Aflac vs. American Family Life Insurance Company [2026]

In this comprehensive exploration of insurance giants Aflac and American Family, we delve into the distinct realms of supplemental health coverage and broad-spectrum insurance offerings, revealing the nuanced approaches each takes to safeguarding individuals from life's uncertainties.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Diego Anderson

Updated February 2024

Navigating the offerings of industry giants Aflac and American Family can be a decisive task. This comparison sheds light on the nuanced aspects of Aflac vs. American Family Life Insurance, delving into coverage options, rates, and customer feedback. From specialized supplemental health plans to comprehensive coverage extending to homes and possessions, the evaluation unveils the distinctive strengths of each insurer. The subheadings succinctly encapsulate vital insights, unveiling which company emerges as the most advantageous choice for diverse customer profiles, with a keen focus on coverage rates, options, discounts, and customer reviews. Join us in this insightful exploration to determine which provider aligns best with your unique insurance needs.

Aflac

Aflac Overview

One company that provides insurance for the average family is AFLAC. While major medical insurance pays for doctors and hospitals, the employees at AFLAC know that many other expenses are involved when a person experiences illness or injury.

They also understand that funds need to be available when a person’s medical needs affect his ability to work. AFLAC offers supplemental dental insurance to keep financial concerns to a minimum when the unexpected happens.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family Life Insurance Company Overview

American Family provides a broad range of insurance policies that go beyond just health care. While it does offer health and life insurance; this company also provides additional coverages for automobiles, homes and other possessions, offering potential customers the peace of mind knowing the variety of coverage options and insurance products available.

American Family describes itself as a “service-driven insurance company”, and employs over 3,500 independent contractor agents across the country to meet the expected affordability in mind among its policy holders. Additionally, it presents plans aimed at ensuring financial security during retirement years. Gain more information by reading the American Family auto insurance details.

Types of Policies AFLAC Offers

1. Short Term Care Policies

- Accident: Instead of paying a provider directly, AFLAC pays cash to the policy holder in case of an accident. Although medical expenses are involved when an accident occurs, there are also everyday expenses that accrue when one has been injured unexpectedly. These are covered by the policy as well.

- Short Term Disability: Sometimes an accident or an illness can mean loss of pay at a person’s place of employment while that person recovers. AFLAC offers monthly benefits in these situations so a person can heal without the stress of financial obligations going unmet.

- Vision and Dental: Benefits for vision care are provided through AFLAC. Routine dental care can also be covered through AFLAC. Prevention is the best policy, so AFLAC provides coverage for cleanings and exams.

2. Long Term Care Policies

- Cancer: The employees at AFLAC understand how frightening a cancer diagnosis can be. Their goal is to give cancer patients the best chance possible to fight the disease. They offer insurance coverage and a lump sum at time of diagnosis to ease the financial burden that often accompanies long term care.

- Critical Illness: Not all debilitating illnesses result from cancer. AFLAC offers two types of benefits for those who suffer a malady such as a heart attack or a stroke. At the beginning of the illness, the company provides a lump sum to cover the extra expenses accrued. To aid in recovery, they offer Critical Care and Recovery Insurance payable in cash directly to the policy holder.

- Hospital Stays: At some point, almost every American will have to be in the hospital. Whether the hospital stay lasts a few days or a few weeks, expenses add up quickly. AFLAC provides coverage for those who must stay in the hospital due to an illness or other reason. The company offers an additional type of policy for those who need to stay in the pricier Intensive Care Unit.

3. Life Insurance

- Whole Life Insurance: Provides coverage for the entire lifetime of the policyholder and includes a cash value component that accumulates over time. This policy allows access to funds earlier if needed.

- Term Life Insurance: Offers coverage for a specific period, typically during the working years, providing a death benefit if the policyholder passes away within that term. It’s often more affordable than whole life insurance.

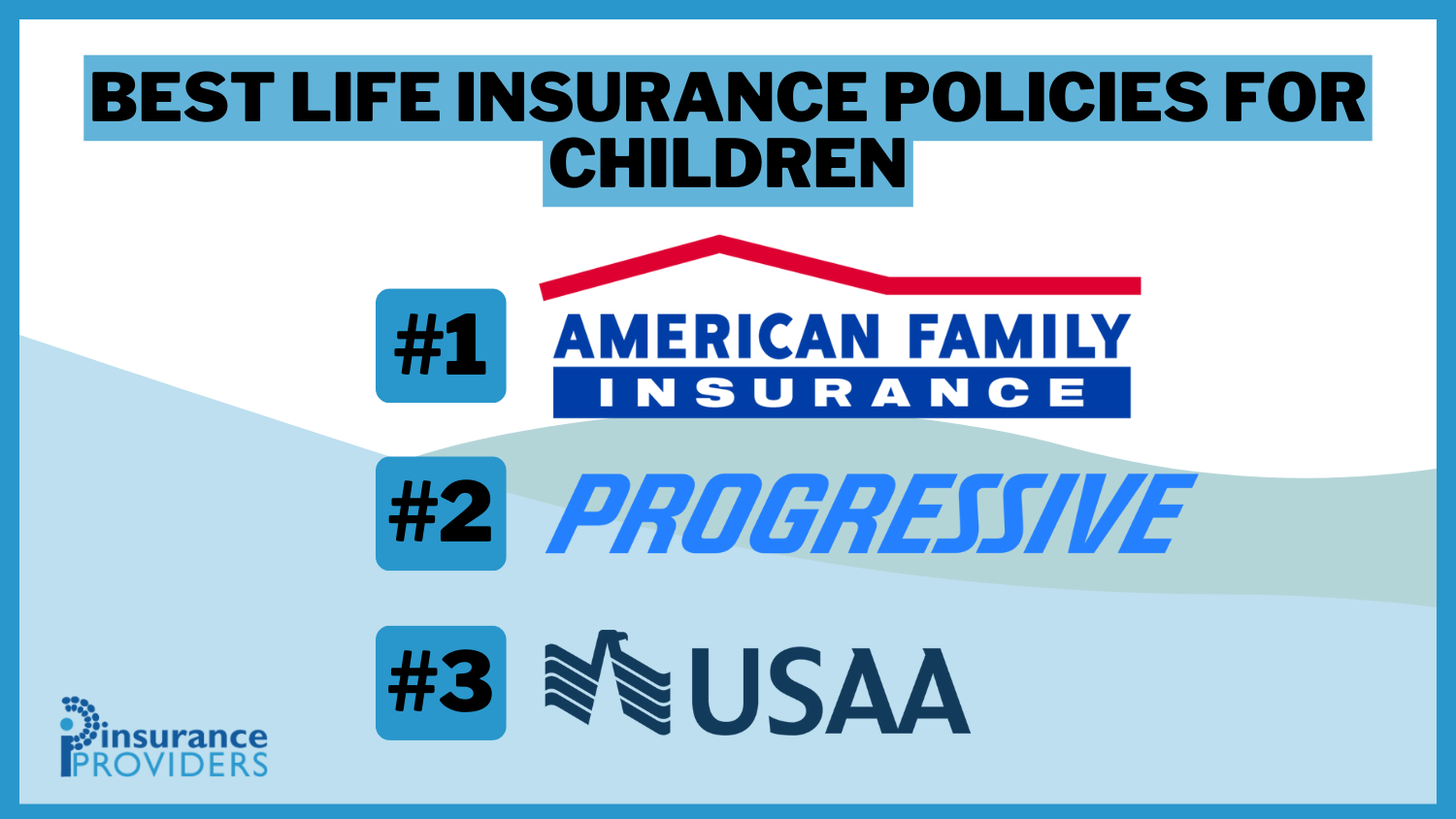

- Juvenile Life Insurance: Specifically designed for children, this policy provides coverage for unexpected events such as illness or accidents. It can assist in covering expenses like funeral and burial costs.

Worried about paying too much for insurance? Start saving now by entering your ZIP code into our FREE quote comparison tool!

Compare Insurance Providers Rates to Save Up to 75% Secured with SHA-256 Encryption

Types of Policies American Family Offers

1. Possessions

Everyone owns things that would be costly to replace. American Family provides coverage for just about all major purchases. The company’s automobile insurance policy has many discounts available such as a good driver discount and a discount for having an air bag in the car.

They offer home insurance as well as business insurance for the small business owner. If a person’s home is their business, they even have a separate policy for Farm and Ranch Insurance. Just in case these policies do not cover all the essentials, American Family provides an Umbrella policy for what they call “an extra layer of protection.”

2. Personal

While many have peace of mind in knowing their possessions are covered by insurance, personal health and well-being is something that cannot be purchased. American Family offers a variety of medical plans for accidents, injury, hospitalization and surgery.

They also have a Medicare Supplement Plan for those costs that Medicare does not cover. American Family helps people to prepare for their retirement years with an array of annuity products.

3. Life

American Family has many options for life insurance. Besides the term life and whole life insurance plans typical of other companies, they offer universal life insurance. For those that hold auto and homeowner policies with American Family, there is also a plan called Simply Protected Life Insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Similarities in the Two Companies

Both AFLAC and American Family are reputable and well-known insurance companies. They are both committed to protecting the financial interests of their customers. Both companies offer life insurance policies.

Differences Between the Two Companies

AFLAC is primarily a supplemental insurance company. The focus of this company’s policies is on health since most of its policies revolve around medical insurance needs. AFLAC offers several specialized plans for different health scenarios. American Family, on the other hand, has a broader focus. They specialize in offering a wide variety of insurance types, not just health insurance.

How to Choose the Best Company for a Customer’s Needs

One of the simplest ways to choose between these two companies, is for the customer to ask what type of insurance is primarily needed. If health care is a concern, AFLAC offers many more options. If one needs to insure a house or a car, AFLAC cannot help.

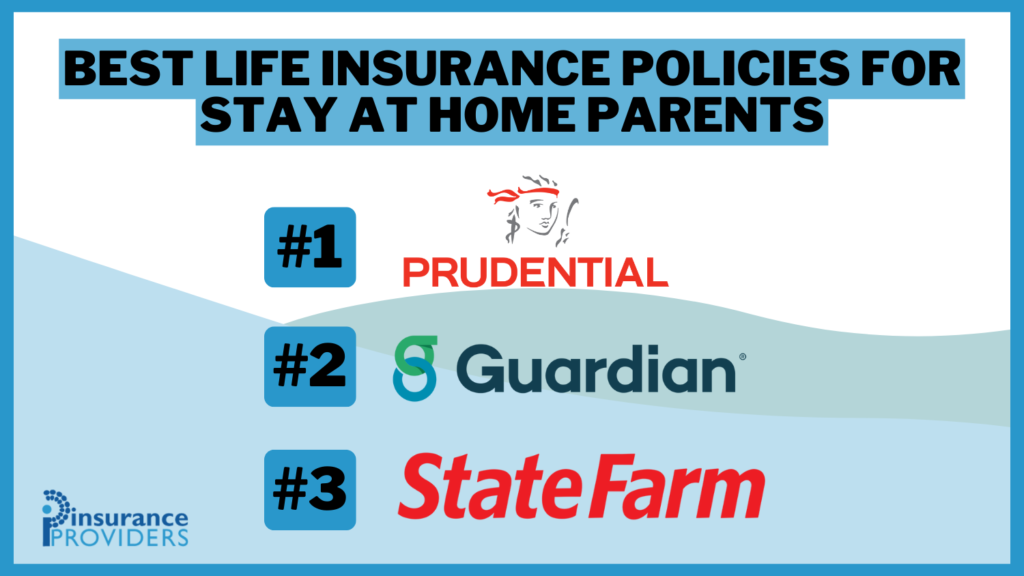

When shopping for life insurance, a person must ask if any special policies are needed, such as AFLAC’s juvenile plan or American Family’s universal life policy.

With competent companies like these available to consumers today, the only planning that is needed is deciding which company and which policy is best for a particular family. With thoughtful foresight while purchasing insurance, policy owners can be better prepared for those unexpected emergencies of life.

Compare insurance quotes now by entering your ZIP code into our FREE quote comparison tool and start saving now!

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Aflac vs. American Family Life Insurance Company: Exploring Claims Process and Coverage

Ease of Filing a Claim

When it comes to filing a claim with both AFLAC and American Family, policyholders have multiple options at their disposal. Both companies offer convenient online claim filing, allowing customers to submit their claims from the comfort of their own homes. Additionally, they provide over-the-phone claim filing for those who prefer a more personal touch.

Mobile apps are also available for added flexibility in the claims process, making it easy for policyholders to initiate a claim on the go.

Average Claim Processing Time

Efficiency in claim processing can be a crucial factor when choosing an insurance provider. While specific processing times may vary depending on the nature of the claim and other factors, both AFLAC and American Family are known for their prompt handling of claims.

Policyholders can generally expect a smooth and relatively speedy claims process with these insurers, reducing the stress associated with unexpected events.

Customer Feedback on Claim Resolutions and Payouts

Customer satisfaction is paramount in the insurance industry, especially when it comes to the resolution of claims and payouts. Policyholders want assurance that their insurance company will provide the financial support they need when they face unforeseen circumstances.

Both AFLAC and American Family have garnered positive feedback from their customers regarding claim resolutions and payouts. Real-world experiences attest to the reliability of these insurers in delivering on their promises.

Aflac vs. American Family Life Insurance Company: Unveiling Digital and Technological Features

Mobile App Features and Functionality

In today’s digital age, insurance companies are expected to offer user-friendly mobile apps that provide easy access to policy information, claims filing, and other essential services. AFLAC and American Family understand the importance of technology in enhancing the customer experience.

Their mobile apps come equipped with a range of features and functionalities, such as policy management, claims tracking, and even virtual assistance. These apps empower policyholders with the tools they need to manage their insurance conveniently.

Online Account Management Capabilities

Online account management is a fundamental aspect of modern insurance. Both AFLAC and American Family offer robust online account management platforms that allow policyholders to access their policies, make payments, update information, and track claims online.

These user-friendly interfaces make it simple for customers to stay in control of their insurance affairs and stay informed about their coverage.

Digital Tools and Resources

In addition to mobile apps and online account management, both AFLAC and American Family provide a wealth of digital tools and resources to educate and assist their policyholders. These resources may include informative blogs, calculators to estimate coverage needs, and educational materials on various insurance topics.

By offering these digital resources, these insurers empower their customers to make informed decisions about their insurance coverage.

Frequently Asked Questions

What types of insurance policies does AFLAC offer?

AFLAC offers a range of insurance policies, including short-term care policies, long-term care policies, and life insurance.

What benefits does AFLAC provide for vision and dental care?

AFLAC offers coverage for vision care, including routine exams, and also provides supplemental dental insurance for preventive care, such as cleanings and exams.

What types of insurance does American Family offer?

American Family offers health and life insurance, as well as additional coverage for automobiles, homes, businesses, and possessions. They also provide annuity products and Medicare supplement plans.

What are the similarities between AFLAC and American Family?

Both AFLAC and American Family are reputable insurance companies focused on protecting their customers’ financial interests. They both offer life insurance policies.

How do I choose the best insurance company for my needs?

To choose between AFLAC and American Family, consider your primary insurance needs. If you require health insurance, AFLAC offers more options, while American Family specializes in a wider range of insurance types. Assess your specific needs and policies offered by each company to make an informed decision.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.