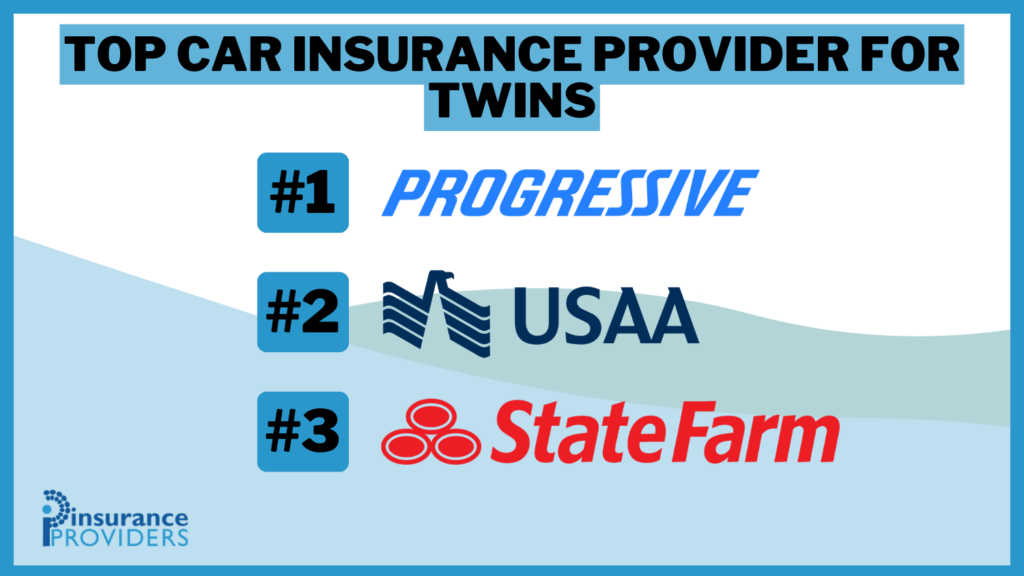

Top Auto Insurance Provider for Twins in 2024 2026 (Top 10 Companies)

Progressive, USAA, and State Farm stand out as the top car insurance provider for twins. Uncover why these companies excel in providing cost-effective plans and tailored coverage, ensuring peace of mind on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated February 2024

6,589 reviews

6,589 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 0 reviews

0 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsDiscover the top car insurance provider for twins like Progressive, USAA, and State Farm, offering tailored coverage and competitive rates for meeting the unique needs. Among these options, Progressive emerges as the standout choice, offering cost-effective plans and diverse coverage options tailored to twin drivers.

In the United States, the twin birth rate record has hit a high of three percent. That means that out of every 1000 births, around 33 of them are twins.

Our Top 10 Best Companies: Top Auto Insurance Provider for Twins

| Company | Rank | See Pros/Cons | Multi-Car Discount | Sibling Discount | Best for |

|---|---|---|---|---|---|

| #1 | Progressive | Up To 12% | Up To 10% | Bundle Discounts | |

| #2 | USAA | Up To 15% | Up To 12% | Customizable Policies | |

| #3 | State Farm | Up To 20% | Up To 15% | Comprehensive Coverage | |

| #4 | Allstate | Up To 18% | Up To 10% | Local Agents | |

| #5 | Nationwide | Up To 15% | Up To 10% | Policy Options |

| #6 | Liberty Mutual | Up To 13% | Up To 8% | Online Convenience |

| #7 | Farmers | Up To 16% | Up To 9% | 24/7 Support | |

| #8 | AAA | Up To 10% | Up To 8% | Vanishing Deductible |

| #9 | Travelers | Up To 12% | Up To 7% | Safe-Driving Discounts |

| #10 | Safeco | Up To 14% | Up To 10% | Multi-Policy Discounts |

If you’re a twin, you know that you live in a unique world where you’ve shared one of the most precious moments in life with another human being.

Twins share a lot of things in life, especially in childhood. They share:

- DNA

- parents

- clothing

- toys

- a room

As twin siblings start to come into their own and grow into young adults, they might even share their first car. The moment that you and your sibling get a car, you need to get insurance.

Enter your zip code into our free rate tool above to find the best price for auto insurance.

#1 – Progressive – Winning With Bundle Discounts

Progressive, with its bundle discounts and tailored coverage, stands out as the top choice for twins seeking reliable auto insurance.Ty Stewart Licensed Life Insurance Agent

Pros

- Up to 12% multi-car discount provides significant savings for insuring multiple vehicles.

- Up to 10% sibling discount recognizes the unique needs of twins.

- Bundle discounts offer additional affordability for customers combining various policies.

Cons

- The specific details of bundle discounts and eligibility criteria may not be explicitly outlined.

- The company’s rank does not provide insights into specific aspects such as customer service or claims satisfaction.

Read more: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA – Leading With Customizable Policies

Pros

- Up to 15% multi-car discount caters to families with multiple vehicles.

- Up to 12% sibling discount acknowledges the special circumstances of insuring twins.

- Customizable policies offer flexibility, allowing customers to tailor coverage to their specific needs.

Cons

- The extent of policy customization options and their impact on rates may not be explicitly detailed.

- The company’s rank does not necessarily reflect specific aspects such as customer service or claims handling.

Read more: USAA Auto Insurance Review

#3 – State Farm – Triumphing in Comprehensive Coverage

Pros

- Exceptionally high multi-car discount (Up to 20%) presents substantial cost savings for families.

- Up to 15% sibling discount recognizes the unique needs of twins, promoting affordability.

- Emphasis on comprehensive coverage suggests a focus on providing extensive protection.

Cons

- The specific details of comprehensive coverage and its inclusions may not be explicitly stated.

- The company’s overall rank may not reflect specific aspects such as customer service or claims processing.

Read more: State Farm Auto Insurance Review

#4 – Allstate – Stands Out With Local Agents

Pros

- Up to 18% multi-car discount provides substantial savings for insuring multiple vehicles.

- Up to 10% sibling discount recognizes the unique needs of twins.

- The presence of local agents may enhance customer support and personalized service.

Cons

- The extent of local agent support and its impact on customer satisfaction may vary.

- The company’s rank does not necessarily reflect specific aspects such as customer service or claims handling.

Read more: Allstate Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide – Excellence in Policy Options

Pros

- Up to 15% multi-car discount caters to families with multiple vehicles.

- Up to 10% sibling discount acknowledges the special circumstances of insuring twins.

- Policy options offer flexibility, allowing customers to choose coverage tailored to their needs.

Cons

- The specific details of policy options and their impact on rates may not be explicitly detailed.

- The company’s rank does not provide insights into specific aspects such as customer service or claims satisfaction.

#6 – Liberty Mutual – Recognized for Online Convenience

Pros

- Up to 13% multi-car discount provides savings for insuring multiple vehicles.

- Up to 8% sibling discount acknowledges the unique needs of twins.

- Emphasis on online convenience may appeal to customers seeking a streamlined experience.

Cons

- The specific details of online convenience and its user-friendliness may vary.

- The company’s rank does not provide insights into specific aspects such as customer service or claims satisfaction.

#7 – Farmers – Providing 24/7 Support

Pros

- Up to 16% multi-car discount offers substantial savings for families with multiple vehicles.

- Up to 9% sibling discount recognizes the special circumstances of insuring twins.

- 24/7 support enhances customer service, providing assistance at any time.

Cons

- The extent of 24/7 support and its impact on customer satisfaction may vary.

- The company’s rank does not necessarily reflect specific aspects such as claims handling or policy customization.

Read more: Farmers Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA – Standout Vanishing Deductible Feature

Pros

- Up to 10% multi-car discount provides savings for insuring multiple vehicles.

- Up to 8% sibling discount acknowledges the unique needs of twins.

- Vanishing deductible feature may attract customers seeking reduced deductibles over time.

Cons

- The specifics of the vanishing deductible feature and its terms may not be explicitly detailed.

- The company’s rank does not provide insights into specific aspects such as customer service or claims satisfaction.

Read more: AAA Auto Insurance Review

#9 – Travelers – Leading with Safe-Driving Discounts

Pros

- Up to 12% multi-car discount caters to families with multiple vehicles.

- Up to 7% sibling discount recognizes the special circumstances of insuring twins.

- Safe-driving discounts may encourage responsible driving habits and offer additional savings.

Cons

- The specific details of safe-driving discounts and eligibility criteria may not be explicitly outlined.

- The company’s rank does not necessarily reflect specific aspects such as claims handling or policy customization.

Read more: Travelers Auto Insurance Review

#10 – Safeco – Excelling in Multi-Policy Discounts

Pros

- Up to 14% multi-car discount provides savings for insuring multiple vehicles.

- Up to 10% sibling discount acknowledges the unique needs of twins.

- Multi-policy discounts offer additional affordability for customers combining various policies.

Cons

- The specific details of multi-policy discounts and eligibility criteria may not be explicitly outlined.

- The company’s rank does not provide insights into specific aspects such as customer service or claims satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do you need insurance if you and your twin have permits?

Ensuring a secure journey for twins begins with selecting the right auto insurance. In our comprehensive comparison, we highlight the leading providers, each tailored to the unique needs of twins. Dive into the table below to discover the average monthly rates for full and minimum coverage plans.

Average Monthly Auto Insurance Rates for Twins

| Insurance Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | $105 | $39 |

| USAA | $59 | $22 |

| State Farm | $86 | $33 |

| Allstate | $160 | $61 |

| Nationwide | $115 | $44 |

| Liberty Mutual | $174 | $68 |

| Farmers | $139 | $44 |

| AAA | $86 | $32 |

| Travelers | $99 | $37 |

| Safeco | $71 | $27 |

Progressive, known for its bundle discounts, offers competitive rates of $105 for full coverage and $39 for minimum coverage. USAA, celebrated for customizable policies, stands out with monthly charges of $59 for full coverage and $22 for minimum coverage. State Farm, a leader in comprehensive coverage, strikes a balance with rates of $86 for full coverage and $33 for minimum coverage.

These rates provide a snapshot of the affordability and diversity offered by the premier auto insurance providers for twins. As twins navigate their journey to find the ideal coverage, this information serves as a valuable guide, empowering them to make informed decisions that align with their unique preferences and needs, ensuring a secure and budget-friendly driving experience.

How much does it cost to insure twins as teens?

Your mother and father’s insurance rates are going to shoot through the roof regardless of what they’re currently paying as soon as their teenagers are licensed.

When you and your sibling are turning 16 at the same time, that makes life even harder for your parents because they’ll be adding two licensed teens at once.

On average, adding one auto insurance for teens will raise your rates by 79 percent. Adding a teenage son costs a lot more than adding a teenage daughter.

New male drivers increase rates an average of 98 percent and their female counterparts will only lead to an increase of 73 percent.

While the rules of mathematics would tell you that you should just add together the average increases to determine how much it will cost to insure twins, but those rules don’t apply here. Insurance carriers look at a variety of factors when determining rates.

If you’re adding one teen, the change in premium is drastic. You’ll still pay a higher rate to add a second teen, but since you’ll already have a risky driver on the plan it won’t cost twice as much.

Adding Twin Drivers and a Vehicle

Adding a teen with no car of their own makes enough of a difference to an existing insurance policy. Now, imagine how much it will cost if you’re adding a car and along with two newly licensed drivers.

Depending on how many cars and drivers there are in the home, the policy could be three or four times higher than it originally was.

If you and your twin are going to share a car, the two of you will have to decide who is going to be listed as the primary driver of the car and who will be the secondary driver.

Both of you can drive an equal amount of time, but the rate for each classification can change. It’s best, in scenarios where there is a brother and a sister, for the sister to be a primary driver because she’ll have a lower rate because of her gender.

Read more: How to Add Another Driver to Your Auto Insurance Policy

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How long should a twin stay on a family plan?

One of the things about sharing everything with someone is that it can create a huge desire to be independent.

If you’re growing up and you want to branch off and buy your own coverage, you should wait until you no longer can stay on a family plan. That usually means you’ll have to move out of the home.

As a young driver, you will pay extremely high rates on your own. You won’t benefit from your parents’ driving experience, their insurance credits, or any other savings on the policy.

You’ll lose multi-car rates, multi-line discounts, and loyalty credits. If you live at home with your parents or you live with your adult twin, you should stay on a family plan for some more than noticeable discounts.

Will you pay the same rate as your twin?

When you finally take the leap and you move out on your own you’ll have to get a separate auto insurance plan in place. When you’re shopping around for a plan, it’s almost natural for you to talk to your twin to see if the two of you are paying similar rates.

No matter how similar the two of you are, that doesn’t mean your insurance rates will be.

There’s a never-ending list of different rating factors that will affect your insurance quotes.

Every little piece of information that you give, aside from your phone number and email address, is used to rate you and give a custom premium. Your age and your driving experience might be the same, but the following factors can be different:

- Gender

- Occupation

- Credit-based insurance score

- Vehicle type and model

- Your driving record

- Your current claims record

- Address where vehicle is stored

- How often you drive

- How many miles you drive

- Coverage options you selected

As you can see, you can’t just double up on insurance because you’re a twin. Every person has their own unique rate that is determined by personal factors.

Get online quotes right here to assess how much your insurance will be on your own and then you can determine which way is best to buy car insurance.

Case Studies: Top Auto Insurance Provider for Twins

Case Study 1: The Wilson Twins

Identical twins John and Sarah Wilson obtained auto insurance from a leading provider for twins in NYC, attracted by comprehensive coverage and competitive rates. The provider acknowledged their twin status, offering discounts for multiple vehicles and customized coverage for shared usage. The Wilson twins’ contentment stemmed from the provider’s dedication to meeting their individual needs.

Case Study 2: The Patel Twins

Fraternal twins Rahul and Priya Patel in LA chose a leading auto insurance provider that catered to their distinct driving habits, offering customization and shared benefits. The provider acknowledged their twin connection, providing affordable rates for Rahul’s long commutes and discounted premiums for Priya’s safe driving, resulting in the Patels’ appreciation for the personalized approach.

Case Study 3: The Johnson Twins

Emily and David Johnson, twins from Chicago, selected the top auto insurance provider for twins due to their outstanding customer service. The provider’s efficient claims process and responsive support impressed the Johnson twins. Competitive rates and comprehensive coverage options provided a sense of security while driving.

Case Study 4: The Lee Twins

Alex and Emma Lee, twins from Houston, selected the leading provider for twins based on value, benefiting from affordability, customer satisfaction, and various discounts. They appreciated the user-friendly online platform for managing policies. Overall, it met their budget while providing quality coverage.

Frequently Asked Questions

Do twins need insurance if they have permits?

If twins with permits live at home with their parents, they are usually covered under their parents’ auto insurance policy.

How much does it cost to insure twin teens?

Insuring twin teens can significantly raise insurance rates. Adding one teen can increase rates by about 79%, with male drivers generally costing more than female drivers.

How long should twins stay on a family plan?

It’s best for twins to stay on a family plan until they are financially independent and no longer eligible for coverage. This allows them to benefit from discounts and savings.

Will twins pay the same insurance rate?

Each twin’s insurance rate is based on their individual factors, such as age, driving experience, and vehicle type. Rates can vary even for twins with similar characteristics.

Can twins save money by sharing a car insurance policy?

Yes, twins can potentially save money by sharing a car insurance policy. By combining their coverage under one policy, they may be eligible for multi-car discounts and other cost-saving benefits. However, it’s important to consider factors such as driving records and potential conflicts that may arise from sharing a policy.

Do insurance rates for twins differ from those of individual drivers?

Yes, insurance rates for twins can vary based on individual factors such as age, driving experience, and other personal details. Each twin is assessed independently, considering their unique characteristics, leading to potential differences in insurance rates.

How do insurance providers calculate rates for twin drivers sharing a policy?

When twins share a car insurance policy, providers typically consider factors such as driving records, age, and gender. It’s important for twins to decide who will be listed as the primary and secondary drivers, as this can impact the overall premium and potential discounts.

What factors contribute to the differences in insurance rates among twins from various providers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.