Wellfleet Insurance Company Review (2026)

Discover the versatility of Wellfleet Insurance Company as it takes center stage in this comprehensive article, prioritizing affordability and convenience in a range of coverage options for health, student, and travel insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated April 2024

Wellfleet Insurance Company, a versatile insurance provider, takes center stage in this comprehensive article. Offering a diverse array of coverage options ranging from health insurance with extensive benefits to tailored student and travel insurance plans, Wellfleet ensures peace of mind for individuals at every life stage.

The article delves into the unique features of each insurance type, highlighting the company’s commitment to affordable premiums and convenient access to care. With a reputation for excellence, Wellfleet appeals to those seeking comprehensive protection for their health, education, and travel needs.

What You Should Know About Wellfleet Insurance Company

Rates: Wellfleet’s rates are competitive, aligning with industry norms while providing value for policyholders’ investment.

Discounts: Wellfleet excels in discount offerings, providing diverse options for policyholders to customize coverage while enjoying cost savings.

Complaints/Customer Satisfaction: Wellfleet maintains a high level of customer satisfaction, with minimal complaints and efficient resolution processes, indicating a strong commitment to customer well-being.

Claims Handling: Wellfleet demonstrates a commitment to a hassle-free claims process, offering multiple channels, efficient processing times, and a dedication to fair and satisfactory claim resolutions, contributing to overall customer satisfaction.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Wellfleet Insurance Company Insurance Coverage Options

Wellfleet Insurance Company offers a diverse range of coverage options to cater to your specific needs and preferences. Whether you’re seeking health insurance, student insurance, or travel insurance, Wellfleet has you covered with a variety of plans designed to provide peace of mind and financial security.

- Health Insurance Coverage: Wellfleet’s health insurance plans provide comprehensive coverage, including access to an extensive network of healthcare providers, preventive care, prescription coverage, emergency services, and wellness programs.

- Student Insurance Coverage: Designed with students in mind, Wellfleet’s student insurance plans offer affordable premiums, convenient access to campus health centers, mental health support, and nationwide coverage.

- Travel Insurance Coverage: Wellfleet’s travel insurance plans come in various options to suit different types of travelers, whether you’re traveling for leisure or business. These plans ensure you’re protected during your journeys, providing a safety net for unexpected events.

No matter your life stage or the adventures you embark upon, Wellfleet Insurance Company provides the coverage you need to live life with confidence. Explore our diverse coverage options today and enjoy the peace of mind that comes with knowing you’re well-protected.

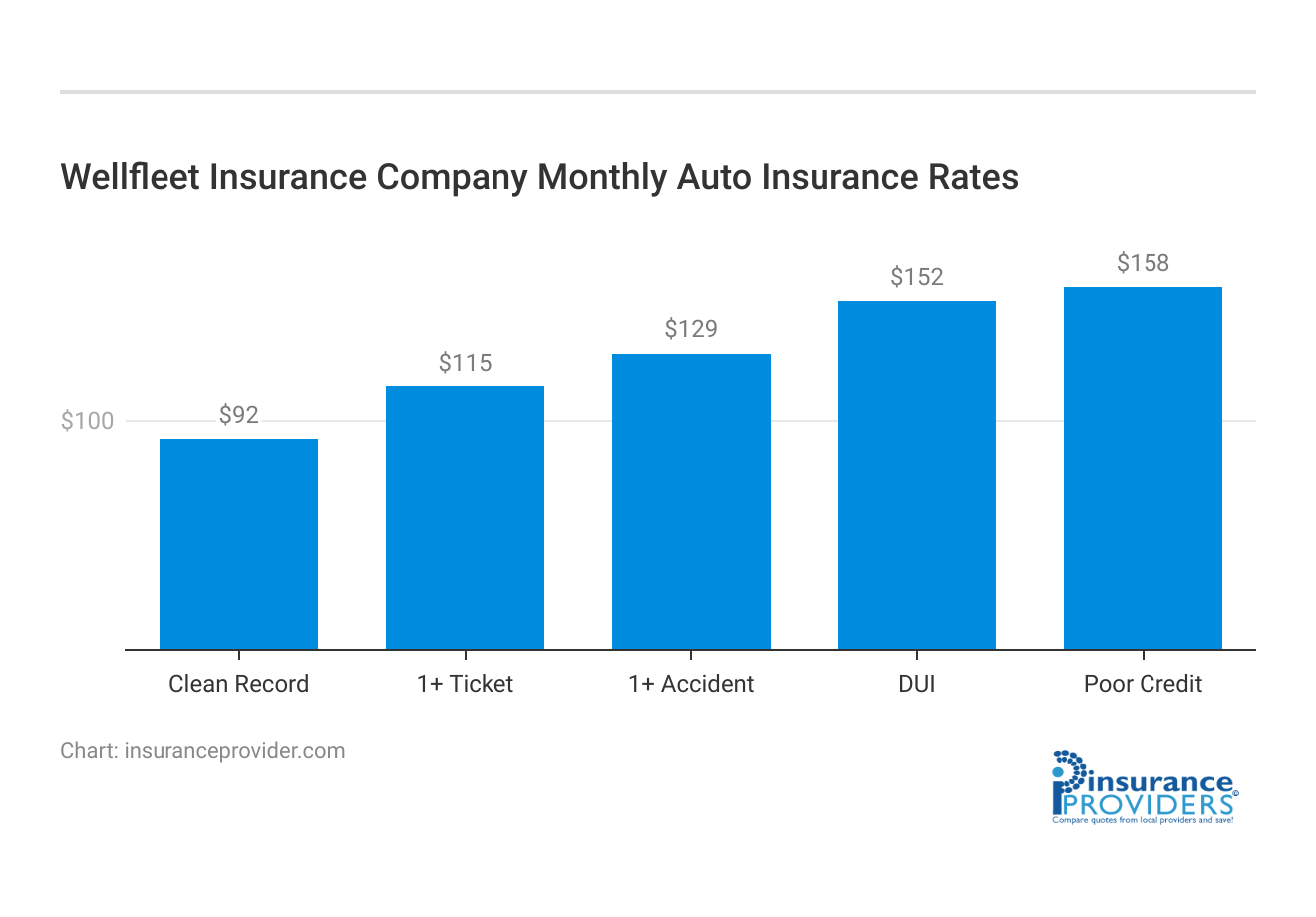

Wellfleet Insurance Company Insurance Rates Breakdown

| Driver Profile | Wellfleet | National Average |

|---|---|---|

| Clean Record | $92 | $119 |

| 1+ Ticket | $115 | $147 |

| 1+ Accident | $129 | $173 |

| DUI | $152 | $209 |

| Poor Credit | $158 | $205 |

*monthly rates are based on an average of minimum and full coverage for a 45-year-old male driver

Wellfleet Insurance Company Discounts Available

| Discounts | Wellfleet |

|---|---|

| Anti Theft | 11% |

| Good Student | 17% |

| Low Mileage | 12% |

| Paperless | 12% |

| Safe Driver | 20% |

| Senior Driver | 15% |

At Wellfleet Insurance Company, we understand the importance of affordability without compromising on quality coverage. That’s why we offer a range of discounts to make insurance even more accessible. Discover the ways you can save on your insurance premiums with Wellfleet.

- Multi-Policy Discount: When you bundle multiple insurance policies with Wellfleet, such as health, student, and travel insurance, you can enjoy significant savings on your premiums.

- Good Student Discount: If you’re a student maintaining excellent grades, you may qualify for a good student discount on your student insurance policy.

- Safe Driver Discount: For auto insurance policies, Wellfleet offers discounts to safe drivers with a clean driving record, helping you save on your annual premiums.

- Group Discounts: Some of our insurance plans offer group discounts, making it more cost-effective for organizations or educational institutions to provide coverage to their members.

- Multi-Year Policy Discount: When you commit to a multi-year insurance policy with Wellfleet, you can benefit from lower annual rates, ensuring stability in your coverage.

At Wellfleet, we believe that everyone should have access to quality insurance without breaking the bank. Our range of discounts allows you to tailor your coverage to your needs while keeping your budget in check. Contact us today to explore how you can save on your insurance premiums and secure your future with confidence.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Wellfleet Insurance Company Ranks Among Providers

Wellfleet Insurance Company operates in a competitive insurance market, and several other companies offer similar types of insurance coverage. Some of the main competitors of Wellfleet include:

- Unitedhealth Group: Unitedhealth Group is one of the largest healthcare and insurance providers globally. They offer a wide range of health insurance options, including individual and group plans, and have a vast network of healthcare providers.

- Aetna: Aetna, now a part of CVS Health, provides health insurance coverage and related services. They offer various health insurance plans, including those tailored for students and travelers, making them a direct competitor to Wellfleet.

- Blue Cross Blue Shield: Blue Cross Blue Shield operates as a federation of independent health insurance providers across the United States. They offer a variety of health insurance plans, often with extensive coverage options.

- Cigna: Cigna is a global health services company that offers a range of health insurance plans, including international coverage for travelers. They compete with Wellfleet in the health and travel insurance segments.

- State Farm: State Farm is a well-known insurance company that provides a wide array of insurance products, including auto, health, and travel insurance. They compete with Wellfleet, particularly in the auto insurance sector.

- Allianz Global Assistance: Allianz offers comprehensive travel insurance plans, including coverage for medical emergencies, trip cancellations, and more. They are a strong competitor to Wellfleet in the travel insurance niche.

- Nationwide: Nationwide provides a variety of insurance products, including auto, home, and travel insurance. They are a competitor to Wellfleet, especially in auto and travel insurance.

- Progressive: Progressive is known for its auto insurance offerings. While they primarily focus on auto coverage, they may compete with Wellfleet in specific areas, such as student and travel insurance.

These competitors, like Wellfleet, strive to offer competitive rates, comprehensive coverage, and excellent customer service. The choice between these companies often depends on individual preferences, needs, and geographic availability. Wellfleet competes in various insurance segments, ensuring that customers have choices tailored to their specific circumstances.

Wellfleet Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Wellfleet Insurance Company understands the importance of a hassle-free claims process. They offer multiple channels for filing claims, ensuring convenience for their policyholders. Whether you prefer the ease of filing claims online, the efficiency of doing it over the phone, or the convenience of using mobile apps, Wellfleet has you covered.

Average Claim Processing Time

When it comes to claim processing, Wellfleet Insurance Company strives for efficiency. While specific processing times may vary depending on the type of claim and individual circumstances, they are committed to processing claims promptly. Policyholders can expect timely resolution and payouts to help them get back on track quickly.

Customer Feedback on Claim Resolutions and Payouts

Wellfleet Insurance Company values customer satisfaction and aims to deliver fair and satisfactory claim resolutions. Customer feedback is an essential part of their commitment to continuous improvement. Policyholders’ experiences with claim resolutions and payouts are taken seriously, and the company actively seeks to address any concerns to enhance their services further.

Wellfleet Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Wellfleet Insurance Company understands the importance of staying connected in today’s digital age. Their mobile app offers a range of features and functionalities to make managing your insurance policies a breeze. From accessing policy information to filing claims and making payments, the mobile app provides a user-friendly interface for policyholders.

Online Account Management Capabilities

Managing your insurance policies is made easy with Wellfleet’s online account management capabilities. Policyholders can log in to their accounts securely to view and update their policy details, check claim statuses, and access important documents. The online portal provides a convenient and efficient way to stay in control of your insurance needs.

Digital Tools and Resources

Wellfleet Insurance Company goes the extra mile in providing digital tools and resources to assist policyholders in making informed decisions. Whether you need educational resources, calculators to estimate coverage needs, or access to policy documents, Wellfleet’s digital tools are designed to empower policyholders with the information they need to protect themselves and their loved ones.

Frequently Asked Questions

What types of insurance does Wellfleet Insurance Company offer?

Wellfleet Insurance Company provides a diverse range of coverage options, including health insurance with extensive benefits, student insurance, and travel insurance plans tailored to individual needs.

How does Wellfleet Insurance Company ensure affordability for policyholders?

Wellfleet prioritizes affordability by offering competitive rates and a variety of discounts. Policyholders can tailor their coverage to meet their specific needs without compromising their budget.

What sets Wellfleet Insurance Company apart from its competitors?

Wellfleet distinguishes itself through its commitment to comprehensive protection, affordable premiums, and convenient access to care. The company’s reputation for excellence makes it a standout choice in the competitive insurance market.

How user-friendly are Wellfleet’s digital tools and resources?

Wellfleet understands the importance of staying connected in the digital age and provides a mobile app with features for policy management, online account management capabilities, and various digital tools to empower policyholders with information and control over their insurance needs.

What is the claims process like with Wellfleet Insurance Company?

Wellfleet ensures a hassle-free claims process, offering multiple channels for filing claims, including online, over the phone, and through mobile apps. The company is committed to efficient claim processing and timely resolutions to support policyholders in getting back on track quickly.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.