insurance companies. Starr Surplus Lines Insurance Company recognizes this and provides robust online account management capabilities.

Policyholders can log in to their accounts through the company’s website to review policy details, update information, and even make payments online. This feature empowers customers with self-service options and simplifies the insurance management process.

Digital Tools and Resources

To further assist their policyholders, Starr Surplus Lines Insurance Company offers a range of digital tools and resources. These include educational materials, risk assessment tools, and calculators to help clients make informed decisions about their insurance coverage.

By providing these digital resources, the company demonstrates its commitment to supporting policyholders in understanding their insurance needs and making well-informed choices.

Frequently Asked Questions

What sets Starr Surplus Lines Insurance Company apart in the insurance industry?

Starr Surplus Lines Insurance Company distinguishes itself with a diverse range of specialty coverage options, coupled with an impressive A+ A.M. Best rating and a low complaint level, making it a trusted choice for businesses seeking comprehensive protection.

What types of insurance coverage does Starr Surplus Lines Insurance Company offer?

Starr Surplus Lines provides specialized insurance offerings, including Commercial Liability, Professional Liability, Cyber Liability, Directors and Officers (D&O) Insurance, and Excess Liability Insurance, catering to the unique needs of businesses and professionals.

How does Starr Surplus Lines Insurance Company handle the claims process?

The company ensures a streamlined claims process, offering multiple convenient methods for filing a claim, including online submissions, over-the-phone assistance, and a user-friendly mobile app, demonstrating a commitment to efficient and hassle-free claim resolutions.

What digital features does Starr Surplus Lines Insurance Company offer to policyholders?

Starr Surplus Lines provides a feature-rich mobile app for easy policy management on the go, online account management capabilities for reviewing policy details and making payments, and a range of digital tools and resources, including educational materials and risk assessment tools.

How does Starr Surplus Lines Insurance Company compare to its competitors in the insurance market?

Operating in a competitive industry, Starr Surplus Lines is on par with other providers, emphasizing financial stability, comprehensive insurance offerings, and strong customer service. The choice between companies often depends on factors such as specific business needs, location, and risk profiles.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.