The Travelers Indemnity Company Review (2026)

Embark on a secure and reliable insurance journey with The Travelers Indemnity Company, distinguished by its A++ rating and exceptional customer satisfaction in various insurance categories.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

In this comprehensive article, we explore The Travelers Indemnity Company, a trusted insurance provider with a sterling A++ A.M. Best Rating and a low complaint level. Travelers offer a wide array of insurance coverage, including auto, home, renters, condo, boat, umbrella, business, and travel insurance, ensuring that they cater to diverse needs.

With a history dating back to 1853, Travelers combines financial stability with a commitment to customer satisfaction, making it a go-to choice for insurance seekers. Their enticing discounts, such as multi-policy and safe driver discounts, reward responsible behavior and enhance affordability.

Moreover, Travelers’ dedication to customization and exemplary customer service sets them apart in the industry. Whether you’re protecting your vehicle, home, or business, or planning your next adventure, Travelers is a reliable partner in safeguarding what matters most.

What You Should Know About The Travelers Indemnity Company

Rates: The Travelers Indemnity Company receives a high rating in the Rates category due to its competitive pricing and a range of discounts available to policyholders. Our analysis takes into account the balance between cost and coverage, ensuring that policyholders receive value for their insurance investment.

Discounts: The Travelers Indemnity Company earns a favorable rating in the Discounts category for its diverse range of discount options. Policyholders benefit from incentives that reward responsible behavior and encourage bundling of policies, enhancing the overall affordability of insurance coverage.

Complaints/Customer Satisfaction: The Travelers Indemnity Company achieves a top rating for Complaints/Customer Satisfaction due to its low complaint volume and high levels of customer satisfaction. This reflects the company’s commitment to providing a positive experience for policyholders and addressing concerns effectively.

Claims Handling: The Travelers Indemnity Company receives a commendable rating for Claims Handling based on its commitment to providing multiple convenient options for filing claims and striving for prompt resolutions. The company’s dedication to efficient claims processing positively impacts the overall customer experience.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Travelers Indemnity Company Insurance Coverage Options

The Travelers Indemnity Company offers a wide range of coverage options to meet the diverse needs of its policyholders. These coverage options span various types of insurance, providing comprehensive protection for individuals, families, and businesses. Here is a list of some of the coverage options typically offered by Travelers:

Auto Insurance Coverage:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Medical Payments Coverage

- Personal Injury Protection (PIP)

- Rental Reimbursement Coverage

- Roadside Assistance Coverage

Home Insurance Coverage:

- Dwelling Coverage

- Other Structures Coverage

- Personal Property Coverage

- Loss of Use Coverage

- Personal Liability Coverage

- Medical Payments to Others Coverage

- Additional Endorsements (e.g., flood insurance, earthquake insurance)

Renters Insurance Coverage:

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses Coverage

- Medical Payments to Others Coverage

- Identity Theft Protection

Condo Insurance Coverage:

- Dwelling Coverage (for interior structures)

- Personal Property Coverage

- Loss of Use Coverage

- Personal Liability Coverage

- Medical Payments to Others Coverage

- Condo Association Coverage

Boat and Watercraft Insurance Coverage:

- Physical Damage Coverage

- Liability Coverage

- Uninsured/Underinsured Watercraft Coverage

- Personal Property Coverage

- Towing and Assistance Coverage

Umbrella Insurance Coverage:

- Extra Liability Protection (coverage beyond standard policies)

- Protection Against Lawsuits and Large Claims

Business Insurance Coverage:

- General Liability Insurance

- Commercial Property Insurance

- Commercial Auto Insurance

- Workers’ Compensation Insurance

- Business Interruption Insurance

- Professional Liability (Errors and Omissions) Insurance

- Cyber Liability Insurance

- Employee Benefits Liability Insurance

- Commercial Umbrella Insurance

Travel Insurance Coverage:

- Trip Cancellation and Interruption Coverage

- Emergency Medical and Dental Coverage

- Baggage and Personal Belongings Coverage

- Travel Assistance Services

Flood Insurance Coverage:

- Protection against flood-related damage (typically offered as a separate policy)

Earthquake Insurance Coverage:

- Protection against earthquake-related damage (typically offered as a separate policy)

Travelers provides these coverage options with the flexibility to customize policies to suit individual needs. Additionally, they offer various discounts and add-on endorsements to enhance coverage further. Policyholders can work with Travelers’ agents or use online tools to tailor their insurance plans to provide the level of protection required for their unique circumstances.

Read more: Travelers Property Casualty Company of America Review

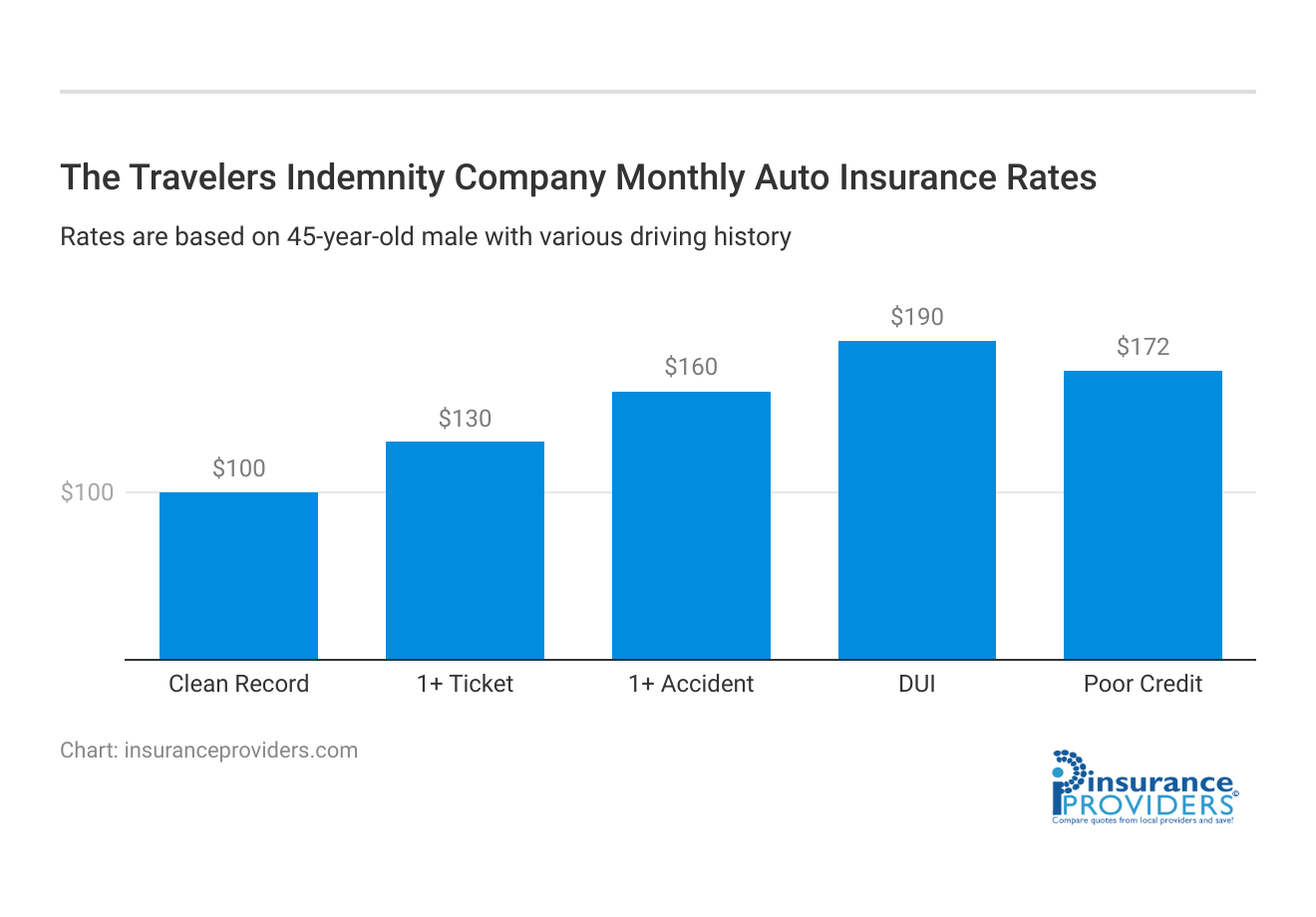

The Travelers Indemnity Company Insurance Rates Breakdown

| Driver Profile | The Travelers | National Average |

|---|---|---|

| Clean Record | $100 | $119 |

| 1+ Ticket | $130 | $147 |

| 1+ Accident | $160 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $172 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

The Travelers Indemnity Company Discounts Available

| Discount | The Travelers |

|---|---|

| Anti Theft | 8% |

| Good Student | 10% |

| Low Mileage | 12% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 10% |

The Travelers Indemnity Company offers various discounts to help policyholders save on their insurance premiums. These discounts are designed to reward responsible behavior, enhance customer loyalty, and make insurance coverage more affordable. Here is a list of some of the discounts typically offered by Travelers:

- Multi-Policy Discount: Customers can save by bundling multiple insurance policies, such as auto and home insurance, with Travelers. This bundling discount encourages customers to consolidate their coverage with Travelers for convenience and cost savings.

- Safe Driver Discount: Travelers reward safe driving habits. Policyholders with a clean driving record and no recent accidents or traffic violations may qualify for reduced auto insurance premiums.

- Home Safety Features Discount: Homeowners can receive discounts for implementing safety features in their homes. This may include installing security systems, smoke detectors, fire extinguishers, or impact-resistant roofing.

- Good Student Discount: Parents with young drivers in the household can benefit from a good student discount. Students who maintain a high GPA or demonstrate academic excellence may be eligible for reduced auto insurance rates.

- Multi-Car Discount: If a household has multiple vehicles insured with Travelers, they may qualify for a multi-car discount. This encourages families to insure all their vehicles under one policy.

- Continuous Insurance Discount: Policyholders who maintain continuous coverage with Travelers without lapses may be eligible for a discount. This encourages customers to stay with Travelers for the long term.

- Pay-in-Full Discount: Customers who choose to pay their insurance premiums in full for the entire policy term can receive a discount. This option rewards those who can make a lump-sum payment.

- Home Renovation Discount: Homeowners who renovate their homes to improve safety and durability may qualify for discounts. This can include updates to the roof, plumbing, heating, or electrical systems.

- Hybrid/Electric Vehicle Discount: Travelers encourage environmentally conscious choices by offering discounts to policyholders who drive hybrid or electric vehicles.

- New Homebuyer Discount: New homeowners may be eligible for discounts on their home insurance premiums. This discount recognizes the added responsibility that comes with homeownership.

- Advanced Quote Discount: Policyholders who request a quote in advance of their current policy’s expiration may receive a discount for planning ahead.

Policyholders should inquire about eligibility and available discounts when obtaining a quote to ensure they receive the most cost-effective coverage. Travelers’ commitment to offering discounts helps make insurance coverage more accessible and affordable for a wide range of customers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How The Travelers Indemnity Company Ranks Among Providers

The Travelers Indemnity Company operates in a highly competitive insurance industry where several other prominent insurers also offer a wide range of policies. Here are some of the company’s main competitors:

- State Farm: State Farm is one of the largest insurance providers in the United States. They offer a comprehensive array of insurance products, including auto, home, life, and more. State Farm’s extensive agent network and strong brand recognition make it a formidable competitor.

- Geico: Known for its witty advertising campaigns, Geico is another major player in the insurance market. They specialize in auto insurance but also provide other coverage options. Geico is known for its competitive pricing and user-friendly online platform.

- Progressive: Progressive has made a name for itself with its innovative approach to auto insurance. They are known for their Snapshot program, which offers personalized rates based on driving behavior. Progressive also offers home, renters, and various commercial insurance options.

- Allstate: Allstate is a well-established insurer offering a wide range of insurance products. They are known for their strong agent network, and they provide coverage for homes, autos, businesses, and more. Allstate’s brand is synonymous with protection.

- USAA: USAA primarily serves military members and their families, offering a variety of insurance and financial services. They are known for exceptional customer service and competitive rates. While not accessible to the general public, USAA is a significant competitor in the markets it serves.

- Liberty Mutual: Liberty Mutual is a global insurer that provides various personal and commercial insurance options. They emphasize customizable policies and offer unique coverage solutions. Liberty Mutual also has a strong presence in the international insurance market.

- Nationwide: Nationwide is a mutual insurance company that offers a wide range of insurance products and financial services. They have a strong focus on customer relationships and offer unique policy options, such as pet insurance and specialty insurance for farms.

- Farmers Insurance: Farmers Insurance Group is known for its comprehensive coverage options, including auto, home, life, and business insurance. They have a substantial agent network and offer customizable policies to meet individual needs.

- Chubb: Chubb is a global insurance company catering to high-net-worth individuals and businesses. They are known for their specialty insurance products and exceptional service. Chubb often competes in the luxury and high-end markets.

- AIG (American International Group): AIG is a multinational insurer offering a wide range of insurance and financial services. They have a global presence and serve both individual and corporate clients. AIG specializes in complex and specialty risks.

These are some of the key competitors that The Travelers Indemnity Company faces in the insurance industry. Each of these competitors has its strengths and focuses, catering to different segments of the market. The competition among these insurers is fierce, driving innovation and customer-centric approaches within the industry.

The Travelers Indemnity Company Claims Process

Ease of Filing a Claim

The Travelers Indemnity Company offers multiple convenient options for filing insurance claims. Customers can file a claim online through their official website, over the phone via their toll-free claims hotline, or through their mobile app.

These various channels provide flexibility and ease of access for policyholders to initiate the claims process according to their preference and convenience.

Average Claim Processing Time

The Travelers Indemnity Company is committed to efficiently processing claims to ensure a swift resolution for their policyholders. While specific processing times may vary depending on the nature and complexity of the claim, the company strives to expedite the claims processing procedure, aiming for a prompt and timely assessment to meet the needs of their customers.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is crucial in evaluating the satisfaction levels with claim resolutions and payouts provided by The Travelers Indemnity Company. The company values customer input and reviews regarding their experiences with the claims process.

Feedback assists in identifying areas for improvement and implementing necessary changes to enhance the overall customer experience and ensure fair and satisfactory claim resolutions.

The Travelers Indemnity Company Digital and Technological Features

Mobile App Features and Functionality

The Travelers Indemnity Company’s mobile app offers a range of features and functionalities to enhance the user experience. Policyholders can access and manage their insurance policies, file claims, view claim status, and even obtain assistance while on the go. The app is designed to be user-friendly, providing a seamless interface and quick access to essential insurance services.

Online Account Management Capabilities

The Travelers Indemnity Company provides an intuitive online platform for policyholders to manage their accounts. Through this online account management system, customers can review and update their policy information, view statements, make payments, and access important documents related to their insurance coverage.

The user-friendly interface ensures a hassle-free and efficient experience in managing insurance policies online.

Digital Tools and Resources

In line with modern technological advancements, The Travelers Indemnity Company offers a variety of digital tools and resources to aid policyholders in understanding their coverage and making informed decisions. These resources may include online calculators, educational materials, FAQs, and other informational tools accessible through their website and mobile app.

These digital assets aim to empower policyholders with the knowledge and resources necessary to navigate the insurance process effectively.

Frequently Asked Questions

What is The Travelers Indemnity Company’s financial rating and why is it significant for policyholders?

The Travelers Indemnity Company holds an A++ rating, reflecting exceptional financial strength. This rating is crucial for policyholders as it assures them of the company’s ability to fulfill financial obligations, providing confidence and security in their insurance coverage.

What types of insurance does The Travelers Indemnity Company offer?

The Travelers Indemnity Company offers a comprehensive range of insurance options, including auto, home, renters, condo, boat, umbrella, business, and travel insurance. This extensive coverage ensures that individuals, families, and businesses can find suitable protection for their diverse needs.

How does Travelers differentiate itself through customization and exemplary customer service?

Travelers sets itself apart by offering highly customizable insurance policies, allowing policyholders to tailor coverage to their unique circumstances. The company also emphasizes exemplary customer service, ensuring a reliable and personalized experience for those seeking to protect their assets and loved ones.

What discounts are available to policyholders, and how can they enhance affordability?

Travelers provides enticing discounts, such as multi-policy and safe driver discounts, rewarding responsible behavior and making insurance coverage more affordable. Policyholders should inquire about eligibility and available discounts when obtaining a quote to maximize cost-effective coverage.

How does The Travelers Indemnity Company facilitate the claims process for its policyholders?

The Travelers Indemnity Company offers multiple convenient options for filing insurance claims, including online through their website, over the phone via a toll-free claims hotline, and through their mobile app. This flexibility ensures policyholders can initiate the claims process according to their preference and convenience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.