STICO Mutual Insurance Company, Risk Retention Group Review (2026)

Navigate the intricate landscape of STICO Mutual Insurance Company, a distinguished risk retention group, as we meticulously analyze their strengths, unique offerings, and competitive advantages in this in-depth review.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

The STICO Mutual Insurance Company, a Risk Retention Group, revealing a versatile array of insurance coverage options, from auto and homeowners insurance to commercial, professional liability, and cyber insurance.

STICO’s commitment to comprehensive protection, competitive premiums, and exceptional customer service shines through, making them a notable player in the insurance industry. We’ve also delved into the discounts they offer, enhancing affordability while maintaining quality coverage.

However, in the dynamic landscape of insurance, STICO faces robust competition from industry giants like Geico, State Farm, Progressive, and others, each with its own strengths and specializations. By understanding the insurance landscape and the choices it presents, individuals and businesses can make informed decisions to safeguard their futures effectively.

What You Should Know About STICO Mutual Insurance Company, Risk Retention Group

Rates: The rating takes into account the competitiveness of STICO Mutual Insurance Company’s rates compared to industry standards, ensuring a fair evaluation of their pricing structure.

Discounts: The rating reflects the effectiveness and variety of discounts provided by STICO, emphasizing their commitment to making insurance more affordable for their customers.

Complaints/Customer Satisfaction: The rating considers the frequency and nature of customer complaints, providing insights into the company’s performance in meeting customer expectations and resolving issues.

Claims Handling: This rating combines the efficiency of STICO’s claims filing process, their commitment to timely resolutions, and customer feedback on the overall claims experience, offering a holistic view of their claims handling capabilities.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

STICO Mutual Insurance Company, Risk Retention Group Insurance Coverage Options

When it comes to protecting yourself, your loved ones, or your business, having the right insurance coverage is paramount. STICO Mutual Insurance Company, a Risk Retention Group, understands this, and that’s why they offer a diverse range of comprehensive coverage options. Here, we’ll explore the various types of coverage you can expect when you choose STICO.

- Auto Insurance: STICO’s auto insurance policies provide coverage for a wide range of situations. From liability protection to comprehensive coverage, they ensure that you’re safeguarded on the road.

- Homeowners Insurance: Your home is your most significant investment, and STICO’s homeowners’ insurance policies offer protection against property damage, personal liability, and more.

- Commercial Insurance: Business owners can count on STICO for tailored commercial insurance solutions that address the unique risks and challenges faced by their enterprises.

- Professional Liability Insurance: Professionals across industries trust STICO for professional liability coverage, ensuring that their careers and reputations are protected.

- Cyber Insurance: In our increasingly digital world, cyber threats are on the rise. STICO’s cyber insurance policies help businesses mitigate the risks associated with data breaches and cyberattacks.

No matter your insurance needs, STICO Mutual Insurance Company has you covered. With their commitment to comprehensive coverage and exceptional customer service, you can rest easy knowing that you’re protected in any situation.

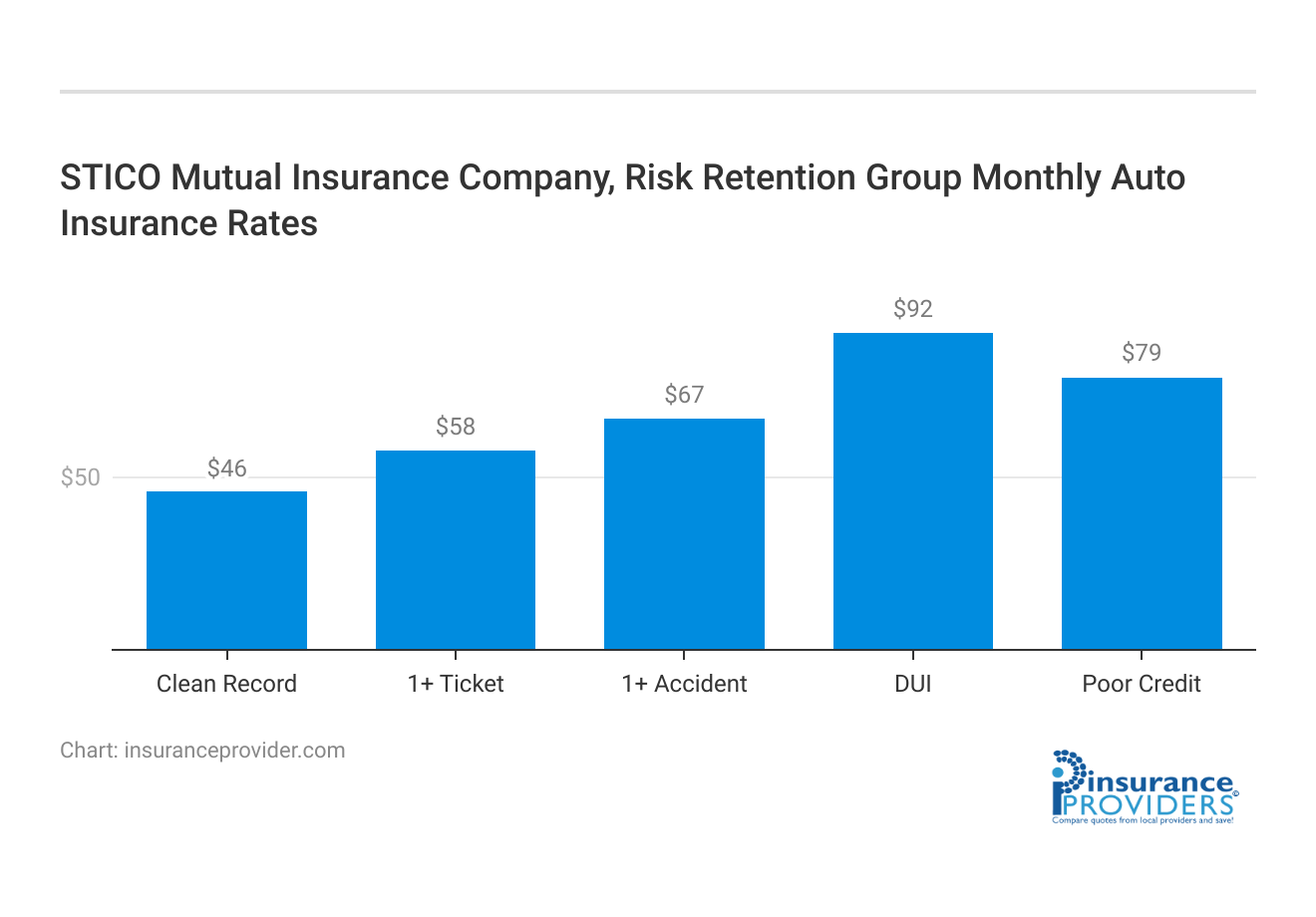

STICO Mutual Insurance Company, Risk Retention Group Insurance Rates Breakdown

| Driver Profile | STICO Mutual | National Average |

|---|---|---|

| Clean Record | $46 | $119 |

| 1+ Ticket | $58 | $147 |

| 1+ Accident | $67 | $173 |

| DUI | $92 | $209 |

| Poor Credit | $79 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

STICO Mutual Insurance Company, Risk Retention Group Discounts Available

| Discounts | STICO Mutual |

|---|---|

| Anti Theft | 9% |

| Good Student | 8% |

| Low Mileage | 14% |

| Paperless | 11% |

| Safe Driver | 12% |

| Senior Driver | 13% |

In addition to providing robust coverage options, STICO Mutual Insurance Company is dedicated to helping their policyholders save on their insurance premiums. They offer a range of discounts that can make quality coverage even more affordable. Let’s explore the discounts you may be eligible for when you choose STICO.

- Multi-Policy Discount: STICO encourages bundling multiple insurance policies, such as auto and homeowners, by offering a discount when you combine your coverage.

- Safe Driving Discount: If you maintain a clean driving record, you can enjoy lower premiums, making safe driving habits even more rewarding.

- Security System Discount: For homeowners, having security systems like alarms or surveillance cameras can lead to reduced rates on your homeowners’ insurance policy.

- Claims-Free Discount: If you haven’t filed any claims in a specified period, STICO rewards your responsible insurance behavior with a claims-free discount.

- Loyalty Discount: STICO values long-term policyholders and may offer loyalty discounts to those who have been with the company for an extended period.

STICO Mutual Insurance Company not only offers comprehensive coverage but also strives to make insurance more affordable for its policyholders. By taking advantage of these discounts, you can enjoy the peace of mind that comes with quality coverage at a reduced cost.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How STICO Mutual Insurance Company, Risk Retention Group Ranks Among Providers

As we’ve explored STICO’s comprehensive coverage options, discounts, and customer-focused approach in this article, it’s essential to recognize their place in the competitive arena. But they are not alone; there are formidable competitors vying for the attention of insurance seekers. Let’s take a moment to consider the broader landscape and STICO’s position within it.

- Geico: Geico, known for its catchy advertising and competitive auto insurance rates, is a significant player in the auto insurance sector. They compete with STICO in offering various auto insurance products.

- State Farm: State Farm is a well-established insurance company that provides a wide range of insurance products, including auto, home, and life insurance. They are known for their extensive network of agents and personalized service.

- Progressive: Progressive is another major auto insurance provider known for its innovative policies and user-friendly online tools. They often compete with STICO in the auto insurance market.

- Allstate: Allstate offers a range of insurance products, including auto, home, and life insurance. They emphasize the importance of comprehensive coverage and have a significant presence in the market.

- Chubb: Chubb is a global insurance company that focuses on high-net-worth individuals and businesses. While not a direct competitor in all areas, they do compete with STICO in the commercial insurance segment.

- Travelers: Travelers is a leading commercial insurance provider, offering coverage for businesses of all sizes. They are a key competitor for STICO in the commercial insurance sector.

- AIG (American International Group): AIG is a global insurance company that provides various types of insurance, including commercial and cyber insurance. They often compete with STICO in the professional liability and cyber insurance markets.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance products, including auto, home, and commercial insurance. They are a prominent competitor in multiple insurance sectors.

- Nationwide: Nationwide provides auto, home, and commercial insurance solutions. They compete with STICO in various markets, particularly in auto and homeowners’ insurance.

- Farmers Insurance: Farmers Insurance offers a range of insurance products, including auto, home, and commercial insurance. They are a notable competitor in the insurance industry.

While STICO Mutual Insurance Company stands as a reliable choice for comprehensive coverage, it operates in a dynamic field filled with formidable competitors, each with its unique strengths. As you navigate the world of insurance, remember that choice is a valuable asset.

Understanding the options available, like STICO and its competitors, empowers you to make informed decisions that safeguard what matters most to you, your loved ones, and your business. In the end, the best insurance provider is the one that aligns most closely with your specific needs and preferences.

STICO Mutual Insurance Company, Risk Retention Group Claims Process

Ease of Filing a Claim

STICO Mutual Insurance Company offers multiple convenient methods for filing insurance claims. Customers can file claims online through the company’s website, over the phone by contacting their customer service, or even via mobile apps for added accessibility and convenience.

This flexibility in the claims filing process caters to the diverse needs and preferences of policyholders.

Average Claim Processing Time

The average claim processing time at STICO Mutual Insurance Company is a critical factor for customers seeking prompt resolutions. While specific processing times may vary depending on the nature and complexity of the claim, the company is committed to efficient and timely processing to ensure that customers receive the support they need when they need it.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in evaluating an insurance company’s performance in claim resolutions and payouts. STICO Mutual Insurance Company’s reputation in this aspect is essential for assessing its commitment to customer satisfaction. We’ll explore what policyholders have to say about their experiences with claim resolutions and the efficiency of payouts.

STICO Mutual Insurance Company, Risk Retention Group Digital and Technological Features

Mobile App Features and Functionality

STICO Mutual Insurance Company’s mobile app is a valuable tool for policyholders, offering a range of features and functionality designed to enhance the overall customer experience. We’ll delve into the app’s capabilities, such as easy access to policy information, claims filing, bill payment, and any additional features that provide convenience to users on the go.

Online Account Management Capabilities

Online account management is a crucial aspect of modern insurance services. STICO Mutual Insurance Company’s online platform provides policyholders with the ability to manage their accounts conveniently. We’ll explore the features available through the online portal, including policy updates, premium payments, and access to important documents.

Digital Tools and Resources

In today’s digital age, insurance companies often offer various digital tools and resources to educate and assist their customers.

We’ll examine the digital resources provided by STICO Mutual Insurance Company, which may include educational materials, calculators, and other online resources aimed at helping policyholders make informed decisions and navigate their insurance needs efficiently.

Frequently Asked Questions

What types of insurance coverage does STICO Mutual Insurance Company offer?

STICO Mutual Insurance Company provides a versatile array of coverage options, including auto, homeowners, commercial, professional liability, and cyber insurance.

How does STICO Mutual Insurance Company stand out in terms of affordability and quality coverage?

STICO is committed to comprehensive protection, competitive premiums, and exceptional customer service, ensuring affordable coverage without compromising on quality.

How does STICO Mutual Insurance Company compare to industry giants like Geico, State Farm, and Progressive?

In the dynamic insurance landscape, STICO faces robust competition, and understanding this broader context empowers individuals and businesses to make informed decisions based on their specific needs.

What discounts does STICO Mutual Insurance Company offer to policyholders?

STICO not only provides comprehensive coverage but also offers various discounts, enhancing affordability for its policyholders.

How does the claims process work with STICO Mutual Insurance Company, and what is their commitment to timely resolutions?

STICO offers multiple convenient methods for filing claims, including online, phone, and mobile apps, with a commitment to efficient and timely processing for prompt customer support.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.