Best Auto Insurance for Drivers Who Go to Mexico in 2026 (Top 10 Companies)

Find the best auto insurance companies for drivers who go to Mexico with Progressive, USAA, and State Farm. This analysis unveils their exceptional offerings, from international coverage options to attractive discounts. Discover why these companies stand out, ensuring a secure cross-border journey.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsIn this guide, we explore the best auto insurance companies for drivers who go to Mexico, including Progressive, USAA, and State Farm. Stay tuned as we analyze their offerings to uncover the ideal choice for your cross-border adventure.

- Progressive, USAA, and State Farm emerged as top companies for drivers who go to Mexico.

- Car insurance coverage for drivers who go to Mexico requires legal requirements and proper insurance.

- Selecting the right insurance policy, understanding coverage needs, and complying with Mexican laws are offered in this guide.

Whether you’re a meticulous planner, a low-mileage driver, or a credit-savvy individual, discover which company emerges as the frontrunner, offering the most advantageous rates tailored to your unique profile. Explore the nuances and make an informed decision before embarking on your cross-border adventure.

Our Top 10 Best Companies: Best Auto Insurance For Drivers Who Go to Mexico

| Company | Rank | See Pros/Cons | Mexico Travel Discount | Multi-Policy Discount | Best for |

|---|---|---|---|---|---|

| #1 | Progressive | Up to 12% | Up to 10% | International-Coverage Options | |

| #2 | USAA | Up to 15% | Up to 12% | Cross-Border Coverage | |

| #3 | State Farm | Up to 10% | Up to 15% | Customizable Policies | |

| #4 | Allstate | Up to 8% | Up to 18% | Online Convenience | |

| #5 | Geico | Up to 10% | Up to 12% | Policy Options | |

| #6 | Farmers | Up to 12% | Up to 15% | Bundle Discounts | |

| #7 | Liberty Mutual | Up to 10% | Up to 20% | Multi-Language Support |

| #8 | Nationwide | Up to 8% | Up to 12% | 24/7 Support |

| #9 | Travelers | Up to 15% | Up to 18% | Roadside Assistance |

| #10 | American Family | Up to 10% | Up to 15% | Loyalty Discounts |

If you are planning a trip to Mexico and will be driving there, it is essential to have the right car insurance coverage. Mexican law requires all drivers to have valid car insurance while operating a vehicle in the country. Navigate through understanding car insurance for Mexico, top insurance companies, how to choose the right policy, legal requirements, and provide tips for driving in Mexico.

#1 – Progressive: International-Coverage Options and Competitive Discounts

Progressive emerges as a top choice for drivers going to Mexico with its international-coverage options and comprehensive solutions tailored to diverse needs.Dani Best Licensed Insurance Producer

Pros

- Comprehensive international coverage options: Ideal for drivers heading to Mexico.

- Up to 12% discounts: Significant cost savings for policyholders.

- Transparent policies and user-friendly online interface: Enhances the overall customer experience.

Cons

- Some users report occasional premium increases: Potential for occasional fluctuations in premiums.

- May not be the most competitive option for high-risk drivers: Competitiveness may vary for drivers with higher risk profiles.

Read more: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Cross-Border Coverage and Attractive Discounts

Pros

- Specialized cross-border coverage: Tailored for drivers heading to Mexico.

- Up to 15% discounts: Offers substantial savings for eligible policyholders.

- Exceptional customer service with a focus on military members: Ensures a high level of service for military members.

Cons

- Exclusive to military members and their families: Limited eligibility to a specific demographic.

- Limited physical branch locations: Inconvenient for some customers who prefer in-person interactions.

Read more: USAA Auto Insurance Review

#3 – State Farm: Customizable Policies and Competitive Discounts

Pros

- Offers customizable policies: Tailored to meet diverse driver needs.

- Up to 15% discounts: Economically attractive choice with potential savings.

- Established reputation and wide network of agents: Ensures personalized service for policyholders.

Cons

- Some customers may find rates slightly higher than competitors: Rates may be perceived as relatively higher by certain customers.

- Limited online quote and policy management options: Online options may not be as extensive as some competitors.

Read more: State Farm Auto Insurance Review

#4 – Allstate: Online Convenience and Competitive Rates

Pros

- Convenient online platform: Facilitates policy management and claims for enhanced customer experience.

- Up to 18% discounts: Significant savings contribute to cost-effectiveness.

- Variety of coverage options: Caters to different driver preferences and needs.

Cons

- Premiums may be higher for certain driver profiles: Rates could be comparatively higher for specific drivers.

- Customer service satisfaction varies among users: Some users may have differing experiences with customer service.

Read more: Allstate Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Diverse Policy Options and Competitive Discounts

Pros

- Wide range of policy options: Accommodates various driver needs and preferences.

- Up to 12% discounts: Contributes to overall cost-effectiveness for policyholders.

- User-friendly online interface: Simplifies policy management through an easy-to-use interface.

Cons

- Some customers report less personalized service: Personalization may vary for individual customers.

- Rates for certain high-risk drivers may be less competitive: Competitiveness may vary based on risk factors.

#6 – Farmers: Bundle Discounts and Versatile Coverage

Pros

- Bundle discounts: Offers savings when combining multiple policies.

- Up to 15% discounts: Contributes to competitive rates for policyholders.

- Versatile coverage options: Caters to different driver preferences and needs.

Cons

- Rates may be higher for certain high-risk drivers: Higher rates may apply to drivers with specific risk profiles.

- Customer service experiences vary: Experiences with customer service may differ among users.

Read more: Farmers Auto Insurance Review

#7 – Liberty Mutual: Multi-Language Support and Competitive Discounts

Pros

- Multi-language support: Enhances accessibility for diverse customers.

- Up to 20% discounts: Provides substantial cost savings for eligible policyholders.

- Comprehensive coverage options: Caters to various driver needs and preferences.

Cons

- Some customers report issues with claims processing: Challenges may arise in the claims processing experience.

- Rates may be higher for certain driver profiles: Rates could be comparatively higher for specific drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: 24/7 Support and Solid Discounts

Pros

- 24/7 support: Ensures assistance at any time for policyholders.

- Up to 12% discounts: Contributes to competitive rates for eligible policyholders.

- Variety of coverage options: Caters to different driver preferences and needs.

Cons

- Rates may be higher for certain high-risk drivers: Higher rates may apply to drivers with specific risk profiles.

- Online experience could be more user-friendly: Enhancements to the online experience may be beneficial.

#9 – Travelers: Roadside Assistance and Generous Discounts

Pros

- Roadside assistance: Provides added peace of mind for policyholders.

- Up to 18% discounts: Offers significant savings for eligible policyholders.

- Variety of coverage options: Suits different driver needs and preferences.

Cons

- Some customers report less favorable claims experiences: Experiences with claims processing may vary.

- Rates may be higher for certain high-risk drivers: Higher rates may apply to drivers with specific risk profiles.

Read more: Travelers Auto Insurance Review

#10 – American Family: Loyalty Discounts and Diverse Coverage

Pros

- Loyalty discounts: Reward long-term customers with potential cost savings.

- Up to 15% discounts: Contribute to overall cost-effectiveness for eligible policyholders.

- Diverse coverage options: Meet various driver preferences and needs.

Cons

- Rates may be less competitive for certain high-risk drivers: Competitiveness may vary based on risk factors.

- Limited availability in certain regions: Accessibility may be restricted in specific regions.

Read more: American Family Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Drivers Who Go to Mexico: Navigating Coverage Rates

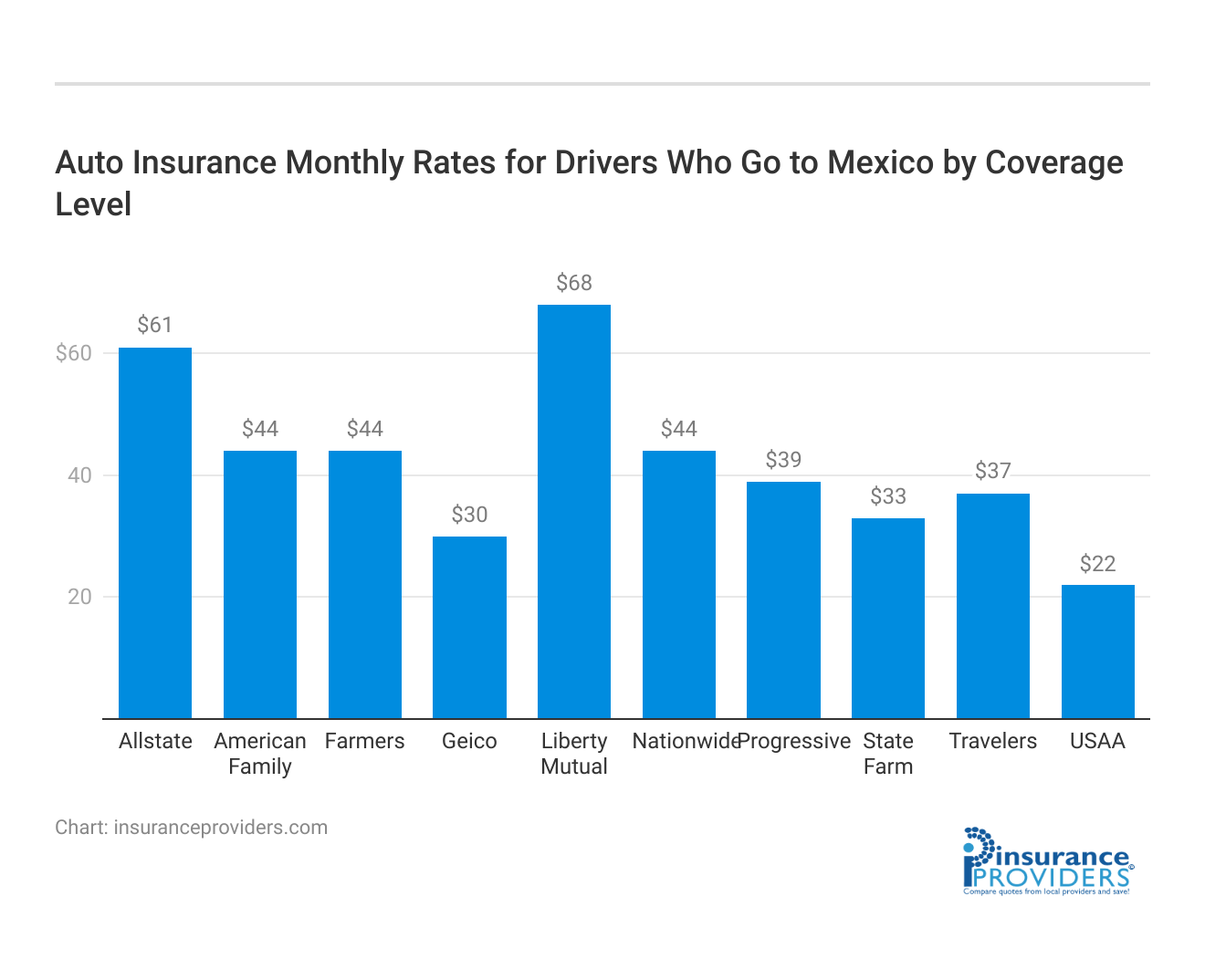

The table offers valuable insights into the average monthly auto insurance rates tailored for drivers venturing into Mexico. It compares both full coverage and minimum coverage options, providing a comprehensive view of those requiring insurance for trips to Mexico.

Average Monthly Auto Insurance Rates for Drivers Who Go to Mexico

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | $105 | $39 |

| USAA | $59 | $22 |

| State Farm | $86 | $33 |

| Allstate | $160 | $61 |

| Geico | $80 | $30 |

| Farmers | $139 | $44 |

| Liberty Mutual | $174 | $68 |

| Nationwide | $115 | $44 |

| Travelers | $99 | $37 |

| American Family | $117 | $44 |

Analyzing the coverage rates, USAA stands out as the most affordable option for both full coverage, priced at $59 per month, and minimum coverage, with a rate of $22. Conversely, Liberty Mutual presents the highest full and minimum coverage rates at $174 and $68, respectively.

Progressive and Geico offer competitive Full Coverage rates at $105 and $80, while State Farm provides a balance of affordability and coverage at $86 for full coverage. These variations in rates highlight the importance of choosing insurance tailored to cross-border driving needs.

Factors beyond cost, such as coverage adequacy, policy features, and the reputation of the insurance provider, should be considered to ensure comprehensive protection for drivers embarking on journeys to Mexico. Making an informed decision involves a careful balance between affordability and the extent of coverage required for safe travels across borders.

Understanding Car Insurance for Mexico

Car insurance in Mexico operates differently from insurance in other countries. It is crucial to understand the unique aspects of Mexican car insurance to ensure you have the right coverage during your trip. When traveling to Mexico, it’s important to be aware that your regular insurance policy from your home country will not cover you in Mexico.

This means that if you get into an accident or experience any other type of vehicle-related incident, you will not have the same level of protection as you would in your home country. Driving without valid car insurance in Mexico can have serious consequences, including fines, vehicle impoundment, or even jail time.

The Importance of Mexican Car Insurance

Mexican car insurance is essential for several reasons. Firstly, it provides you with the necessary liability coverage to protect you in case of an accident. Without this coverage, you would be personally responsible for any damages or injuries caused to others involved in the accident. Secondly, Mexican car insurance is required by law. The Mexican government mandates that all drivers have at least third-party liability insurance.

This means that if you plan on driving in Mexico, you must have a valid car insurance policy that meets the minimum coverage requirements. Lastly, having Mexican car insurance gives you peace of mind. Knowing that you are protected financially in case of an accident can help alleviate any stress or worry that may come with driving in a foreign country.

Different Types of Car Insurance in Mexico

There are various types of car insurance policies available in Mexico. The two main types are third-party liability insurance and full coverage insurance. Third-party liability insurance is the minimum coverage required by law. This type of insurance covers damages or injuries caused to third parties involved in an accident that you are responsible for. It does not cover any damages to your own vehicle.

On the other hand, full coverage insurance includes third-party liability coverage along with coverage for your vehicle in case of theft, vandalism, or accidents. This type of insurance provides more comprehensive protection and can give you greater peace of mind during your trip. It’s important to carefully consider your insurance needs and budget when choosing between these two types of coverage.

While full coverage insurance offers more extensive protection, it may also come with a higher premium. Evaluating your individual circumstances and driving habits can help you determine which type of insurance is best for you.

How to Choose the Right Car Insurance for Your Mexico Trip

Choosing the best car insurance for your Mexico trip involves careful consideration of your insurance needs, comparing rates, and understanding the policy terms and conditions.

Assessing Your Insurance Needs

Start by assessing your insurance needs. Consider factors such as the duration of your trip, the value of your vehicle, and the level of coverage you require. If you plan on driving in remote areas or off-road, you may need additional coverage to protect against potential damages.

When assessing your insurance needs, it’s important to think about the potential risks you may encounter during your Mexico trip. Mexico has different road conditions compared to your home country, and it’s crucial to have adequate coverage to protect yourself and your vehicle. Additionally, consider the value of your vehicle. If you have a high-value car, you may want to opt for a more comprehensive insurance policy to ensure that you are fully protected in case of an accident or theft.

Comparing Insurance Rates

Obtain quotes from multiple insurance companies to compare rates. Keep in mind that the cheapest option may not always provide the best coverage. Look for a balance between affordability and comprehensive coverage. Consider factors such as deductibles, coverage limits, and any additional benefits offered.

When comparing insurance rates, it’s essential to look beyond the price tag. While affordability is important, it’s equally crucial to consider the level of coverage provided. Some insurance policies may offer a lower premium but have higher deductibles or lower coverage limits. It’s important to evaluate these factors and choose a policy that provides the right balance between cost and coverage.

Reading the Fine Print

Before purchasing car insurance, carefully read the policy terms and conditions. Pay attention to exclusions, limitations, and any additional requirements. Understand what is covered and what is not to avoid any surprises in case of an accident or claim.

Reading the fine print is crucial to fully understand the extent of your coverage. Insurance policies may have exclusions or limitations that can affect your ability to file a claim. For example, some policies may not cover damages caused by driving under the influence or participating in illegal activities. By carefully reviewing the policy terms and conditions, you can ensure that you are aware of any limitations and can make an informed decision when selecting your car insurance.

Additionally, it’s important to be aware of any additional requirements that may be specified in the policy. For example, some insurance companies may require you to provide certain documents or follow specific procedures in the event of an accident or claim. By understanding these requirements beforehand, you can ensure that you are prepared and can fulfill them if necessary.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Legal Requirements for Car Insurance in Mexico

Understanding the legal requirements for car insurance in Mexico is crucial to avoid penalties and legal issues during your trip.

When it comes to driving in Mexico, it’s important to be aware of the mandatory insurance coverage that Mexican law requires all drivers to have. This coverage is known as third-party liability insurance, and it provides financial protection in case of damages or injuries caused to third parties involved in an accident. This means that if you were to cause an accident in Mexico, this insurance would cover the costs of any damages or injuries sustained by the other party involved.

Having valid third-party liability insurance is not only a legal requirement but also a responsible choice. By having this coverage, you can ensure that you are financially protected in the event of an accident, and you won’t have to worry about facing significant financial burdens.

Read more:

- Best Auto Insurance for Foreign Drivers

- How do you get auto insurance for a foreign exchange student?

Mandatory Insurance Coverage

Mexican law requires all drivers to have valid third-party liability insurance. This coverage provides financial protection in case of damages or injuries caused to third parties involved in an accident.

It’s important to note that third-party liability insurance in Mexico is different from the insurance coverage you may be familiar with in your home country. Mexican law requires a specific type of insurance that is issued by a licensed Mexican insurance company. This means that your existing car insurance policy from another country may not be valid in Mexico.

When purchasing car insurance for your trip to Mexico, it’s crucial to ensure that the policy meets the legal requirements set by Mexican law. This includes verifying that the insurance company is licensed to operate in Mexico and that the policy provides the necessary coverage limits.

Penalties for Lack of Insurance

Driving without valid car insurance in Mexico can result in severe consequences. You may face fines, vehicle impoundment, or even arrest. It is essential to have proper insurance coverage to comply with Mexican law and protect yourself financially.

Not only can driving without insurance lead to legal issues, but it can also leave you vulnerable to significant financial liabilities. If you were to cause an accident without insurance, you would be responsible for covering the costs of any damages or injuries out of your own pocket. This can quickly add up to thousands or even tens of thousands of dollars, depending on the severity of the accident.

To avoid these potential consequences, it is highly recommended to obtain valid car insurance coverage before driving in Mexico. This will not only keep you in compliance with the law but also provide you with peace of mind knowing that you are protected financially in case of an accident.

When purchasing car insurance for Mexico, it’s a good idea to carefully review the policy and understand the coverage limits and exclusions. This will help you make an informed decision and ensure that you have the necessary protection during your trip.

Case Studies: Navigating Mexico With the Top Insurance Providers

Case Study 1: Progressive- Sarah’s Seamless Cross-Border Experience

Sarah, an adventurous solo traveler, was gearing up for a road trip to Mexico. With Progressive’s international coverage options, she found a tailored solution that addressed her specific needs. From navigating Mexican regulations to providing comprehensive coverage, Progressive ensured Sarah’s journey was not only exciting but also worry-free.

The transparent policies and user-friendly interface added an extra layer of convenience, making Progressive the perfect companion for Sarah’s cross-border adventure.

Case Study 2: USAA- John’s Military Precision on the Mexican Roads

Meet John, a military servicemember relocating to Mexico. USAA’s cross-border coverage became the linchpin in his move, offering not just financial protection but also a seamless transition.

John appreciated the dedication to military members, experiencing unmatched customer service and attractive discounts. USAA’s commitment to its members shone through, making John’s journey to Mexico a smooth and secure process.

Case Study 3: State Farm- Emma’s Tailored Coverage for a Unique Road Trip

Emma, a meticulous planner, was organizing a group road trip to Mexico with friends. State Farm’s customizable policies turned out to be the perfect fit for their diverse needs. From adjusting coverage levels to accommodating multiple drivers, State Farm offered a level of flexibility that surpassed expectations.

The up to 15% discounts sweetened the deal, making State Farm the go-to choice for Emma and her friends as they embarked on their unforgettable Mexican adventure.

Tips for Driving in Mexico

Driving in Mexico can be an exciting and rewarding experience. However, it is crucial to follow road safety guidelines and be prepared for any unexpected situations.

Road Safety in Mexico

Follow local traffic laws and regulations while driving in Mexico. Be cautious of speed limits, road signs, and any specific rules of the region you are visiting. Avoid driving at night whenever possible and maintain a safe distance from other vehicles.

What to Do in Case of an Accident

In case of an accident, follow the necessary steps to ensure your safety and comply with Mexican law. Contact the authorities and your insurance company to report the incident. It is also advisable to take photos, gather witness information, and exchange contact details with the other party involved.

By understanding car insurance for Mexico, selecting the right policy, and adhering to legal requirements and road safety guidelines, you can have a smooth and worry-free driving experience during your trip. Stay protected and enjoy the beauty of Mexico!

Frequently Asked Questions

Are these insurance providers suitable for drivers planning a trip to Mexico?

Yes, several of the listed companies, such as Progressive, USAA, and State Farm, offer international-coverage options specifically tailored for drivers heading to Mexico.

How can I find the most cost-effective insurance for my specific needs?

To identify the most advantageous rates, consider factors like your credit score, mileage, coverage level, and driving record. Companies like Geico and Travelers may offer competitive rates based on these criteria.

What unique features do these companies offer beyond discounts?

Each company has distinct offerings. For instance, Liberty Mutual provides multi-language support, while Farmers offers bundle discounts. Explore the specific benefits that align with your preferences and needs.

How do I ensure I’m covered for roadside assistance during my travels?

Travelers insurance, listed in the rankings, includes roadside assistance as part of its offerings. Verify the details of each provider’s roadside assistance coverage to ensure it meets your requirements.

How long does Mexican car insurance coverage last?

Mexican car insurance policies can vary in duration, but they are typically available for daily, weekly, or annual coverage. It is important to select a policy that aligns with the duration of your trip to Mexico.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.