Verde Insurance Company Review (2025)

Navigate the insurance landscape with Verde Insurance Company, acknowledged for its A+ rating and comprehensive coverage options, as we explore the nuances of competitive pricing and exceptional customer service in this detailed review.

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance providers please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Verde Insurance Company

Average Monthly Rate For Good Drivers

N/AA.M. Best Rating:

A+Complaint Level:

LowPros

- Wide range of insurance offerings to meet diverse needs

- Competitive rates and flexible payment options

- Excellent customer service with personalized guidance

- Strong financial stability for added peace of mind

- Hassle-free claims process and quick resolution

Cons

- Limited regional availability

- Online account management options could be improved

- Some policy options may have specific eligibility criteria

In this comprehensive article, we delve into the world of Verde Insurance Company, a trusted name in the insurance industry. Verde offers a wide spectrum of insurance policies, including Auto, Home, Health, Life, and Business Insurance, all meticulously tailored to meet the unique needs of its clients.

With competitive rates, a personalized approach, and an unwavering commitment to customer service, Verde stands out as a top choice for safeguarding your future. Their straightforward online quote process ensures convenience, while satisfied customer testimonials speak to their excellence.

Choose Verde Insurance Company, and entrust your protection to a company dedicated to securing what matters most to you.

What You Should Know About Verde Insurance Company

Rates: Verde Insurance Company determines its rates based on coverage specifics and individual customer factors, employing a competitive pricing strategy that aligns with industry standards while maintaining transparency.

Discounts: Verde Insurance Company offers a variety of discounts, such as those for safe driving, safety features, and policy bundling, aiming to make insurance coverage more affordable and enhance overall value for eligible policyholders.

Complaints/Customer Satisfaction: With a commitment to customer satisfaction, Verde Insurance Company addresses concerns promptly, as reflected in its low complaint levels and continuous efforts to monitor and improve services based on customer feedback.

Claims Handling: Verde Insurance Company excels in claims handling, providing a streamlined process through various channels and prioritizing efficiency, aiming for prompt resolutions and garnering positive customer feedback on fair and timely settlements.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

Verde Insurance Company Insurance Coverage Options

Verde Insurance Company offers a comprehensive range of coverage options to meet the diverse needs of its customers. These coverage options provide protection and peace of mind in various aspects of life. Here’s a list of the coverage options typically offered by the company:

Auto Insurance:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

- Medical Payments Coverage

- Rental Reimbursement Coverage

- Roadside Assistance

Home Insurance:

- Dwelling Coverage

- Personal Property Coverage

- Other Structures Coverage

- Liability Coverage

- Additional Living Expenses Coverage

- Personal Liability Umbrella Policy

- Flood Insurance (if applicable)

- Earthquake Insurance (if applicable)

Health Insurance:

- Individual Health Insurance

- Family Health Insurance

- Group Health Insurance

- Health Savings Accounts (HSAs)

- Dental Insurance

- Vision Insurance

- Medicare Supplements

Life Insurance:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Final Expense Insurance

- Mortgage Protection Insurance

- Group Life Insurance

Business Insurance:

- Commercial Property Insurance

- Commercial General Liability Insurance

- Business Interruption Insurance

- Workers’ Compensation Insurance

- Commercial Auto Insurance

- Professional Liability Insurance (E&O)

- Cyber Liability Insurance

- Business Owners Policy (BOP)

Renters Insurance:

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses Coverage

- Identity Theft Protection

Condo Insurance:

- Dwelling Coverage (walls-in)

- Personal Property Coverage

- Liability Coverage

- Loss Assessment Coverage

- Condo Association Master Policy Coverage

Motorcycle and RV Insurance:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Medical Payments Coverage

- Roadside Assistance

Boat and Watercraft Insurance:

- Hull Coverage

- Liability Coverage

- Personal Property Coverage

- Towing and Assistance Coverage

Pet Insurance:

- Accident Coverage

- Illness Coverage

- Routine Care Coverage

- Hereditary and Congenital Condition Coverage

These coverage options encompass a wide array of insurance needs, allowing customers to tailor their policies to match their specific circumstances. Verde Insurance Company aims to provide comprehensive protection while accommodating various budgets and preferences. Customers can work with Verde’s agents to determine the best coverage options for their unique requirements.

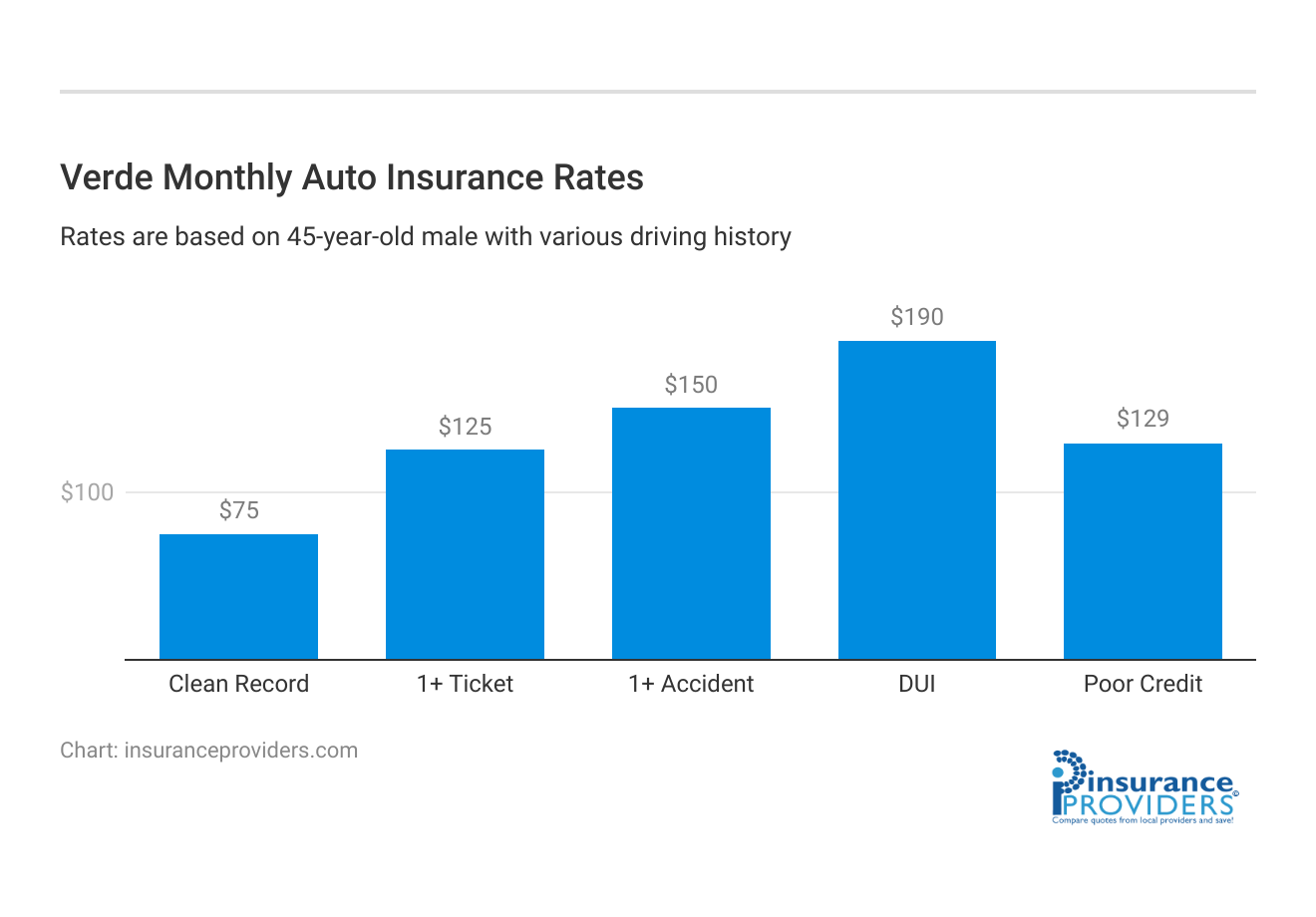

Verde Insurance Company Insurance Rates Breakdown

| Driver Profile | Verde | National Average |

|---|---|---|

| Clean Record | $75 | $119 |

| 1+ Ticket | $125 | $147 |

| 1+ Accident | $150 | $173 |

| DUI | $190 | $209 |

| Poor Credit | $129 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Verde Insurance Company Discounts Available

| Discount | Verde |

|---|---|

| Anti Theft | 4% |

| Good Student | 15% |

| Low Mileage | 6% |

| Paperless | 11% |

| Safe Driver | 20% |

| Senior Driver | 3% |

Verde Insurance Company provides a range of discounts to help customers save on their insurance premiums. These discounts are designed to reward responsible behavior and promote customer loyalty. Here are the discounts offered by the company:

- Multi-Policy Discount: Customers can save by bundling multiple insurance policies with Verde Insurance Company. Combining, for example, auto and home insurance, can lead to significant savings.

- Safe Driver Discount: Policyholders with a clean driving record and no recent accidents or traffic violations are eligible for this discount, which rewards safe driving habits.

- Good Student Discount: Students who maintain a high GPA or meet certain academic criteria may qualify for this discount. It encourages responsible behavior both on and off the road.

- Multi-Vehicle Discount: Insuring multiple vehicles under the same policy can lead to reduced premiums. This discount is ideal for families with multiple cars.

- Home Security Discount: Customers who have implemented home security systems, such as alarms and surveillance cameras, may receive a discount on their home insurance premiums.

- Payment Discounts: Verde Insurance Company often offers discounts to policyholders who choose to pay their premiums annually or via electronic funds transfer (EFT).

- Claims-Free Discount: Staying claims-free for a specified period can result in lower premiums. This incentivizes policyholders to prevent accidents and file fewer claims.

- Renewal Discount: Loyal customers who renew their policies with Verde Insurance Company may receive discounts as a token of appreciation for their continued business.

- New Customer Discount: The company occasionally offers discounts to new customers as an incentive to switch to Verde Insurance Company.

- Defensive Driving Course Discount: Completing a defensive driving course can lead to reduced auto insurance premiums. This encourages policyholders to improve their driving skills.

- Senior Driver Discount: Older drivers who meet certain criteria may be eligible for discounts designed to cater to their unique insurance needs.

- Military and First Responder Discounts: Verde Insurance Company may offer special discounts to military personnel, veterans, and first responders as a gesture of gratitude for their service.

Please note that the availability and eligibility criteria for these discounts may vary depending on the state and specific policy details. It’s advisable for customers to contact Verde Insurance Company directly or consult with an agent to determine which discounts they qualify for and how much they can save on their insurance coverage.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

How Verde Insurance Company Ranks Among Providers

Verde Insurance Company operates in a competitive insurance industry where several well-established companies vie for market share. Below are some of the company’s main competitors:

- Allstate Corporation: Allstate is a prominent insurance provider in the United States, offering a wide range of insurance products, including auto, home, and life insurance. They are known for their strong brand presence and extensive network of agents.

- State Farm Mutual Automobile Insurance Company: State Farm is one of the largest insurers in the U.S. and is recognized for its auto insurance coverage. They have a vast network of agents and a long history in the industry.

- Progressive Corporation: Progressive is renowned for its innovative approach to auto insurance, particularly its usage-based policies. They are known for competitive rates and a user-friendly online experience.

- Geico (Government Employees Insurance Company): Geico is famous for its witty advertising campaigns and affordable auto insurance options. They have a substantial market share and offer various discounts to policyholders.

- Liberty Mutual Group: Liberty Mutual provides a wide range of insurance products, including auto, home, and life insurance. They are known for their focus on customer service and comprehensive coverage options.

- Nationwide Mutual Insurance Company: Nationwide offers various insurance products, including auto, home, and pet insurance. They emphasize customer-centric services and are especially known for their home insurance policies.

- AIG (American International Group): AIG is a global insurance giant with offerings in both personal and commercial insurance. They have a strong international presence and cater to a wide range of insurance needs.

- Travelers Companies, Inc.: Travelers is a well-established insurer offering a range of coverage, including home, auto, and business insurance. They are recognized for their risk management expertise.

- USAA (United Services Automobile Association): USAA primarily serves military members and their families, offering insurance, banking, and investment products. They are known for exceptional customer service and tailored policies.

- Farmers Insurance Group: Farmers is a leading insurer with a broad portfolio, including auto, home, and business insurance. They have a substantial agent network and customizable coverage options.

These competitors, along with Verde Insurance Company, contribute to a competitive landscape in the insurance industry, each having its unique strengths and weaknesses. Customers often compare factors such as pricing, coverage options, customer service, and reputation when choosing an insurance provider.

Verde Insurance Company Claims Process

Ease of Filing a Claim

Verde Insurance Company offers a streamlined and user-friendly claims process for its customers. Whether you prefer the convenience of filing a claim online, over the phone, or through their mobile app, Verde provides multiple options to suit your needs.

The company understands that a smooth claims experience is essential during stressful times, and they strive to make it as hassle-free as possible.

Average Claim Processing Time

One crucial factor in assessing an insurance company’s reliability is the speed at which they process claims. Verde Insurance Company prides itself on its efficient claims processing system.

While processing times may vary depending on the nature of the claim and specific circumstances, Verde aims to resolve claims promptly, ensuring that customers receive the support they need when they need it most.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. Verde Insurance Company has garnered positive reviews from satisfied customers regarding their claim resolutions and payouts.

Their commitment to providing fair and timely settlements has left many policyholders content with the outcomes of their claims. It’s essential to consider the experiences of other customers when evaluating an insurance provider’s claims process.

Verde Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Verde Insurance Company offers a feature-rich mobile app that enhances the overall customer experience. The app provides convenient access to policy information, allows customers to file claims, and offers tools for managing their insurance coverage on the go.

From checking policy details to receiving updates on claims, the mobile app streamlines communication and puts essential information at your fingertips.

Online Account Management Capabilities

Managing your insurance policies online has never been easier with Verde’s online account management capabilities.

Customers can log in to their accounts through the company’s website, where they can view and update policy information, make payments, and access important documents. The online portal offers a user-friendly interface that simplifies the management of insurance policies.

Digital Tools and Resources

Verde Insurance Company understands the importance of providing digital tools and resources to empower their customers. They offer a range of digital resources, including educational materials, FAQs, and online calculators, to help customers make informed decisions about their insurance coverage.

These resources aim to assist customers in understanding their policies and making the right choices for their insurance needs.

Frequently Asked Questions

What types of insurance does Verde Insurance Company offer?

Verde Insurance Company provides a wide range of insurance coverage options, including Auto, Home, Health, Life, Business, Renters, Condo, Motorcycle and RV, Boat and Watercraft, and Pet Insurance.

How does Verde Insurance Company stand out in terms of pricing and customer service?

Verde Insurance Company distinguishes itself with competitive rates and a commitment to excellent customer service, offering a personalized approach to meet the unique needs of its clients.

What is the average monthly rate for good drivers with Verde Insurance Company?

For good drivers, Verde Insurance Company’s average monthly rates are based on a 45-year-old male driver and vary for both minimum and full coverage, providing transparency for potential policyholders.

How efficient is Verde Insurance Company’s claims process?

Verde Insurance Company boasts a streamlined and user-friendly claims process, allowing customers to file claims online, over the phone, or through their mobile app, emphasizing a hassle-free experience during stressful times.

What digital tools and resources does Verde Insurance Company offer to its customers?

Verde Insurance Company provides a feature-rich mobile app, online account management capabilities, and a variety of digital tools and resources, including educational materials, FAQs, and online calculators, empowering customers to make informed decisions about their insurance coverage.

Compare Insurance Providers Rates to Save Up to 75%

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.